As we prepare to ring in a new year, the recent trends of holidays past point to a number of opportunities for BevAlc brands to stand out as consumers stock up so they can continue celebrating safely in the weeks and months ahead.

Holiday celebrations in 2020 became, by necessity, subdued affairs. With popular social settings off-limits and smaller gatherings now the new normal, consumers have turned public festivities into intimate, at-home events. This brought tidings of good cheer to the BevAlc category, which experienced spirited holiday sales growth throughout the year.

Uncorking a bottle of BevAlc insights in a recent webinar, Numerator detailed the driving factors behind the boost in this category’s growth. From significant shifts in shopper behavior and demographics to making sure messaging matches the moment, we highlighted how brands can adapt even further to meet the holiday needs of today’s BevAlc consumer.

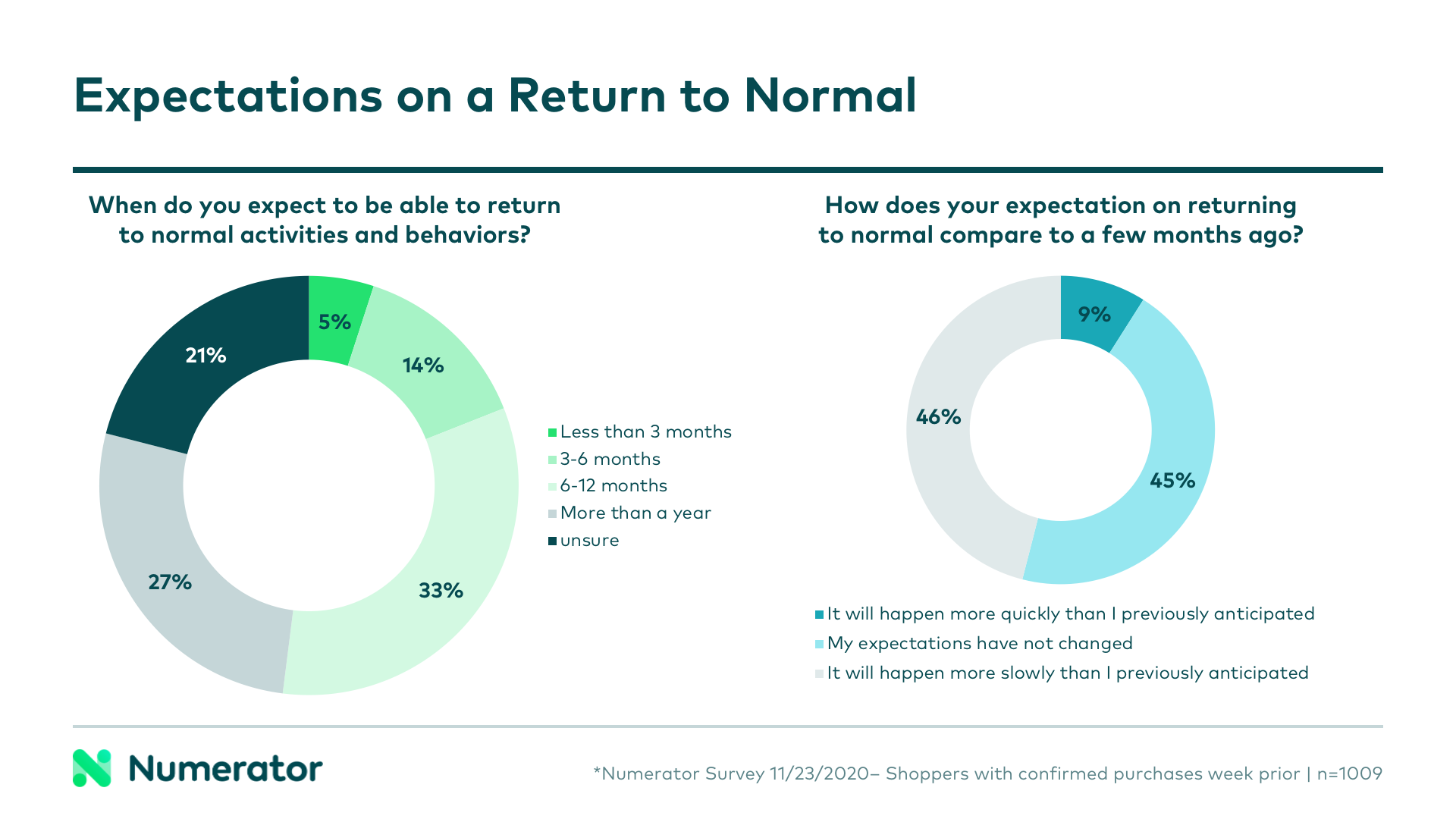

Consumers remain cautious heading into 2021

When surveyed, shoppers shared they would be spending holidays close to home among immediate family due to COVID-19 concerns and restrictions. Moving into 2021, this trend is likely to continue as 60% of shoppers expect it will be another six months to a year before they’re able to return to normal activities.

Grocery trips key to BevAlc growth as shoppers bring happy hour home

With limited access to their favorite bars and restaurants, consumers are recreating the happy hour experience at home. As a result, BevAlc has seen a 19% increase in holiday sales this year with gains in trips, spend, and household reach. Shoppers are also experimenting with new brands and types of alcohol as well as splurging on premium labels.

Enjoying cocktails from the comfort of their couch means BevAlc purchases are becoming a staple on consumer grocery lists. Alcohol sales on grocery trips have grown 28% this year, as consumers aim for one-stop shopping, and we anticipate even more households will be splurging on spirits during the final weeks of December.

This is an ideal opportunity for brands to connect with shoppers in-store. Cross-promoting with other grocery categories, offering specials on multiples and larger sizes, and encouraging adventurous shoppers to try new products or trade up to a premium option are all holiday marketing strategies to explore.

