In the dynamic world of consumer interest and retailer demands, it’s challenging for emerging brand leaders to meet consumers where they are due to innovative brand and value propositions that don’t align with traditional categories. This requires brands to seek the perfect category and retailer fit to attract new shoppers and grow customer loyalty. However, brands must consider more than just where they think they belong on the shelf. Their category and shelf placement must be centered on the mindset of consumer needs and occasions.

To foster strong retailer relationships, brands must build their merchandising strategies on consumer preferences and explore adjacent categories for potential synergies. Through understanding shopper affinities and metrics, brands and retailers can strategically position themselves for sustained growth and success. Below are pivotal steps every emerging brand should take to champion their category placement in buyer meetings based on verified purchase data.

Your Step-by-Step Guide to Uncover the Right Category Placement as an Emerging Brand:

1. Understand consumer views and how they interact with your brand during a shopping trip

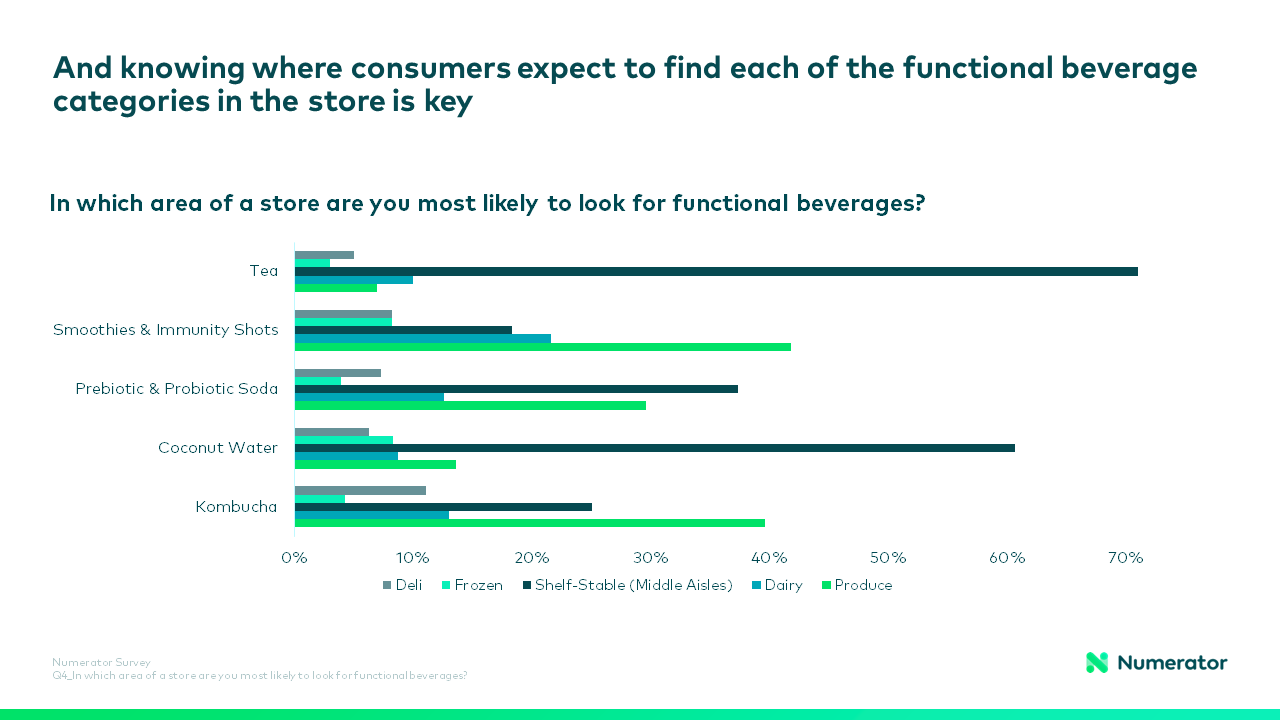

Brands have to uncover the underlying attitudes that influence both their own shoppers’ purchase decisions and those of their competitors. This will guide brands to align their shopper occasions with the category that meets consumer needs. Within Numerator’s Cracking Open Functional Beverage Growth Opportunities, shoppers in categories like Prebiotic & Probiotic Sodas, Tea, and Coconut Water expect to find Functional Beverages in the Shelf-Stable section (Middle Aisles), whereas shoppers in categories like Smoothie & Immunity Shots and Kombucha expect them in the Produce section. Through conducting surveys, brands can uncover where their verified buyers expect to find their category or brand within a store, whether their brand serves as a replacement or addition to their shopping trip, which brands they replace, and when they typically consume the product. Panel data helps brands strategically position their products to meet consumer expectations and maximize visibility and appeal in-store.

