With shelter-in-place orders enacted in most states across the country, shopping behavior is rapidly changing in response to the COVID-19 pandemic. Despite the fluctuating nature of these shifts, there is much retailers can do to respond to the evolving needs of shoppers during this critical period.

In this post, we’ll summarize some of the main takeaways shared in our recent webinar on how retailers can respond to shifting behavior in response to COVID-19. Using data from Numerator’s Insights and Promotions Intelligence solutions, we’re breaking down the biggest impacts to retailers and sharing ways in which retailers can continue to support consumers during these challenging times.

COVID-19 Impact on Retail Channels

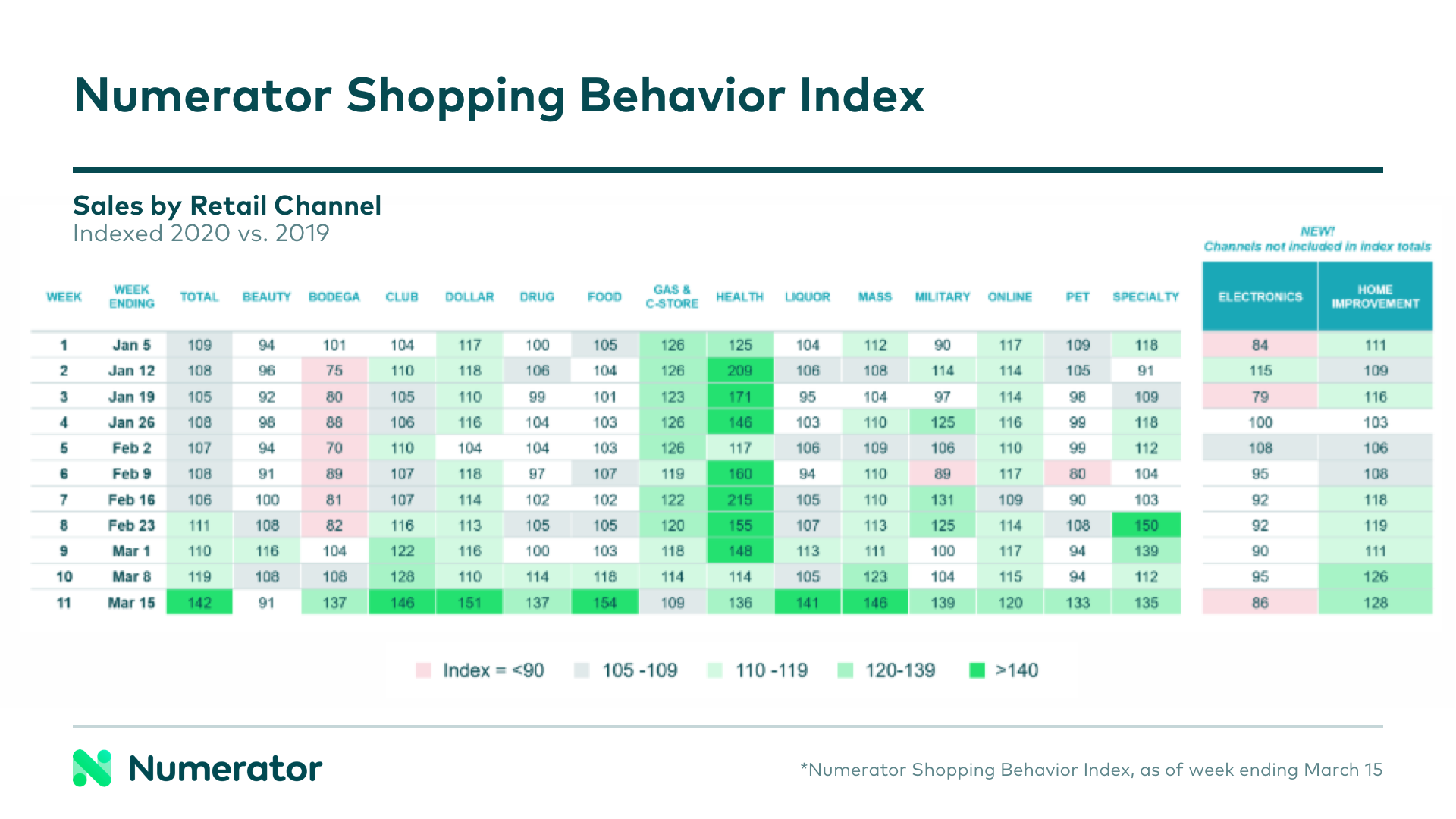

Numerator’s Shopping Behavior Index provides weekly updates to measure impact across retail channels during the COVID-19 outbreak. The Club channel saw an early surge during the crisis as consumers stocked up on household essentials like toilet paper. However, Dollar and Food channels are now emerging as core channels for shoppers. Liquor is also seeing an increase, perhaps due in part to people learning to cope with the crisis and social distancing measures, but also possibly out of fear of statewide closures.

Slowing down are Beauty and C-Store channels. Beauty was quick to close locations early on, respecting social distancing measures and efforts to flatten the COVID-19 curve. C-Store’s decline is more a result of shoppers making fewer discretionary trips for non-essential items.

QSR started strong in 2020, but trips and sales had declined by the week of March 15th. The good news is that, in terms of households, the decrease is small. This means that people are still visiting QSR; they’re simply making fewer trips. This finding was also echoed in our latest survey of consumers on the impact of COVID-19 on their buying behavior. We expect to see QSR rebound once shelter-in-place restrictions have eased.

