If you’re among the marketers tracking buyer sentiment, “coupons” and “sales” are likely the buzz words you’ve seen trending as inflation increasingly impacts consumer purchase decisions. As price points start to grow, you likely will need to reasses your pricing strategy to remain competitive and profitable. Tackling price sensitivity is one of the first steps towards solving the pricing equation.

Pricing Research Basics

The importance of tracking price sensitivity

Dramatic price increases have left shoppers feeling uncertain especially as the price of groceries and fuel continues to climb. As a result, consumers are increasingly reporting spending cutbacks. But not necessarily in all categories. For example, more than one in four consumers still plan to spend their surplus budget on travel.

Sentiment about inflation is also causing a realignment in brand loyalties, as consumers are increasingly using rewards and loyalty programs to ease the burdens of inflation. This is especially true at the pump as gasoline prices reach near-high levels. These shifting sentiments and buying habits have left brands re-examining their tactics as they are faced with the question, “what will happen if we raise our prices?”

How to measure price sensitivity

When it comes to measuring what’s important to consumers and how much they are willing to pay, not all brands face the same challenges. For example, during the most recent holiday period, spending on snack products and alcohol beverages topped consumer shopping lists, while dining out topped the cutback list.

When it comes to measuring price sensitivity, how do marketers find the point where consumers say “enough is enough?” Consumer perception about a product’s price relies upon two factors: one, the consumer’s own internal reference point of the value of the product, and two, the actual cost.

We start with the consumer reference price, which is the amount a consumer believes a price should be. The lower the cost of a product with respect to the customer’s reference price, the more they believe they are getting a better deal.

