When Walmart announced its 2018 Q4 earnings, shares jumped 3.6%. Much of that investor excitement was the result of a 43% increase in online sales. One of the core drivers behind that growth, and another weapon for Walmart in its ongoing battle with Amazon, is the expansion of grocery pickup services.

With Walmart Grocery Pickup, you place your order online and enjoy the convenience of free curbside pickup, getting the same prices online as you do in-store with no subscription fees. Walmart has announced that it plans to offer Walmart Grocery Pickup at an additional 1,000 locations by the end of this year, bringing the service to a total of 3,100 stores. Walmart also intends to back up this expansion with 40% of advertising spend.

Let’s take a look at Numerator Insights data from February 2018 to February 2019 to get a sense of who Walmart Grocery Pickup shoppers are, what’s driving their shopping behavior, how Walmart Grocery Pickup compares to Amazon Prime, and what those shopping baskets look like.

Getting Under the Hood of the Walmart Grocery Pickup Shopper

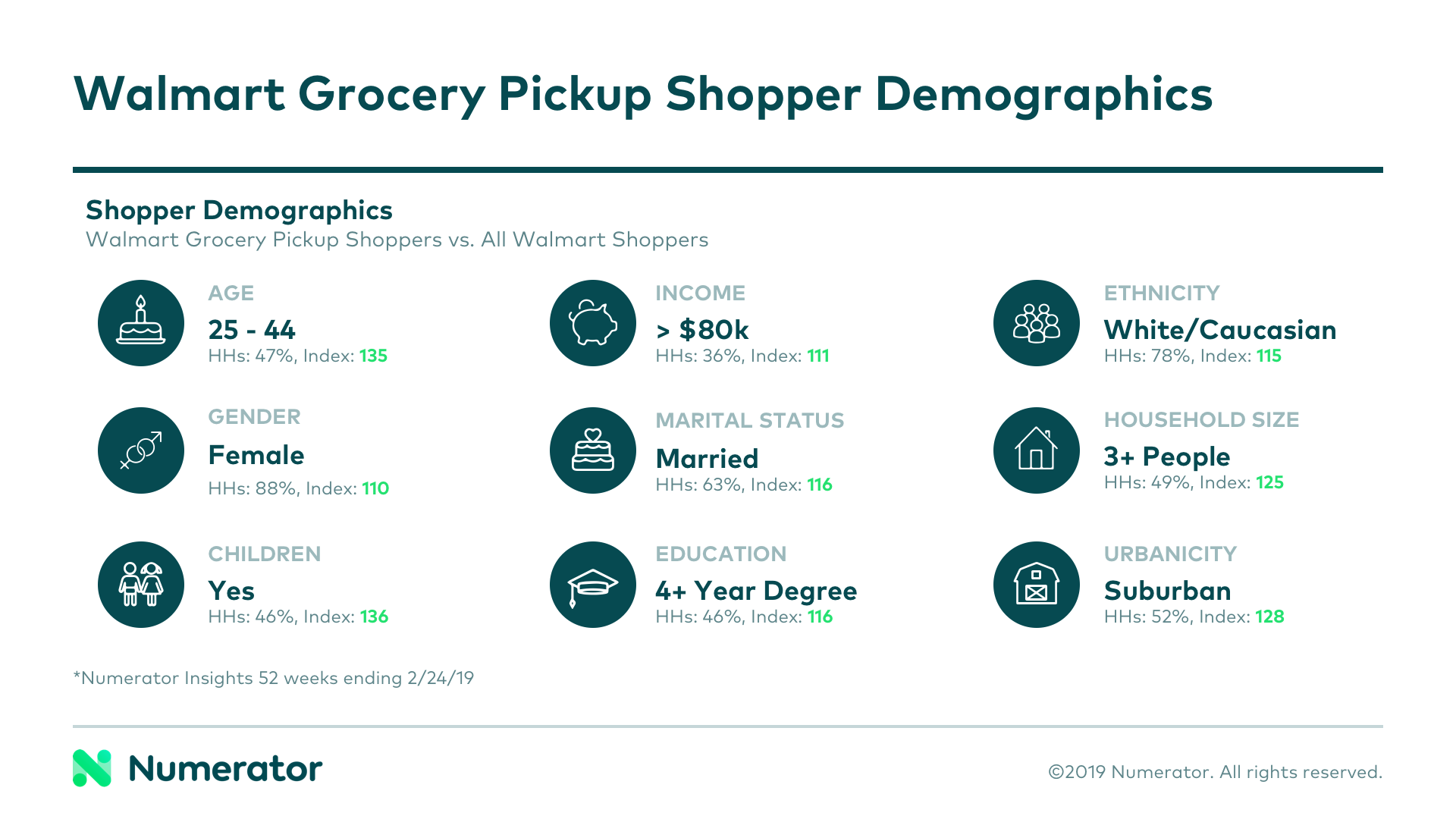

Compared to all Walmart shoppers, Walmart Grocery Pickup shoppers tend to be younger (mid-20s to mid-40s), affluent, educated, and married with children in the suburbs.

These cash-rich, time-poor, and tech-savvy shoppers use Walmart Grocery Pickup to make life easier. About one-third (32%) say they have no time to take care of themselves, and about three-quarters (76%) save time shopping online. 82% of Walmart Grocery Pickup users shop on their smartphones – 15% more than all Walmart shoppers – while 59% use their computers.

How Walmart Grocery Pickup Stacks Up with Prime

There is significant overlap as nearly two-thirds (65%) of Walmart Grocery Pickup shoppers use Amazon Prime. 45% of Walmart Grocery Pickup shoppers think grocery shopping is a chore, and 39% want a quick, in-and-out trip. 40% are budget driven when shopping. This data suggests that Walmart Grocery Pickup can compete with Prime on convenience and budget in a way that few services from retail competitors can.

Walmart’s Growth Potential Is Huge

The vast majority of shoppers are either extremely or very satisfied with their grocery pickup experiences from top grocery retailers, including Walmart (85%), Kroger (86%), Target (83%) and HEB (89%). Overall, a little more than seven in 10 users of grocery pickup services from these retailers would recommend the service to others.