Shopping Patterns by Region

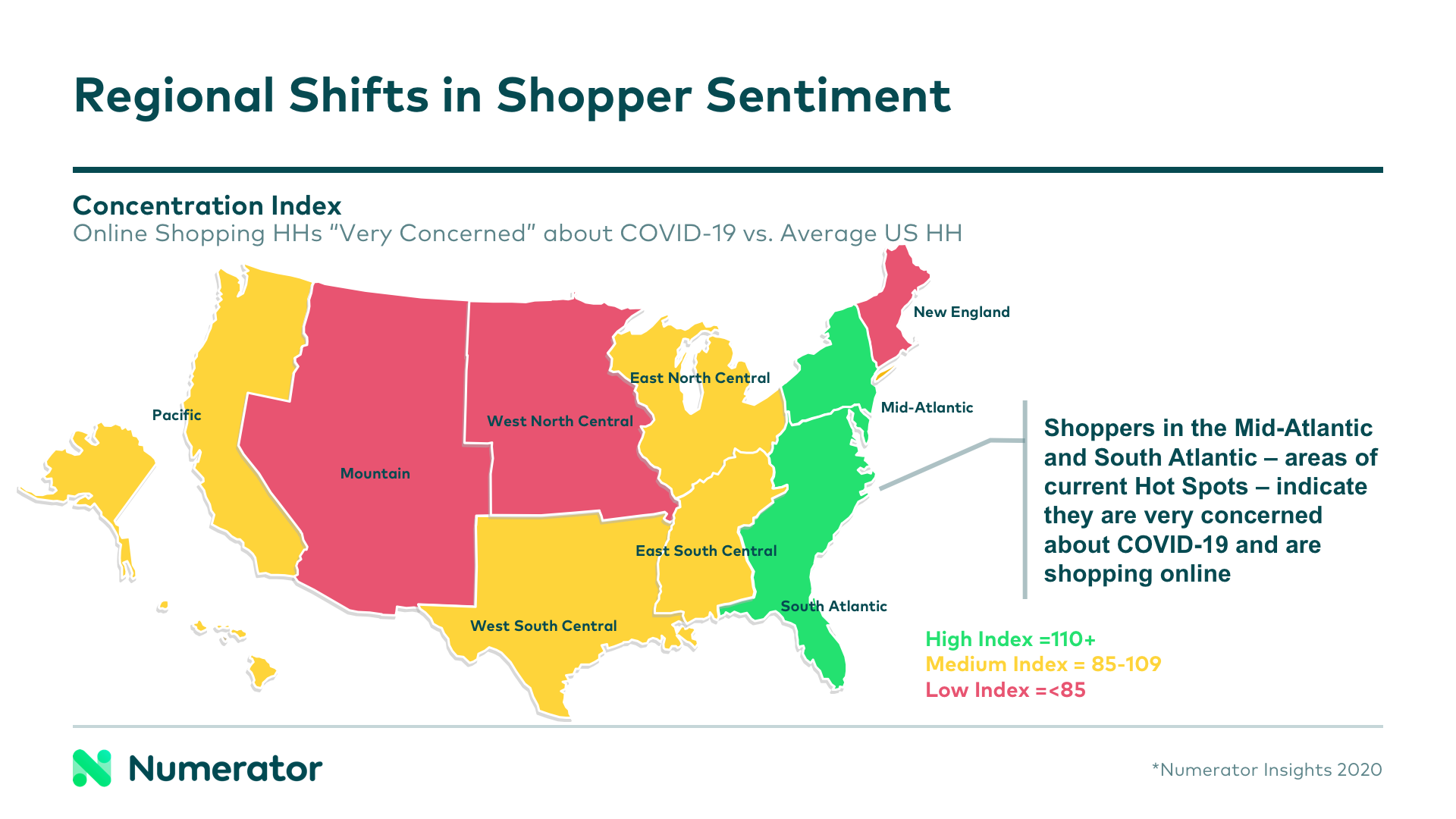

We’re finding shopper behaviors and fears are intricately tied to virus hot spots. The Mid- and South Atlantic regions reflect a much greater concern about COVID-19 due to these areas being harder hit by the virus. This impacts what items people are looking for from their retailers.

As we anticipate new hot spots will arise, retailers offering delivery options should increase their capacity in these areas as they’re able. They may also want to consider supply chain options to maximize the availability of products. While this is an opportunity to grow consumer conversion to online shopping methods, positively managing the in-store shopper experience will still be key to optimizing any long-term conversion potential.

Addressing Shopper Concerns in Times of Crisis

Shoppers have different needs during a crisis, and attitudes have continued to shift even within the last few weeks. While shoppers surveyed said they’d like to see more fully stocked shelves, they acknowledged it wasn’t the fault of retailers and due instead to the crisis. However, their willingness to be understanding could change if some stores recover more quickly than others and only certain retailers can keep up with demand.

