On February 3rd, viewers across the country will tune in to watch the Los Angeles Rams take on the New England Patriots in Super Bowl LIII. Some will be watching for the football, some for the commercials, and some, admittedly, for the snacks on what has become one of the biggest food & drink occasions of the year. In the battle of East vs. West, which team will emerge victorious? Even more importantly, which brands & retailers will win with fans?

Last year, the day before Super Bowl Sunday was the highest single day of grocery sales in all of 2018. Hot Sauce, Meatballs, Frozen Pizza and Dips were all roughly 2x more popular pre-Super Bowl than they were any other given day of the year, with Chips, Beer and Cheeses all experiencing a revenue bump as well. As all eyes turn towards the big game, we’re keeping ours focused on the shoppers.

Using Numerator’s microsurvey abilities, we’ve captured hundreds of psychographic, behavioral, and interest-based attributes for the majority of our 100,000 panelists. Thanks to these holistic panelist profiles, we have thousands of self-identified Rams and Patriots fans, and we’re breaking them down for you. How do shopping habits differ between the two fan bases, and what can brands and retailers expect from these groups when game-day rolls around?

PLAYER PROFILES: WHO ARE THE FANS?

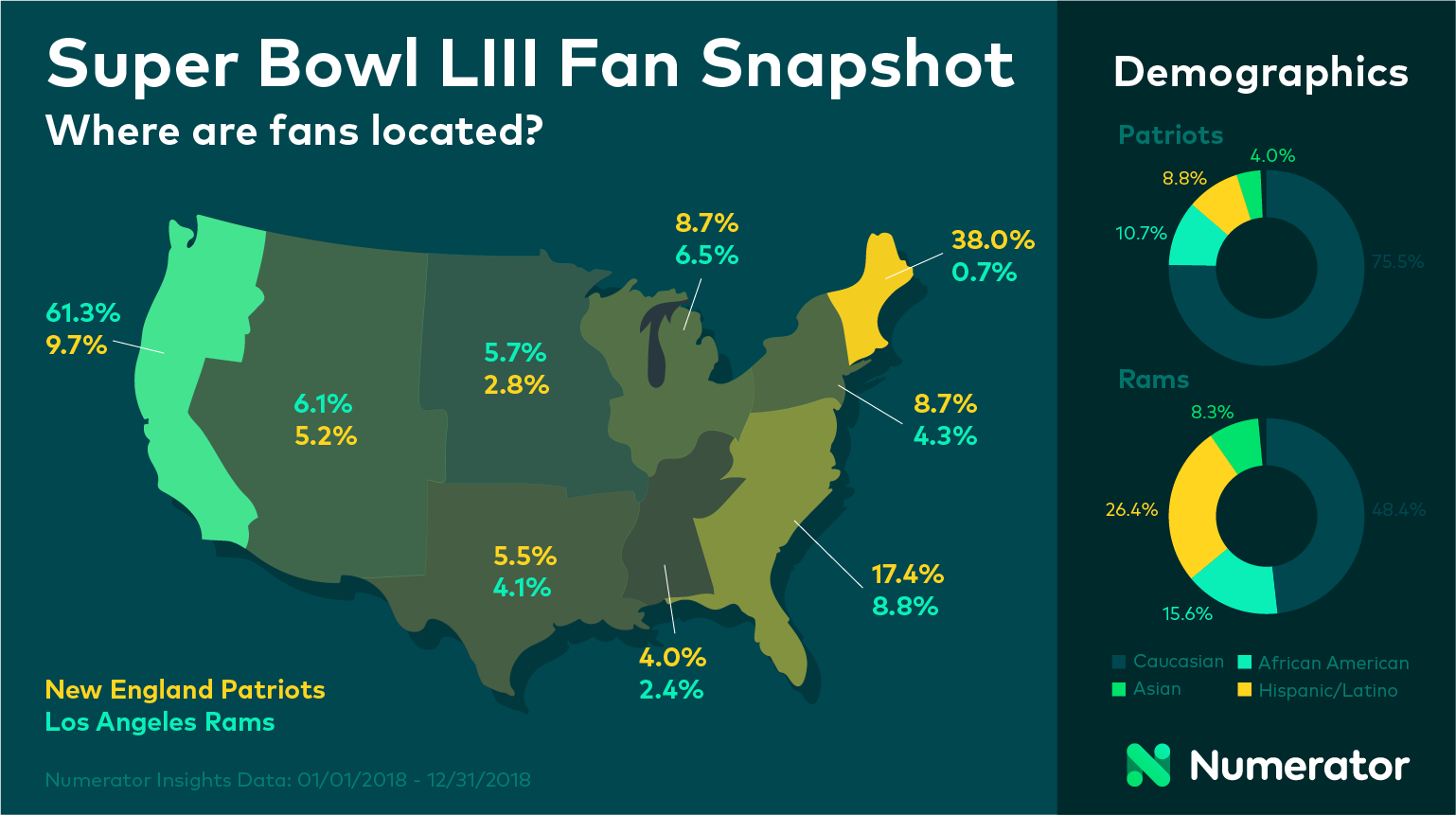

Geographically, Patriots fans are a bit more dispersed; a testament, perhaps, to their national presence as five-time Super Bowl champs. 38% of Patriots fans live in New England, 17.4% in the South Atlantic, and 9.7% in Rams territory, the Pacific. The geographic spread of Rams fans is much more pinpointed, with 61.3% of them currently residing in the Pacific region. Rams fans are primarily urban (58%), while Patriots are more likely to be suburban (39%) or rural (26%).

The Rams fan base is far more diverse, with large Hispanic/Latino (26.4%) and African American (15.6%) contingents, compared to the Patriots base, which is majority Caucasian (75.5%).