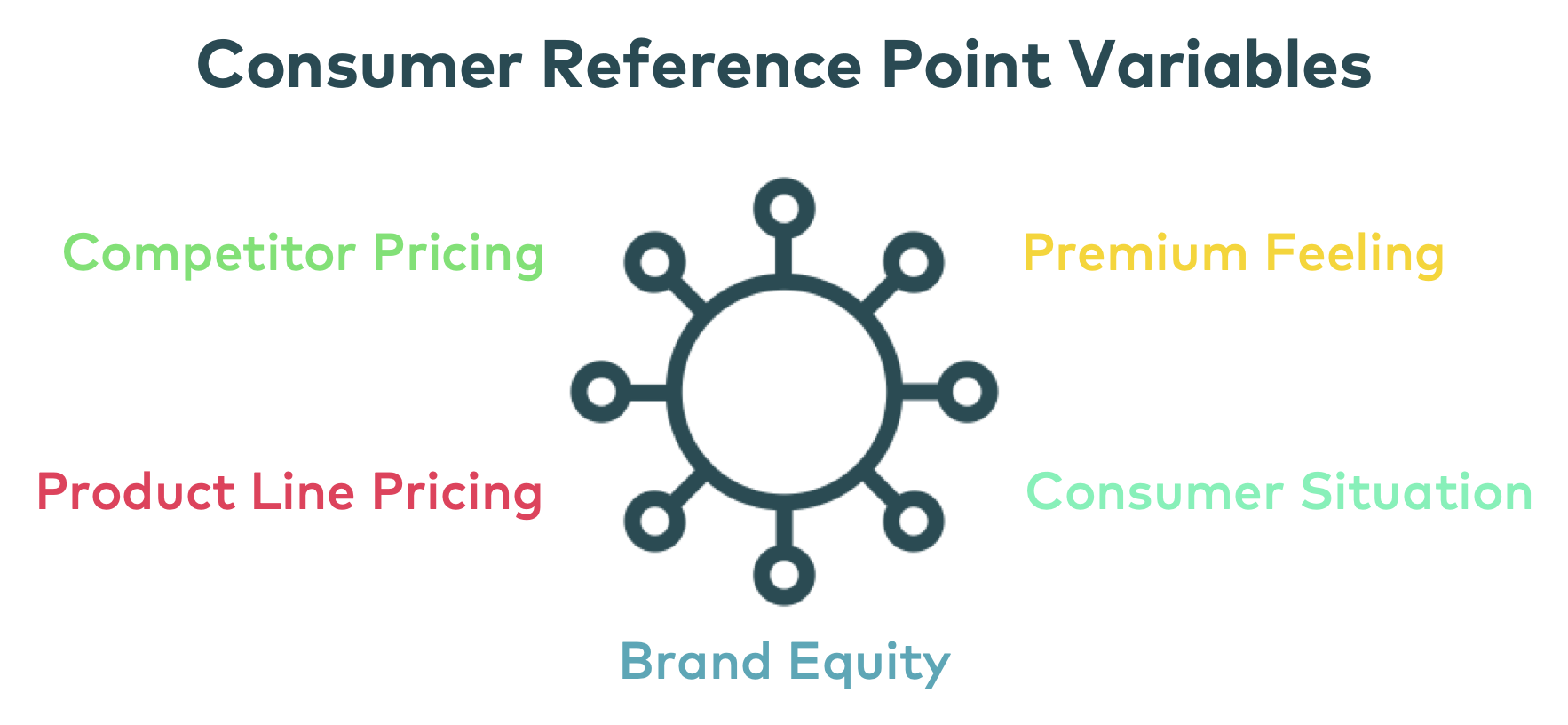

However, there are many variables that can affect how a consumer arrives at their reference price. Among them:

Then come the next questions. If the price of the product is perceived to be too high, what will the consumer do next? Skip the purchase? Visit a competitor? Which competitor? Finding these answers through a pricing sensitivity analysis will result in critical information for business planning.

How to run a pricing study

Pricing research has two typical objectives:

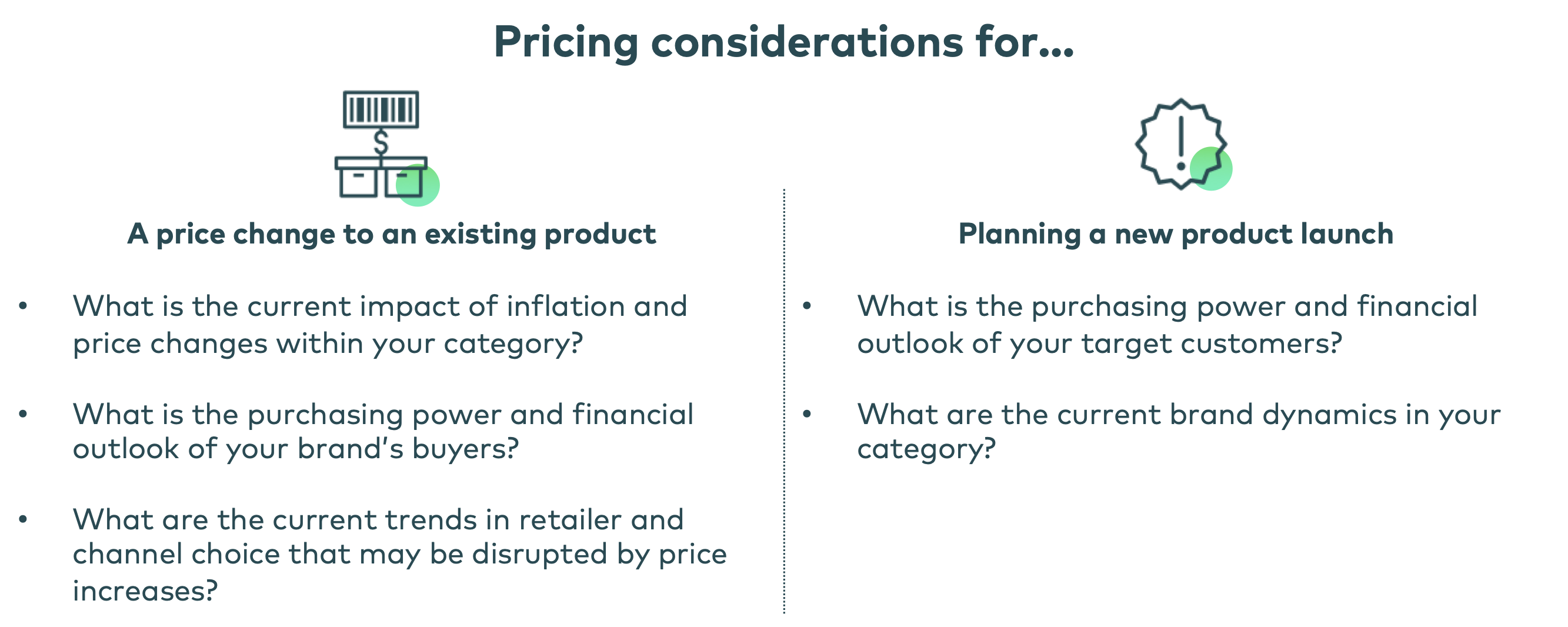

- Assess the potential impact if you’re planning to change the price of an existing product, or

