As the second largest restaurant chain in the US and a favorite choice for all things coffee and morning meals, Starbucks stands out as a clear leader in the breakfast space. 83% of US households have visited Starbucks in the past year— more than have visited Target. Their reach is impressive, but what’s even more impressive is their mastery of digital strategy showcased in their highly successful mobile app.

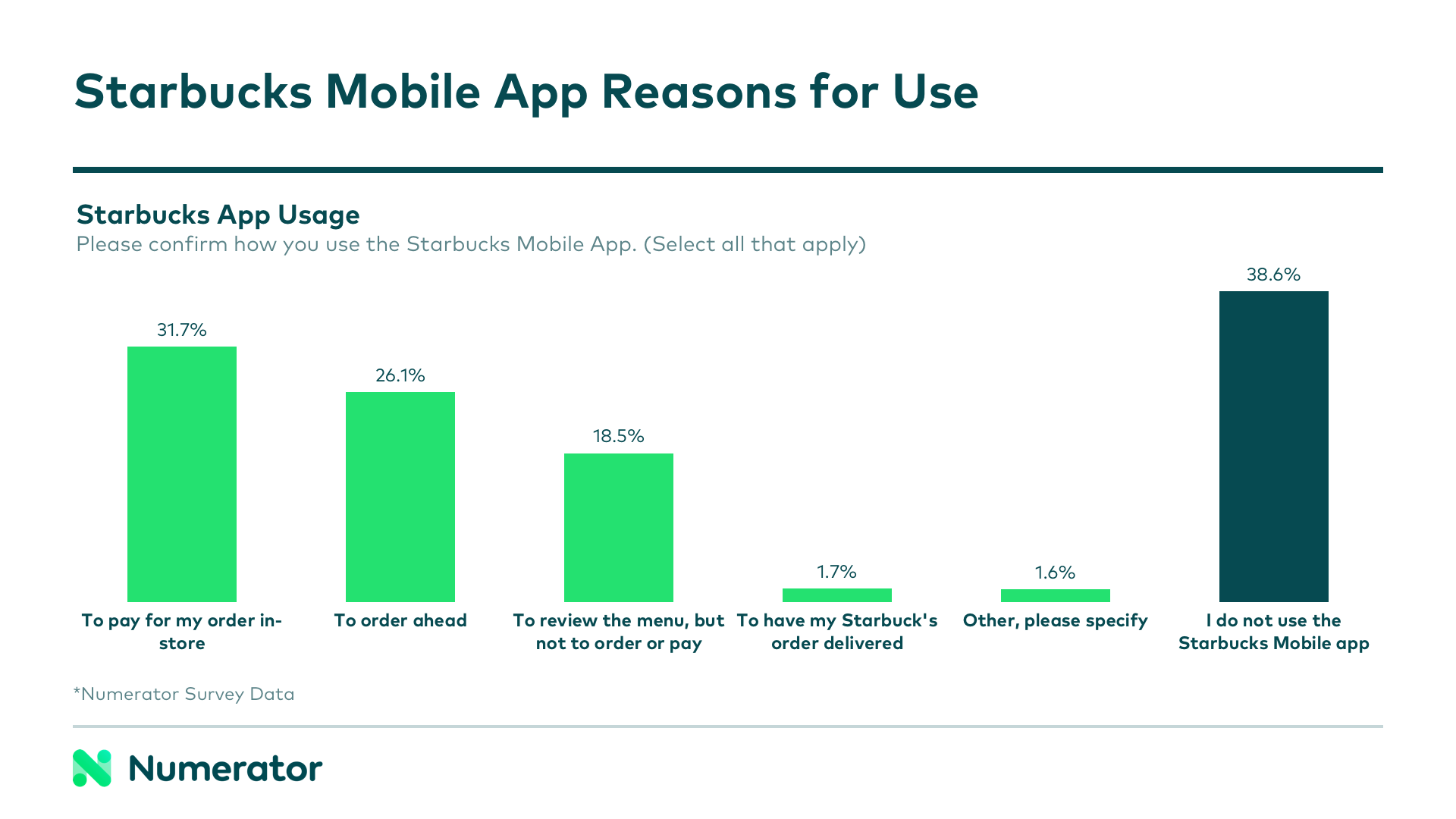

According to Numerator survey data, nearly two-thirds (61.4%) of Starbucks guests use the Starbucks app. Though 18.5% said they only used it to review the menu, the majority used it to order ahead or pay in-store. In-store payment was the top feature, used by 31.7% of guests, followed by order-ahead, used by 21.1%. Both features had high repeat rates, as well; 64.4% of guests who used the pay in-store feature used it every time they visited Starbucks, and 35% said the same of order-ahead, with an additional 54.1% who used order ahead at least half of the time.