FANS ROOT FOR LOCAL BRANDS & RETAILERS

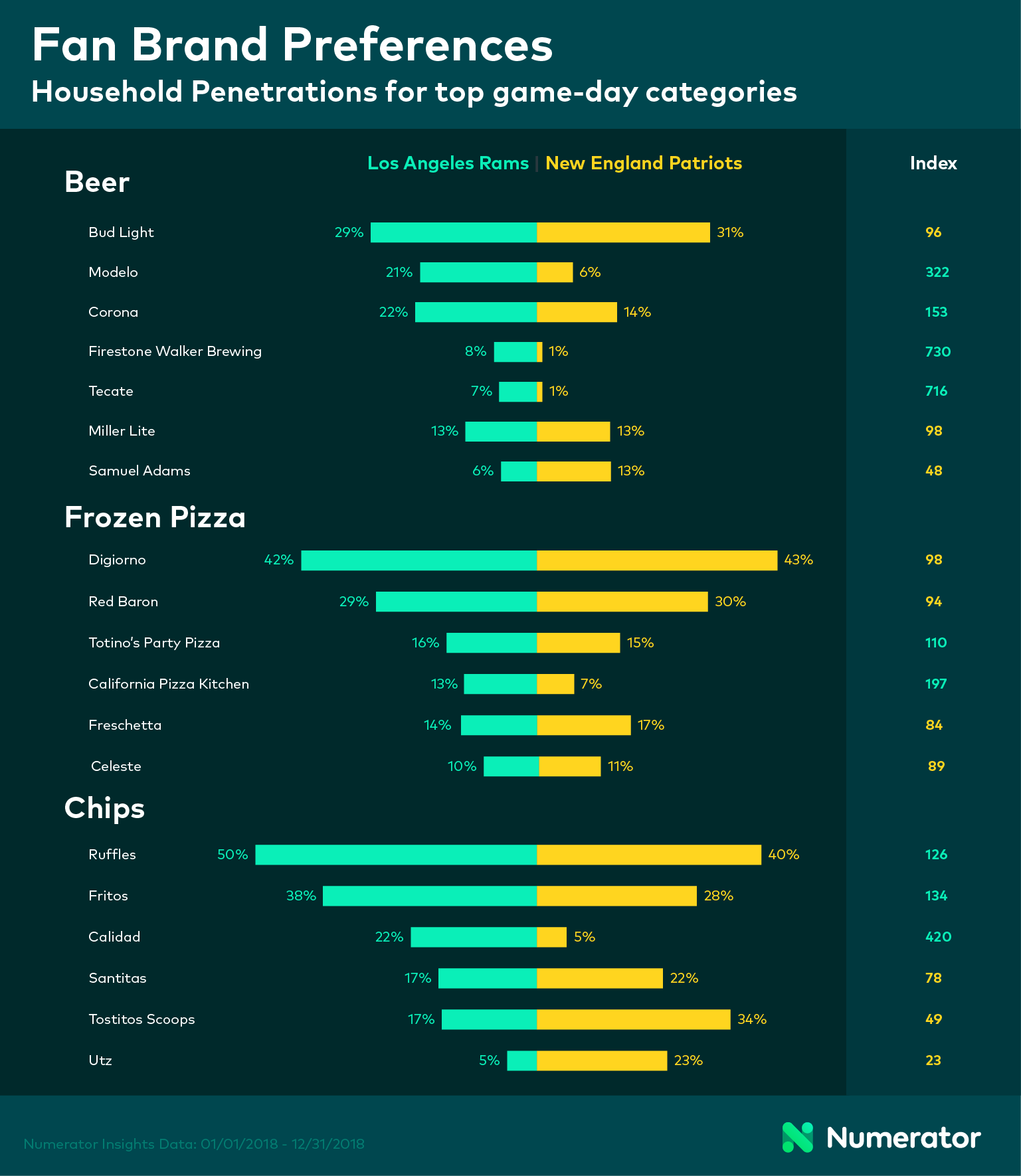

When it comes to beer, Rams fans love Hispanic brands like Modelo, Tecate and Corona, while Patriots tend to favor Bud Light and Miller Lite. Other top brands for the two fan bases are strongly correlated to geography; California-based Firestone Walker Brewing wins big with Los Angeles Rams, and Boston-brewed Sam Adams is a favorite for New England Patriots.

What will fans be munching on during the big game? Chips and Frozen Pizza are safe bets, but while Rams fans are likely to be found snacking on California Pizza Kitchen and Calidid, Patriots are more likely to pick up Freschetta, Celeste, Tostitos Scoops or Utz. As its name suggests, California Pizza Kitchen hails from the Golden State. Brands Celeste and Utz are both manufactured and primarily distributed in the Eastern United States.

