To get a clearer picture of Gen Z drinking trends and their influence on the BevAlc landscape, Numerator blended a mix of Insights and TruView data with survey responses from Gen Z panelists (ages 21+) and offered a generous pour of the results in a recent webinar. Gen Z consumers are just beginning to flex their purchasing power muscle, but it will only grow stronger in the years to come. Understanding the factors that drive Gen Z buying behavior—especially how their attitudes, usage, and preferences around alcohol set them apart from Millennials—will be key for BevAlc brands to achieve sustained growth.

Moderation is the Gen Z Mantra

When it comes to Gen Z drinking habits, our survey found that last call likely comes earlier in the evening for this group, a trend that holds for Millennial drinkers as well. Both consumer groups are more deliberate drinkers, with 4 out of 10 mindful about how much they’re drinking and 3 out of 10 actively limiting their intake. However, it’s the distinct difference in how the younger Gen Z crowd perceives and purchases beverages that brands should pay close attention to.

Does Gen Z Drink Less Alcohol?

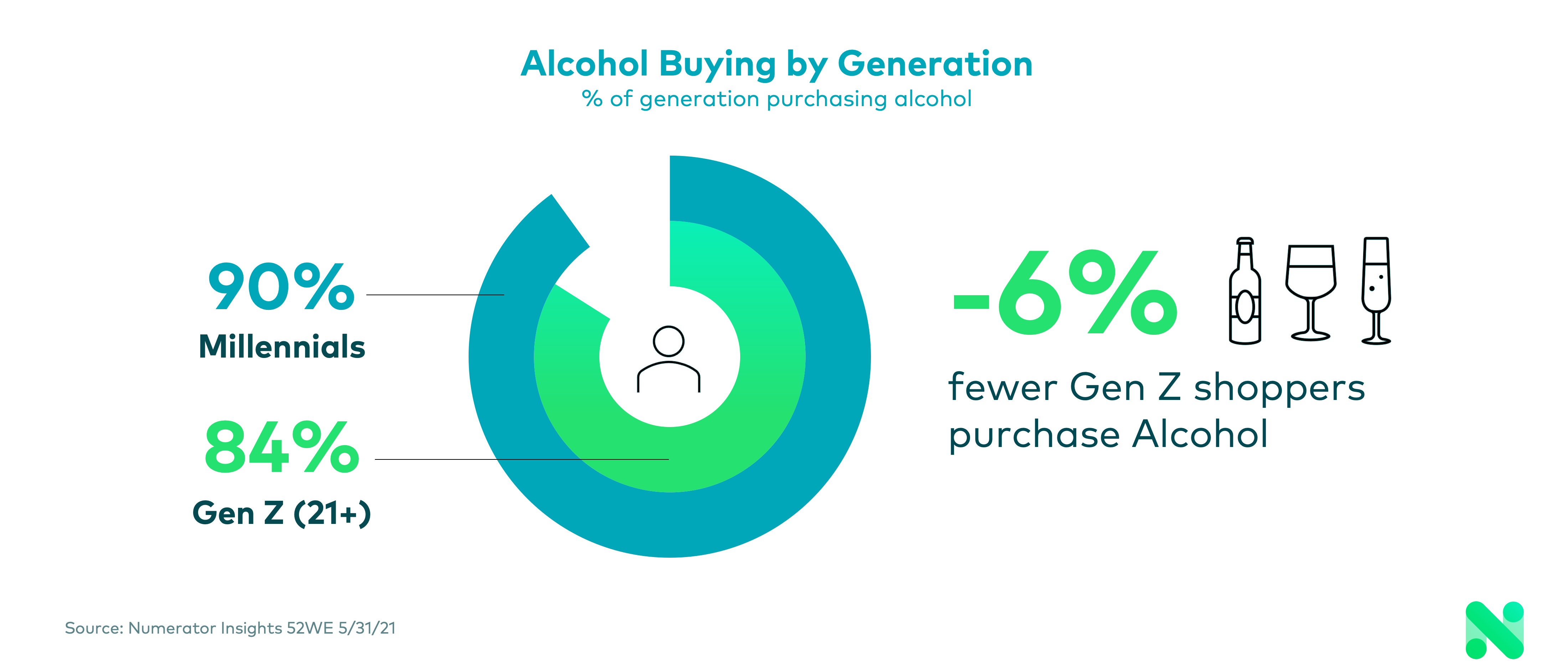

Overall, alcohol is less appealing to Gen Z consumers. Concerned about alcohol’s impact on their mood, level of alertness, and even their image on social media, these moderate drinkers make fewer trips and spend less on the channel. Only 84% of Gen Z shoppers are buying alcohol compared to 90% of Millennials, a significant 6-point differential. And while Gen Z also spends less than Millennials on non-alcoholic beverages, the gap between the two consumer groups is greater with alcohol purchases, indicating this is an alcohol-specific trend.