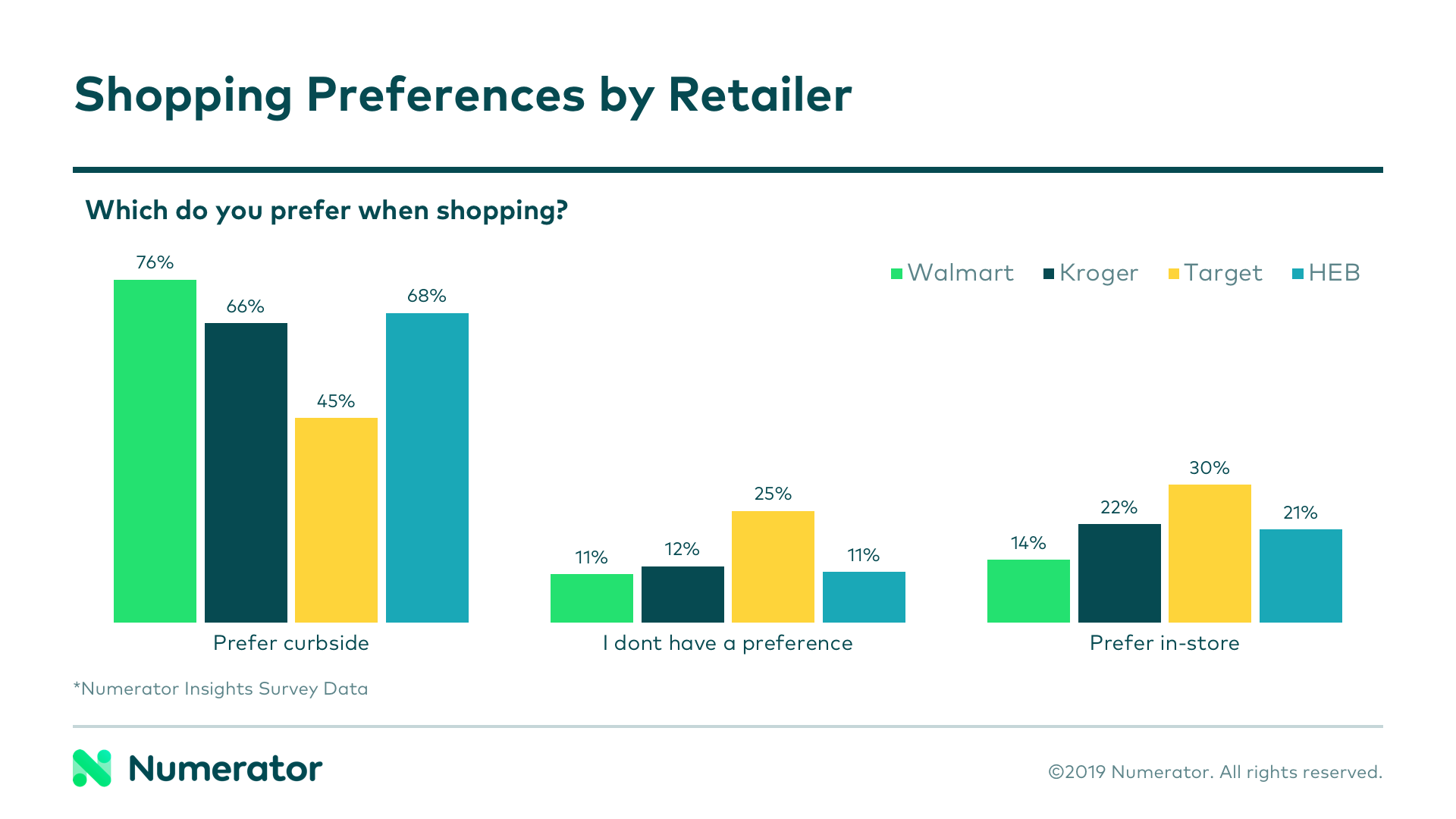

While the success of grocery pickup certainly hasn’t been limited to Walmart, it does appear that Walmart has the most to gain. Walmart Grocery Pickup users prefer curbside pickup over in-store shopping by more than a 5-to-1 margin, the largest disparity among the four major grocery retailers analyzed.

Walmart Grocery Pickup Baskets: Larger, More Diverse, and Growing

Among Walmart Grocery Pickup shoppers, Walmart Grocery Pickup baskets are more than twice the size of in-store baskets in terms of spend per trip ($124.86 vs. $49.70) and units per trip (30.7 vs. 13.2).

