Picture it: You’re relaxing on a Sunday afternoon, scrolling through Instagram, and an ad for “the most comfortable pillow ever” catches your eye. Ten minutes later, an order confirmation lands in your inbox. This is the next generation of “As Seen on TV,” and it perfectly encompasses the ease and excitement of direct-to-consumer.

The direct-to-consumer (DTC) model is a disruptive brand model that involves direct transactions between manufacturers and buyers— no retailer required. DTC brands are also known as “internet-born” or “digital-first brands,” given their origins online and on social media. Brands using DTC are now disrupting the retail scape and challenging legacy brands across a wide range of categories.

Mainstream vs. Direct-to-Consumer Brands

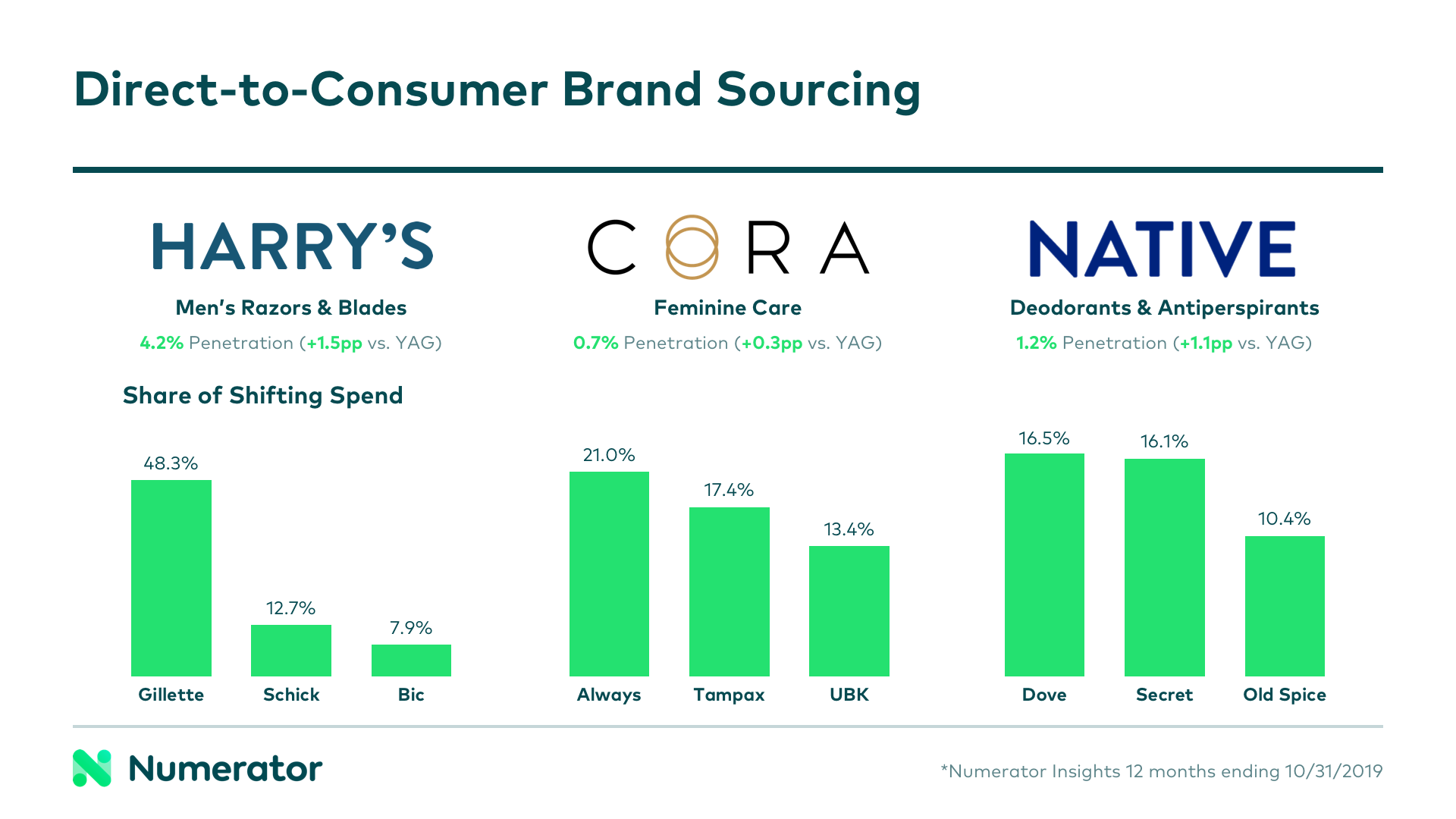

Whenever a new brand enters the marketplace, there are two potential types of consumers for them to capture: those who are completely new to the category, and those who shift from existing brands. In the case of Harry’s razors— one of the original and most well-known DTC brands on the market— Numerator Insights data shows that nearly half (48.3%) of their shifted dollars were sourced from former Gillette buyers. For Cora feminine care, 21% of shifted dollars came from Always, and another 17.4% from Tampax. Native, which sells deodorants and antiperspirants, sourced 16.5% of spend from Dove and 16.1% from Secret.

How Digital-First Brands Spoil Shoppers

Given their high success rates and ability to snag share from well-established brands, these DTC brands must be doing something right. But what? With digital-first brands, shoppers perceive fewer trade-offs between performance, price, and convenience. Manufacturers are stepping up to the plate to deliver superior quality and the kind of customer experience today’s shoppers demand.

