From the Naked Egg Taco at Taco Bell to two-for-$4 breakfast bundles at McDonald’s, brands are investing in menu innovation and price promotions to resonate with consumers and drive traffic and sales around breakfast time. While these are very important aspects to driving growth, restaurant brands need to understand that breakfast is anchored on functional habits and convenience before anything else.

Numerator Insights data shows that QSR breakfast buyers have higher purchase frequency and buying rate than total fast food visitors, making them a lucrative target segment. Breakfast is also the only growing day part in QSR representing a big opportunity for fast food brands. Restaurant brands trying to compete and win in this mealtime have to get these components right.

Need for Speed

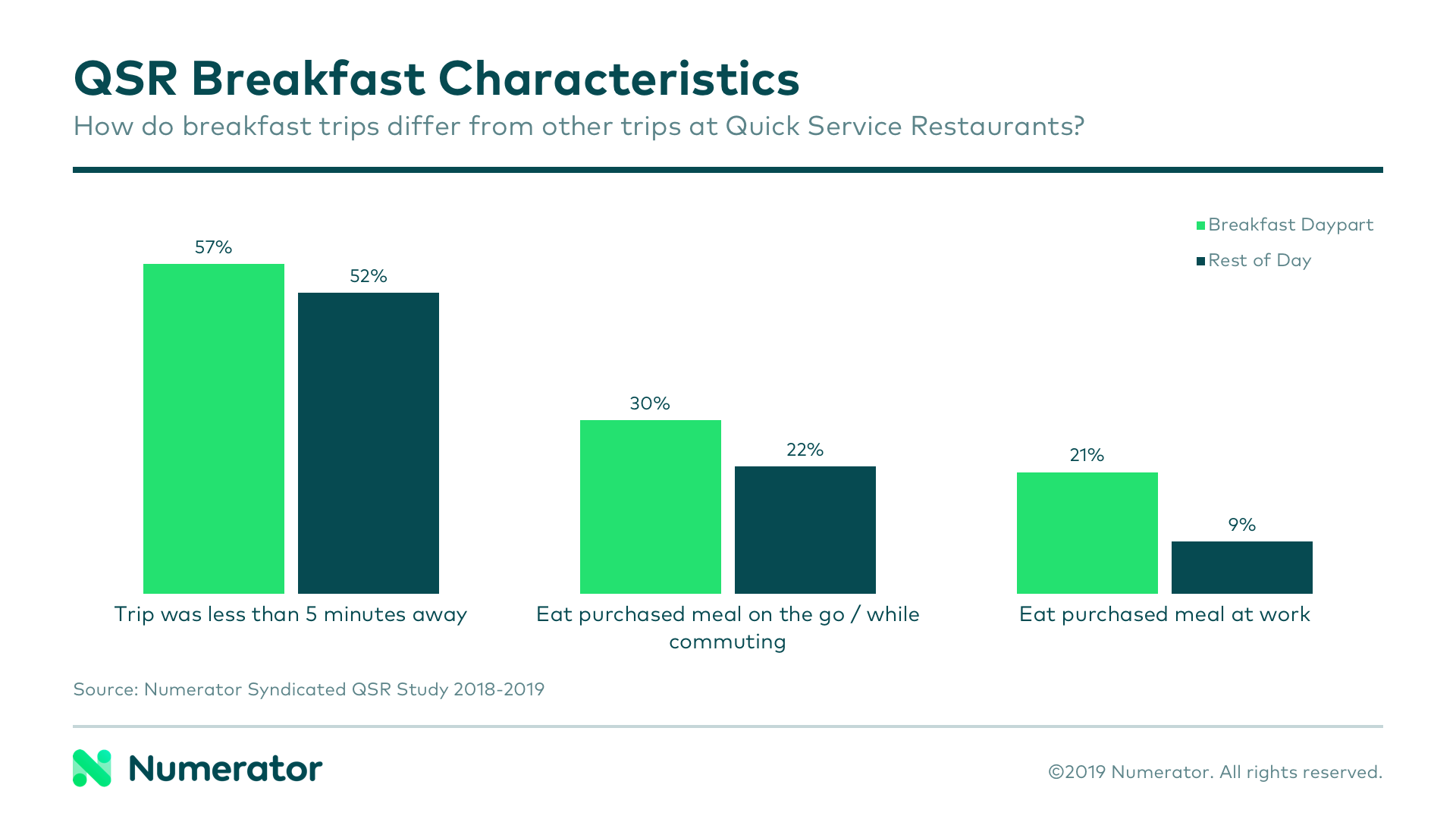

As their name suggests, the defining characteristics of Quick Serve Restaurants are speed & convenience. Consumers have come to expect full meals a couple of minutes after ordering. However, they continue demanding more streamlined experiences, especially for the breakfast day part, which is arguably the most time constrained. Numerator data shows that 57% of QSR breakfast trips were made to locations less than 5 minutes away, +5% points from rest of day. Furthermore, QSR breakfast shoppers are more likely to eat the meal at work (21% vs. 9% for Rest of Day) or on-the-go / while commuting (30% vs. 22% for rest of day).

