NUMERATOR GENERATIONS HUB

Uncover generational shopping trends.

Explore shopper insights across Gen Z, Millennials, Gen X and Boomers including their market size, distinct shopping behaviors and shifting consumer expectations. Go deeper with nuanced breakdowns that reveal meaningful differences within each generation, so you can strategize, target and resonate with greater precision.

Which generation drives consumer spending?

A third of consumer spending now comes from adult Gen Z and Millennials.

Boomers and Gen X still lead US CPG, general merchandise and QSR spending but the balance is shifting.

Younger households are driving the gains. Millennials and adult Gen Z now command 32% of spend, an 8-point increase since 2020. Gen Z’s share has more than doubled—from 2.6% in 2020 to 6.1% in 2025—while Millennials have steadily climbed to 26.1%, representing over one in four spending dollars.

Gen X’s share has stayed steady at about 34%, but Boomers+ have seen a nearly 10-point drop since 2020, falling to 33.7% today.

As the generational mix of spending power evolves, so do the expectations that shape how and where consumers engage. Brands that adapt with precise, generation-specific strategies, grounded in what drives each group’s choices, will be positioned to win both today’s dollars and tomorrow’s loyalty.

Where do different generations shop—and how is it changing?

Consumer dollars are moving to different channels in CPG and General Merchandise.

Generational behavior is reshaping where consumers shop, but not always in expected ways. While Gen Z is digitally native, their CPG spending still leans in-store, especially toward value-driven formats like club and convenience. Club saw the strongest share growth across generations, led by Gen Z (+1.1 points), while convenience posted consistent gains, including among Boomers. Meanwhile, traditional mass and drug channels declined across most age groups, suggesting a broader trend.

Online growth in CPG was modest and mostly Millennial-led, with small gains in mass and pureplay channels.

In contrast, general merchandise tells a more digital story: pureplay online channels gained across all generations, with Gen Z and Boomers each up 1.2 points—challenging assumptions that eCommerce growth is driven only by the young.

Similar trends challenging preconceived notions also emerged in general merchandise. Younger shoppers showed movement toward home improvement, auto and club retailers, while older shoppers drove growth in online general merchandise. Department stores and electronics—both in-store and online—lost share among younger generations, signaling a potential mismatch with their evolving expectations.

Select Your Industry:

How does each generation define their own identity?

Each generation represents a theme of change, resilience and self-awareness.

