While consumer confidence has dipped to a three-year low, shoppers remain engaged in the category, approaching consumer electronics purchases with a more thoughtful and value-driven mindset. A Numerator Verified Voices survey of over 300 consumer electronics buyers from the past three months reveals how rising prices are shaping purchase behavior as we approach Black Friday and Cyber Weekend.

Price Sensitivity Shapes Consumer Electronics Market Spending

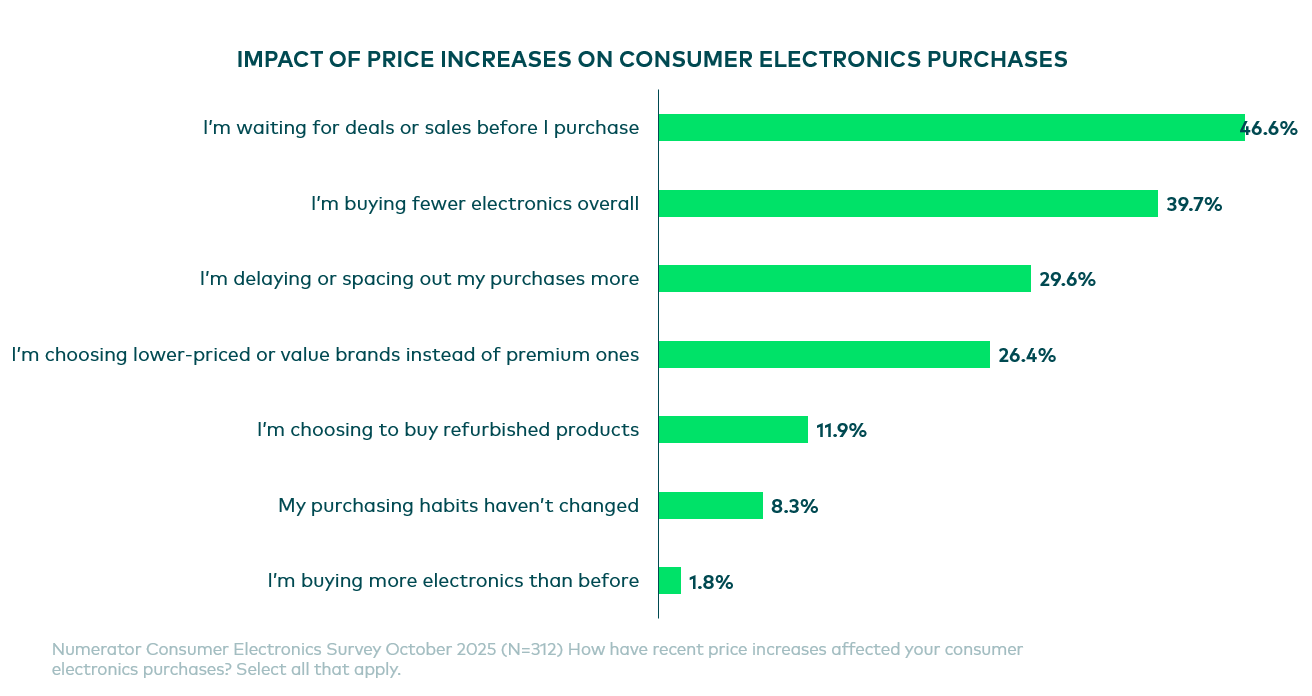

Shoppers are considering the consumer electronics market with caution, as nearly nine in ten respondents have noticed recent price increases. In response, many are delaying purchases — 47% are waiting for deals or sales, 40% are buying fewer electronics overall, 30% are delaying or spacing out their purchases more, and 26% are choosing lower-priced or value brands instead of premium ones. Price is a primary driver influencing both the timing and type of purchases shoppers make in the electronics category.

Loyalty Persists, But Price Drives Choice

Brand loyalty is fragmented among shoppers as only a quarter consistently remain loyal to a single brand, while 37% and 26% will purchase from two and three brands, respectively. However, when purchasing multiple consumer electronics, loyalty still heavily influences shopper purchase decisions, with nearly half (49%) of shoppers often buying from the same brand whenever possible, and 13% prefer to stay loyal across all products. Factors such as price and availability lead over a third (34%) of shoppers to mix and match, highlighting that while brand loyalty remains influential and preferred, shoppers are ultimately value-driven.