By surveying verified buyers of many of these new DTC brands, Numerator was able to verify whether or not brands’ claims held up with consumers. As it stands, 73% of shoppers said digital-first brands such as Dollar Shave Club, Harry’s, Cora, Native, and Quip were better than the brand they had been using prior, claiming the products were, “Much better than other brands,” and “[A] high quality product for a reasonable price.”

High Quality Does Not Equal High Price

As pointed out by one of our survey respondents, one of the benefits of DTC brands is that they don’t force you to pay top dollar for high quality. In fact, these brands typically offer very competitive prices, driven in part by the direct supply chain from brand to customer.

For example, 80% of Dollar Shave Club shoppers were driven by price the first time they bought the brand, according to Numerator Insights data. The $7.65 unit price is 10% lower than the category average. When buyers were asked what made them decide to buy Dollar Shave club the first time, the recurring theme was the right combination of price and quality.

Additionally, unique-to-the-category models can drive perceptions of convenience and value. In the toothbrush space, Quip allows you to subscribe to a refill plan so you can have toothbrush heads, fresh floss and toothpaste automatically delivered every three months with free shipping. Deliveries serve as reminders that it’s time to switch toothbrush heads, which helps people practice better oral hygiene without a trip to the store. According to a Numerator survey, 65% of Quip buyers said Quip is a good value for the money while 53% said they would describe Quip as innovative.

