As retailers like Best Buy and Toys R Us close the doors on hundreds of their locations, small format and specialty retailers are popping up left and right, with 2,970 small format shops opening in 2017 alone. Emerging retailers like Trader Joe’s, Aldi and Dollar General are finding massive success with their smaller stores, and established retailers like Target, Walmart and Macy’s are testing smaller formats for their traditionally large stores, as well.

What’s causing this small format revolution? Many retailers simply want to be closer to their customers, especially in urban areas that don’t have room for mega stores. Smaller stores allow retailers to be more agile, to offer new services and different brands, to take full advantage of technology, and to maintain leaner inventories.

Of course, there’s more to small format success than just cutting down on square footage. Big box retailers won’t succeed if they simply open smaller versions of their bigger boxes. What’s the key to big success with a small format, how does a compact footprint affect shopping trips, and what do customers like most about small format stores?

Numerator conducted a custom analysis of small format & specialty stores to answer these questions and more.

Small Format Shopping

Households make an average of 87 small format shopping trips per year, spending an average of $1,430, according to InfoScout OmniPanel™ data. 25% of CPG trips and 13% of CPG dollars go to small format and specialty stores.

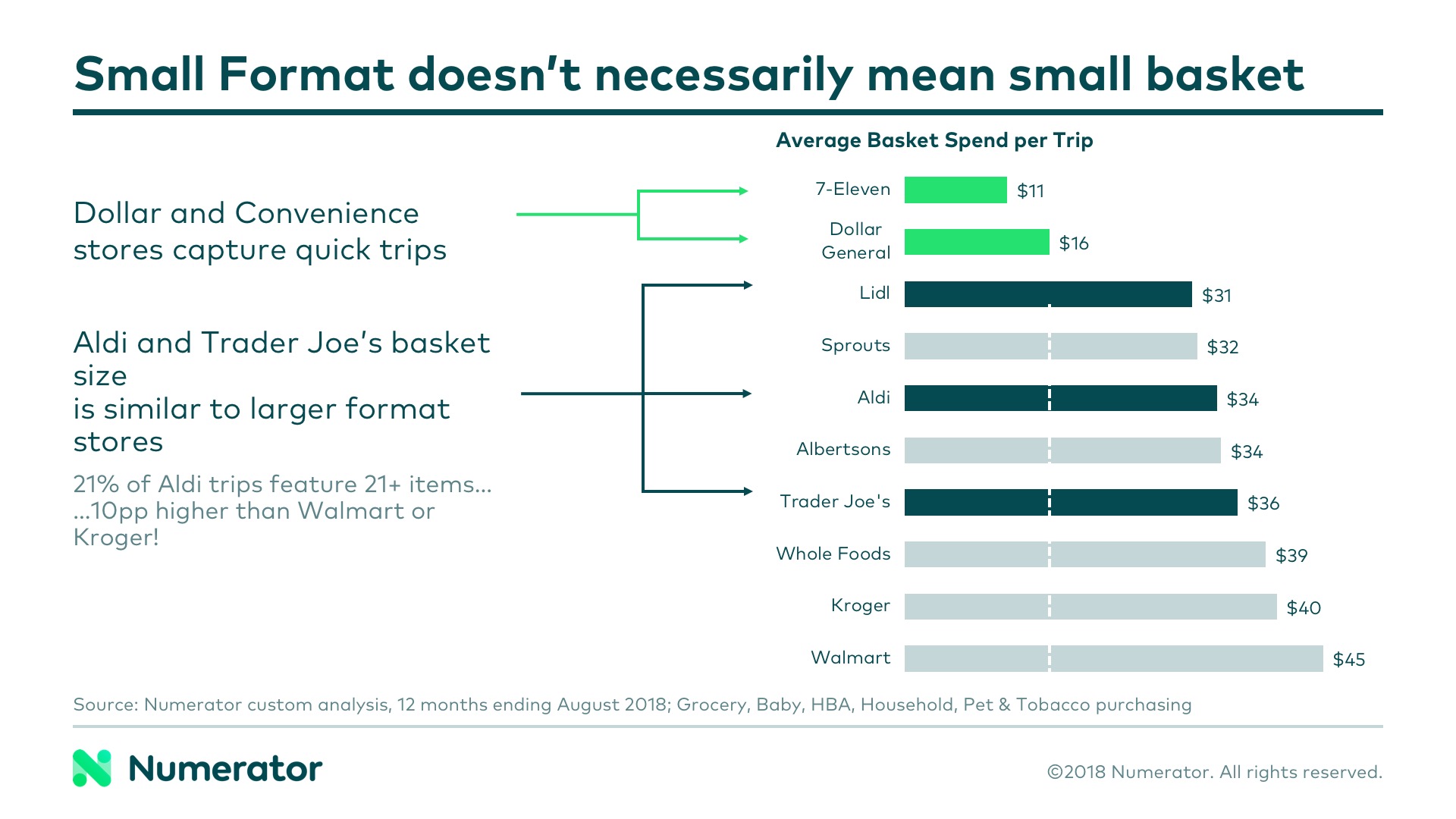

Small stores don’t necessarily translate to small baskets, though. While dollar and convenience stores capture quick trips and tend to have lower average basket spend per trip, that’s not the case for Trader Joe’s, Aldi and Lidl. In fact, 21% of Aldi trips include 21 or more items, which is a higher percentage than Walmart and Kroger.

