In the wake of the COVID-19 crisis, consumer behavior has undergone rapid and dramatic shifts. Retailers and brands have been faced with the challenge of rapidly adapting to these new patterns. With today’s consumer better educated on the many shopping options they have, one theme that has emerged from this disruption in daily life is the importance of omnichoice.

Consumers have been experimenting with new brands and channels in order to purchase the products they need while also staying safe, protecting their health, and following shelter-at-home protocols. Even as these protocols have begun to lift across the country, we’ve continued to see elevated online shopping, as demonstrated in our Shopping Behavior Index. In this post, we’ll be using data from Numerator Insights to take a look at these new purchasing patterns and identify behaviors and habits that are likely to continue post-COVID.

Omnichoice: Who’s Going Where Post-COVID?

As shoppers get to know new retailers and explore different shopping options, we’ve observed some distinct shifts. Older shoppers, less affluent shoppers, even senior couples, have been making the switch to online orders. Brick-and-mortar discount stores like Dollar General are seeing an increase in younger, less affluent shoppers, who have been impacted by the economic downturn and job loss stemming from the COVID-19 crisis.

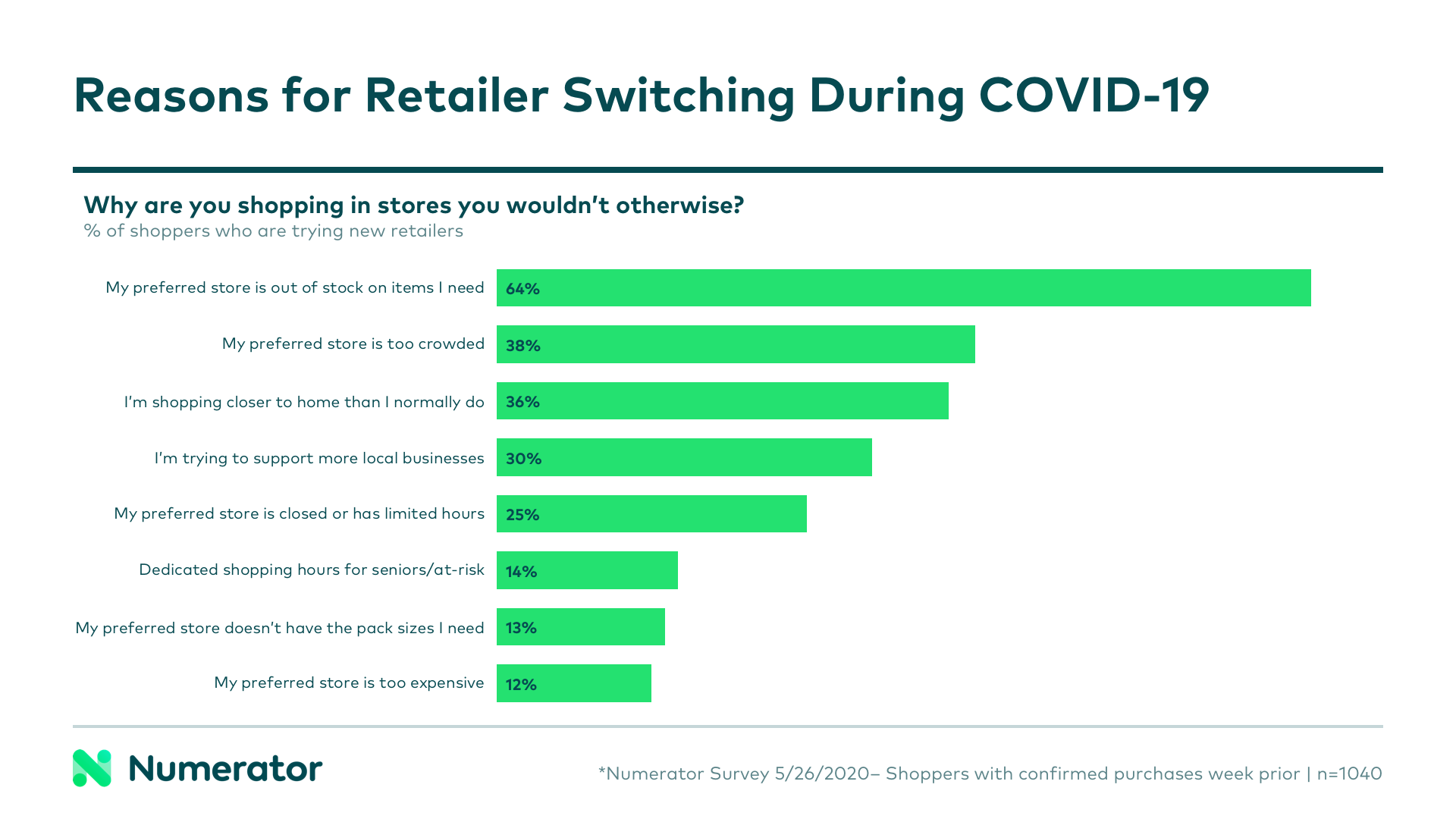

In addition to financial considerations, much of this change has been driven by consumers’ desire to avoid large groups, supplement empty shelves, and limit how far they have to travel. When asked why they were trying new stores and purchasing methods during the crisis, 38% of shoppers said their preferred retailer was too crowded and 36% wanted to shop closer to home.

