Ecommerce has been reshaping the retail landscape for years. But in 2020, the pandemic accelerated ecommerce adoption far beyond the pre-COVID baseline. Understanding how shoppers are engaging with ecommerce is critical as retailers compete for fewer trips and work to meet consumer needs amidst uncertainty. How are the current shifts in online shopper behavior impacting brick-and-mortar? Where are shoppers spending their online dollars? And with Amazon launching their own Shopper Panel to track consumer patterns and purchases outside their website, how can retailers remain competitive?

To answer these questions, Numerator hosted a webinar explaining why it is more important than ever to discover the factors driving the increase in online consumer spending. We also shared how tracking consumer behavior both in-store and online provides retailers the insights they need to effectively attract and keep customers today and in the future.

The online experience leads to predictable shifts in behavior

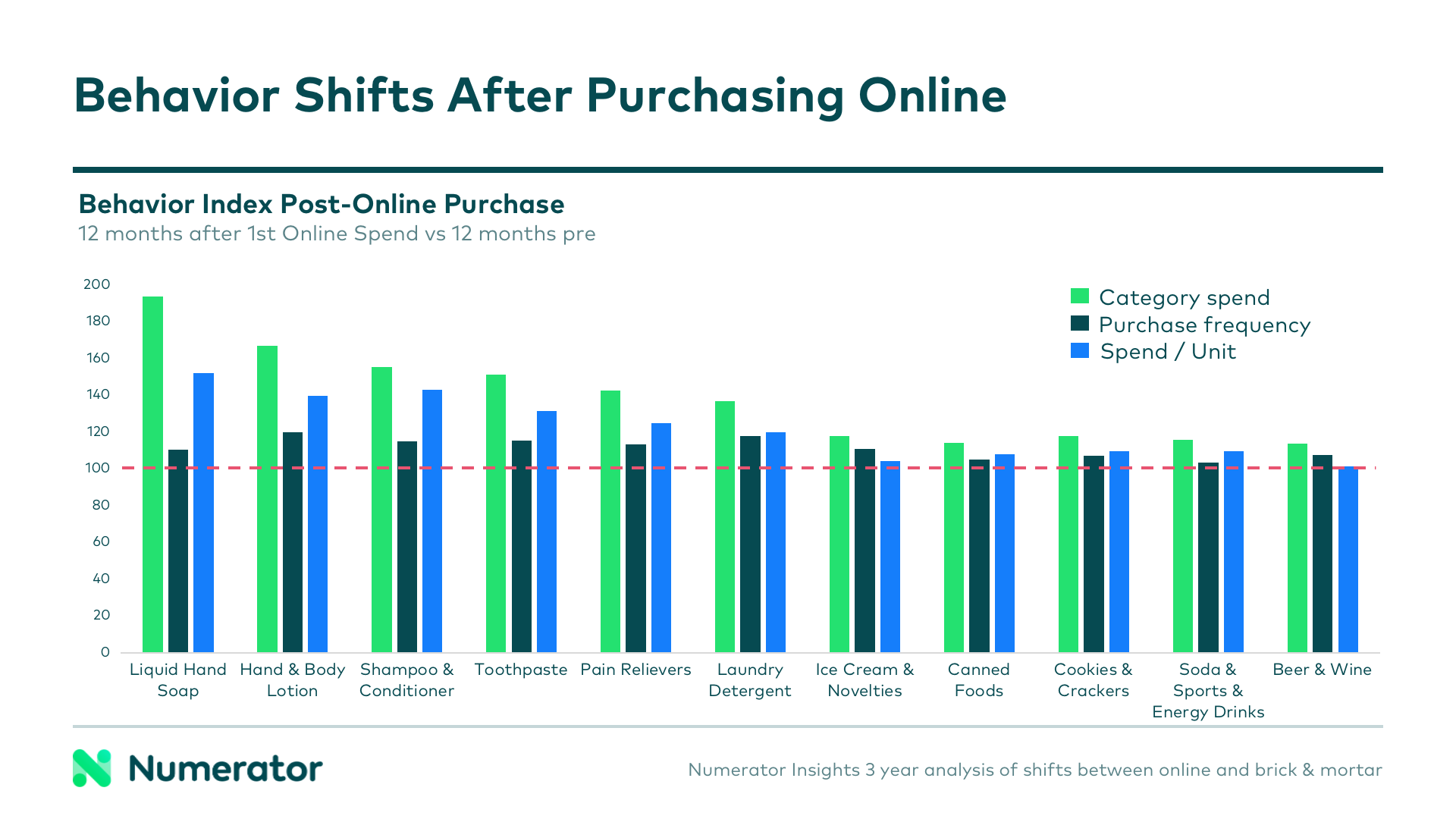

The ease and convenience of online shopping has been key in helping consumers feel safe throughout the COVID-19 crisis. In the last 12 months we’ve seen an important behavior pattern emerge: our data shows that once shoppers begin buying a category online, the switch typically becomes permanent. This is occurring across the board, even in high-frequency categories and with perishables.

This shift also leads to an increase in online spending. In fact, online spend is almost 2X higher than brick-and-mortar stores due to consumers making larger purchases, similar to the club channel effect. As a result, retailers are losing trips each year despite customers still shopping in-store. We expect this trend to continue in most categories as more shoppers experiment with buying online.

These behavioral shifts result in an overall increase in category purchasing behaviors, as well. That is, once a shopper starts purchasing a category online, they spend more on that category overall in the future, driven both by an increased spend per unit and increased purchase frequency.