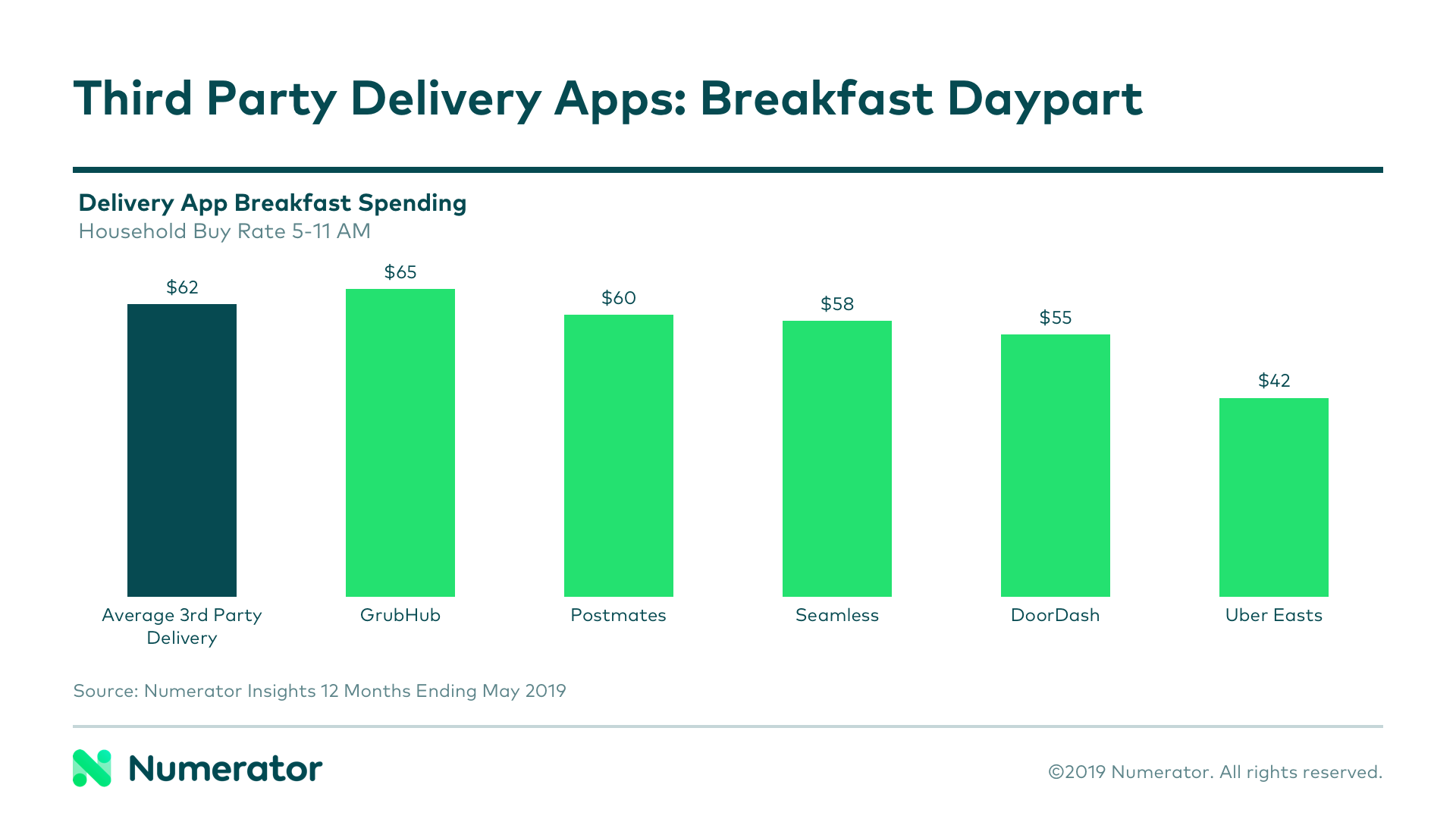

To that end, consumers are leveraging technology offerings to streamline the process, especially for breakfast. For example, 4% (vs. 2% for rest of day) of breakfast fast food trips used mobile ordering or order ahead capabilities and 8% used kiosks (vs. 4% for rest of day). They are also relying on 3rd Party delivery providers to save time. Per Numerator data, over the past year, consumers have spent about $62 dollars with the Grubhubs, UberEats, and DoorDash’s of the world during the breakfast day part with average basket size about $20, highlighting consumers are willing to pay for convenience.

Panera is one example of a QSR leaning on technology to drive breakfast growth. Not only do they deliver and cater, but they’ve developed capabilities such as the Rapid Pick-Up which allows consumers to pick up their food at the consumer specified time without waiting or making lines. Additionally, via their mobile app, guests can skip the register and purchase a grab-and-go coffee via mobile payment and can reorder previous purchases with one tap. While their breakfast growth strategy also includes quality, made-to-order food, Panera understands that convenience remains king and they are using technology to streamline the process for consumers.