Online Shopping Becomes the Top Option

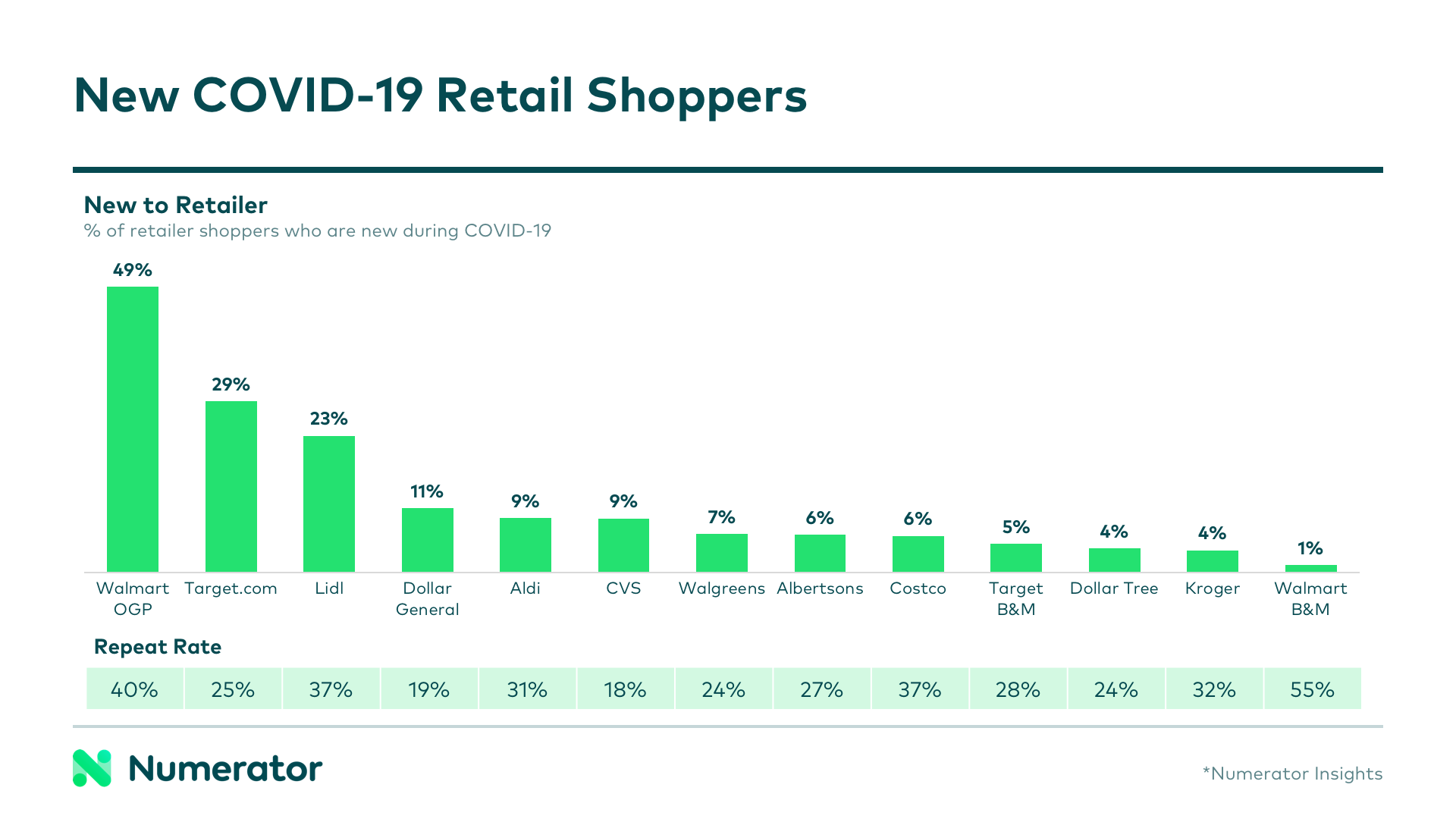

Consumers quickly leaned into online shopping when COVID-19 hit. Overall, ordering online has experienced the biggest surge in new consumers with both ship-to-home and click-and -collect options continuing to climb.

Walmart and Target are two retailers who have seen a high rate of new shoppers converting to their online offerings. For Walmart, this surge has been especially seen with their online grocery pickup services at grocery.walmart.com. Not only are we seeing many new shoppers on these websites, but we’re also seeing significant return rates as shoppers revisit these stores again and again. This indicates these new consumer behaviors may be long-lasting.