Starbucks guests using the app are creatures of routine and typically buy the same size and type of drink each time they visit. 65% order the same type of drink, and 90% order the same size: 40% grande, 36% venti and 14% tall. The favorites section of the app and the option to repeat past orders likely has everything to do with this consistency; in offering such a quick and easy way to order and pay for their favorites, Starbucks has built a loyal base of customers.

Other QSRs can look to the Starbucks app as the gold standard for their own apps, but also must acknowledge the differences across categories and dayparts; while consumers might enjoy the same coffee and breakfast sandwich combo day-to-day, they’re probably less likely to eat the same lunch or dinner day after day, making habitual re-ordering less likely.

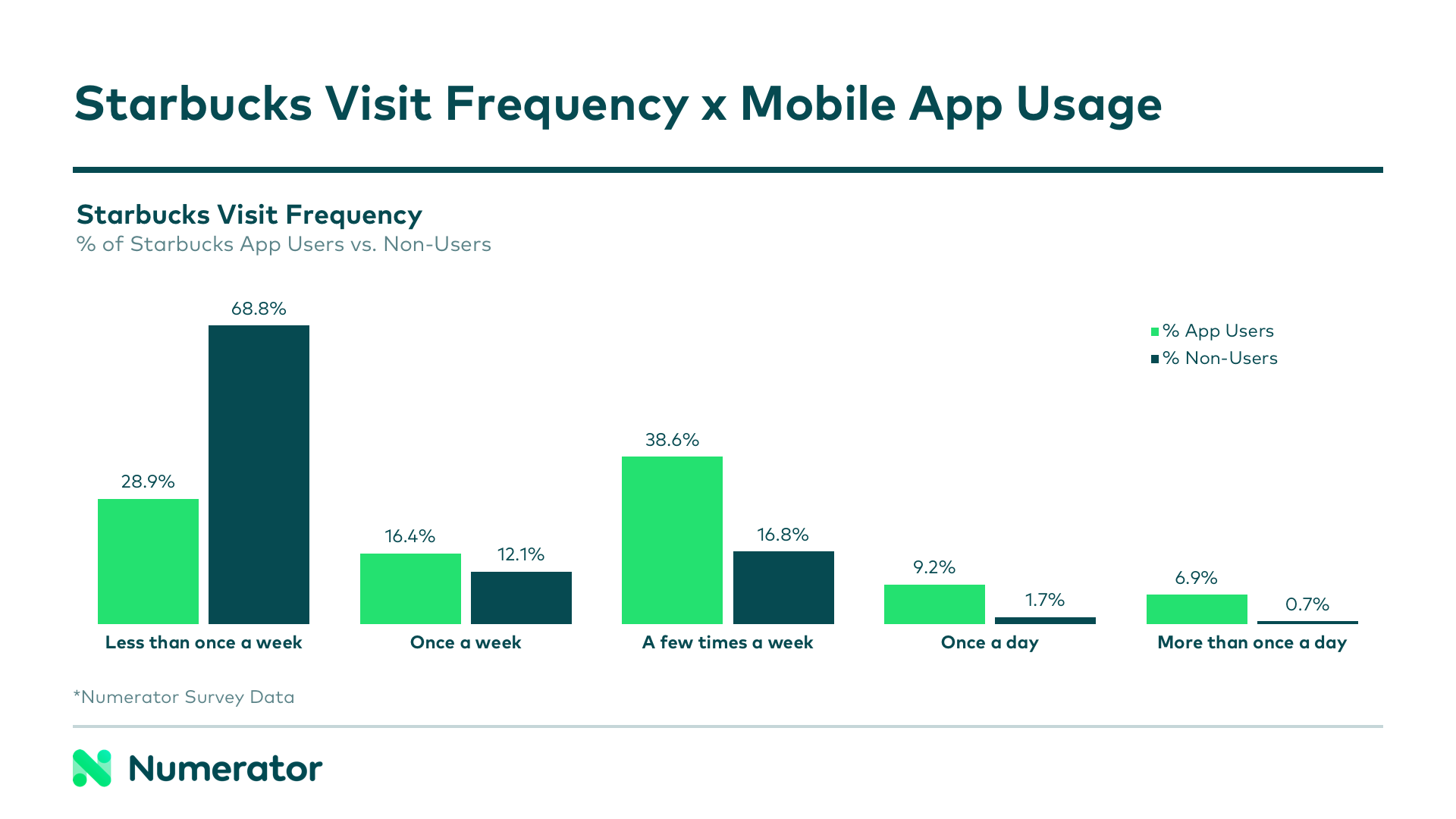

Frequency of Starbucks visits appeared to be correlated with app usage, according to our data. Overall, 47% of Starbucks guests visit the chain at least once a week; for app users, this number was 71%, and for non-users it was only 31%. The trend intensified as trip frequency increased: app users were 2.3x more likely to visit multiple times per week, 5.6x more likely to visit daily, and 10.1x more likely to visit multiple times per day.