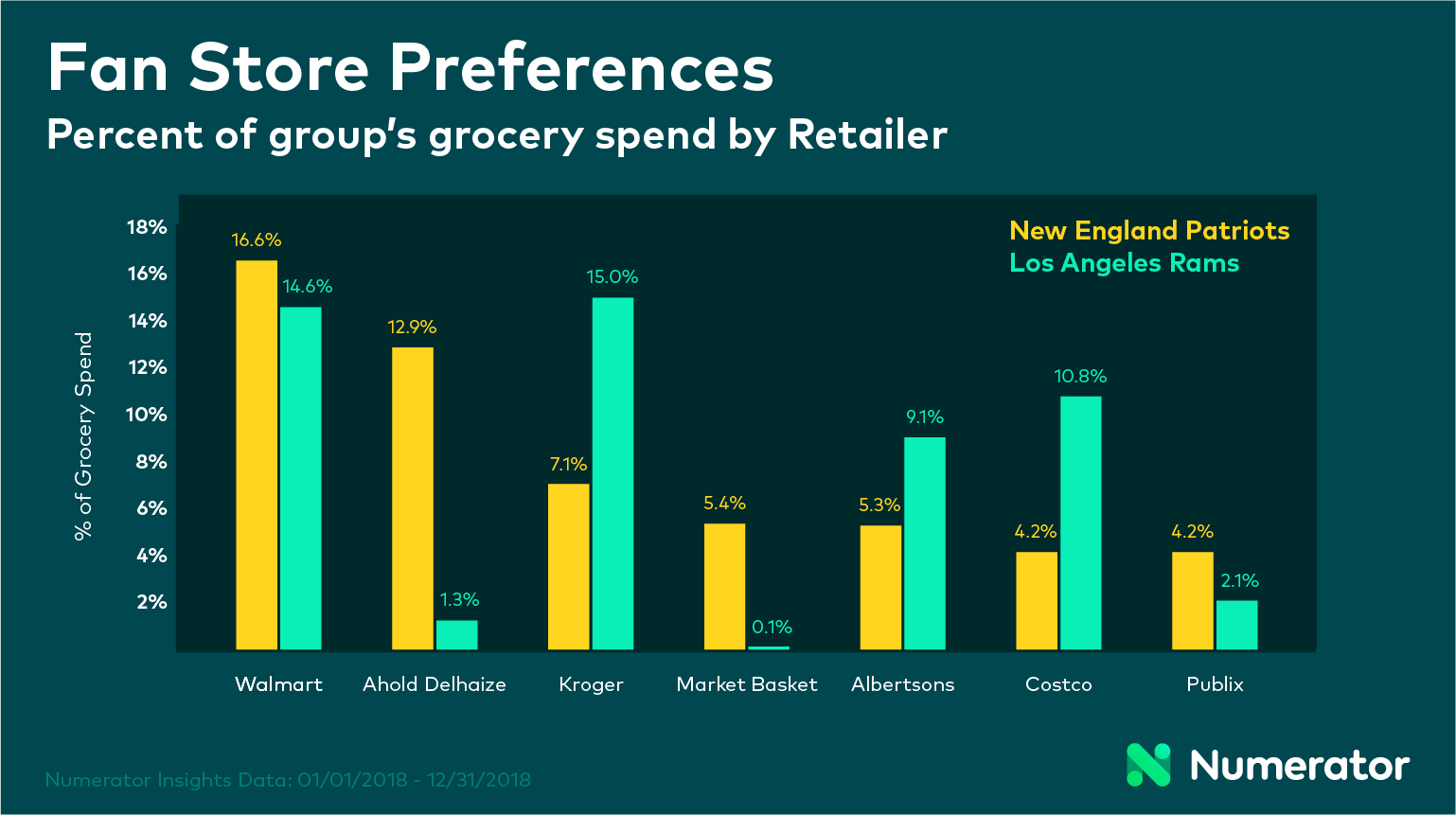

Rams and Patriots fans also have different retailer preferences, likely influenced by both regionality and urbanicity. Both bases spend a large portion of their grocery budget at Walmart, but Rams fans are more likely to shop at Kroger, Costco and Albertsons, while Patriots tend to choose Walmart, Ahold Delhaize and Market Basket.

FUMBLES COULD COST RETAILERS THE GAME

With so many sales to be made Super Bowl weekend, failing to carry or promote brands that resonate with consumers can mean lost dollars for retailers. But how do you identify opportunities and activate sales in top game-day categories, and what is the implication of leaked trips?

For Walmart, our data tells us they have a significant opportunity to gain share of wallet for beer purchases among Rams fans. Of Rams fans who bought Beer and shopped at Walmart in 2018, only 37% made a beer purchase at Walmart. 63% bought their beer exclusively elsewhere, and for those who did buy beer at Walmart, they still spent 81.3% of their beer dollars at other stores. This means that among beer-buying, Walmart-shopping Rams fans, only 6.9% of beer dollars went to Walmart.

We know, based on Numerator Promotions data, that in Los Angeles in the past week, Food 4 Less, Ralphs and Stater Bros have all run front-page promos in their circulars for beer brands like Modelo and Tecate, favorites among Rams fans. Could a strong promotional push help Walmart to steal back share for game day and every day?

THE RUNDOWN

Whether individuals are rooting for the Rams, the Patriots, or the commercials this upcoming Sunday, we can almost guarantee they will be rooting for some quality food & drinks to accompany the festivities. Numerator is here to give you unparalleled insights into your shoppers and why they buy. To learn more, click here, and let us help you step up your game, Super Bowl Sunday and beyond.