A door of opportunity for brick-and-mortar amid online gains

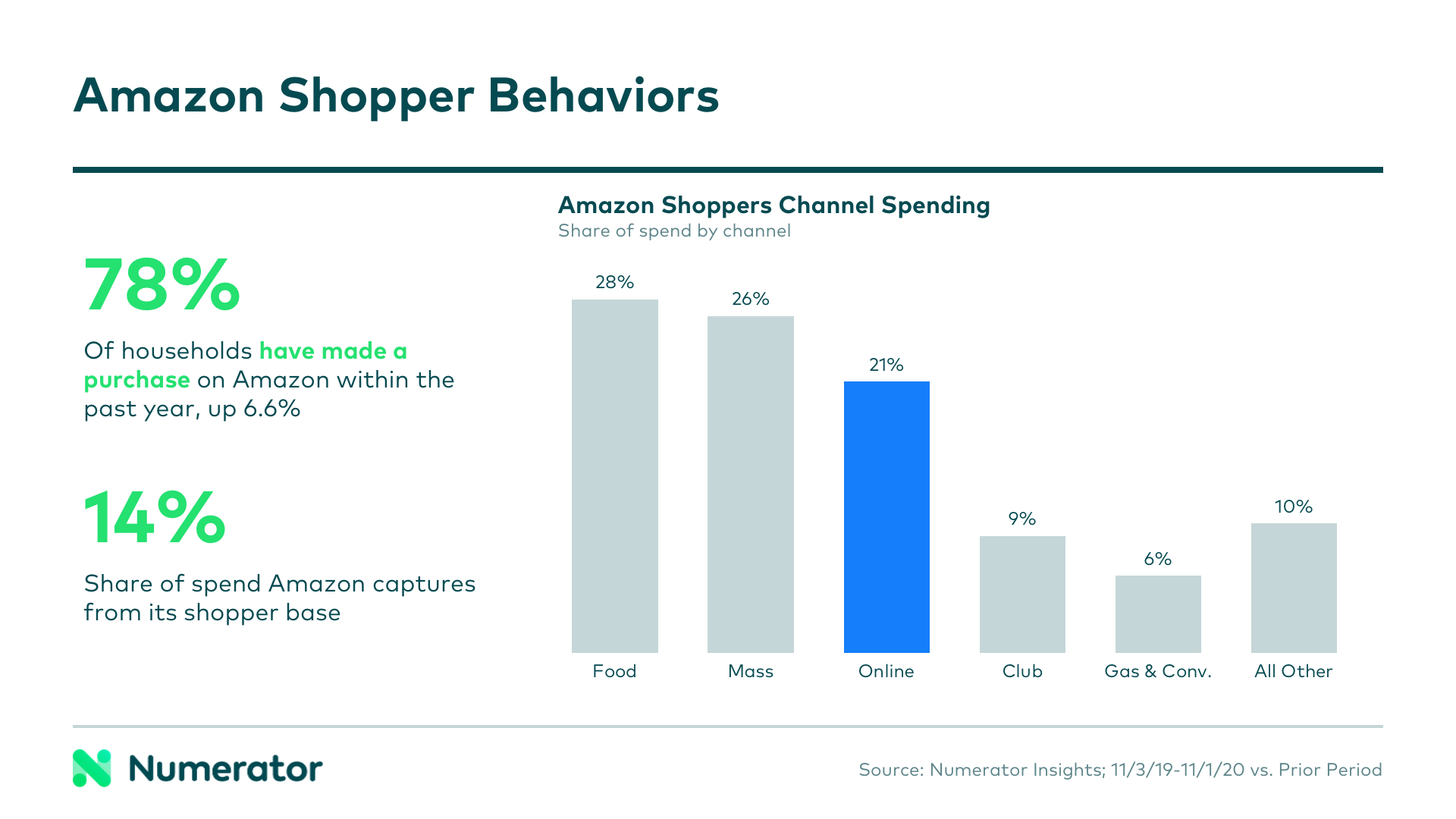

Over the last year, Amazon, Walmart, and Target have captured the most share of online wallet, with Amazon seeing the greatest percentage of growth. However, while 78% of households have made a purchase through Amazon, the ecommerce giant only acquired 14% of household spend among their shoppers. Amazon shoppers are still spending the majority of their dollars outside of Amazon and in brick-and-mortar stores.

This is good news for retailers. It means they have an opportunity to retain existing customers and re-engage lapsed customers if they learn what shoppers are doing online and why, and how to apply that information to the products on their shelves.