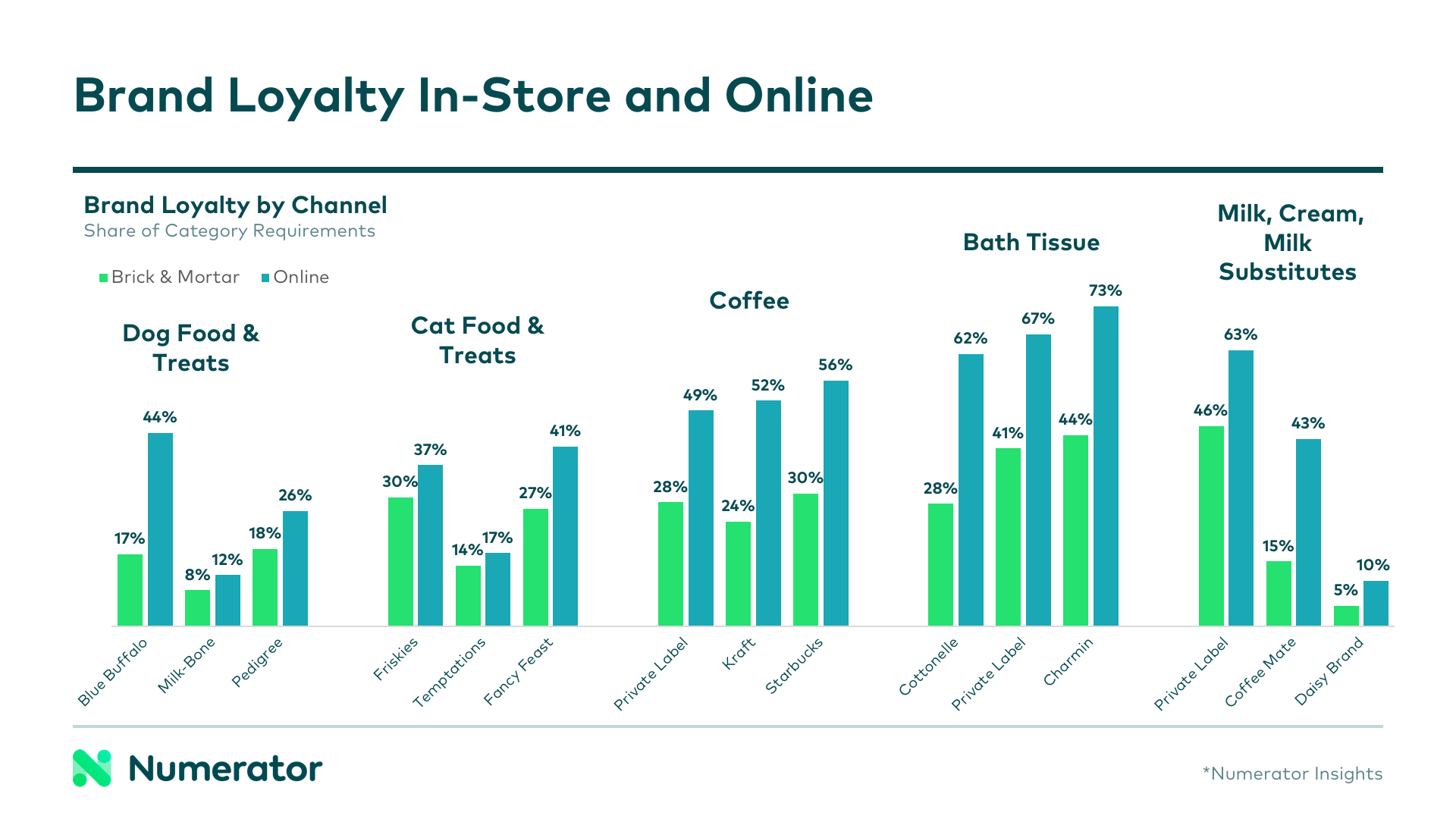

Online Buying Builds Brand Loyalty

With more consumers converting to online channels, we’ve observed a marked increase in brand loyalty. This could be due to the ease of selecting the same item previously ordered. But as a whole, we’re seeing online consumers sticking with the brands they have bought more so than they did in brick-and-mortar stores. This has been consistent across all categories.