- Determining what price consumers are likely to pay for a new product.

For each objective, a simple pricing survey can net valuable insights. For example, a pricing survey might ask simple questions to examine how much a consumer will pay at the pump. The survey might ask for yes or no responses, such as is $5.00 a gallon too high, or might present several pricing options and ask people to rate which ones are too high.

Pricing surveys work best when not conducted in a vacuum. Surveys can help validate other pricing research done through point-of-sale and panel and provide a consumer and forward-looking lens. When considering a price change, below are some considerations:

Pricing Methodologies

To understand pricing research and consumer pricing panels, it helps to have an overview of the different types of consumer insight strategies Numerator utilizes depending on the business need.

Gabor Granger

Developed in the 1960s, the Gabor Granger pricing research methodology continues to be widely used today. In a Gabor Granger analysis, respondents are shown a product at various price points and asked whether or not they would purchase at each of those price points. From the data collected, we can build a price sensitivity curve – a demand curve of what percentage of consumers are willing to purchase at each price point.

Example: This model essentially leads consumers down a pre-set path. Would you pay $3 for a gallon of gas? $3.50? $4? Then it tracks how many respondents say yes at each level.

Price Sensitivity Meter

An enhanced pricing model is Van Westendorp’s pricing sensitivity model, which prompts consumers about their willingness to pay in an open-ended form. Respondents answer questions by entering their own prices into numerical open-ended questions (within a minimum and maximum range). Since this methodology does not require specific price inputs, PSM is often used to assess price sensitivity during new product development.

Example: This model would leave the responses open for the consumer to fill in. Questions include, “At what price is a gallon of gas too expensive?” “At what price is gasoline becoming incredibly expensive but still affordable enough to buy?” “At what price is a gallon of gas a bargain?” “At what price is a gallon of gas so inexpensive you might question the quality of the gas (or the fuel station?)”

Newton, Miller, Smith Extension

Adding on the Newton, Miller, Smith extension also asks consumers to indicate their likelihood to purchase at the “getting expensive” and at the “bargain” points. From this information, we can identify not only price sensitivity curves but also the acceptable price range where consumer dissatisfaction with pricing is minimized.

Example: In the Newton Miller Smith Extension, not only would consumers be asked “at price would a gallon of gas be considered ‘getting too expensive,’” but also, “what is the likelihood that you would still purchase gas at that rate?”

Conjoint Analysis

The conjoint analysis offers a deeper dive into product pricing by investigating consumer perceptions about brand-by-brand pricing dynamics within a category. The exercise presents respondents with sets of product and price combos, out of which the respondent selects one product they prefer the most. From this series of trade offs, we can infer the underlying price sensitivity of every product tested.

Example: In this model, a panelist might be offered a series of gasoline pricing options at various locations. Perhaps $5 a gallon at your grocery store fuel pump, $5.25 at your discount supercenter pump or $4.75 at the corner fuel station. Through this method, research might indicate that price alone isn’t a factor as customers might actually be willing to pay a little more for the convenience of a supercenter fuel station.