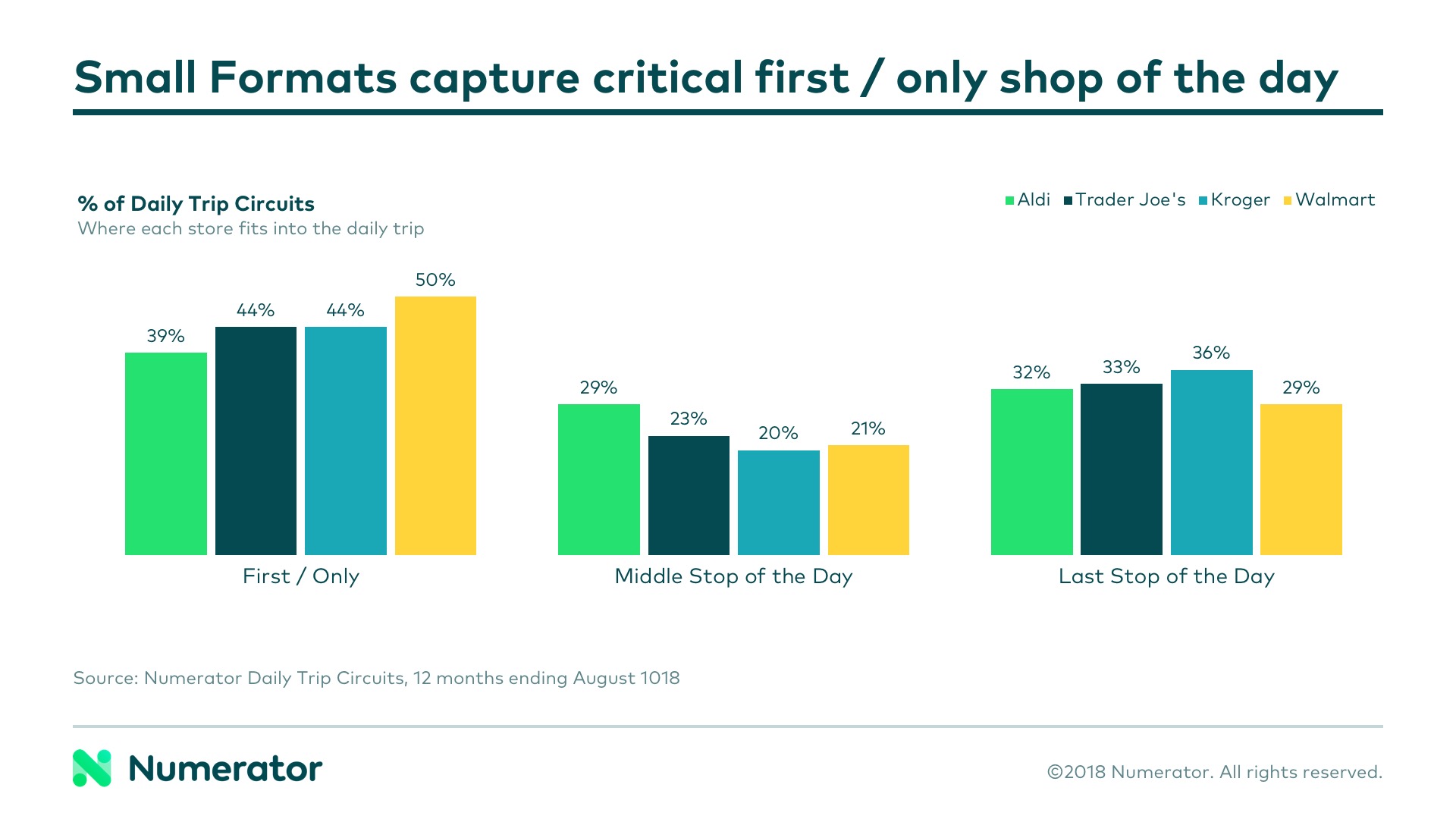

Basket size declines after the first or only stop in a trip circuit, and small formats capture those critical first or only stops. 44% of Trader Joe’s trips and 39% of Aldi trips are the first or only stop of the day in the trip circuit.