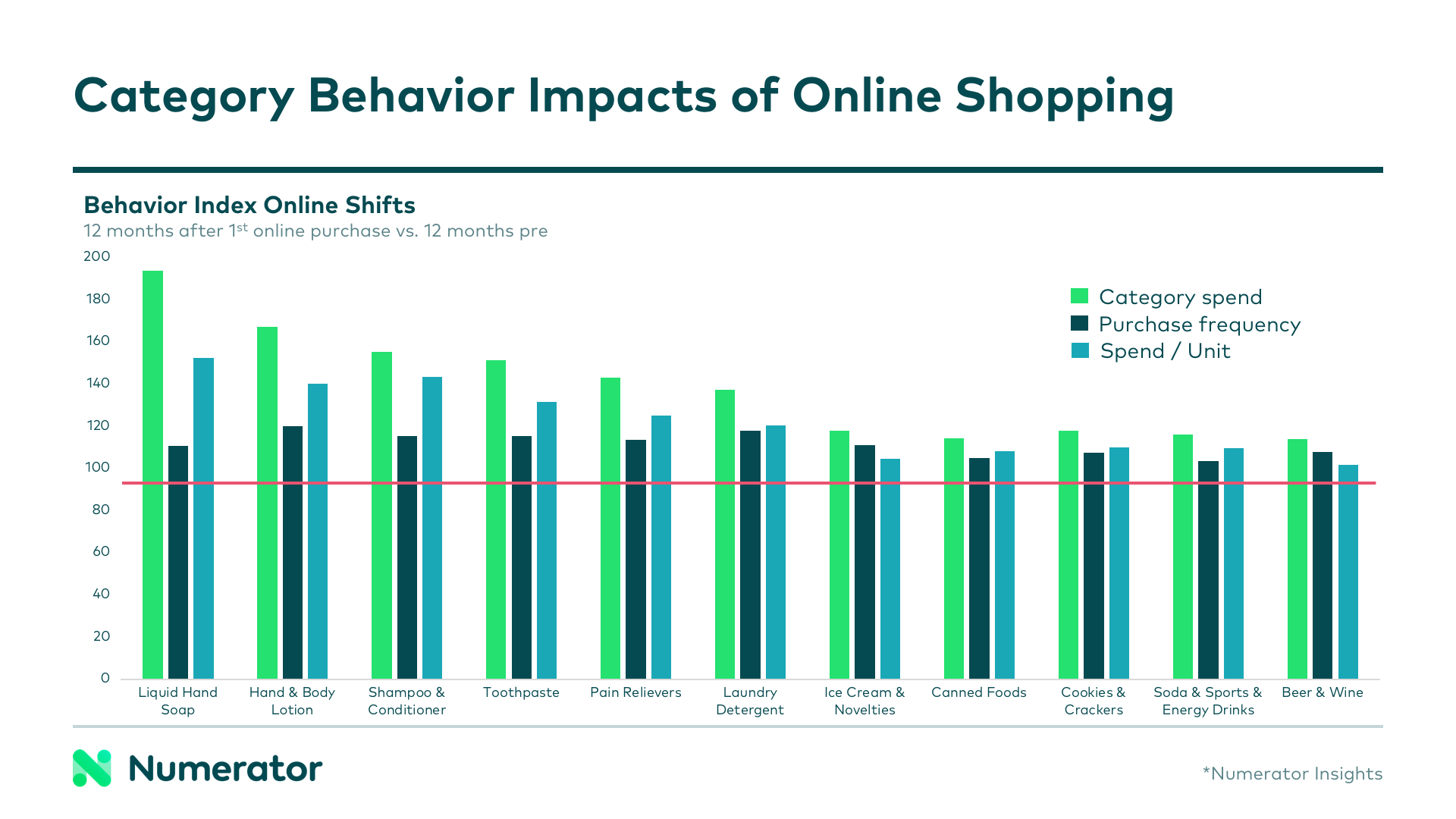

Category Spending Increases with Online Shopping

We’re also noticing a definitive change in category spending once a consumer tries online shopping for the first time. Once they’ve switched to online shopping, consumers tend to continue buying those same categories online. Additionally, these households make more frequent purchases while also spending more per category and per unit.

This is good news for manufacturers, as it has a positive effect on the category itself. However, it does have some negative implications for brick-and-mortar retailers as they lose trips per year. As online shopping continues to grow, retailers must continue to prioritize their assortments and let shoppers know what’s available online, so as not to lose category dollars.

Click and Collect Continues to Charm

For brick-and-mortar stores, the click-and-collect option has been a boost to both the retailer and the consumer during the COVID-19 crisis. It replaces an in-store trip, so consumers can avoid crowds, while allowing them to pick-up their items quickly and conveniently.