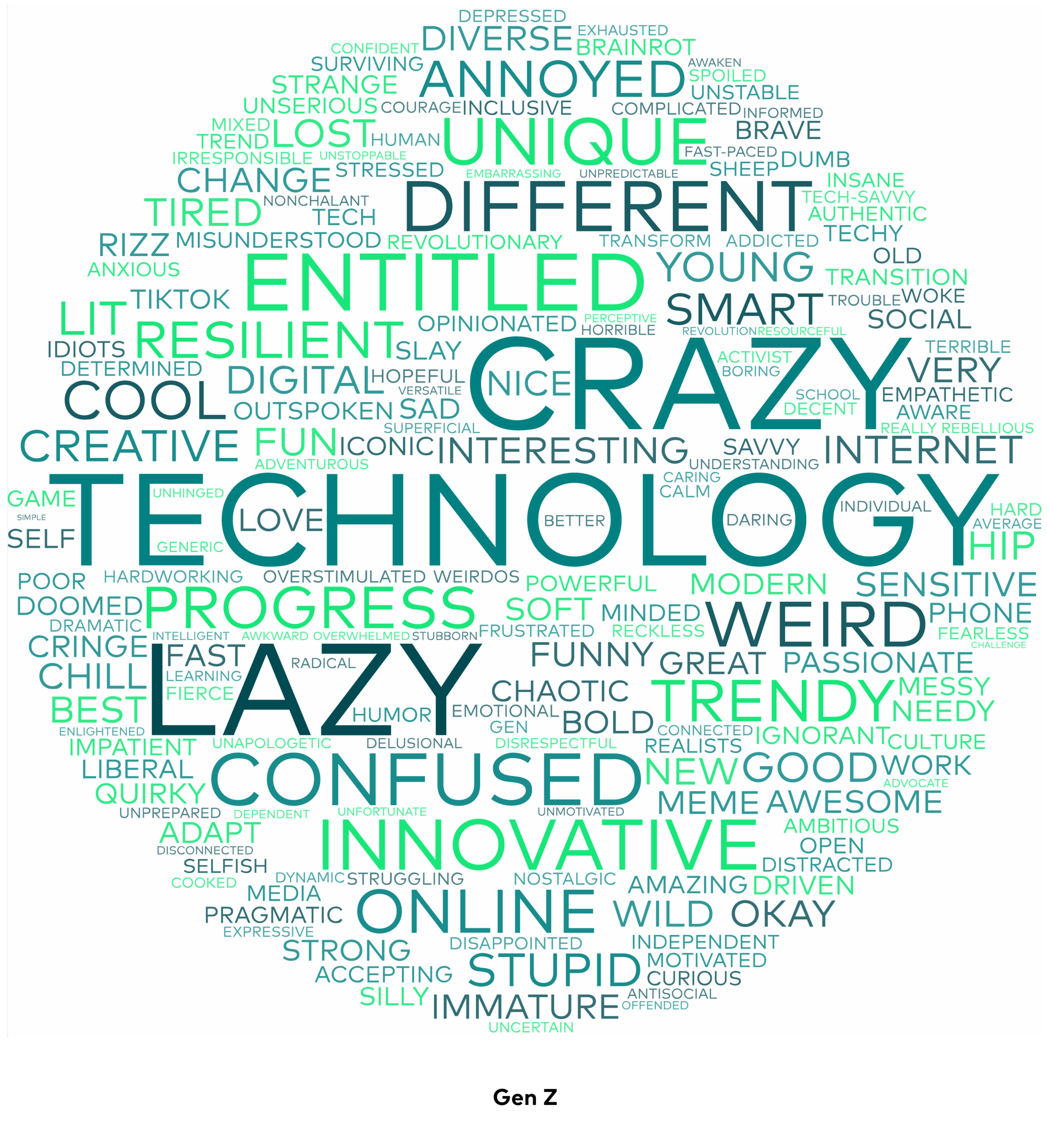

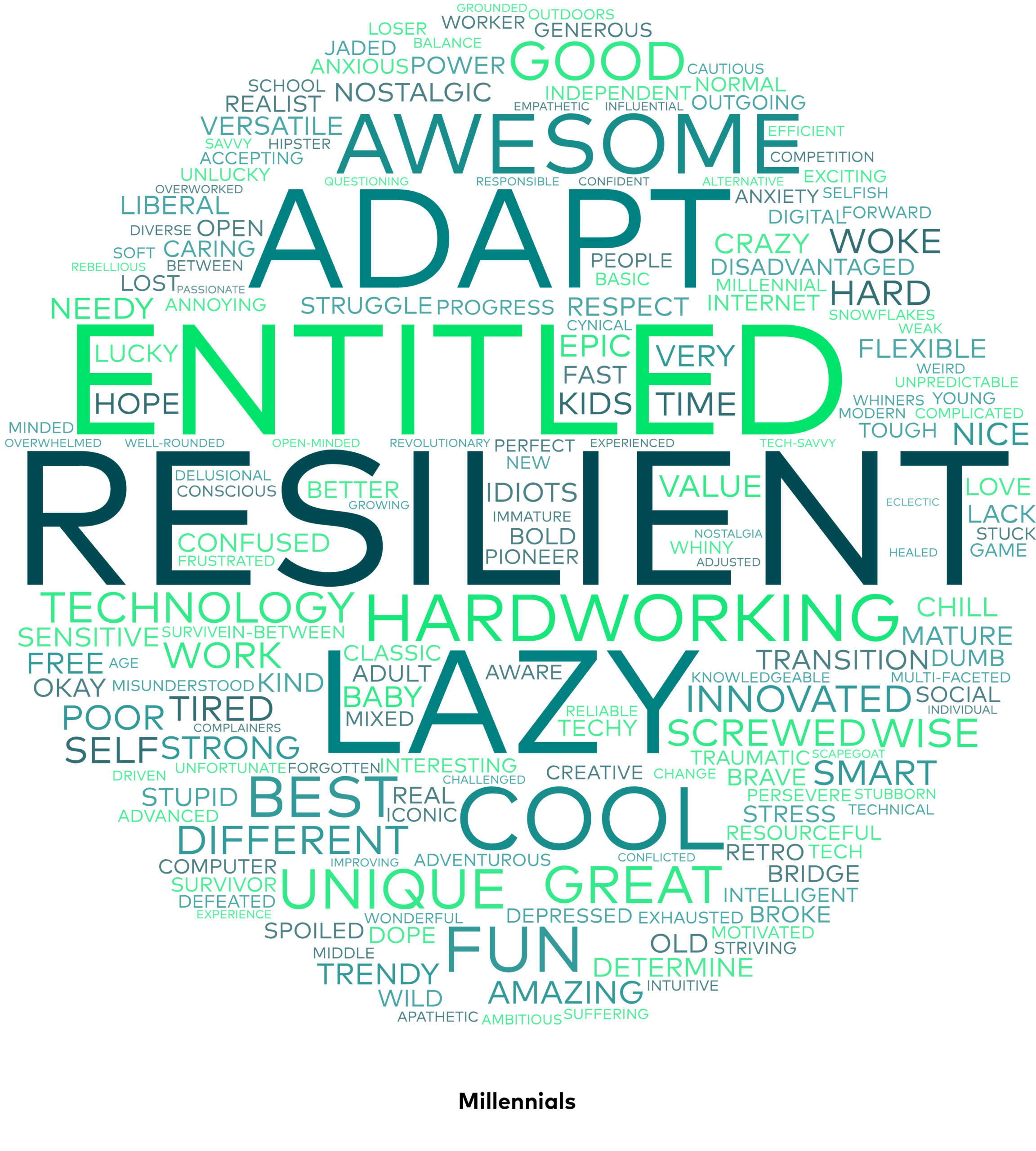

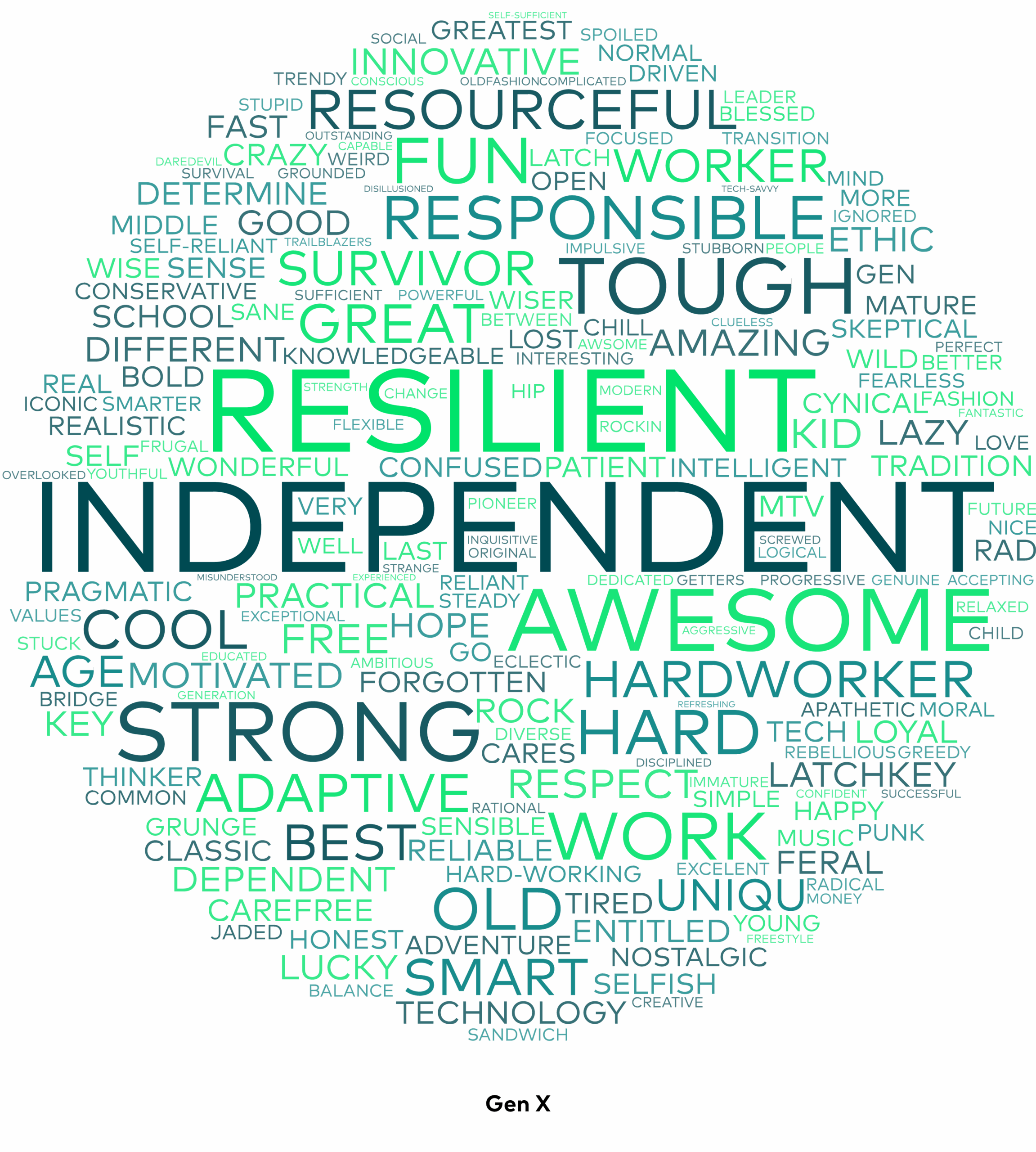

Q. If you could describe your generation, [generation], in one word, what would it be?

Source: Numerator | Showing top 200 most frequently used words.

When asked to describe their own generation in a single word, Gen Z describes itself with words like “Technology,” “Innovative” and “Different,” but also “Crazy” and “Entitled.” Their self-image is shaped by both digital confidence and cultural critique. Only 50% say they identify with their generation, the lowest of any group, hinting at ongoing identity changes and a disconnect between how they see themselves and how they feel seen.

Millennials reflect a dual narrative. While “Entitled” and “Lazy” surface, so do “Resilient,” “Adapt” and “Hardworking.” Two-thirds of Millennials feel aligned with their generation, signaling a complex but active effort to redefine their reputation in the face of long-standing stereotypes.