Staying competitive with Numerator: a study in dry coffee at Target

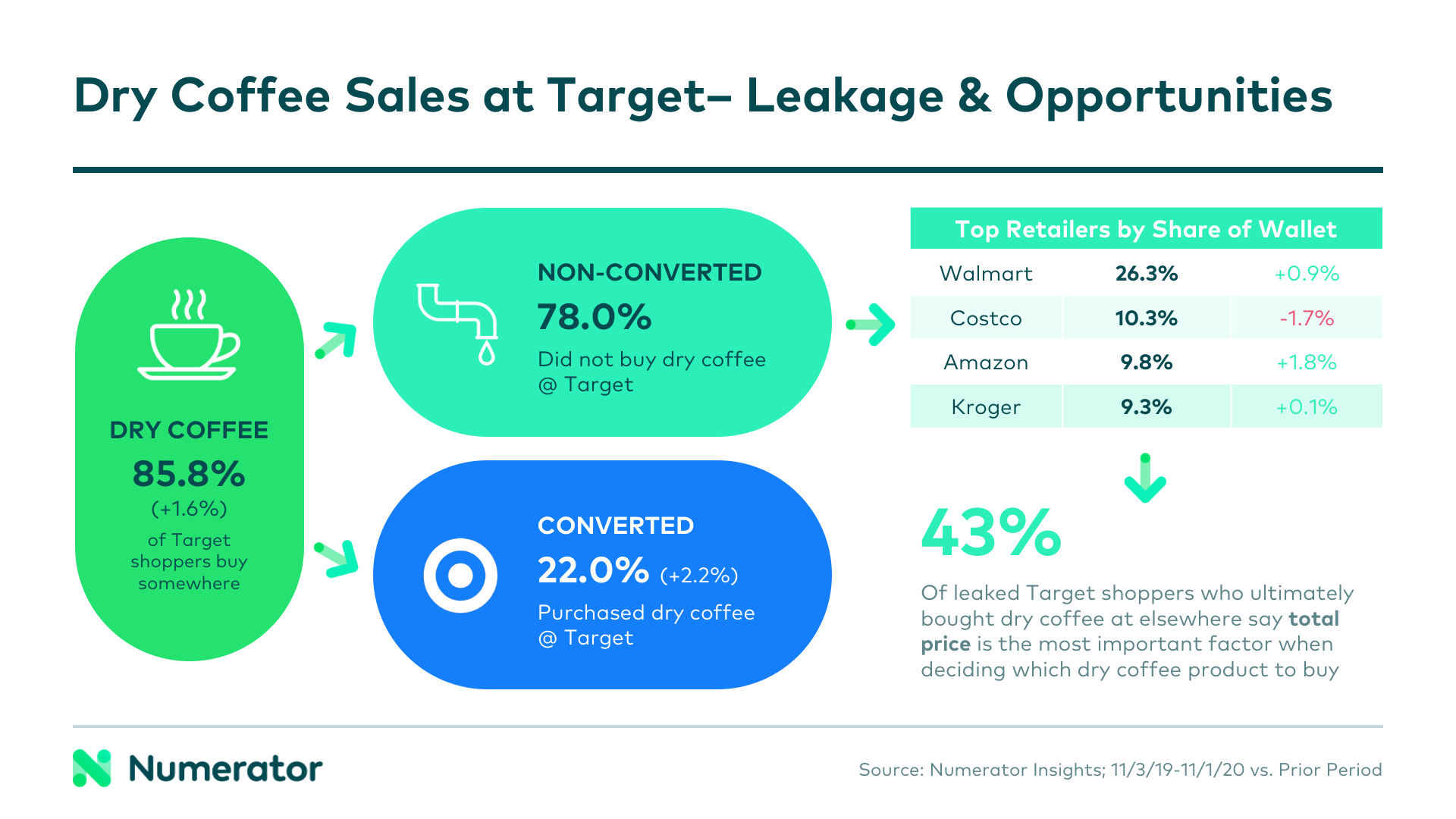

Knowing what’s prompting the shift to online shopping and which online retailers are engaging their shoppers is only part of the equation for retailers to remain competitive. It is also crucial for retailers to understand which customers they are already successfully engaging online and which products are driving leakage to competitive retailers. Numerator provides comprehensive and advantageous insights into all these areas and more.

For example, we used Numerator omnichannel panel data, demographics, psychographics, and an instant survey to analyze Target’s conversion rate in the dry coffee category. Despite growth in this category, we found Target is leaking 78% of dry coffee buyers to other retailers.

We identified gaps in the dry coffee brands Target offered, the demographic breakdown of who is and isn’t buying this category in-store, and the leading reasons why 43% of shoppers bought dry coffee elsewhere: price. With this knowledge, Target can work on improving price perception and enhancing their assortment to convert more customers.

Looking ahead

This year has accelerated ecommerce adoption in ways no one could have anticipated. For retailers to stay competitive, having access to immediate, in-depth data on shopper attitudes and activity across all channels is essential as ecommerce continues to expand its reach.

At Numerator, we can provide those customer insights today. With the largest and fastest set of omnichannel market data for both brick and mortar and online spending, we help our clients understand and adapt to the evolving shifts in shopper behavior. Our insights offer much-needed leverage in a rapidly changing retail landscape.

Listen to the full webinar replay for more detail on how Amazon is impacting FMCG retailers and the many ways Numerator Insights can help you gain the omnichannel customer insights you need to stay competitive. Our goal is always to provide our retailers the most up-to-date information on shopper behavior, so you can make the right decisions while guiding your business through this challenging time.

To quantify the impact of ecommerce on your business, please contact your Numerator Customer Success Consultants or get in touch with us.