With a third round of stimulus payments now under consideration in Congress, households across the country await news of forthcoming financial assistance, as do brands and retailers eager for increased consumer spend in a struggling economy. What do we know about how consumers used their first two stimulus payments, and what might a third payment mean for businesses looking to capture stimulus spend?

When the first stimulus check hit consumer bank accounts last spring, it provided much-needed relief to individuals across the country, as well as a notable boost in sales across both essential and discretionary categories. To further understand how consumers used their stimulus dollars— and how they’d expect to use a future payment— Numerator fielded a survey to over 1,500 of our OmniPanelists who identified themselves as having received the first two payments.

Most Consumers Spent their Stimulus Checks

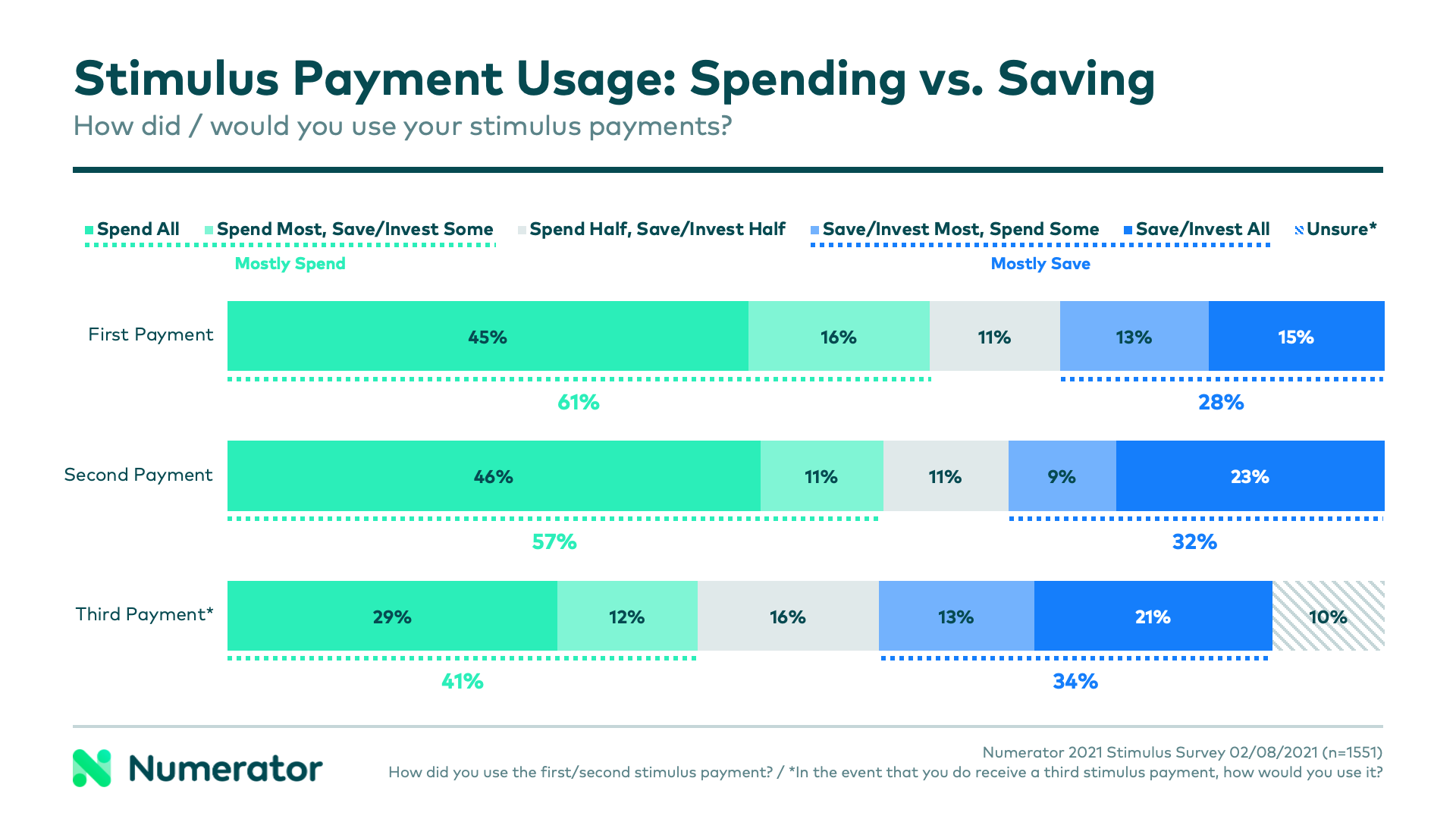

Over half of stimulus recipients say they spent all or most of their first two checks, compared to about a third who mostly saved them. Should they receive another payment— which two-thirds of those surveyed believe is likely in the next couple months— fewer consumers expect to spend it outright. Lower income households (making <$40k annually) were more likely to spend their checks than middle or high income households, but across the board, spend or intent to spend is trending down slightly with each payment.

