Thanksgiving is two weeks away, and for a holiday typically celebrated with shared meals and cozy gatherings, the impact of COVID-19 will certainly be felt. While it may look different this year, the majority of U.S. consumers still plan to celebrate Thanksgiving, and shifts in celebrations are likely to lead to shifts in shopping behavior.

In Numerator’s pre-holiday survey, we asked 2,000 consumers about their holiday shopping plans; more than 9 in 10 (93%) said they plan to purchase items to celebrate Thanksgiving 2020. Over two-thirds of these consumers (68%) expect to celebrate the holiday differently this year, and many (66%) expect to shop differently as well. By combining these insights with an analysis of verified purchase data, Numerator has been able to predict how shifting consumer behaviors during COVID-19 could impact Thanksgiving 2020.

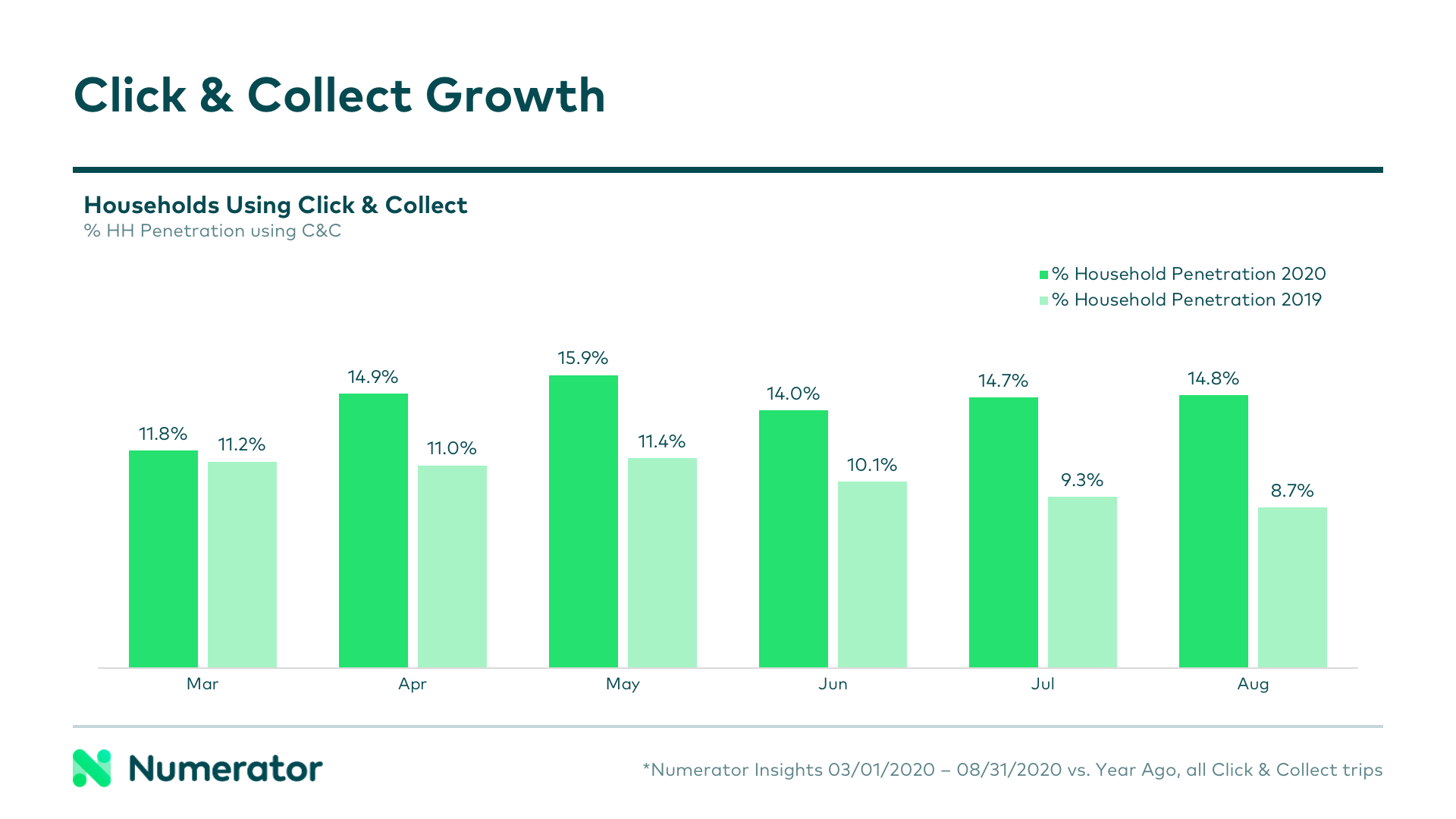

Thanksgiving spend likely to shift online and to click-and-collect

Click-and-collect trips have soared in 2020, with household penetration up an average of 41% per month between March and August versus last year. Based on this high rate of growth, it is very likely we will see an increased reliance on click-and-collect for Thanksgiving shopping, as consumers look to avoid longer stock-up trips and crowded stores. Last year, about 7.3% of US households placed a click-and-collect order in the two weeks leading up to Thanksgiving; this year, at the rate of growth we’ve seen, we could expect close to 10.3% of households, which would mean four million additional click-and-collect trips for Thanksgiving 2020.

