As brands like LEGO and Labubu broaden the boundaries of play, the toy industry is attracting a more diverse set of shoppers—each with their own unique reasons for buying. Numerator’s Verified Voices survey of 300+ verified toy buyers who have purchased three or more toys in the past three months uncovers who is driving the toy evolution, the motivations behind their purchases, and which toys are fueling category growth heading into the holiday season.

The Shoppers Driving a New Era of Play

The majority of toy spending still comes from shoppers purchasing for children—whether their own or grandchildren (63%) or friends’ and relatives’ children (19%). However, the growing “kidult” trend is redefining the category, especially among urban consumers: 15% of shoppers now buy toys for themselves or another adult.

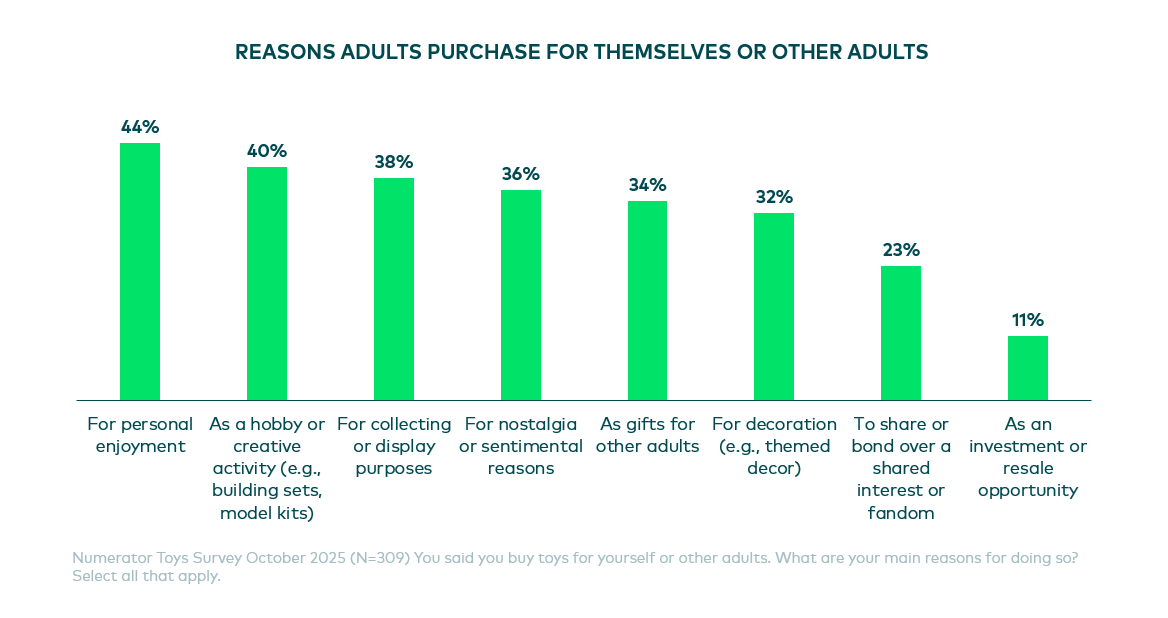

The “kidult” shoppers are driven by a range of motivations, including personal enjoyment (44%), hobbies or creative activities (40%), collecting or display purposes (38%), and nostalgia or sentimental value (36%). Their engagement reflects how the toy industry is evolving beyond play into expressions of identity, creativity, and comfort.

Among those buying for children, purchases continue to center around celebrations such as birthdays (82%) and holidays (80%). However, everyday play (“just because”) remains an important driver for 40% of shoppers. Regional differences also stand out: in the West, nearly half of shoppers (49%) buy toys as rewards or incentives for good behavior or grades, an impressive 147 index above the overall average.

These findings highlight how purchasing motivations vary across demographics such as region, urbanicity, and ethnicity, offering brands new opportunities to tailor messaging, product mix, and engagement strategies to a wider audience of play-driven consumers in the toy industry.

Playtime Powerhouses: The Winning Toys and Franchises

Top factors influencing shoppers’ toy purchase decisions include price or affordability (59%), the child’s or adult’s interest or request (58%), and educational or developmental value (43%). However, these factors vary by generation — for example, 28% of Gen X cite licensed branding (e.g., characters from Disney, Marvel, Pixar, etc.) as an influence, which represents a 145% over-index compared to the overall average.