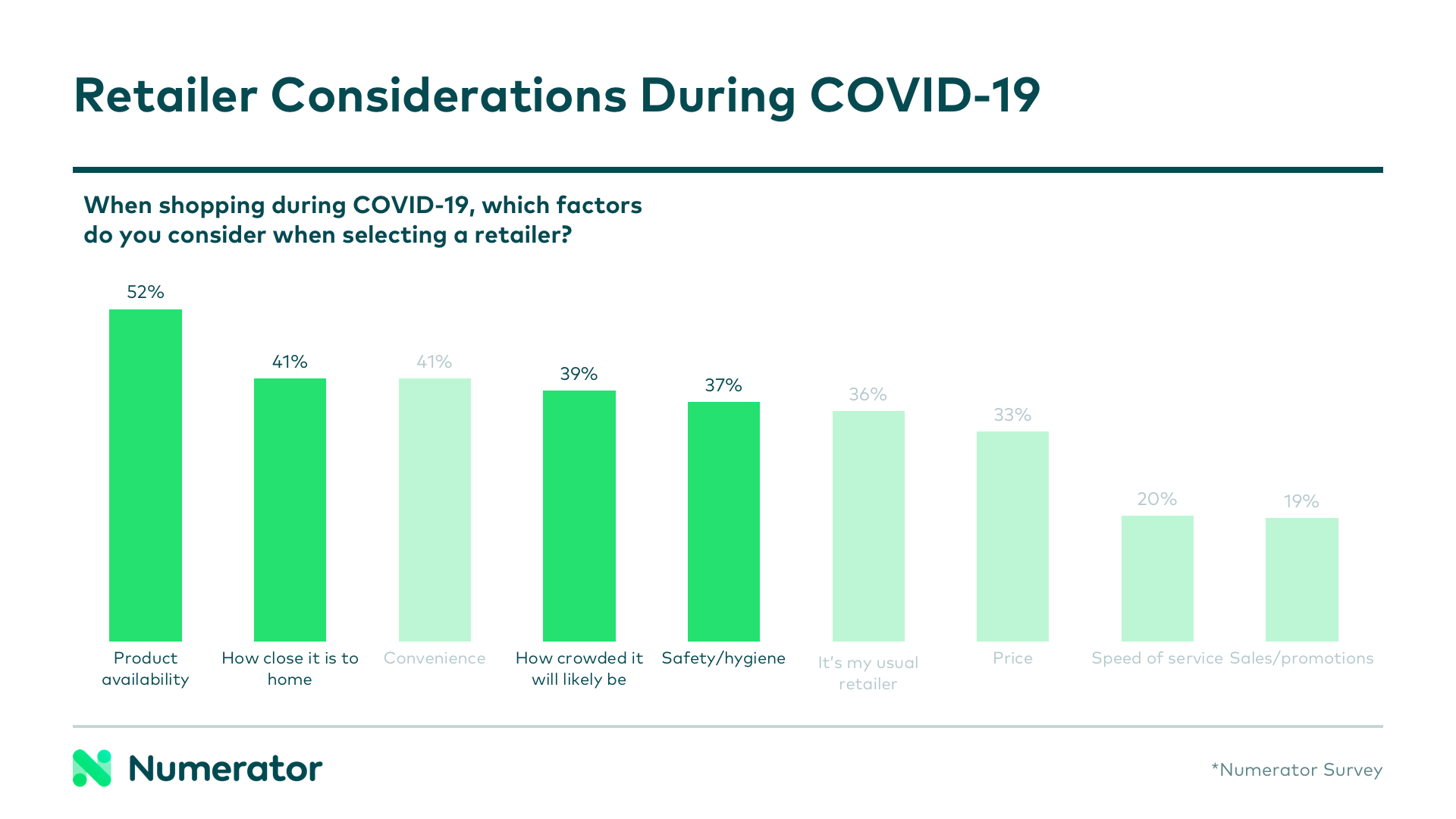

When selecting a retailer, price and convenience are still driving forces for shoppers regardless of channel. However, other factors have now taken priority. Product availability is now a key factor for 52% of shoppers. Closeness to home and crowd size are also prominent concerns with 39% of consumers trying to spend less time in the store to limit their exposure to others.

Shoppers are looking to retailers for reassurance that their shelves will be stocked. They want to know measures are in place to follow social distancing guidelines and that they’re in a safe and clean environment. Retailers who can provide that peace of mind, help customers get in and out quickly, and reduce crowds will win more loyalty on those points in addition to price.