Lower-Cost Alternatives Win with Value-Driven Shoppers

As shoppers look for ways to stretch their budgets, private label and lower-cost electronics are gaining momentum. More than seven in ten consumers frequently or occasionally consider options such as Amazon-exclusive or store-brand devices. Low-income shoppers (under $40K) and urban shoppers significantly over-index compared to the overall average in always considering lower-priced alternative electronics—by 173 and 154 over-index to the overall average, respectively.

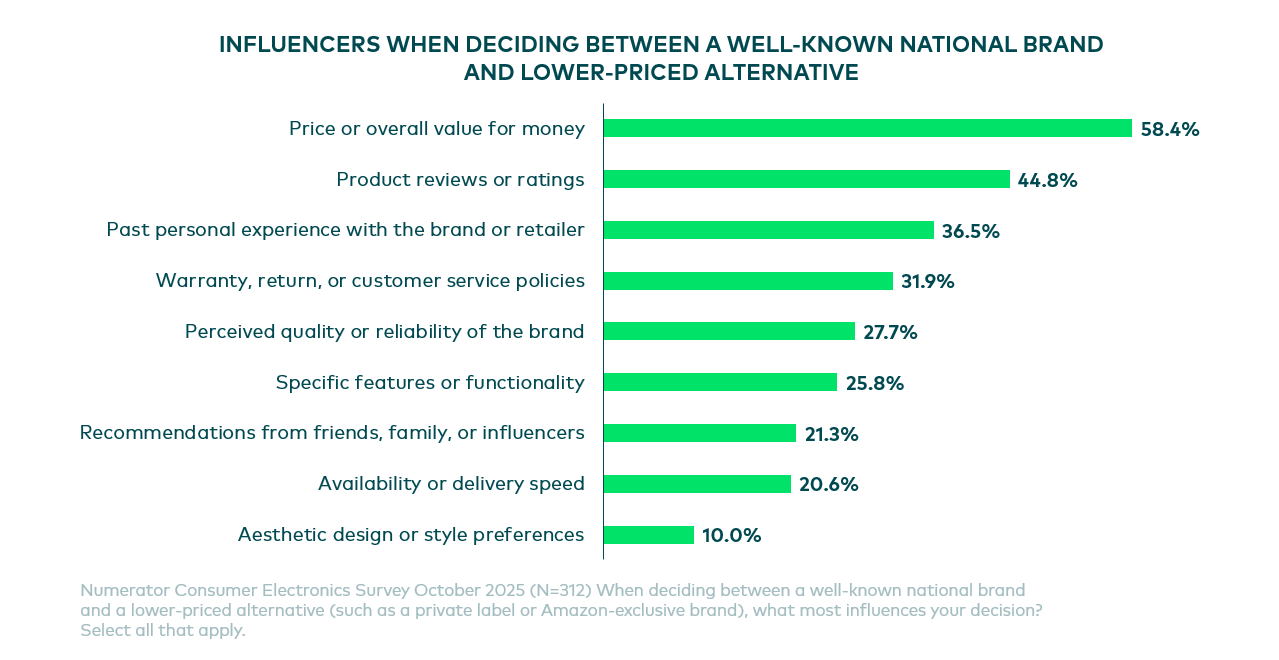

When choosing between a well-known national brand and a lower-priced alternative, shoppers are most influenced by price and value (58%), product reviews (45%), and past experience with a brand or retailer (36%). Boomers, in particular, place greater emphasis on warranty and customer service policies, over-indexing by 135 compared to the average shopper. For the consumer electronics market, these insights reveal how purchase drivers vary across demographics—creating opportunities to tailor messaging, product offerings, and engagement strategies to meet shoppers’ evolving expectations around value, trust, and reliability.