Gen Z Reaches for a Wide Range of Beverages to Quench Their Thirst

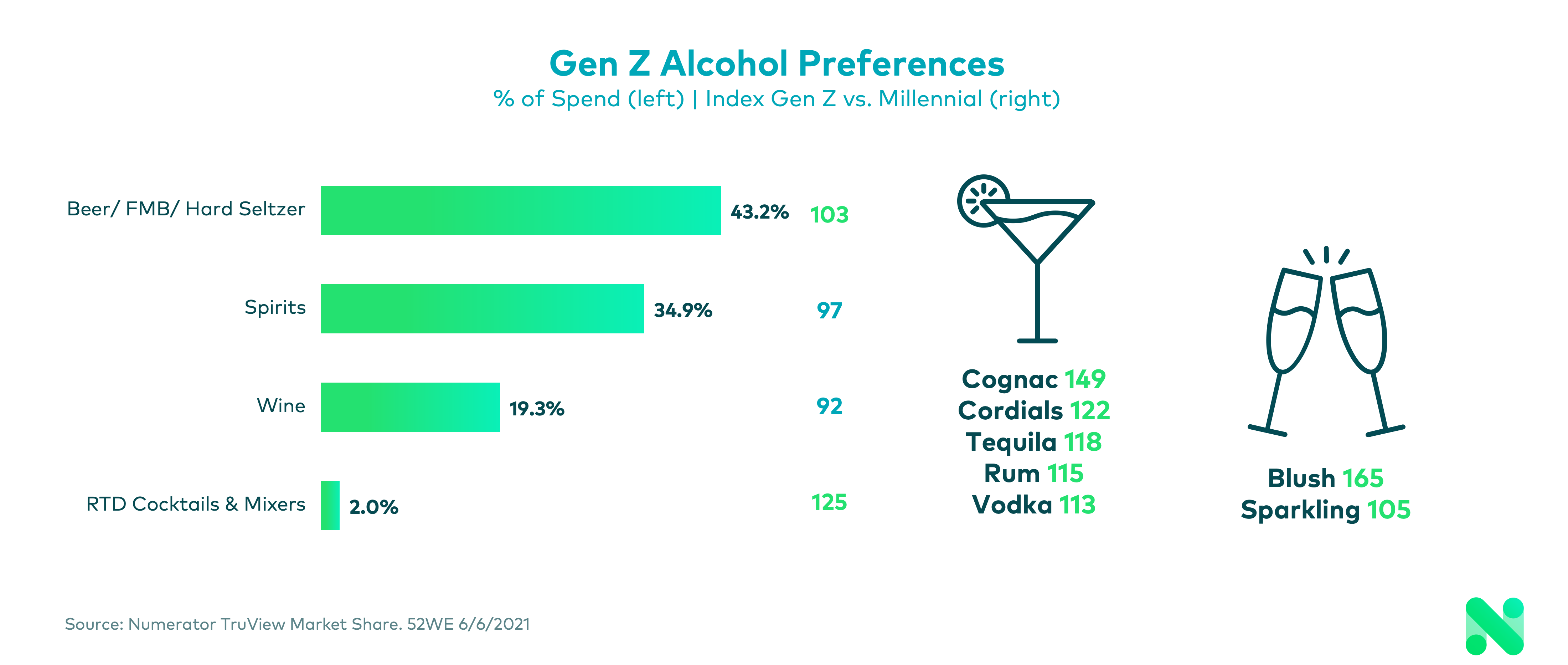

Additionally, Gen Z shoppers are distinguishing themselves from Millennials through the types of beverages they consume. Gen Z favors hard beverages, champagne, and drinks with little or no alcohol over wine and beer. And a higher percentage of Gen Z dollars are spent on sweeter spirits like cognac, flavored malt beverages, cordials, and blush wine. Gen Z consumers also prefer non-alcoholic choices such as juices, sports drinks, and newer niches like mocktails or CBD and cannabis-infused beverages, though traditional categories like bottled and sparkling water, sodas, tea, and energy drinks remain popular.

As a result, Gen Z’s unique preferences are driving innovation in the BevAlc industry. A wide variety of new players and flavors are now competing with established brands for Gen Z’s attention. Smirnoff Ice, Mike’s Hard, and Seagram’s, which focus on socializing and personal expression in their media, are modern brands currently winning Gen Z wallet share. Coors, a mainstream brand, is also succeeding with a social presence geared toward environmental issues and an active, outdoorsy lifestyle, which may appeal to Gen Z values.