Click-and-Collect on the Rise

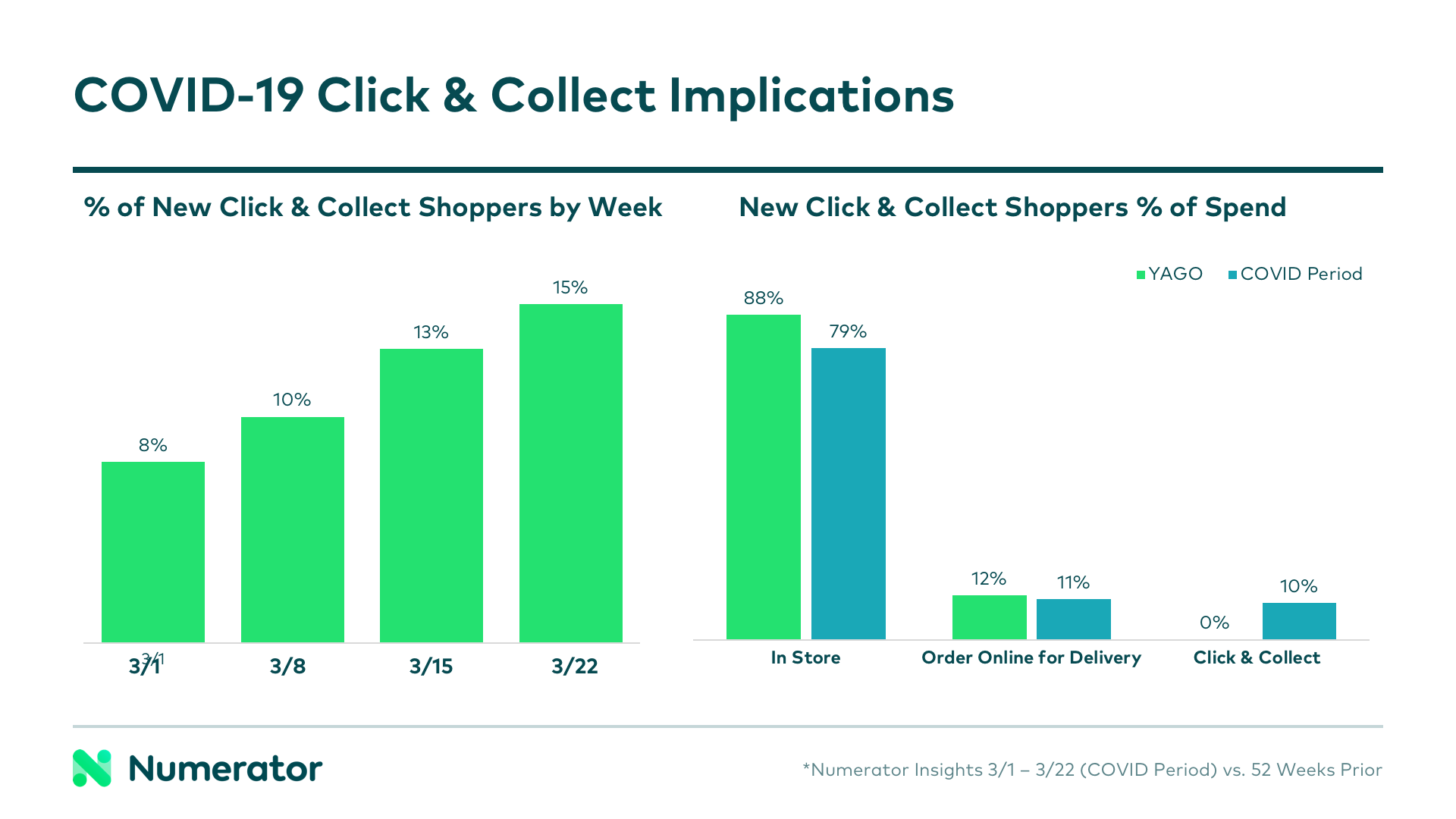

Not surprisingly, online shopping has experienced a boom. Shoppers are trying to avoid leaving home, electing to have products shipped to them or taking advantage of click-and-collect options. Convenience remains key for consumers, and the crisis is exposing them to new ways of making their shopping experience easier.

We’re seeing more shoppers try click-and-collect for the first time, and it’s rapidly increasing week by week. Greater click-and-collect usage is also leading to larger baskets as consumers stock-up through this format and spend less in stores.

Click-and-collect is also attracting new demographics with more seniors and young singles taking advantage of this option. These particular consumer groups were harder to convert initially, but we’re seeing a significant increase in their engagement with this service.

Supporting shoppers as they use these tools will help encourage long-term, repeat behavior. We recommend retailers track the data on these shoppers to see if this shift sticks since this could end up becoming a lasting change.