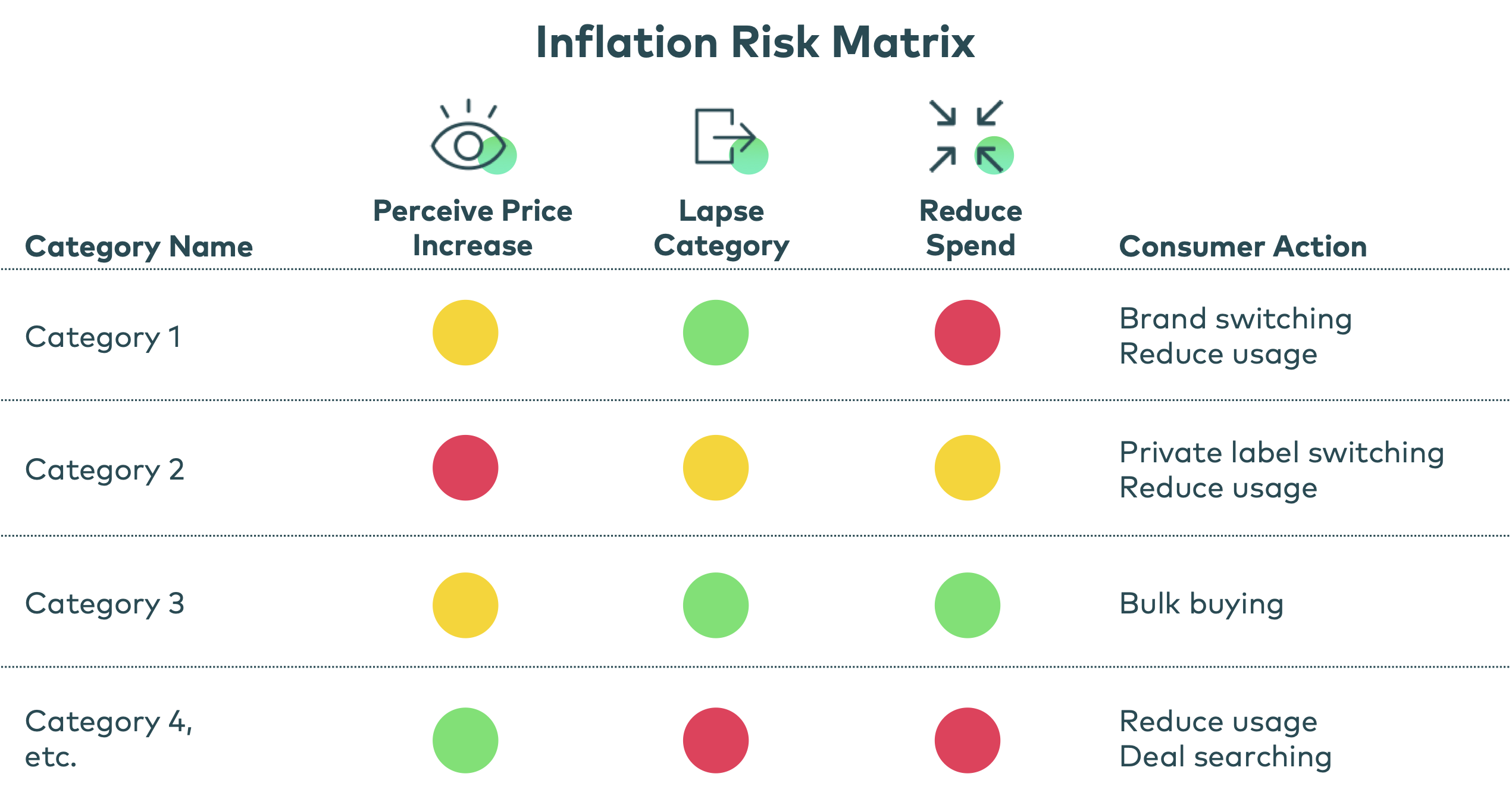

Inflation Risk Matrix

When conducting pricing-specific research, pricing-focused surveys that include additional questions can help contextualize consumer price perceptions.

For example, the inflation risk matrix can help create a framework for category-level strategies based on risk profile and likely consumer actions. The matrix applies a three-dimensional look across several items in a product category and estimates the likelihood of anticipated actions.

Getting started with pricing research

If you’re considering launching a new product or setting a new rate for an existing product, Numerator can help. We can work with you to select the best pricing methodology or combination of methodologies based on your research questions, existing research and category dynamics, and we can build a follow-up panel to track behavioral consumer responses to price changes and new product launches with our 1 million+ consumer-sourced panel to capture the why behind the buy. Contact your Numerator representative or get in touch with our team today.