Shoppers Weigh In

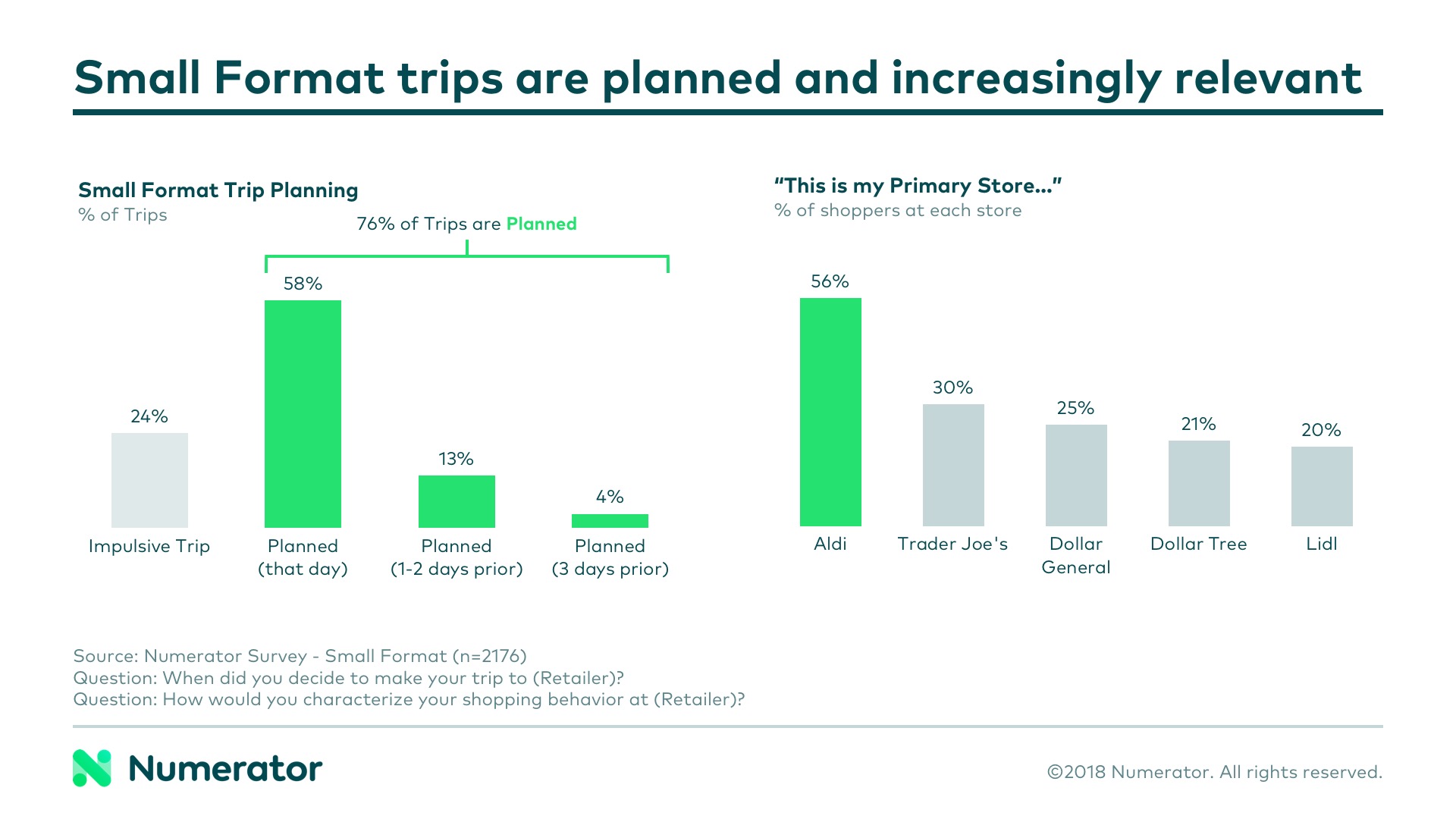

While many smaller retailers are struggling to become relevant, Aldi’s model has already proven viable. According to Numerator survey data, 93% of Aldi trips are planned, compared to 76% for other small format stores. Additionally, 56% of Aldi shoppers consider Aldi their primary store, a far higher percentage than Trader Joe’s, Dollar General, Dollar Tree and Lidl.

It’s no secret that convenience is a major driver behind the success of small format stores, and our data reinforces that fact, with 50% of survey respondents saying small formats are much more convenient than larger stores.

