Ecommerce’s share of the retail market has been steadily growing for years. At its onset, the only option for receiving an online order was a standard ship-to-home service. Now, with the emergence of click-and-collect and subscription offerings, there’s even more potential for ecommerce to grab a larger share of the retail pie. How do these various fulfillment options drive growth for brands and retailers, why is it important to win a shopper’s first ecomm trip in a given category and how does growth online impact to in-store buying?

According to an analysis conducted by Internet Retailer, ecommerce was responsible for 14.3% of total retail sales in 2018, up from 12.9% in 2017 and 11.6% in 2016. Further, ecommerce sales were responsible for 51.9% of all retail sales growth in 2018– that’s the highest percentage of growth for ecomm since 2008. With such a large volume of sales on the line, and a rapidly changing ecommerce space, we decided to take a look at the various fulfillment methods helping to fuel this growth.

Fulfilling Different Needs

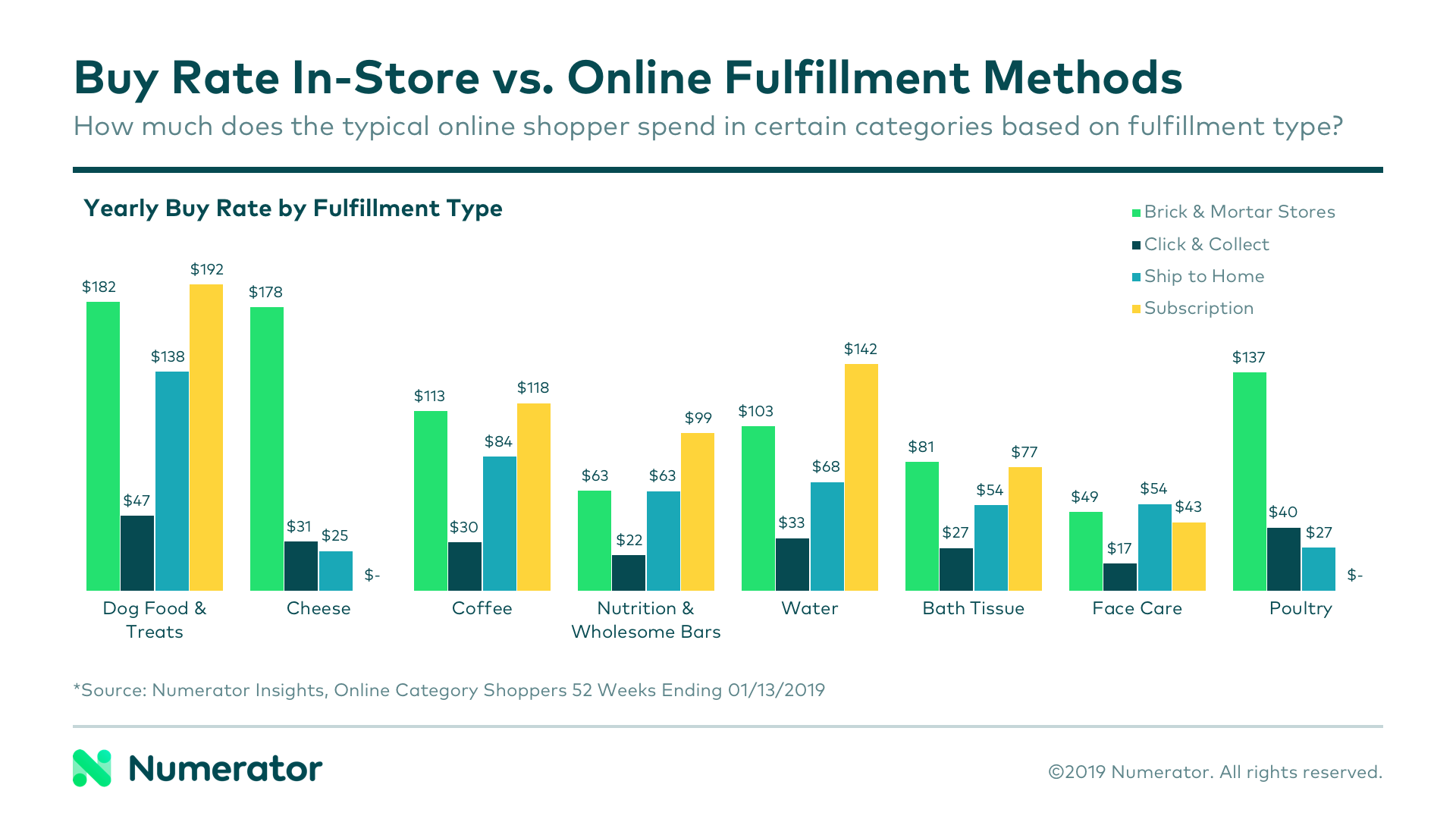

Online purchase frequency lags behind in-store purchase frequency by a fairly significant margin, but some fulfillment options have begun to approach parity within particular categories. Subscription services are seeing a rise in non-perishables trips, and click-and-collect trips continue to grow in frequency, particularly for perishable items. Though in-store purchases happen more frequently, spend per trip is much higher for online purchases. For non-perishable categories, ship-to-home and subscription spend per trip is about twice as high as brick-and-mortar spend per trip.