Cultivating Strong Relationships with Shoppers

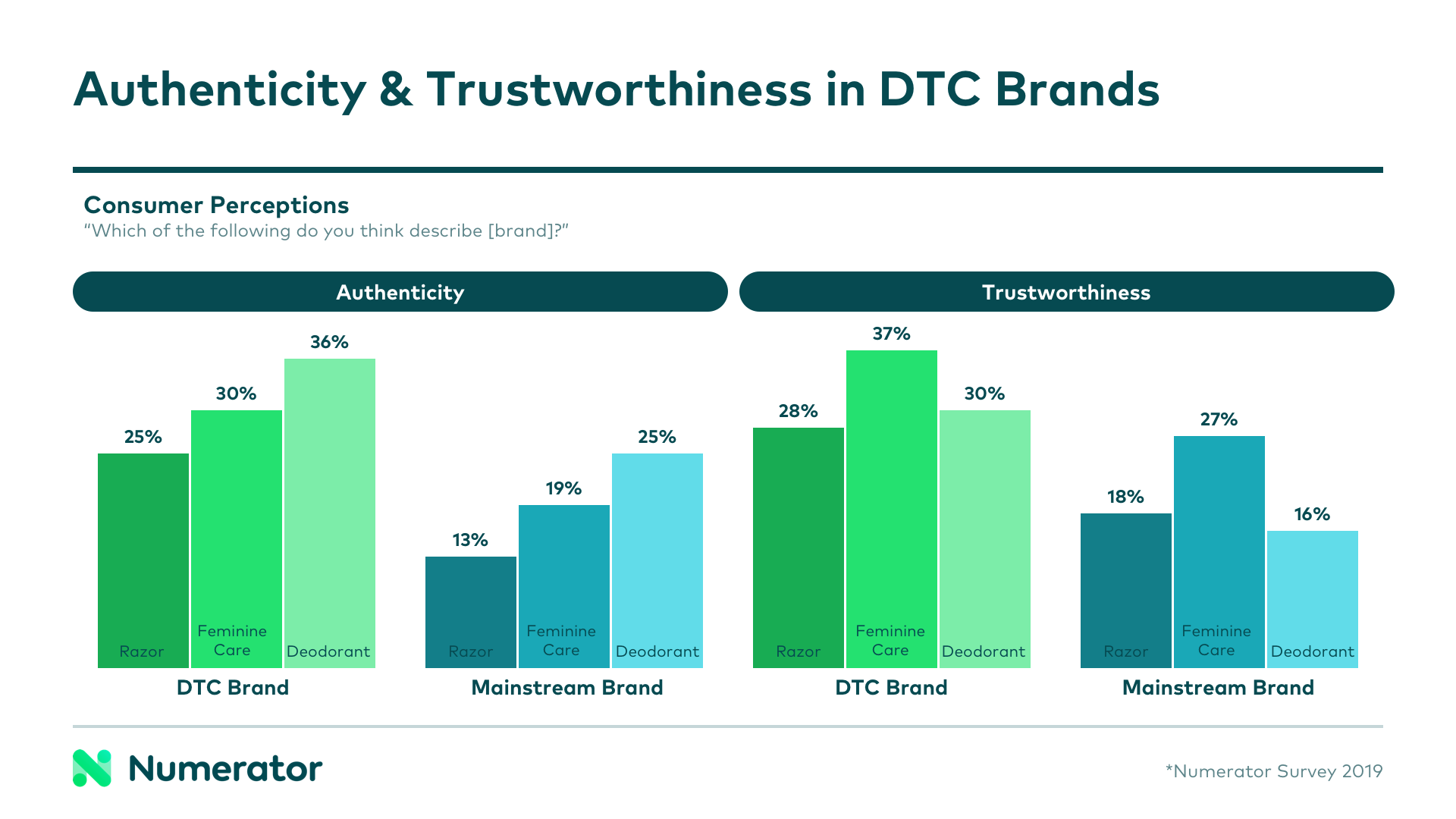

Digital-first brands own every aspect of the customer experience, which gives them the opportunity to earn trust and build lasting relationships. In fact, authenticity and trustworthiness even differentiate digital-first brands from similarly new but traditional, mainstream brands. According to Numerator survey data, digital-first brands in the razor, feminine care, and deodorant categories are more likely to be described as authentic and trustworthy.

These perceptions can translate to greater loyalty and higher category spend. For Harry’s buyers, 63% of category spend went to Harry’s, compared to an average of 53% for top mainstream brands in that category. For Native buyers, 39% of category spend went to Native, compared to an average of 30% for the average of top mainstream brands in that category.

DTC brands are making a splash and disrupting the consumer goods industry. We’ve heard a bit about why they appeal to consumers, but what else can we learn about these brands and their growth models? Stay tuned for part two of this post where we’ll look into how Target helped Harry’s increase sales and expand its customer base, and how mainstream brands are fighting back.