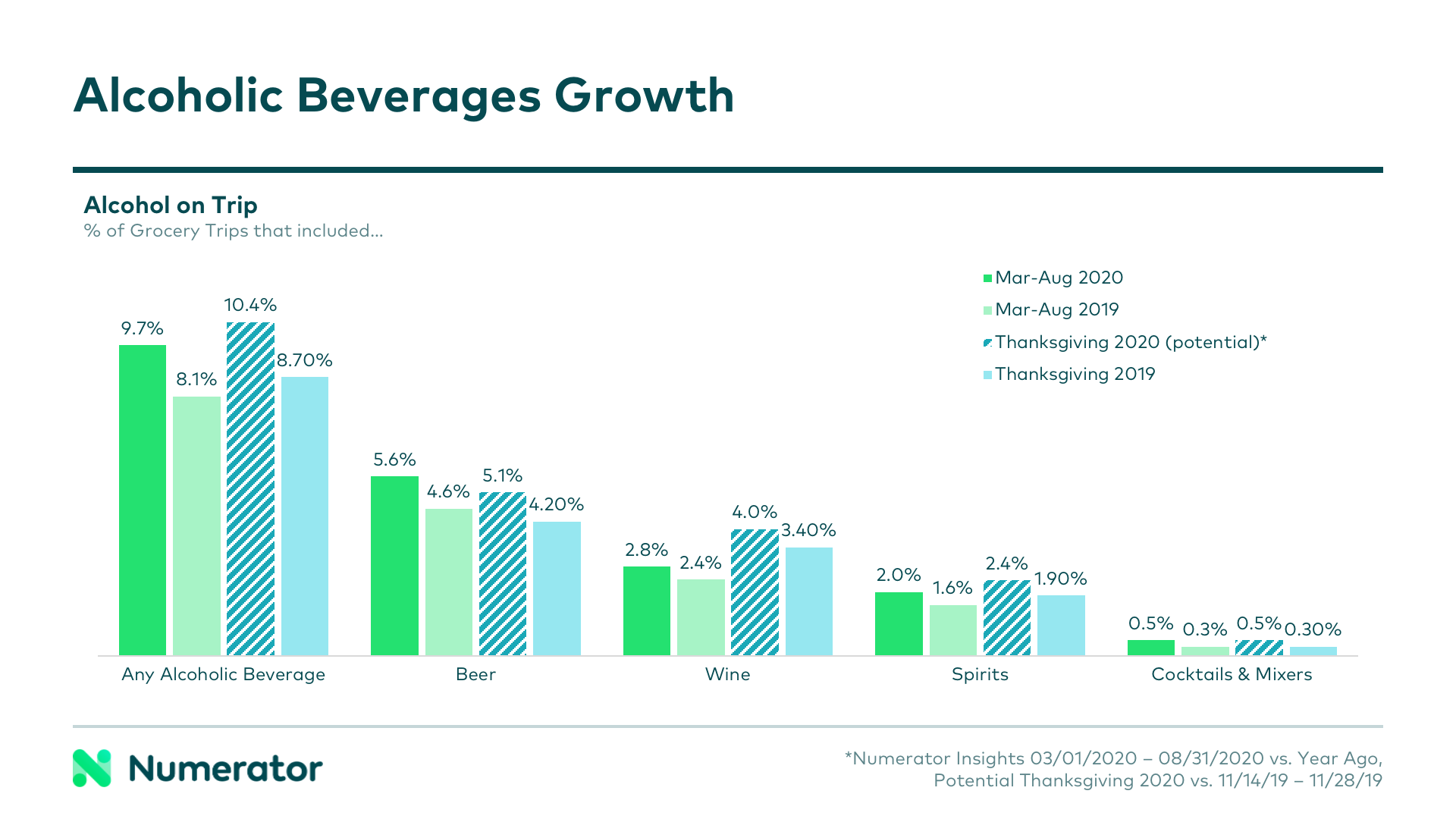

More Thanksgiving grocery trips will include alcohol

Alcohol sales have also seen immense growth in 2020. From March through August, the number of grocery trips that included an alcohol purchase grew by 19.8%, on average, as consumers shifted towards fewer trips and one-stop-shopping. In 2019, 8% of Thanksgiving grocery trips included beer, wine or spirits in the basket. Given the growth in alcohol sales we’ve seen throughout the year, it is possible we will see an additional 21 million grocery trips that include alcohol this Thanksgiving, as consumers aim for a one-stop shopping experience. Broken out by category, an additional 9 million Thanksgiving trips are expected to include beer, 8.5 million expected to include wine, and 5.7 million expected to include spirits.