Buy rates– which take into account a household’s purchase frequency and spend per trip– for some types of online fulfillment are more on-par with in-store rates. In fact, subscription buy rates have surpassed in-store buy rates for some non-perishables like dog food & treats, coffee, bars and water.

Digging deeper into click-and-collect vs. ship-to-home data (excluding subscription purchases), we found that consumers are more likely to use click-and-collect for high-frequency perishable categories such as poultry and cheese, while ship-to-home has a sizable advantage in non-perishable categories.

Loyalty On the Line

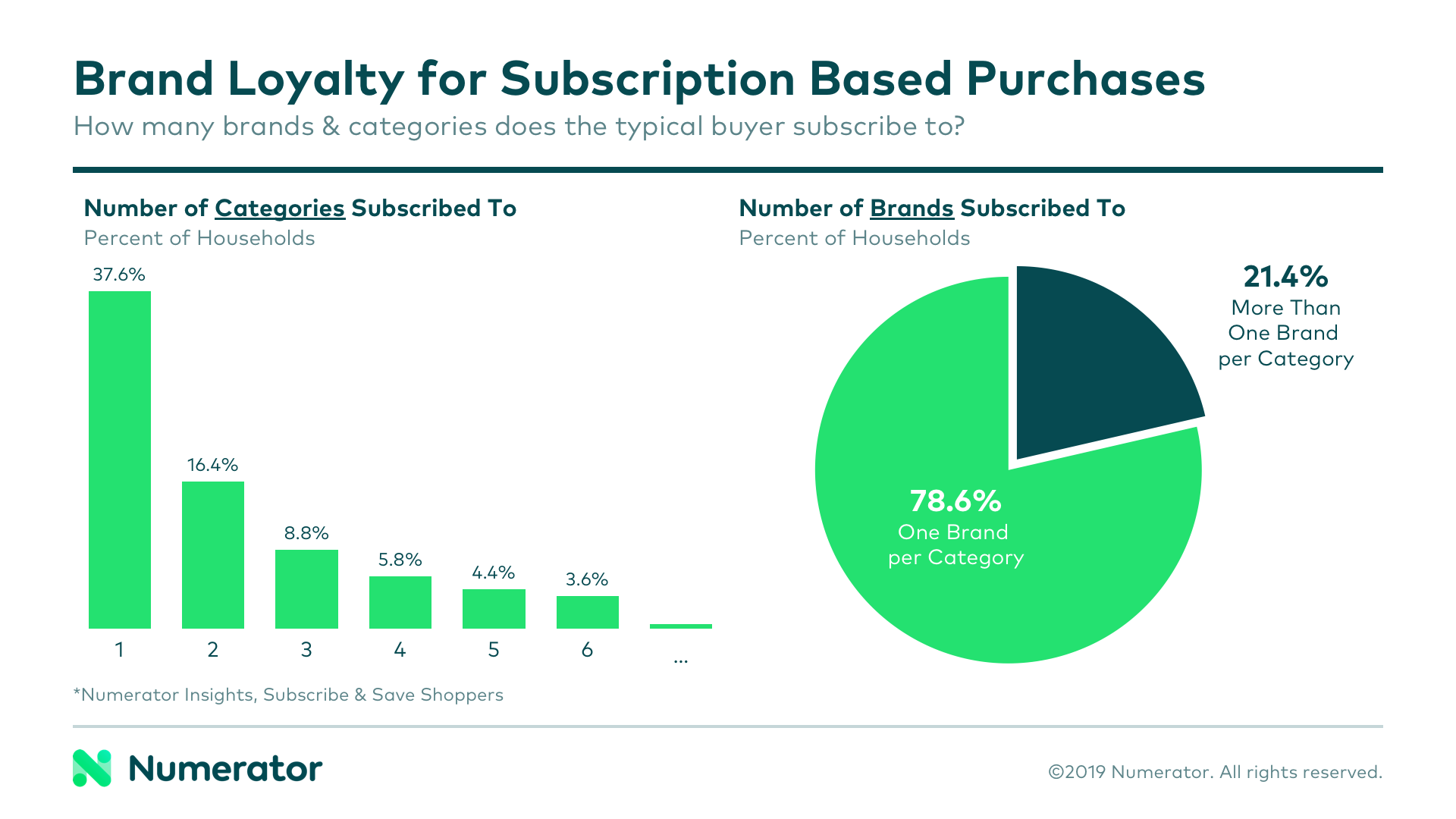

According to Numerator Insights data, nearly two-thirds of households using subscription services subscribe to three categories or fewer. When you look at how many brands per category these households are subscribing to, you see just how loyal subscription shoppers are– nearly four-in-five households subscribe to a single brand per category.

