NACS’s 30th annual conference was held October 4-6 in Atlanta’s Georgia World Congress Center, with a focus on education, networking and a look at new products designed to meet the evolving needs of Gas & Convenience consumers.. The Numerator team was thrilled to attend the event and highlight our unique ability to provide brands and retailers with unparalleled visibility into consumer purchasing behavior within the Gas & Convenience channel.

Trends and Insights from Numerator

While walking the show floor, the Numerator team noted many differentiated benefits that brands are delivering to their consumer base but identified a handful of emerging trends that were most common. Condensed into four key themes, these trends focus on the needs that consumers are looking for brands to satisfy: new caffeinated occasions, better-for-you, premium, and flavor innovation towards Asian cuisines.

Innovating Towards New Caffeine Occasions

There was an abundance of caffeine-infused products across the expo floor, including Grinds coffee pouches and That’s it. Organic Dark Chocolate Expresso Truffles. Brands such as Grinds and That’s it. are rising to the occasion as consumers have increased their coffee spend across most CPG and restaurant categories. However, according to Numerator’s Grounds for Concern? Omnichannel Coffee Consumption Trends Article, Millennials currently comprise over a third (36%) of LSR coffee spend, but have significantly decreased their spend (-25.9%) and trips (-22.3%) to restaurants and cafes for coffee. These consumers are searching for other forms of consumption, including spending more on Dry Coffee (+10.4%). As Millennials search for new caffeinated occasions and in new channels, That’s it. caffeine-infused product innovations prove to be a wise move since their shoppers are more likely to be Millennials (155 over-index) and like to try new things (120 over-index) in comparison to the average Gas & Convenience Snacks shopper.

Winning Consumers Based on Nutritional Benefits

Brands across a range of snacks and beverage categories showcased investments in functional products based on a certain nutrition benefit, such as ZOA Energy Drinks. ZOA entered the energy drink space in 2021 with a new, better-for-you twist, heavily focused on health benefits with ingredients like turmeric, B vitamins, camu camu, and more. According to Numerator’s webinar, “Cracking Open Functional Beverage Growth Opportunities”, when consumers choose a nutrient-beneficial beverage, many times their top choice factors rely heavily on taste, price, and flavor variety. ZOA is clearly listening to their consumer base with their recent “Fuel Something Bigger” campaign, which introduced 4 new flavors to their everyday offering and with new formulas that are focused on greater functionality and taste. As Gas & Convenience continues to be a strong growth channel, better-for-you energy drinks such as ZOA will have a strong value proposition to share with their buyers for the category to gain the shelf space consumers are searching for.

Investing in Premiumization

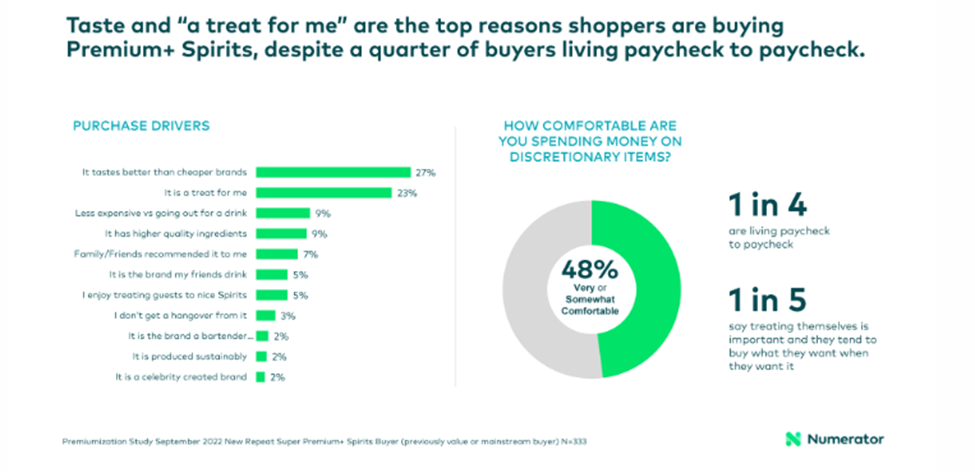

Across a broad range of categories, buy rate has been growing year over year. While there are many external forces— including inflation— driving this increase, in some categories spending has grown beyond what we might expect to see from those factors alone, suggesting that some consumers are spending more and trading up to more premium products. For example, according to Numerator’s recent article, “Premiumization Trends Amid Inflation”, last year premium Spirit Buyers included 65% existing buyers and 35% new buyers. These new purchasers represented an additional 5.9M households, stating that their top reasons for purchase were better taste (27%), treating themselves (23%), and buying premium spirits is less expensive than going out (9%).

While attending NACS, the Numerator team identified brands across a multitude of categories who are listening to their consumers and continuing to invest in key products, such as Q Mixers made with high-quality ingredients. Premium brands in the Cocktail Mixers category are heavily desirable for Gas & Convenience shoppers, as they are more likely to be willing to pay any price for organic (128 over-index) and equate brand name with quality (112 over-index) in comparison to all shoppers.

Flavor Innovation

In a landscape marked by the challenges of rising prices and reduced volumes, it is imperative for brands, restaurants, and retailers to gain a deep understanding of consumer preferences. This encompasses everything from food choices and cooking habits to dining decisions, all with the aim of capitalizing on growth opportunities. At NACS, one of the striking consumer preferences that came to the forefront, as also emphasized in Numerator’s Stomach Share Report, was a palpable demand for flavor innovation. This trend has been prominently visible in the CPG sector, where Asian flavors are being seamlessly integrated into everyday culinary experiences.

Key players in the snacking space, such as Herr’s Foods, Werner Jerky and Chung’s Gourmet Quality have successfully identified actionable opportunities to fuel market growth. Herr’s, a seasoned innovator in the realm of flavors, made waves earlier this year when they introduced their Korean BBQ Wings flavored chips in June. Meanwhile, the family-owned Werner Jerky showcased their Teriyaki and Honey Soy Sauce products, while Chung’s supplied a delightful mid-day snack at NACS with their egg rolls and samosas.

This trend in Asian flavor innovation doesn’t stop at established brands; it extends to the exciting emergence of Asian brands like Momofuku, Fly by Jing, J-Baslet, Kewpie and more. These brands aren’t just selling products, they are offering a gateway to experiencing new flavors and items consumers are eagerly embracing to elevate their everyday culinary experiences.

Conclusion

NACS continued to highlight consumer trends and expectations that are here to stay, however, as consumers continually evolve how and where they make their purchases, it’s crucial to discern the critical elements that drive their decisions during these purchasing occasions. Brands need to understand where they’re shoppers are heading and what they’re buying, if their promotions are impacting new or repeat customers in comparison to the competition, which channels shoppers are shifting their spend to, and who their shopper segments are and how they can most effectively build their marketing strategies.

Understanding these nuances not only equips brands to stay ahead in an evolving market but also to meet their consumers’ needs – whenever and wherever they choose to engage with their brand.

Interested in learning about how your brand’s shopper engages within the Gas & Convenience channel? Reach out to our team today to learn more.