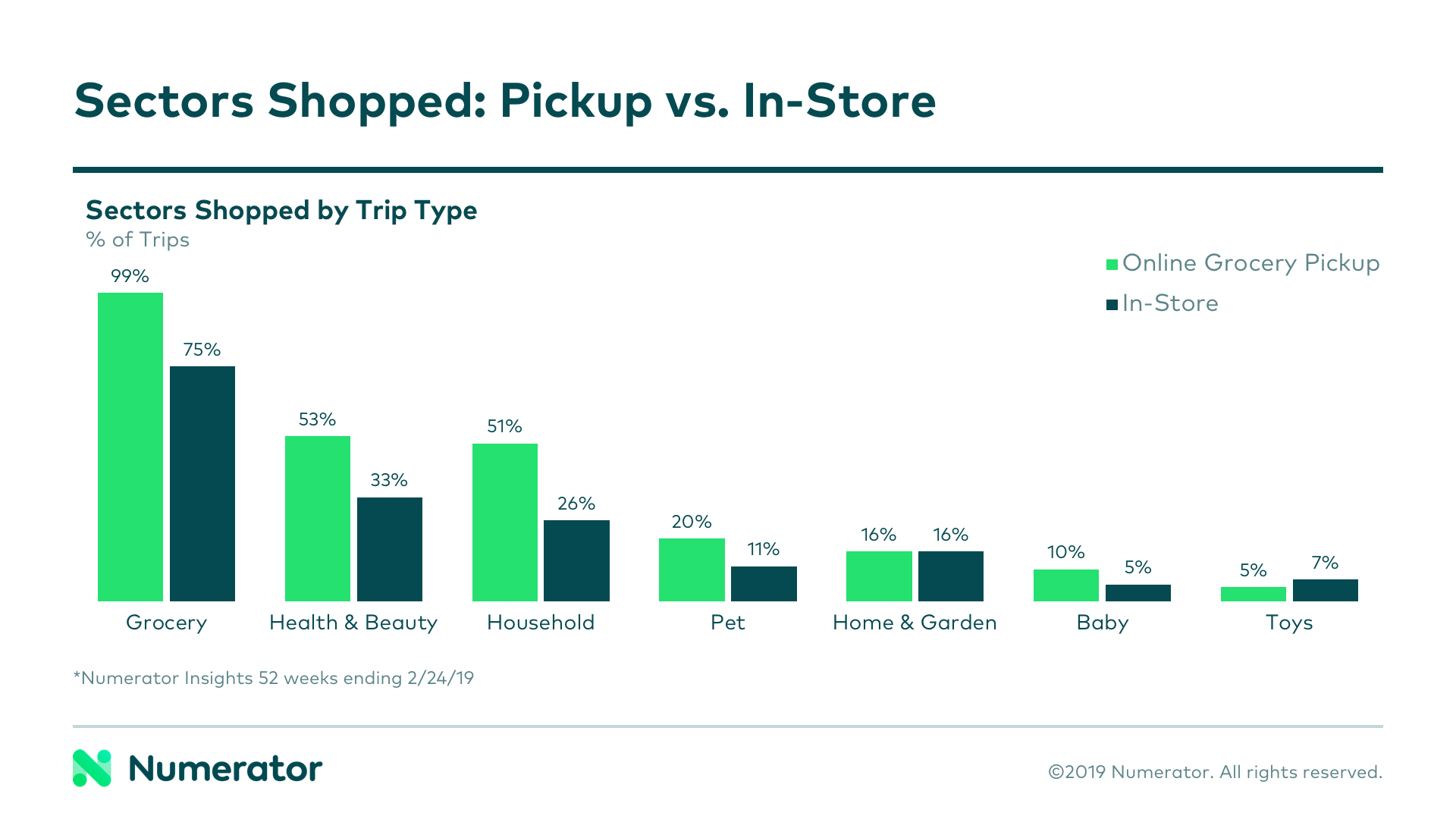

Not only are Walmart Grocery pickup baskets much larger, but they tend to get bigger over time and they’re more diverse than in-store baskets. The average basket spend for the first trip was $116.21, gradually growing to $127.03 for 12 or more trips. More than half of shopping trips include health & beauty and household products, while pet, home & garden, and baby were also well-represented.

Grocery pickup has been quite the revelation for Walmart, as most experts assumed that Walmart could never win these shoppers. The fact is, Walmart Grocery Pickup is attracting valuable shoppers and their high level of satisfaction is evident in growing basket sizes.

As successful as this service has been thus far, there’s plenty of room for growth. Our data shows that Walmart Grocery Pickup users prefer this service over in-store shopping by a wide margin, and customer satisfaction is very high.

Walmart Ramps Up Promotion of Grocery Pickup

Numerator Ad Intelligence data, which accounts for TV, radio, online video, and online display advertising, tells us that Walmart dedicated approximately 40% of all ad spending to promoting online ordering between February 2018 and February 2019. In fact, two-thirds (67%) of Walmart’s TV ad spend in January and February of 2019 focused on grocery pickup.

These investments included the Super Bowl ad for Walmart Grocery Pickup, which also appeared during the Gold Globes and was repurposed into 15- and 30-second ads to run during many other programs. This ad alone has been supported with an estimated $31 million in total spend.