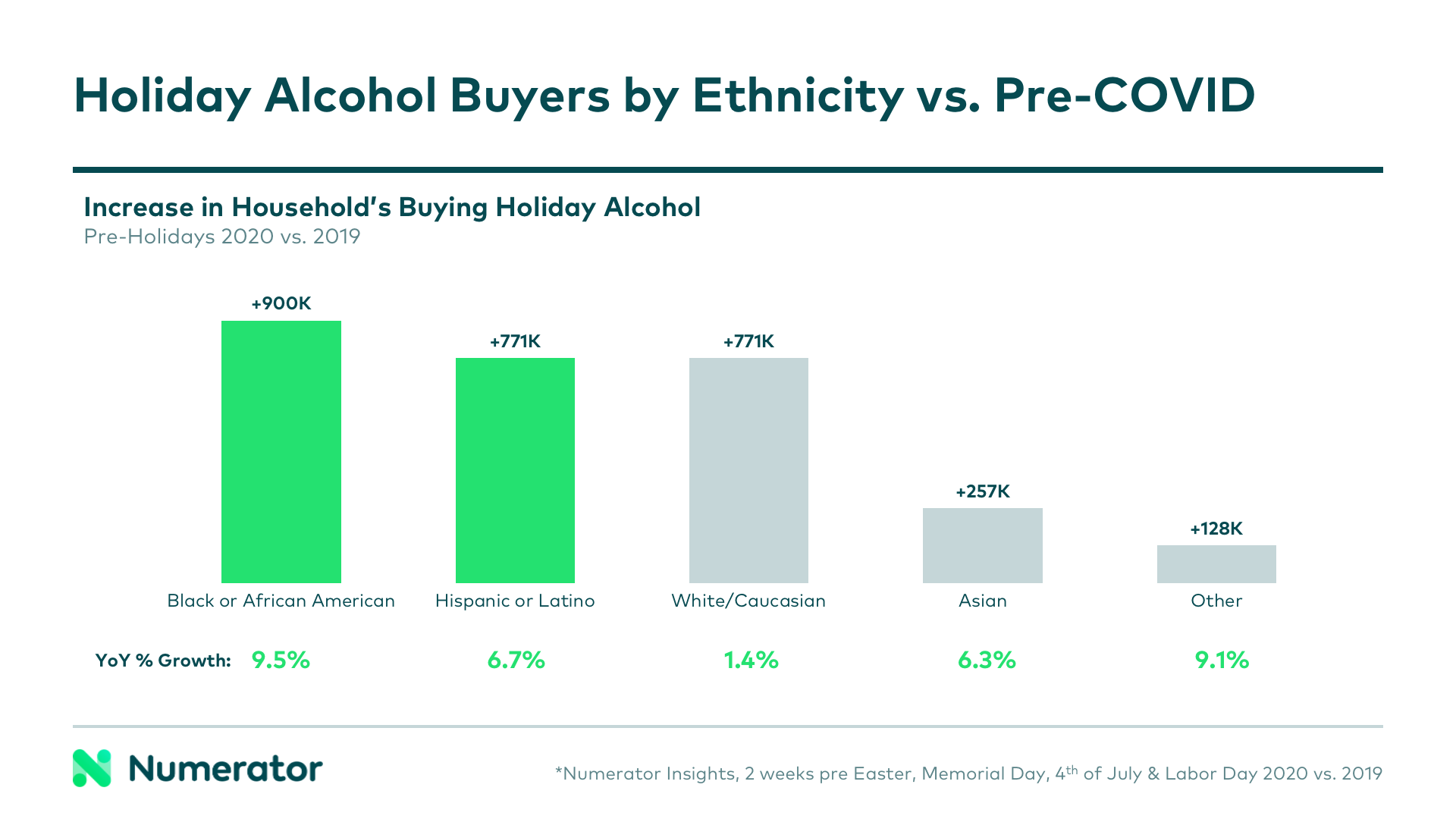

Multicultural households and millennials bubble up as the top shopper base

Knowing which shoppers are visiting the BevAlc grocery aisle and what they’re buying are critical components for retaining them. This year, two important demographic groups have emerged as chief contributors to the BevAlc category: multicultural households and young shoppers.

Black/African American households and Hispanic/Latino households are seeing the largest growth rates with holiday alcohol buying this year, contributing 2.7x more new households versus White/Caucasian households. Wine gained popularity in Black and African American homes, while Bubbles, Hard Seltzer and Tequila have appealed to a large portion of Hispanic and Latino households.

The surge in at-home consumption among young shoppers is significant with an additional 1.8 million Gen Z and Millennial households spending on BevAlc brands. As a group that prefers the club to their couch, this growth is likely due to losing access to their regular watering holes.

Wine is the big winner for Gen Z shoppers with a 29% household increase, though they like to keep beer and spirits on hand too. Meanwhile, Millennials are driving both Tequila and Bubbles growth as well as the move to premium brands. The increase in spend per unit with Millennial shoppers is over 2X the average BevAlc shopper.