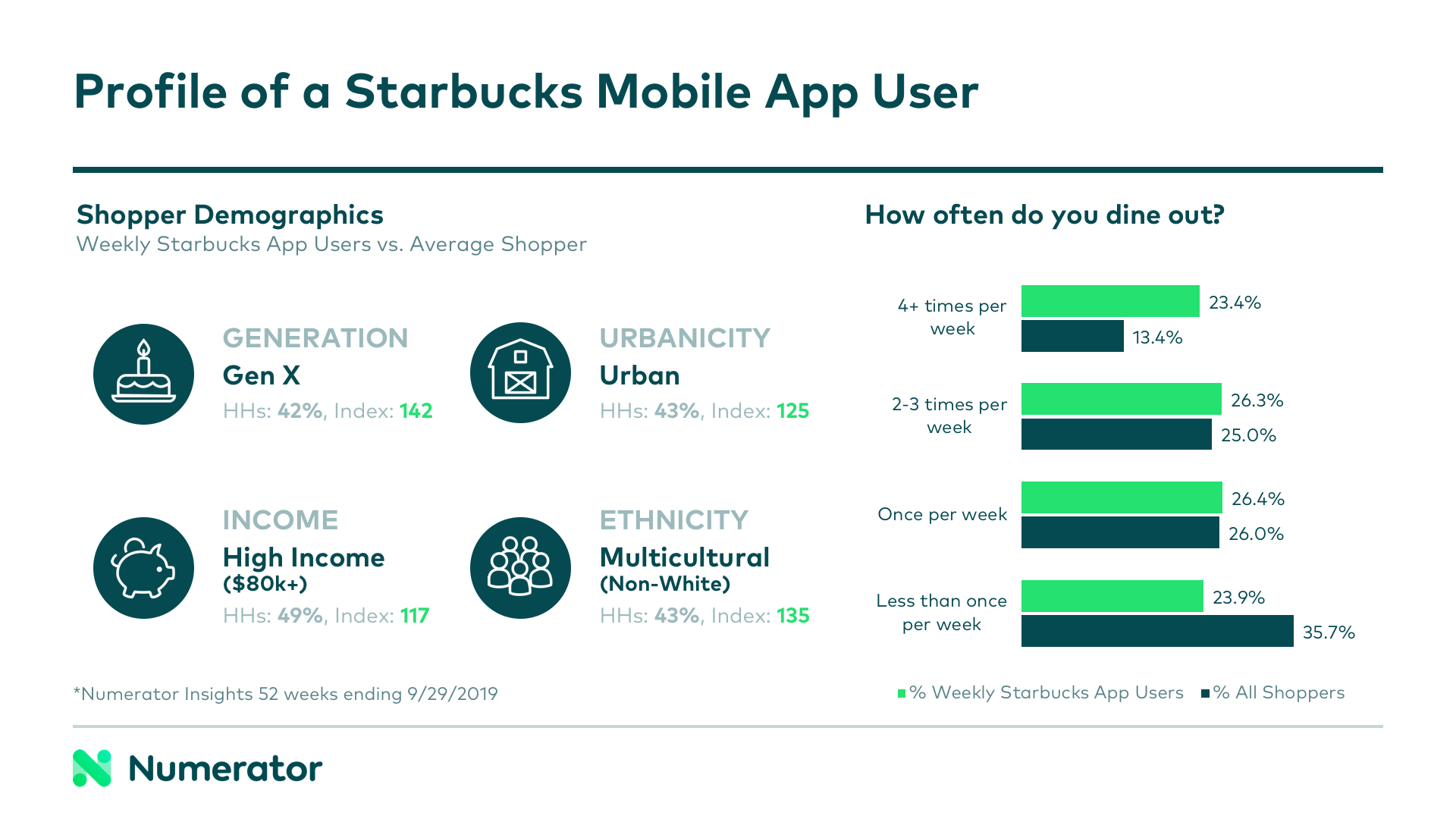

Starbucks guests who used the app and visited at least once a week skewed Gen X, high income, urban and multicultural. Not only did they spend more at Starbucks than the typical guest, they also spent more at QSRs in general. 50% of the group dines out at least twice per week, which is 1.3x higher than the general population.

For competitors— QSR and beyond— going up against Starbucks will require more than just carrying appealing food and beverages. Most Starbucks guests, especially frequent visitors and app users, have their routines down pat, meaning the most difficult part of competing will be to disrupt the Starbucks cycle and promote trial of your brand. Targeted ad campaigns, competitive pricing and compelling promotions will be necessary to capture the attention of Starbucks loyalists, and an equal or better digital experience will be key to retaining their business.

Are you a QSR or brand manager competing in the breakfast space? The most important meal of the day deserves the most complete data. Reach out today and let us help you better understand the shifting landscape so you can win share of stomach.