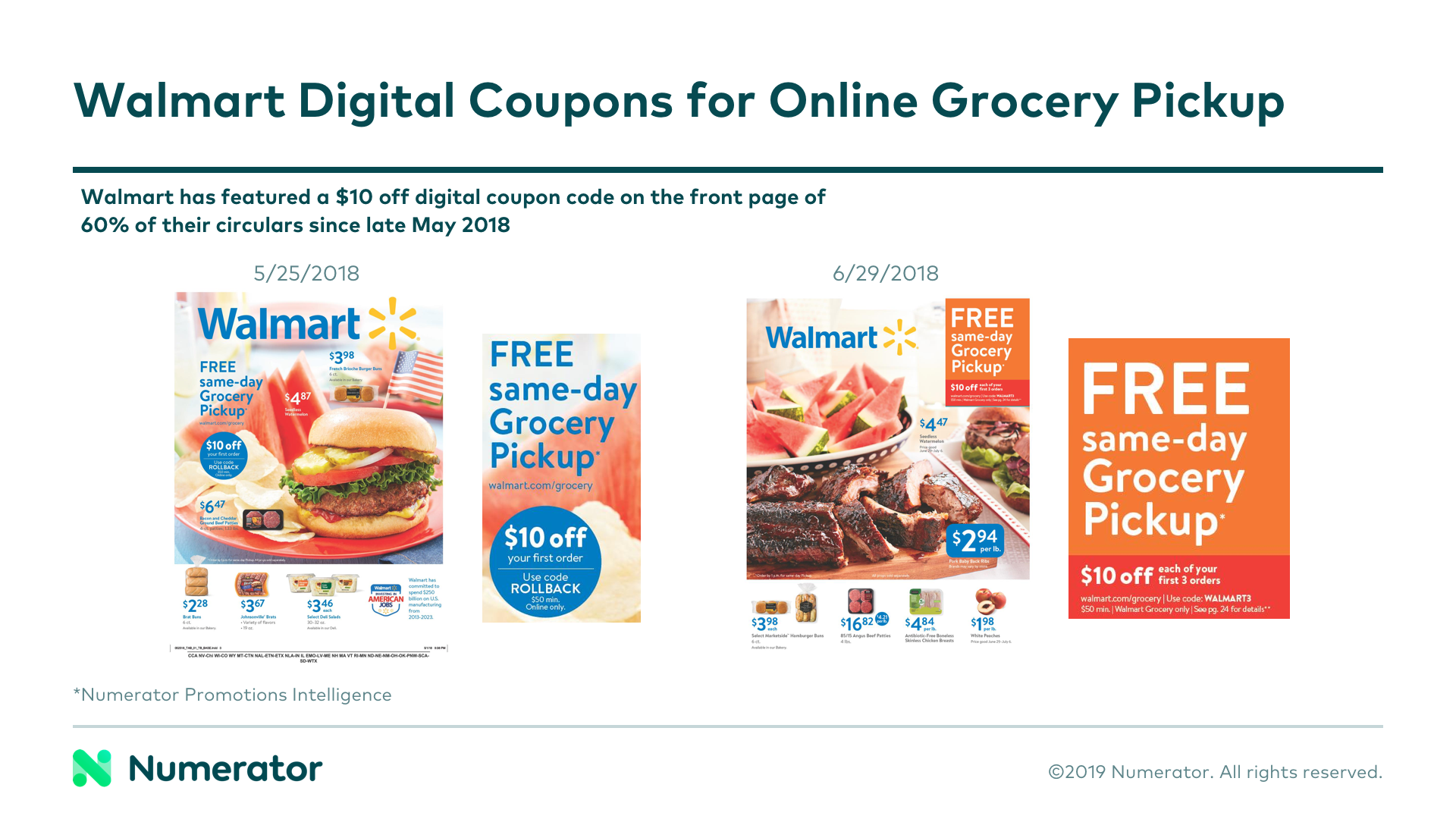

According to Numerator Promotions Intelligence data, Walmart has also been promoting grocery pickup with digital coupons since May 2018. A “$10 off” digital coupon has been on the front page of 60% of their circulars since late May 2018, and the offer was upped to $10 off for the first three orders from late June through the middle of July.