Gen X clearly sees itself as “Independent,” “Resilient” and “Strong.” With 75% identifying with their generation, they express quiet confidence and self-reliance. Their words reinforce their reputation as adaptable, steady and overlooked, but they are content with it.

Boomers lead in generational pride. Words like “Great,” “Worker,” “Respect” and “Responsible” dominate their self-description. With 78% identifying strongly or somewhat, they project a legacy built on discipline, contribution and earned status.

Understand the consumer across generations through our deep dives.

Gen Alpha

Becoming

the Next Generation

Learn about how the future generation shops, take care of their health and use social media.

Gen Z

Powerful and

Growing Fast

Uncover Gen Z’s biggest trends such as personalization and social shopping.

Millennials

Transforming

Shopping Trends

As Millennials hit major milestones, see how flavor preferences and brand loyalty change.

Gen X

Core Anchors

of Spend

Being the largest spenders, discover what drives Gen X’s purchasing and consumption.

Boomers

Unstoppable

Shoppers

Find out what key trends are helping Boomers make their purchasing decisions.

Ready to connect with your consumer across generations?

600K+ purchase-verified panelists to survey based on purchasing behaviors and understand the why behind the buy.

Millions of Gen Z trips captured with digital and in-store methods for longitudinal tracking.

200K static panelists to discover historical and in-depth shopping behaviors across 44K tracked retailers.

Numerator uncovers your consumer to inspire you for growth. Reach out to find out how.

Thank you!

A member of our team will get back to you within 24 hours. In the meantime, explore our content to get a pulse on the latest consumer and shopper insights trends.