The shift to saving may be due to decreased financial pressures for some, but is also likely indicative of the drawn-out nature of this pandemic, with uncertainty around if or when future financial assistance may be necessary and available. Over one-third of households who chose to save their stimulus funds did so with future necessities or unforeseen expenses in mind, higher among low-income households.

Observed Increases in Shopping Behaviors Post-Payment

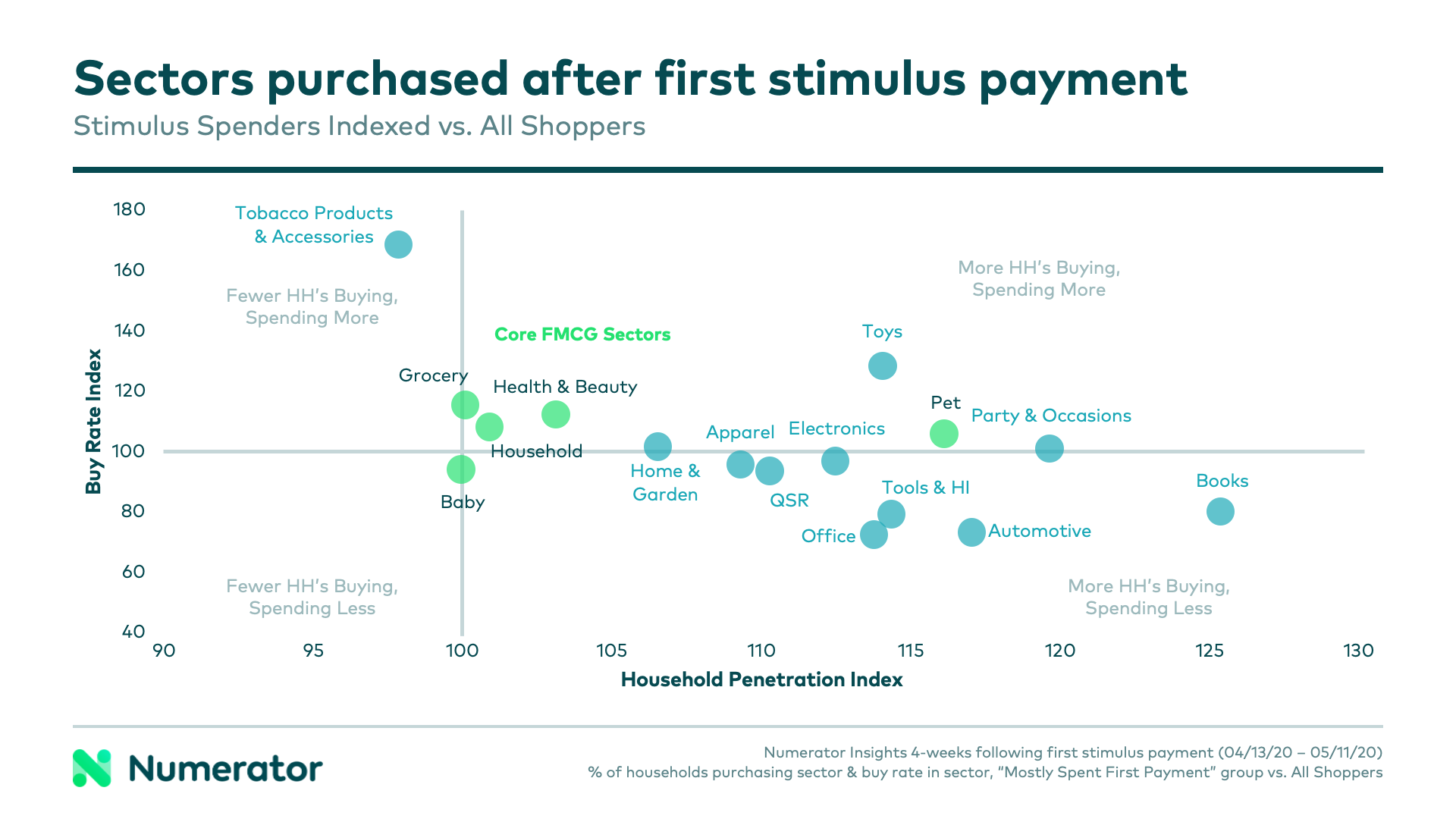

Digging into the verified purchase behavior of those who say they spent their stimulus checks, we see distinct increases in shopping behavior immediately after the first payments went out. Compared to the average shopper, more stimulus spenders made purchases across the board in the four weeks post-payment, especially in discretionary sectors like tools & home improvement, toys and electronics. While their buy rate in some of these sectors was lower than that of the average household, the percent of households shopping clearly outpaced the average. These shoppers were also more likely to have purchased core FMCG sectors like household supplies and health & beauty, and spent more in these sectors and on groceries than the average shopper.