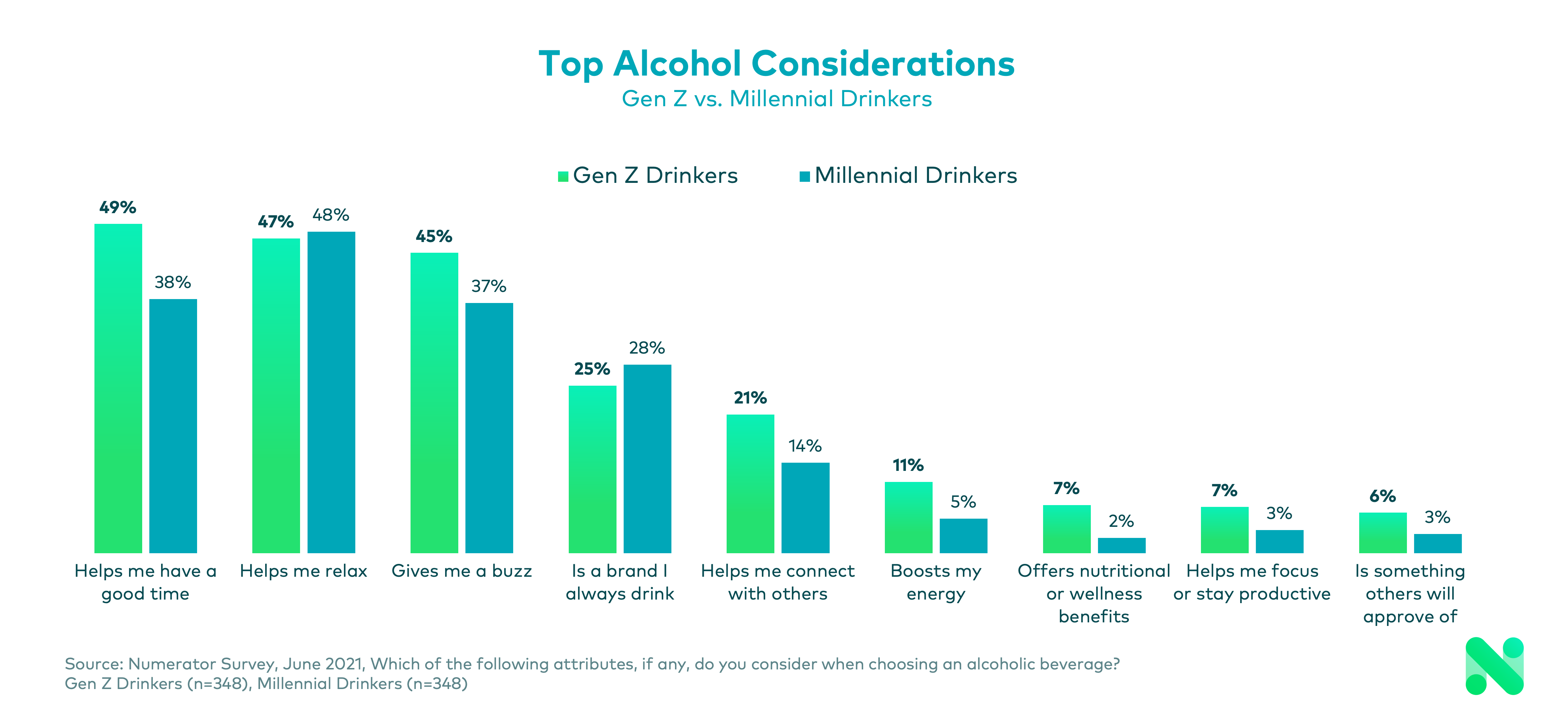

Gen Z Drinkers Just Want to Have Fun

For Gen Z consumers, drinking is about socializing, another notable factor separating them from Millennials. Contrary to Millennials, who largely prefer indulging in a cocktail to relax, 49% of Gen Z drinkers pop open a can or pour a glass primarily to have a good time. Also unlike Millennials, beer isn’t the main beverage of choice for Gen Z social occasions. To compete with hard seltzers, flavored malt beverages, or mixed cocktails, traditional beer brands will need to come up with new and creative ways to appeal to this younger generation.

When it comes to non-alcoholic beverages, both Gen Z and Millennial consumers are seeking hydration first and foremost. However, Gen Z consumers also seek out go-to brands that promise added wellness benefits such as a boost of energy and nutritional value or one that helps them connect with others. This leaves an opening for brands to build loyalty if they are able to position their products to meet Gen Z’s needs.