2. Uncover which categories are most often purchased with your brand during the same shopping trip

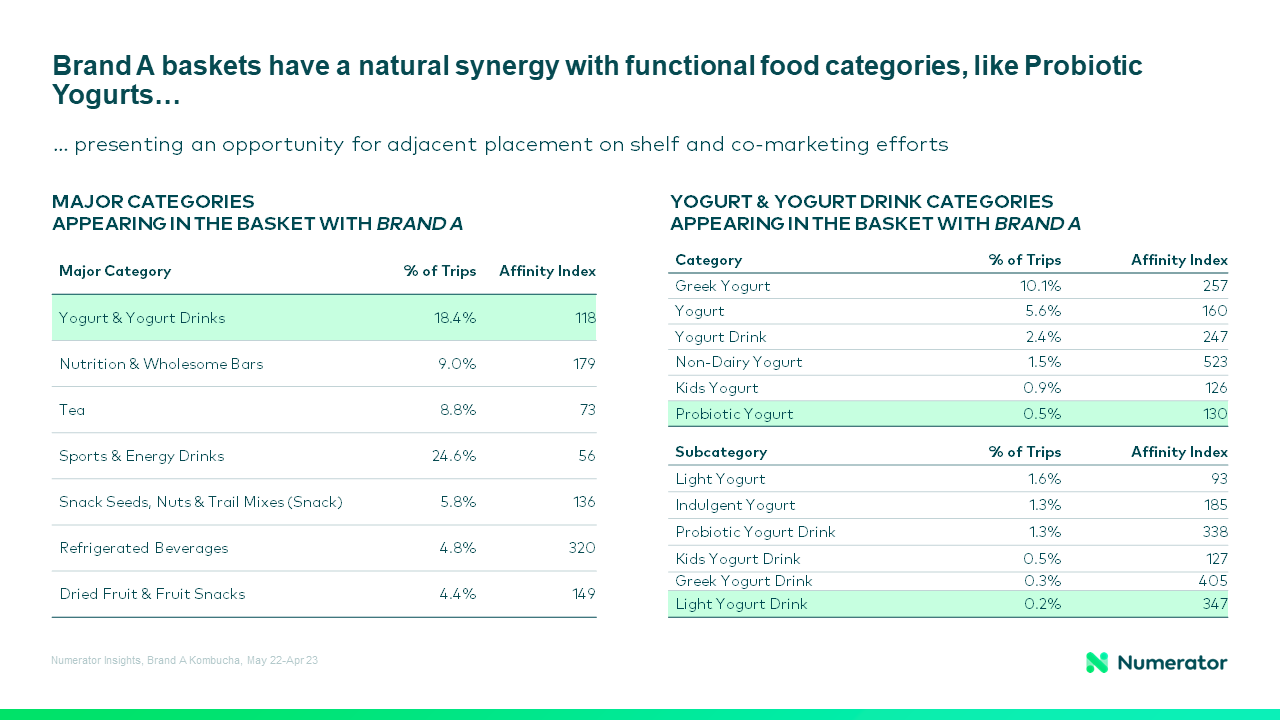

To effectively navigate category identity challenges, emerging brands must analyze which categories frequently accompany their brand in consumers’ shopping baskets. This entails calculating the percentage of shopping trips where their brand appears with other categories, a crucial metric for understanding consumer behavior. By identifying these patterns, brands can pinpoint categories that resonate most with their core buyers, indicating prime opportunities for strategic category placement. For example, the Cracking Open Functional Beverage Growth Opportunities webinar also discussed how a Functional Beverage brand was trying to grow their shopper base with Functional Food buyers and uncovered that the brand was most likely to appear in the basket with the Yogurt & Yogurt Drinks category (Affinity Index 118), specifically within the Probiotic Yogurt category (Affinity Index 130) and Light Yogurt Drink sub-category (Affinity Index 347). Numerator’s Basket Affinity allows brands to understand which products or categories are found together in the same basket across the total market or in a specific retailer, uncovering optimal category positioning for attracting and retaining shoppers.

3. Define your brand’s target shopper and pinpoint in which categories they have high brand affinity and shop heavily

Once the categories for consideration have been selected, emerging brands need to determine which category shopper profile aligns best with the brand’s consumer. For example, if Millennials are a primary target, brands can utilize panel data to determine which categories these consumers engage with most. According to Numerator’s Generations Hub, Millennials over-index with the Children’s & Infant Vitamin & Supplements (177 over-index), Sun Care (114 over-index) and Tampons (147 over-index) categories. Leveraging Numerator’s People Insights, brands can uncover these specific shopper insights related to their brand and the categories being considered for shelf placement. This includes key demographic metrics such as employment, household size, census division, and ethnicity.