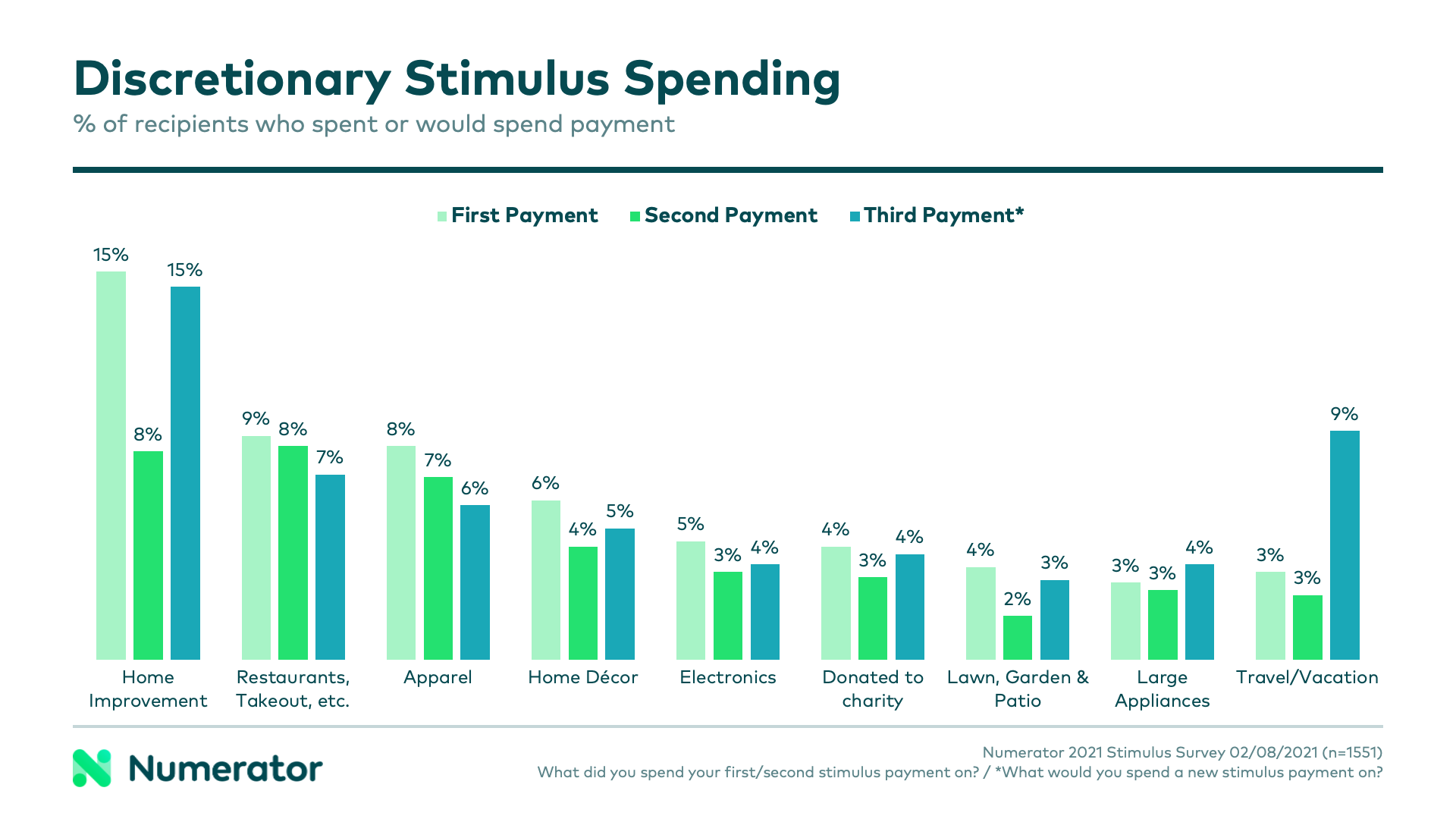

Discretionary Spending Could Rise with Third Payment

Discretionary spending was down slightly with the second payment, likely due to a smaller payout, compounded with seasonal influences for categories like home improvement and lawn, garden & patio. A third payment could see an increase in these categories, and a 3x boost in the number of consumers using the funds for travel, now that some COVID restrictions have eased and vaccine rollouts have begun.

