This past weekend, Easter Sunday marked the first major US holiday since the COVID-19 outbreak began. It was the beginning of a series of spring holidays and events that, under normal circumstances, would gather people together for celebrations— something that is currently impossible given national stay-at-home restrictions. As consumers shift their behaviors in response to these new limitations, how should retailers adjust their promotional strategies for upcoming events to better support and attract customers?

The outbreak of COVID-19 has led to many changes in day-to-day life across the globe— most notably, limiting our ability to gather together. Stay-at-home orders have significantly changed the way that consumers are able to observe major holidays in 2020 and, consequently, shopper behavior is adjusting to those limitations. With consumers facing restricted celebrations, retailers will have to adjust their promotional strategies around key events to better support their customers and attract new ones. But how?

With Easter now behind us, we can examine a variety of components that will help retailers plan for upcoming holidays like Mother’s Day, Memorial Day, Graduation, and Father’s Day. How did consumers adjust their activities for Easter 2020, and consequently their shopping behaviors? How did retailers adjust their messaging, promoted categories and promotional offers to reflect the realities of celebrating the event at home and in a struggling economy?

Family Activities at Home Replaced Large Easter Gatherings

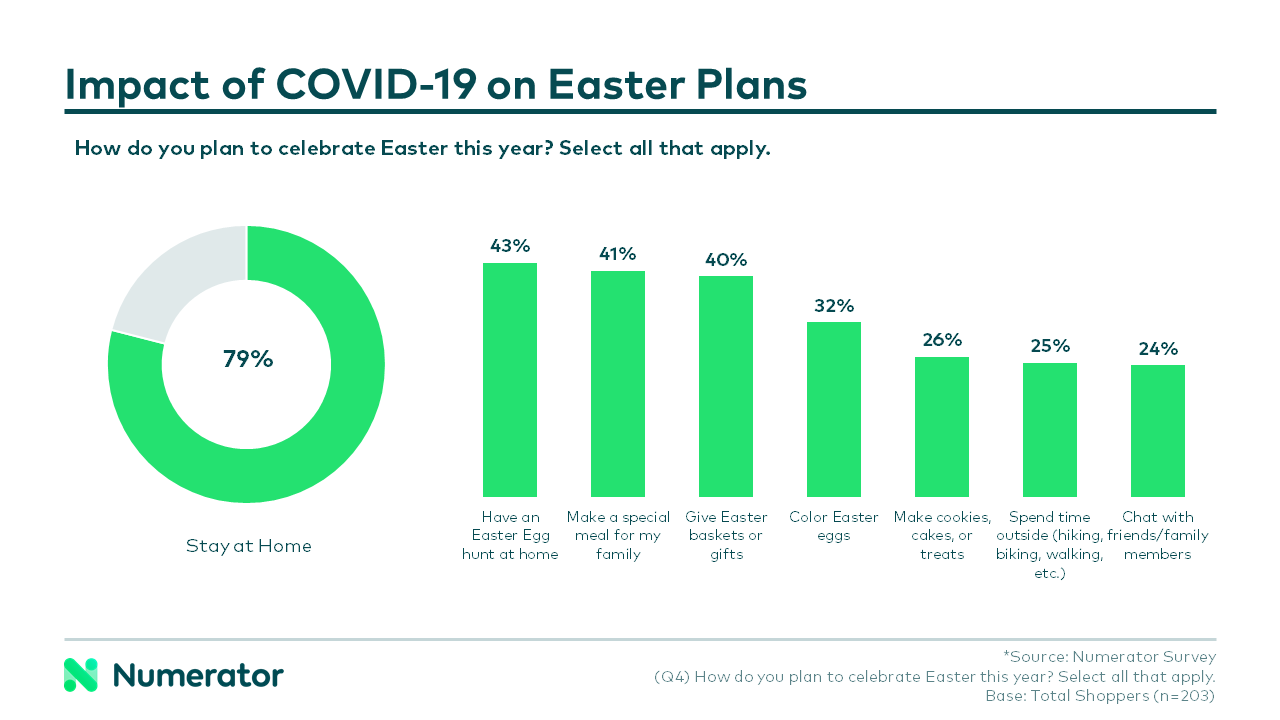

Last week, we fielded a Numerator Survey to better understand how COVID-19 was impacting consumers’ Easter-related plans and purchases. The majority of shoppers indicated that they would replace large Easter gatherings with social distancing and web-camera based connections, with 79% of respondents reporting they planned to stay at home for the holiday.

As a result of those disrupted celebrations, the majority of shoppers (59%) told us they spent less on Easter-related goods this year than they did last year. While they weren’t celebrating to the same scale as previous years, they still found ways to celebrate. Large celebrations were canceled, but many shoppers still planned on having Easter activities for the family at home— egg hunts (41%), a special meal (41%), and Easter baskets (40%), to name a few.

Retailers Adjust Promotions Towards Stay-at-Home Celebrations

A review of Numerator Promotions Intel data showed some promotional shifts leading up to Easter this year versus last. We examined the promotional activity of key national food, drug, mass, and dollar retailers and found that while timing remained consistent— most retailers began promoting Easter two weeks before the holiday— number of promotions, promotional messaging, and promotional offers all differed some in 2020.

Though we know from the Numerator Promotions Index the number of overall circular and bonus pages decreased YoY the last week of March, retailers continued to feature promotions in critical Easter categories. While the number of Easter promotions for apparel decreased, in-line with a stay-at-home approach to the holiday in 2020, promotions for candy and toys decreased less than 12% and gained front-page prominence across the analyzed retailers. For upcoming holidays, this more narrow, tailored approach to promotions and messaging will be key for retailers.

Additionally, though the category mix and volume for candy and toy ad blocks were relatively steady from 2019 to 2020, the promotional tactics changed to reflect a new economic and consumption reality for many shoppers. Instead of a more traditional multiple purchase offer for candy two weeks prior to the holiday, Target shifted their Mars candy ad blocks to a BOGO 50 offer. Since shoppers will primarily be consuming products themselves, rather than buying for a gathering or larger group, promotions that can be applied to smaller, two or three item purchases will be more beneficial in this time of social distancing.

Lastly, within two weeks of Easter we saw the usual return of specific food promotions, with spiral cut ham featured on the front page of Kroger’s circulars. However, with a circular reduced from 6 to 4 pages, Kroger dropped items like party platters and general grocery items and replaced them with a grill and other backyard cooking essentials. The shift in messaging for large gatherings to intimate shelter-in-place family meals is evident, and it will be important for retailers to make these types of adjustments in coming weeks and months.

Looking Ahead

With stay-at-home orders likely extending at least through May, there’s a lot to learn from Easter in planning for the upcoming celebrations of Mother’s Day and Memorial Day— and perhaps for holidays even further into the future. As shoppers adjust to the limitations created by COVID-19, the retailers and manufacturers that win will be those who adjust their messaging and offers to match these new needs, so having insight into both shopper behavior and the competitive promotional landscape will be of paramount importance.

Numerator will continue to closely monitor the situation to ensure brands and retailers have the most up-to-date information on consumer behavior. Each week during the outbreak we will publish a variety of resources to help you understand COVID-19’s impact on consumers.

For more information on how your brand or category is affected by COVID-19, please contact your Numerator Customer Success and Consultants or get in touch with us.