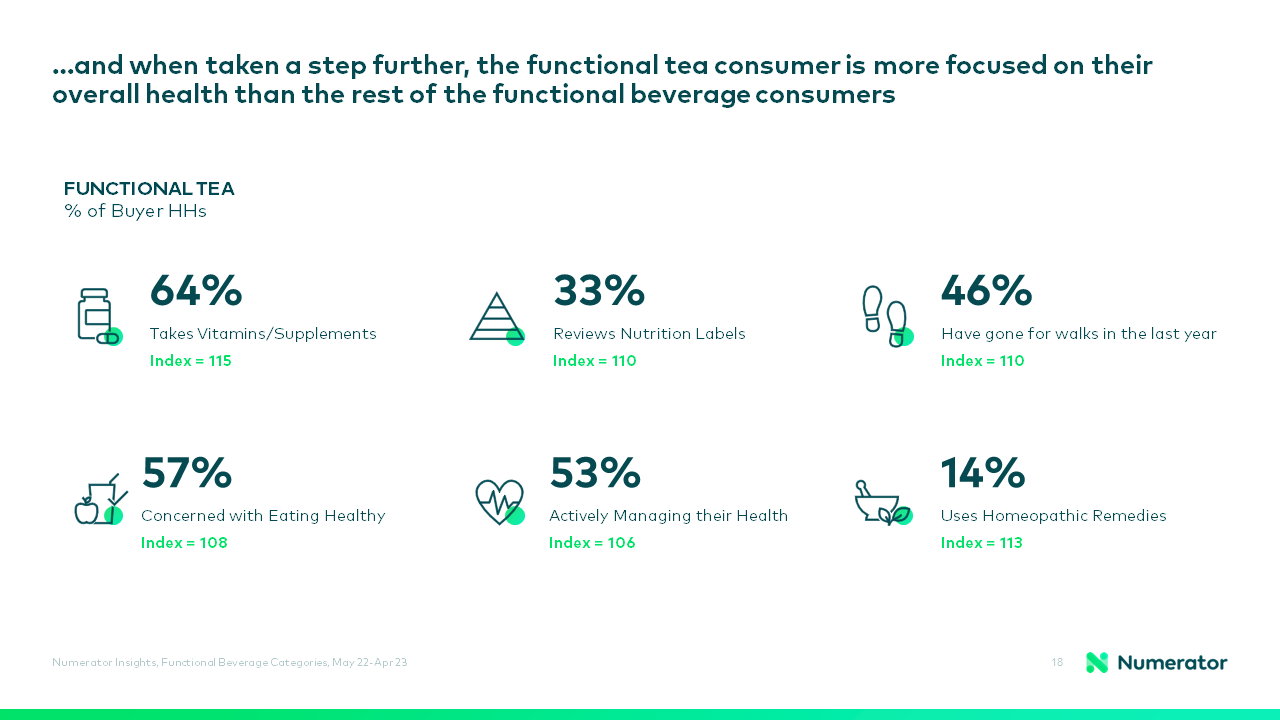

Additionally, brands should understand how their shoppers’ attitudes and habits compare to the average category shopper in the categories being considered. For instance, the Cracking Open Functional Beverage Growth Opportunities webinar also introduced how Functional Tea buyers are likely to be more health-conscious compared to overall Functional Beverage buyers. These households are more likely to take vitamins and supplements (over-index 115), review nutrition labels (over-index 110), and use homeopathic remedies (over-index 113). Brands within the Functional Beverages category can use this data to compare their specific Shopper Psychographics with those of other categories, identifying which category aligns best with their brand buyers’ attributes compared to others.

4. Identify the brands toward which your target shoppers gravitate in the categories being considered

After selecting the categories for consideration, emerging brands can identify the top brands favored by their consumer base within each relevant category. This involves understanding how key shopper segments, like Millennials, engage with brands across the various categories being considered for product placement. For example, according to Numerator’s Millennial Insights, Millennials over-index in household (HH) penetration with brands such as Munchkin (18%), Zarbee’s (13%), and The Honest Company (11%) compared to all brands. Besides HH penetration, brands should also consider additional Shopper Metrics such as purchase frequency, spend, average basket size, and annual shopping trips. These metrics provide insight into which brands Millennials prefer across categories, as well as which categories attract their highest annual trip frequency and purchase frequency, indicating stronger overall affinity. By leveraging these insights, brands can strategically position themselves to better resonate with their target consumers, such as Millennials, and optimize their category placement.

By leveraging verified purchase data, brands can pinpoint the optimal category placement and develop merchandising strategies that guide brand growth confidently. These strategies should be tailored to align with consumers' mindsets, addressing their specific needs and occasions. Brands should focus on identifying product adjacencies, targeting appropriate audiences, and making strategic adjustments to product placement. To discover how Numerator can enhance your merchandising approach and buyer engagements to drive both brand and category growth, and foster meaningful buyer relationships, contact our team today.