In addition to focusing on one brand per category, shoppers spend more per category during the first year of shopping a category online. This increase in buy rate could indicate an expansion in stock-up trips or an increase consumption of the category overall.

Taking it Offline

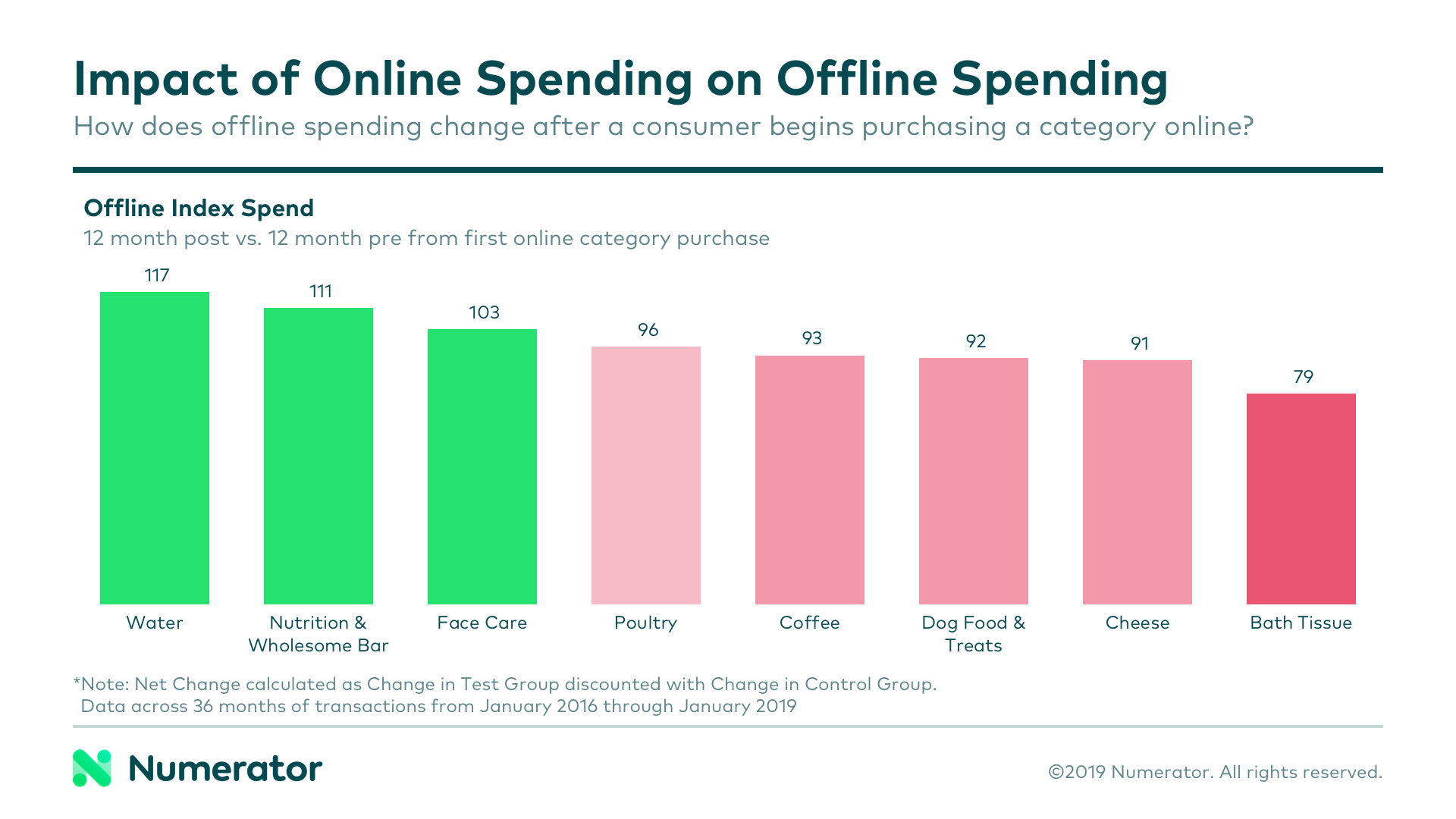

The impact of online spending on offline spending is relatively minor in most categories. In many cases, individuals did spend slightly less in-stores after they began purchasing online, but only marginally so. Some categories actually saw increased spending in-stores after a consumer began purchasing online, indicative of an overall increase in their consumption of that category. Most notably, categories with fewer brands, like toilet paper, tended to see the largest decrease in in-store spend as sales shift online.

To learn more about online shopping and emerging trends in the e-tail space, register for our upcoming webinar, Friend, Foe or Frenemy: Unpacking Online Shopping, taking place on March 20th at 1pm CST.