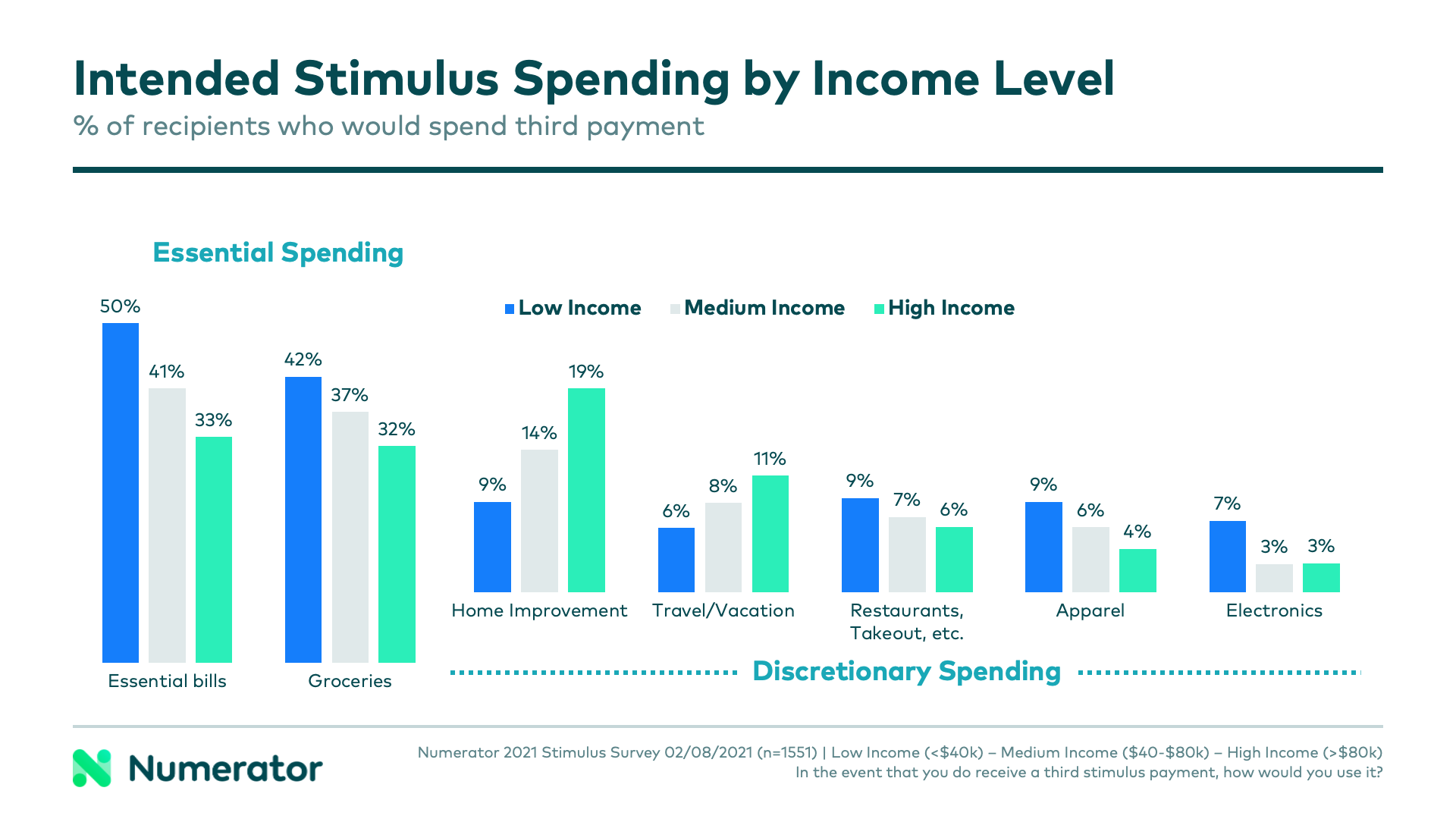

Similar to the overall intent to spend versus save, what consumers spend their stimulus checks on varies significantly by income level. If a third stimulus payment comes through, half of low income consumers expect to put the funds towards essential bills, while only a third of high income households say the same. When it comes to discretionary spending, higher income consumers are twice as likely to spend on home improvement or travel, while lower income consumers are more likely to indulge in electronics, apparel, or eating out. These trends were reflected in the first and second payments as well, indicating an overall split between groups on which splurges make the most sense for their households.

Looking Ahead

If a third stimulus check does indeed arrive in the coming weeks, the funds will bring welcome assistance to a number of consumers. The payments have helped keep families afloat and stocked up on essentials, while also giving non-essential categories a notable sales boost. Download our full Stimulus Check Report for a comprehensive look at the impact of stimulus payments on consumer behavior, including which retailers benefitted from initial payments, what consumers are saving for, and more.

To learn more about how your category has been impacted by the stimulus packages, reach out to your Numerator Customer Success Representative or get in touch with us today.