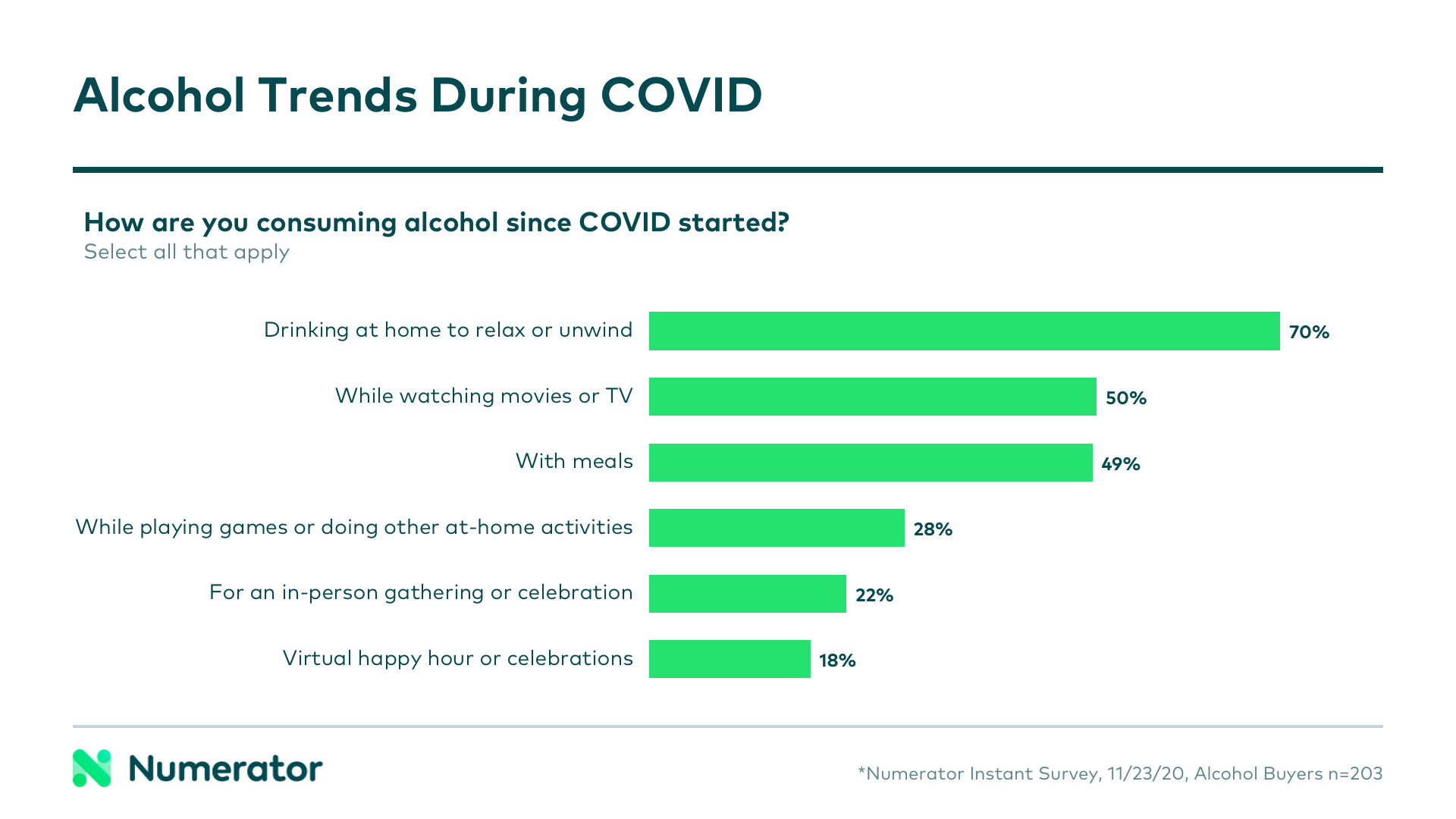

Messaging that fits the occasion and fills every consumer’s glass

To successfully resonate with shoppers, promotional messaging needs to target both the relevant occasion and the reasons why shoppers are engaging with the BevAlc category at home. Overall, 70% of shoppers say they use BevAlc purchases to unwind, so centering brand messaging around relaxation is critical.

During the holidays, brands also want to address the desire of shoppers to indulge and treat themselves, which is what drives increased spending. At the same time, it’s important to appeal to shoppers who are spending less and seeking value because they’re entertaining smaller groups of people. Messaging and bottle sizes that suit the aims of each audience will go a long way in building loyalty.

Looking ahead

Even with restrictions in place, consumers are seeking ways to celebrate special occasions. With a healthy pour of growth across the board, brands within the BevAlc category have ample opportunity to stay top of mind with shoppers filling their grocery carts, glasses, and liquor cabinets in preparation for holiday celebrations now and into 2021.

We invite you to listen to our webinar replay for additional details on shopper behavior within the BevAlc category as well as our recommendations on how brands can best respond to new trends in BevAlc. Our goal is always to provide our brands and retailers with the most up-to-date information on consumer behavior, so you can make the right decisions as you guide your business through this unusual time.

To learn more about how your brand or category is affected during the holidays, please contact your Numerator Customer Success Consultants or get in touch with us. We’re here to help!