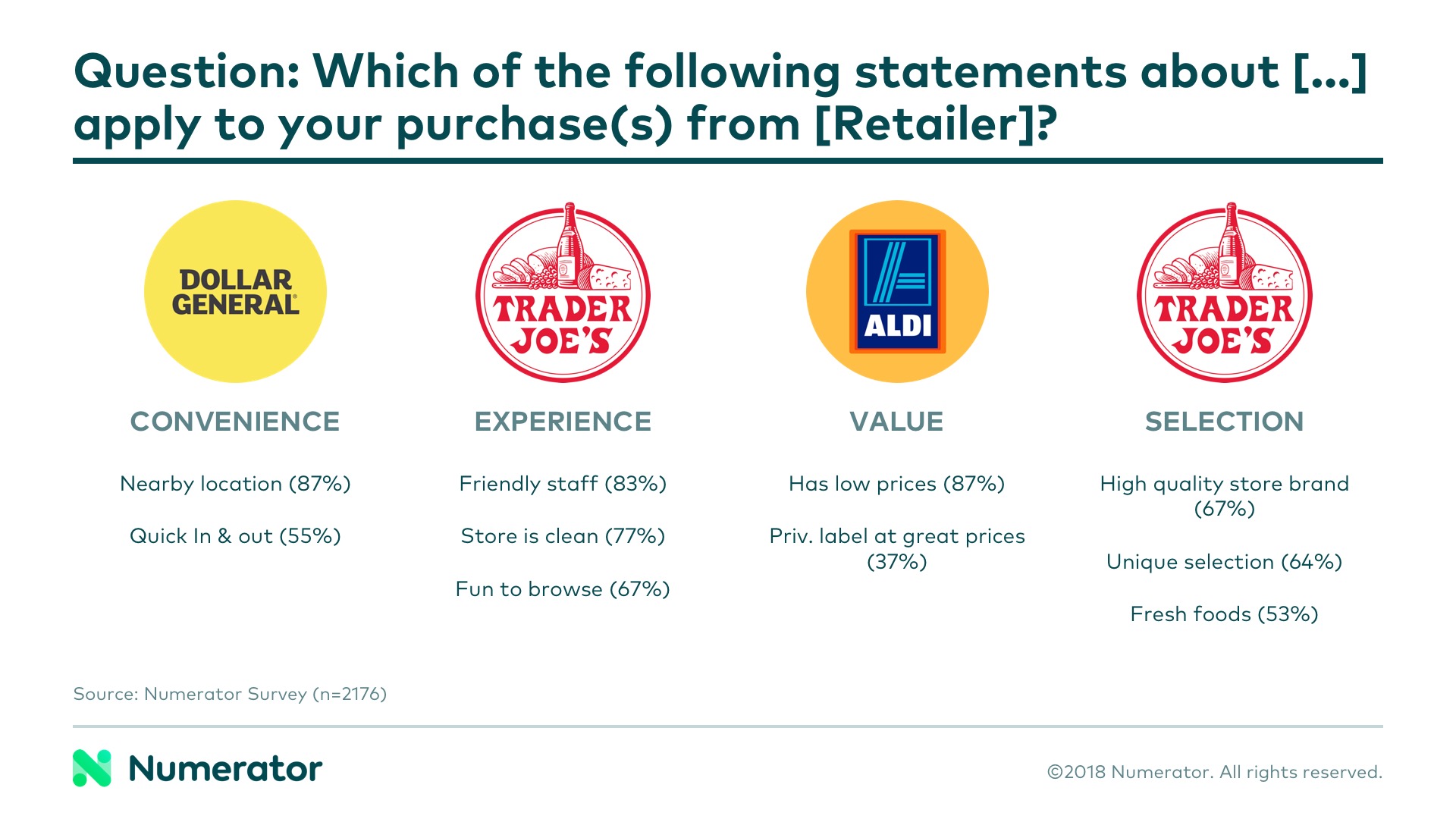

But it’s not just about convenience. Shoppers are also reporting much better experiences (38%), value (36%) and selection (23%) at small format stores. Digging deeper into customer perception of Dollar General, Trader Joe’s and Aldi, we see that customers point to not only convenience, but friendly staff, store cleanliness, prices, brands and selection as positive attributes.