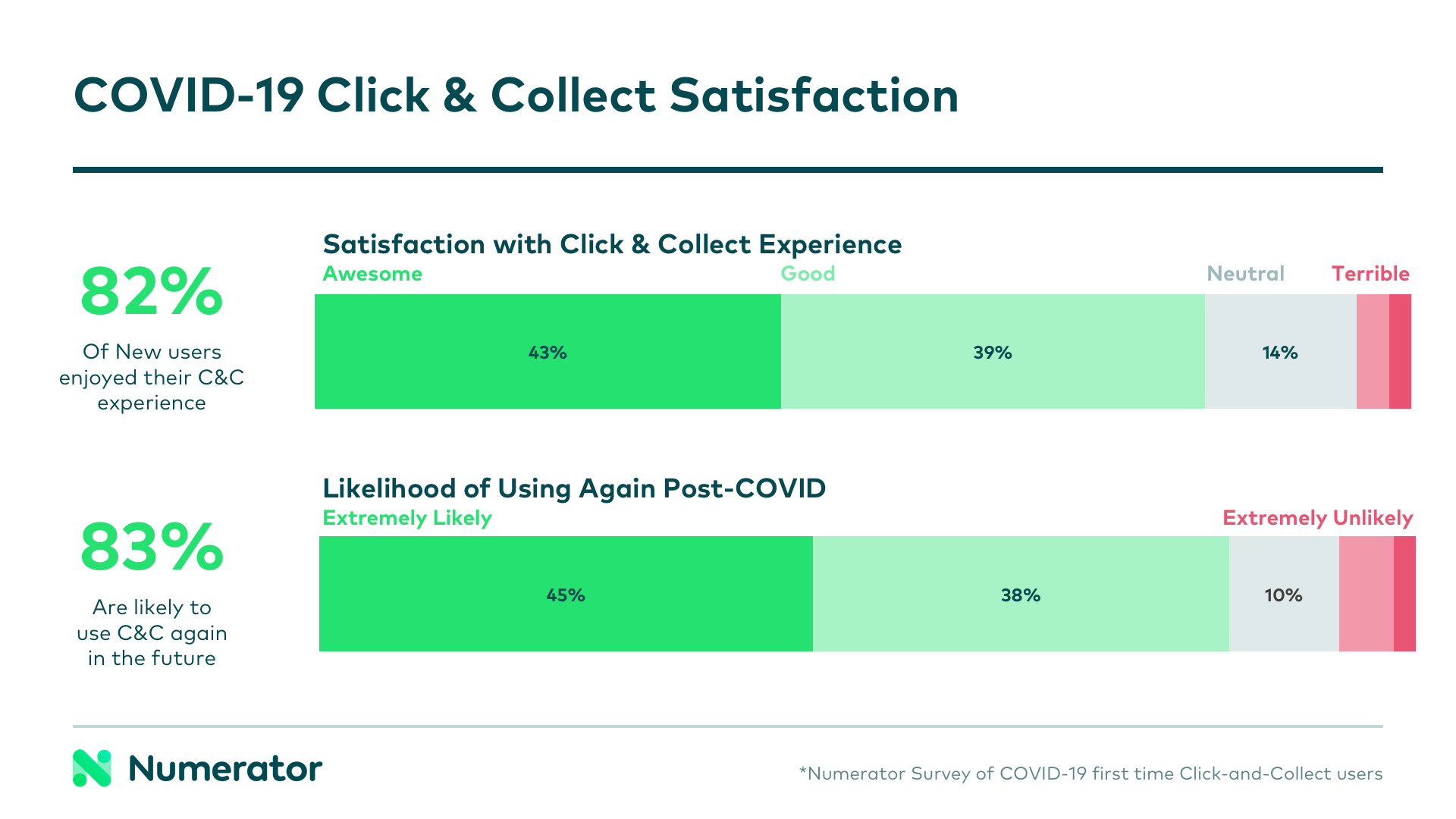

Not only are 82% of new users enjoying the experience, 83% indicate they are likely to continue using the service moving forward. This is something for retailers to keep their eye on so they can adapt with the demand. For more information specific to click-and-collect, check out our latest report, COVID-19 Click & Collect: Who’s Clicking, Who’s Sticking.

Looking Ahead

The omnichoice consumer knows they have a variety of retail options available to them, many right at their fingertips. By understanding what channels have become most appealing to shoppers during this crisis, retailers can frame a path forward post-COVID. For more information on this topic, download our latest research on Anticipating the Post-COVID Consumer.

As businesses continue to open and more safety protocols are eased, Numerator will be watching closely to observe the degree to which consumers maintain these new behaviors. We anticipate many to become more permanent as people remain cautious while slowly resuming some regular activities.

For more information on how your brand or category is affected by COVID-19, please contact your Numerator Customer Success Consultants or get in touch with us.