These drivers contribute to the popularity of certain toy categories being purchased and/or collected, including LEGO sets (50%)—America’s leading toy brand— and plush toys (47%), such as stuffed animals and the 2025 phenomenon, Labubu. Board games and puzzles (42%) and cars or other toy vehicles (40%) also remain popular, though preferences vary by demographic. For example, Hispanic/Latino shoppers over-index strongly for action figures or figurines (+145).

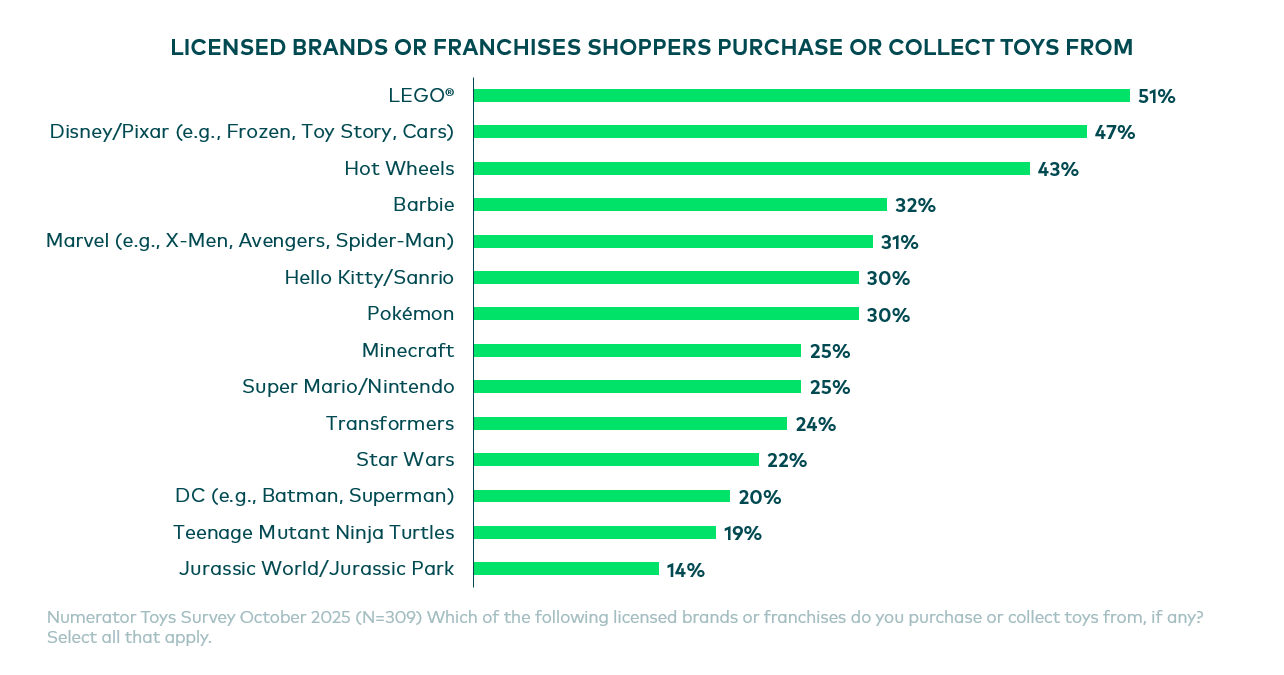

Although Labubu has dominated the toy industry in 2025, continued success will hinge on emotional connection and brand trust. Beloved franchises with established loyalty will maintain their share of spend. The top licensed brands or franchises from which shoppers purchase or collect toys include LEGO (51%), Disney/Pixar (47%), and Hot Wheels (43%).

Demographic nuances also reveal opportunity: male shoppers over-index on Transformers (+154%), while urban shoppers over-index on Hello Kitty/Sanrio (+146%). For toy brands, understanding these differences is key to sustaining engagement and strategically expanding their reach.

Navigating the Holiday Season

As the toy industry evolves, shoppers are gravitating toward brands that reflect their interests and lifestyles. To stay top of mind and win key occasions, brands must meet shoppers where they are. Want to learn how your brand or your key retail partners can win this holiday season? Connect with your Numerator account team or reach out to our team today.