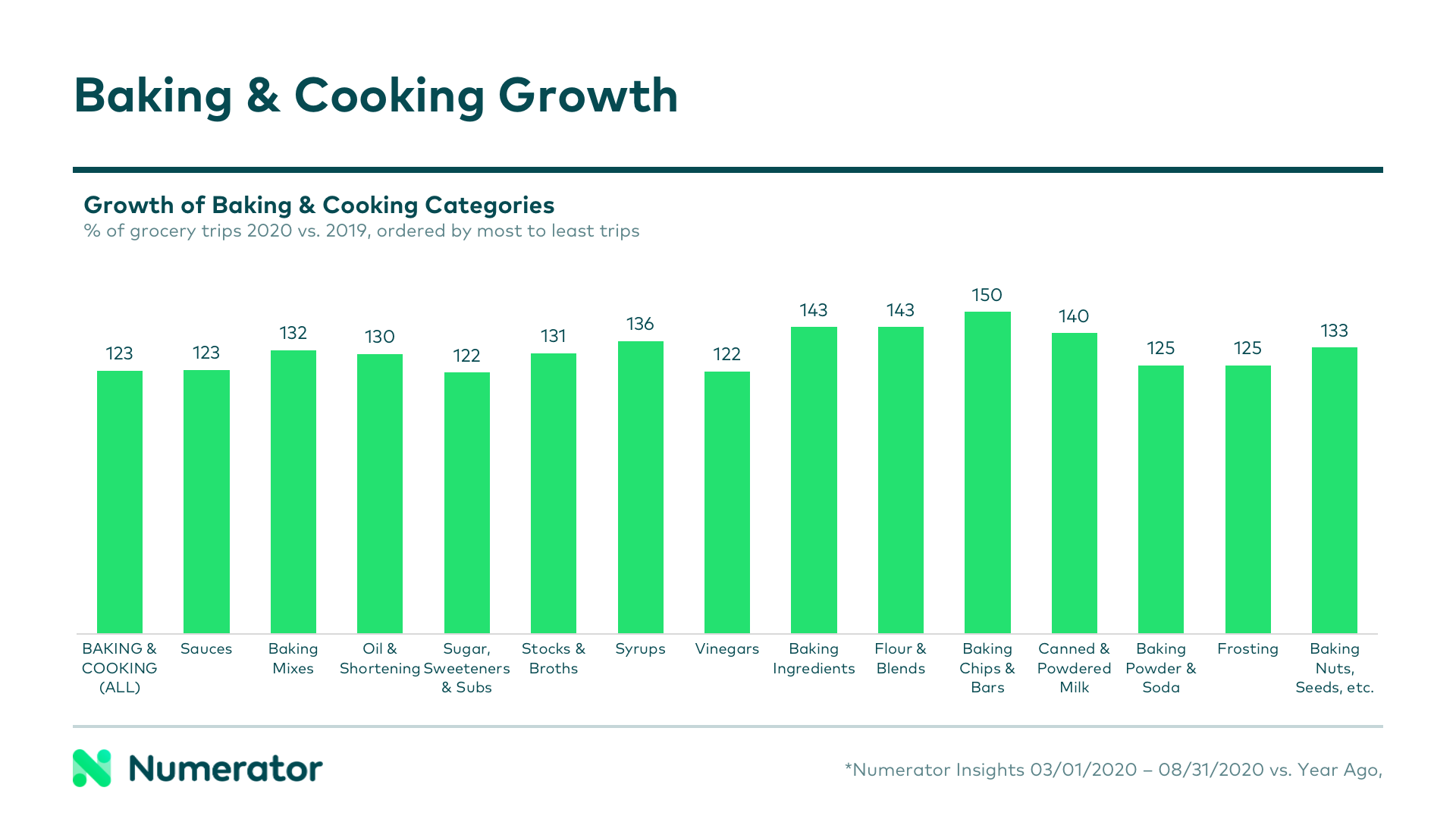

Baking boom will drive Thanksgiving basket growth

With more time spent at home, the past seven months saw significant growth in household penetration for categories related to baking & cooking. Baskets containing baking & cooking ingredients also tend to be larger— roughly 19% larger— so we may see bigger Thanksgiving baskets compared to Thanksgiving 2019. These new-to-baking buyers are demographically different from traditional bakers, skewing younger, male and more racially diverse. Based on the household penetration increases seen over the past months, an estimated 10% more Thanksgiving turkey trips may include baking and cooking ingredients, as consumers test out their newfound skills on a holiday known for homemade meals.

Some holiday food categories at-risk for brand trade-down

Amidst concerns about the economy and increased familiarity with private label due to out-of-stocks and availability, some categories are at risk of trade-down to less expensive private label brands this Thanksgiving. Among the categories most commonly purchased during Thanksgiving, baking nuts, seeds, and chips & bars are the most at-risk of being substituted with private label counterparts, followed by pies and pie-making ingredients, refrigerated packaged soups, sugar and sugar-substitutes, and baking powder and soda.

Looking Ahead

We’ve already seen a number of holidays differ in light of COVID-19, and the remaining 2020 holidays will be no different. For more information on holiday consumer behavior, check out our Holiday Hub, or reach out to us to see how your retailer, brand or category can prepare.