What Grocery Pickup Shoppers Mean for the Future of Walmart

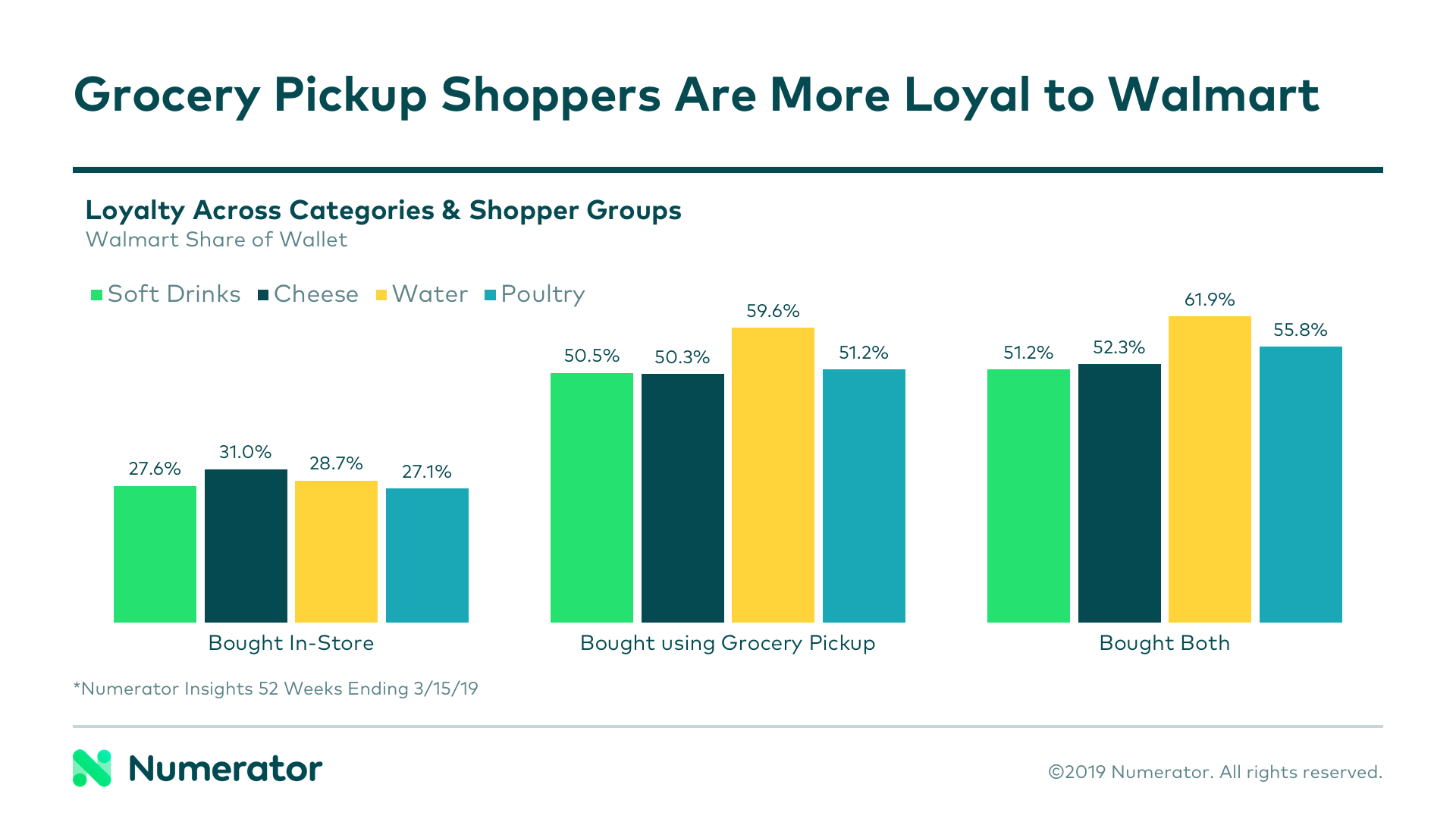

When shoppers start using Walmart Grocery Pickup, they become more loyal to Walmart. In fact, share of wallet for soft drinks, cheese, water and poultry is significantly higher for grocery pickup purchases than in-store purchases.

Stepping back to look at the larger grocery picture, we see just how much of an impact Walmart Grocery Pickup has on total grocery spend. Walmart captures 34.1% of total grocery spend for that shoppers who have completed at least three Walmart Grocery Pickup shopping trips, compared to just 21.1% of total grocery spend for all Walmart shoppers. Also, more than six in ten Walmart Grocery Pickup shoppers (61%) plan to use the service more frequently, compared to just 6% who plan to use it less.

How You Can Win Grocery Pickup

Grocery pickup is still in its infancy. Online technology and fulfillment processes are still being developed and refined. Retailers and brands still need to figure out, for example, how to avoid losing impulse purchases that typically occur at checkout in a brick-and-mortar store. However, the early success of Walmart Grocery Pickup shows just how valuable this service and users of this service can be. Because shoppers are loyal and overwhelmingly satisfied with grocery pickup, odds of getting a shopper to switch once they’ve entered the online grocery world are slim. Early adoption is key.

Contact Numerator to find out how you brand is performing with online grocery and curbside pickup services. Let us provide insights into your target audience so your products end up in their online grocery baskets first.