Breakfast Buys are Habitual

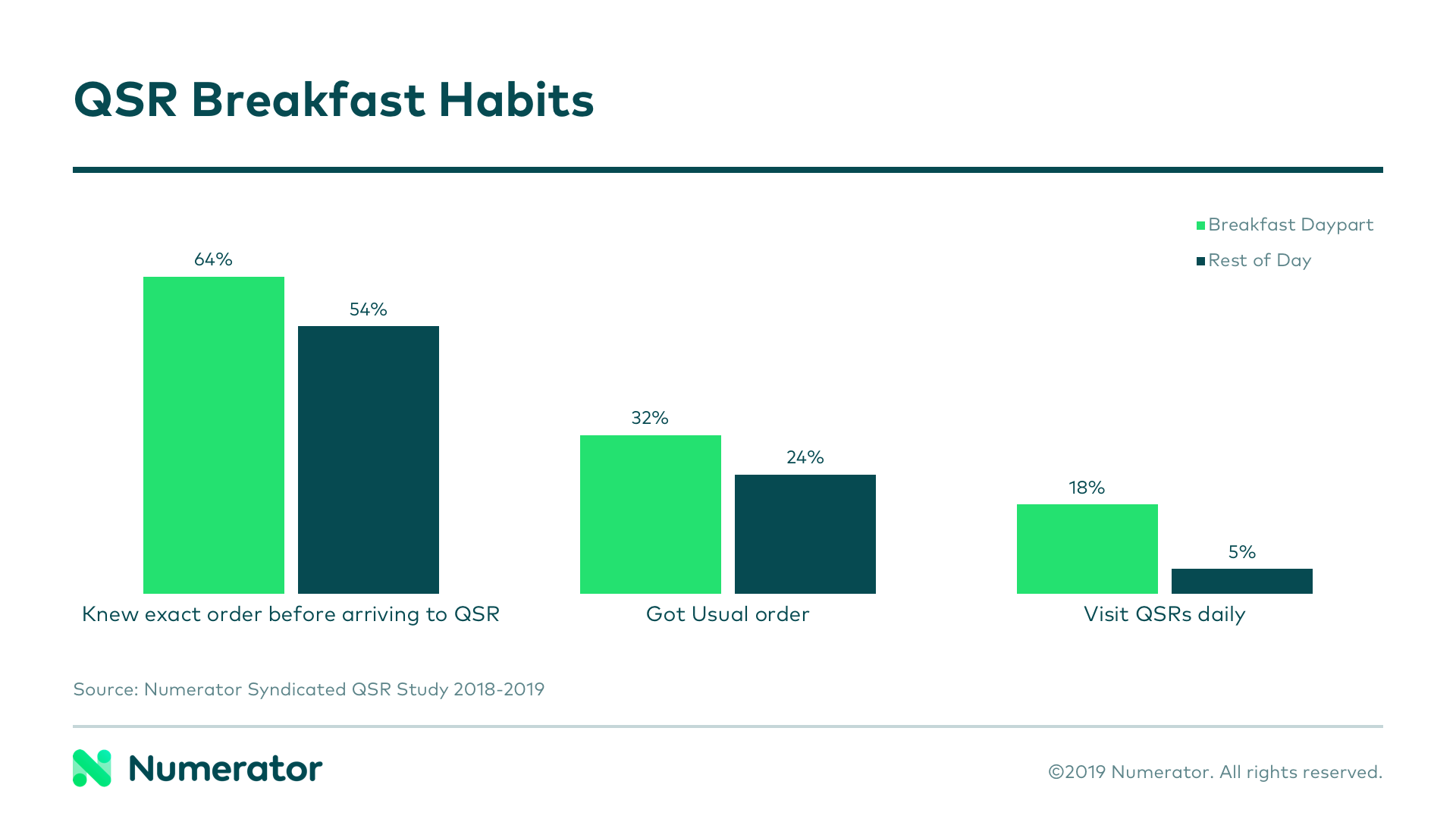

Compared to all other day parts, breakfast is the most habitual, likely stemming from the time-constraint associated with mornings. Numerator data highlights these aspects as 64% of consumers on breakfast trips (vs. 54% for rest of day) knew their exact order before they arrived, 32% visited to get the usual order (vs. 24% for rest of day), and almost a fifth (18%) visit QSRs for breakfast daily (vs. 5% for rest of day). Breakfast trips were very functional as well – 39% visited a QSR for breakfast to satisfy hunger and 17% needed something to eat while at work. This is not to say that menu innovation, pricing strategies, or shopper marketing promotions are not important to drive breakfast growth, but given the habitual component of the breakfast day part, brands must push that much harder to capture consumers.

A great example of someone taking advantage of habitual breakfast buying is Burger King, who recently launched their $5 coffee monthly subscription launch. In an effort to drive guest count and sales, BK is allowing customers to grab a coffee every day if they sign up through the app. Coffee is arguably the most habitual breakfast item for many consumers. By offering coffee at such a low price, they are likely to drive traffic among non-out of home coffee buyers and steal coffee buyers from other QSRs. This in turn potentially allows BK to upsell consumers with day part menu innovations or even pricing bundle promotions which leads to higher tickets. Not to mention the fact that they are developing their tech ecosystem as this promotion runs solely through the app.

How can your brand take advantage of compelling promotions and break through the noise in the battle for breakfast? Contact us today and let Numerator help you win the morning mealtime.