A Social and In-Store Presence are Key to Attracting Gen Z’s Attention

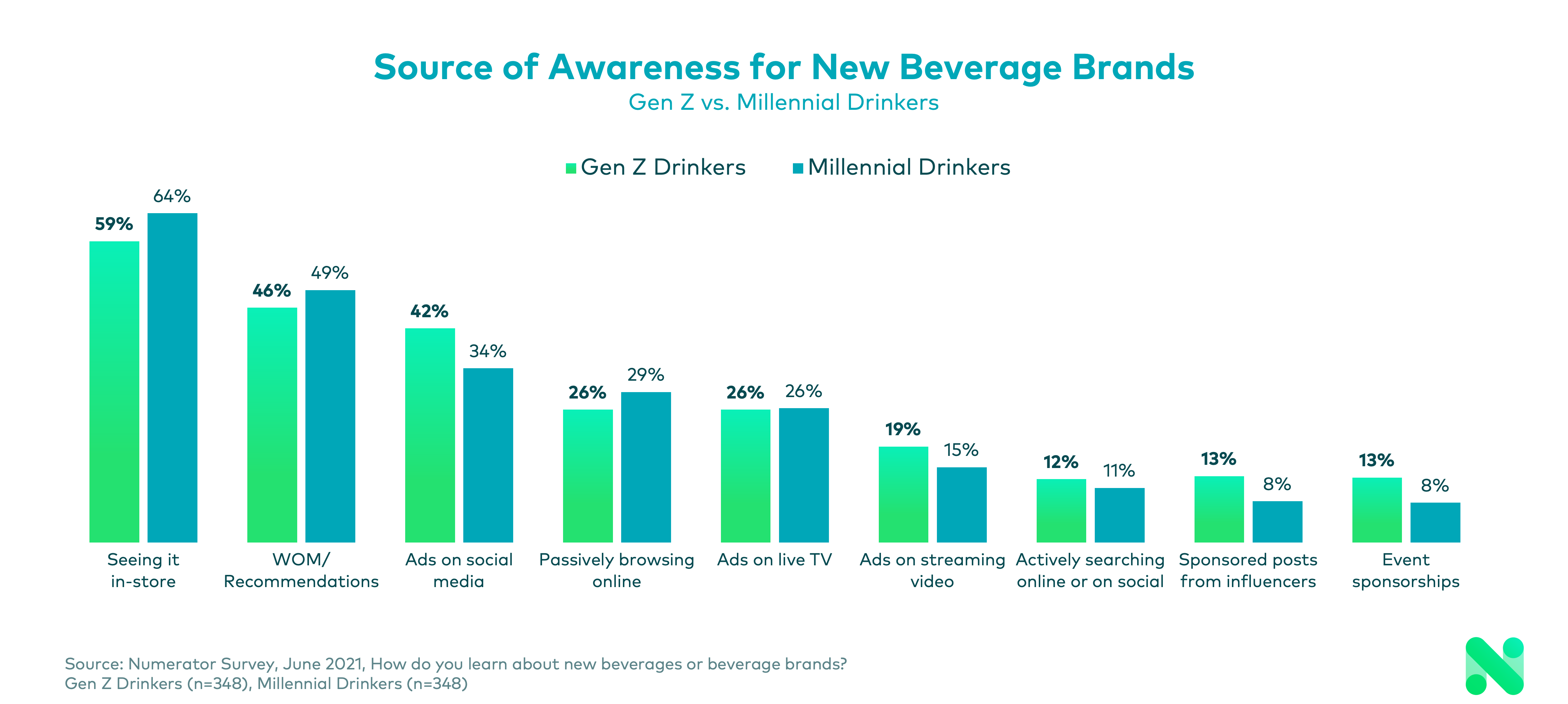

Capturing Gen Z consumers means tapping into the mindset of these social drinkers who are also creative and tech savvy. Gen Z consumers are 45% more likely to learn about new beverage brands through social ads, making a strong social media strategy key to attracting these shoppers.

Partnering with relevant influencers in music, beauty, and fashion is another highly effective avenue to pursue in bringing awareness to your brand online, particularly on user-generated content platforms like YouTube, SnapChat, and TikTok. However, Gen Z consumers are very mindful of a brand’s values. They’ll avoid a product if they disagree with a brand’s posts, so beverage companies need a message that resonates, not alienates.

Though an online presence is crucial, having a variety of products available on retailer shelves is equally important. That’s because 59% of Gen Z’ers still rely on discovering beverage options while shopping in store. Budget-friendly Mass, Club, and Dollar retailers like Target, Sam’s Club, and Dollar Tree are where Gen Z consumers are most likely to stock up on both alcoholic and non-alcoholic beverages. Securing distribution at these retailers is essential in converting Gen Z consumers.

Looking Ahead

For Gen Z consumers, their liquor choices are a reflection of their lifestyle. They’re more interested in the experiential and social benefits of their beverages, both alcoholic and non-alcoholic, than Millennials. Gen Z consumers also lean toward sweeter profiles and a broader variety of beverages and are more likely to connect with brands through social media. Brands and retailers need to continue evolving, diversifying, and innovating in order to meet Gen Z’s unique preferences and win their shopping occasions, trips, and loyalty.

You can listen to the webinar replay for additional details on Gen Z alcohol consumption and this group’s growing influence on the BevAlc industry. To learn more about the impact of Gen Z buyer behavior on your product or store, reach out to us.