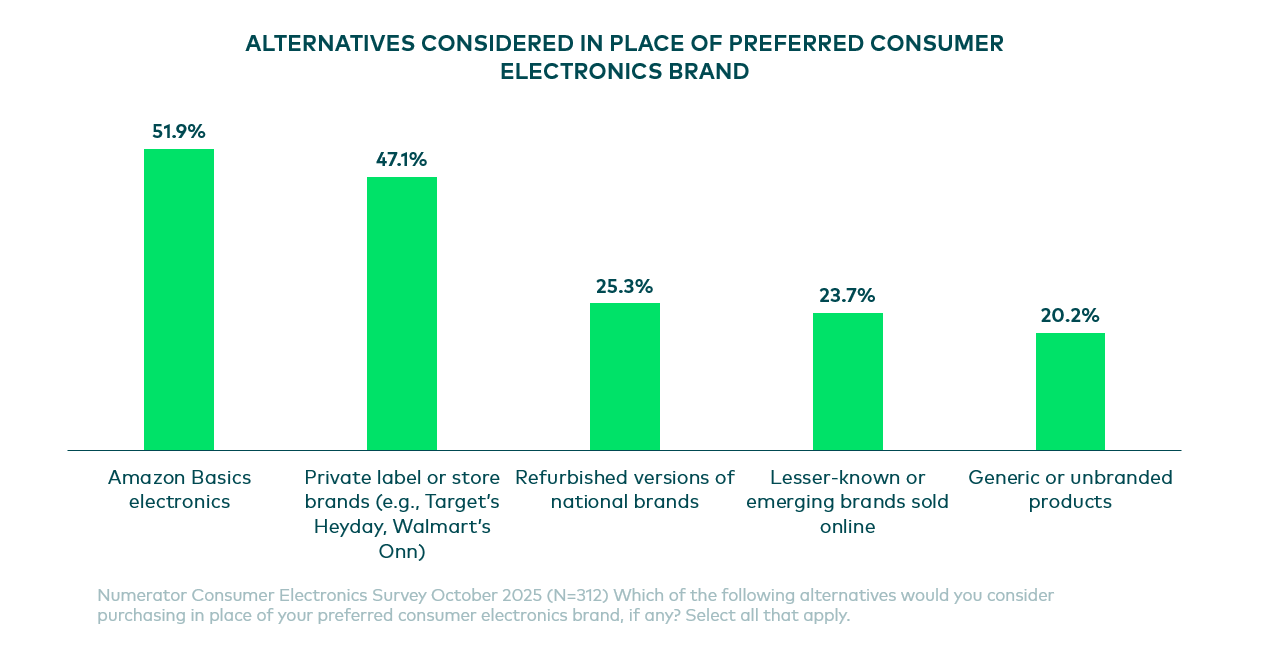

Online Shoppers Lean Towards Lower Cost, Private Label Options

Online giants like Amazon and Walmart.com are driving shoppers toward price and value-focused brands. Nearly one in three consumers (32%) say they’re more open to lower-cost or private-label electronics when shopping online. However, this openness depends on the electronic product type (37%), and many shoppers still show strong loyalty to trusted national brands regardless of the platform (27%). When consumers do consider alternatives, the top contenders include Amazon Basics (51.9%), private label or store brands (Target’s Heydey, Walmart’s Onn) (47.9%), and refurbished versions of national brands (25%).

This trend presents both a challenge and an opportunity for national brands in the consumer electronics market. While strong brand trust still plays a crucial role, especially for certain types of electronics, shoppers are increasingly leaning toward lower-cost alternatives online. As shoppers grow more comfortable with budget-friendly options, national brands must compete on perceived value, reliability, and a clear justification of price premiums to win over online shoppers.

The Impact of Continued Price Hikes

If prices continue to rise, shoppers say they’ll adjust further — 40% expect to reduce the number of electronics they buy, 26% plan to switch to more affordable or private label brands, and 20% will continue buying their preferred brands but less frequently. Boomers are especially likely to cut back, with an over-index of 132 compared to the overall average in reducing electronics purchases.

As Black Friday and Cyber Weekend near, these trends spotlight a price-conscious shopper willing to reduce their spend or trade brand loyalty for value when the right deal comes along. Ongoing price sensitivity highlights the need for brands to strike a balance between affordability and brand equity by offering accessible price points and compelling promotions to maintain trip frequency and share of wallet.

Winning During the Holiday Season

As consumer confidence shifts, shoppers are approaching the consumer electronics market with greater intention and a stronger focus on value. To stay top of mind and win key occasions, brands must meet shoppers where they are. Want to learn how your brand or your key retail partners can win this upcoming Black Friday and Cyber Weekend? Connect with your Numerator account team or reach out to our team today.