Promotion Strategies in the Age of COVID-19

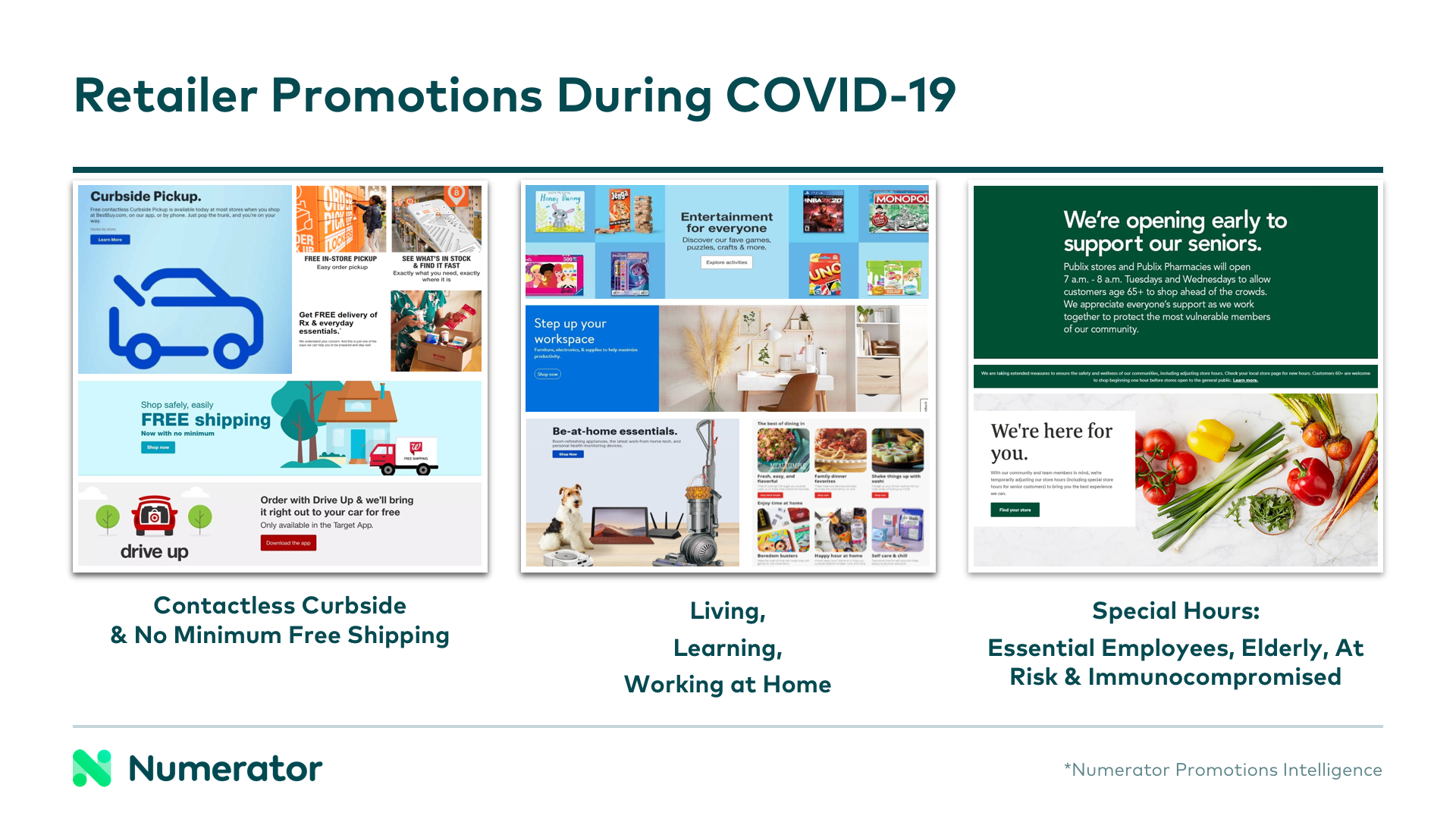

Due to these changes in consumer needs, retailers are beginning to market differently to consumers. They’re advertising efficient shopping alternatives such as contactless curbside pick-up and removing minimum purchase requirements for free shipping. Simply having these new services available has given shoppers enough incentive to try them.

Retailers are also focusing their promotions on in-home activities as people continue to work, live, and learn while isolating at home.

Empathy during a time of hardship wins greater loyalty as normalcy returns, and people are looking to retailer brands to provide guidance and support during this difficult time. We’re seeing retailers highlight how they’re assisting the community in a variety of creative ways, such as offering special hours for the elderly and at risk.

Looking Ahead

These are unprecedented times. Moving forward, we can’t predict what the new normal will be, but there will likely be a lasting change in shopper behavior. Retailers are attracting new shoppers while shoppers are trying new categories, often through new methods. Understanding the “why” behind these transitions is essential to retailer success in the future.

With our extensive set of data, we’re here to help you navigate these dynamic circumstances. We’re actively monitoring the situation and offering the most up-to-date information weekly on consumer behavior. Visit our website to view our regularly updated Shopping Behavior Index which provides a weekly year-over-year index of sales in 16 retail channels, an Early Read Index with data on the most recent two weeks of shopper behavior, and our Stockpiling Index measuring in-store bulk buying behavior in response to COVID-19.

If you’d like to delve more deeply into the data presented here, we invite you to listen to our webinar replay. To find out how your brand or category is affected by COVID-19, please contact your Numerator Customer Success and Consultants or get in touch with us.