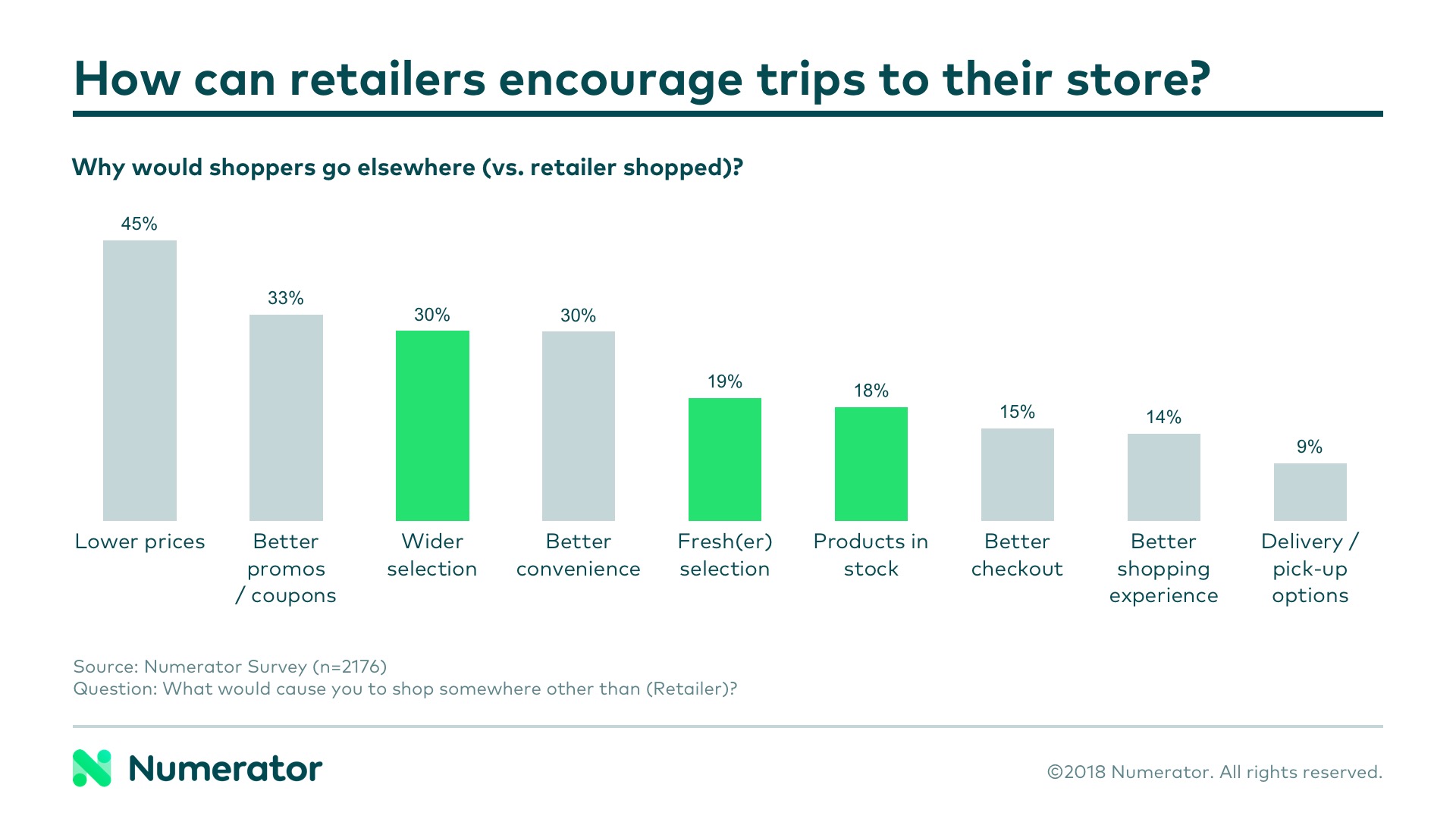

While customers certainly value the shopping experience, it’s not a key factor that would cause someone to switch to a different retailer. Product selection and availability are areas in which retailers and manufacturers can collaborate to win more shopping trips.

The Role of Private Label

With such a limited amount of shelf space, small format retailers must think carefully about their product assortment; too many options could significantly cut into private label margins, while too few options could fail to satisfy shoppers. According to Numerator Analytics, private label represents a large percentage of sales for small format retailers such as Aldi (86% of sales), Lidl (73% of sales) and Dollar Tree (49% of sales).

To stay competitive and differentiated, larger retailers have the opportunity to promote a wide range of both products and price points to meet shopper needs. At the same time, manufacturers can offer brands that deliver benefits not found in private label, both to complement small store assortments and to stand out in large stores.

Key Takeaways

Despite their smaller footprints and limited assortments, small format stores see dollar spend that is on par with their large format counterparts. As these new stores continue to flourish, we have a few suggestions for manufacturers and retailers large and small.

For Small Format Retailers:

-

Optimize assortment to attract the maximum number of trips.

-

Continue to deliver the convenience and value that make smaller stores stand out from larger retailers in the eyes of the consumer.

-

Find the right balance between food and non-food products to operate efficiently.

-

Identify categories in which private label is competitive and determine when national brands are necessary to satisfy core shopper needs.

For Manufacturers:

-

Offer the right product at the right price to meet consumer expectations.

-

Differentiate products from the private labels offered by small format retailers.

For Large Format Retailers:

-

Focus on providing a better assortment, not a larger assortment, to differentiate from smaller retailers.

-

Find the right mix of local and niche brands that appeal to shoppers. This should include unique, value-added private label.

-

Look for ways to accommodate on-the-go shoppers by making shopping more convenient for smaller trips.

-

Develop marketing strategies that speak to the needs and preferences of small format shoppers.

Click here to set up a demo and learn more about how Numerator, powered by the InfoScout OmniPanel, can help you succeed in a quickly evolving retail landscape.