A new decade is upon us, and for many, January is a time of resolutions: eat healthier, exercise more, lose some weight… The year is full of possibilities for personal improvement, and for brands operating in related categories, it also holds potential for business growth as well. How can brands utilize shopper insights when preparing for peak sales periods like the new year? Can a look back at past purchase behavior predict New Year’s resolutions?

In a survey of over 10,000 Numerator panelists, we found that 79% made health and wellness related goals and another 8% made goals related to their environmental impact. While it’s too soon to tell if these resolution-makers have shifted their purchases to be healthier or more environmentally conscious, we were interested in knowing whether their past purchase behavior was at all indicative of their new resolution. Were there any commonalities among the groups that signaled their upcoming resolution?

The Healthy Get Healthier

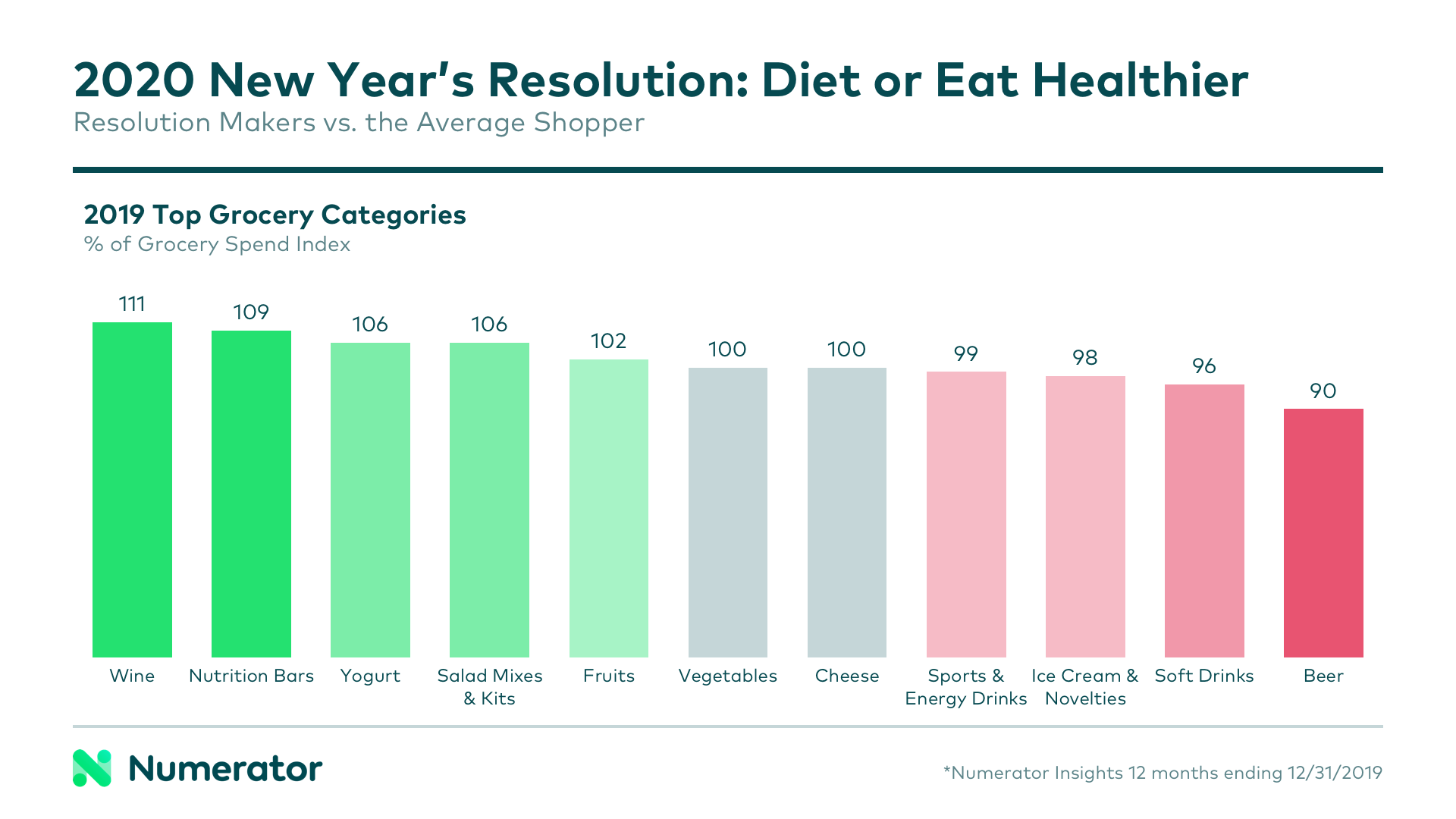

Resolutions are often thought of as a changing of old ways, but in fact, our data shows the opposite: those who made a 2020 resolution to diet or eat healthier (57%) were already spending more than the average shopper on healthy foods in 2019. At a department level, they spent a larger portion of their grocery dollars on produce and seafood than the average shopper and less on alcohol and traditional meats. A healthy skew was also noticeable at the category level, with these shoppers over-indexing on nutrition bars, yogurt and salad kits, and under-indexing on ice cream, soft drinks and beer.

Numerator Psychographics data backed up their healthy lifestyles as well. This group was more likely to be concerned or very concerned with eating healthy, to take vitamins or supplements, to review nutrition labels and to stay up to date on health trends. And these were all attitudes and behaviors they exhibited prior to the dawn of the new year. So, while these shoppers are resolving to eat healthier this year than last, it’s important to note they’re no stranger to healthy eating.

The Eco-Friendly get Friendlier

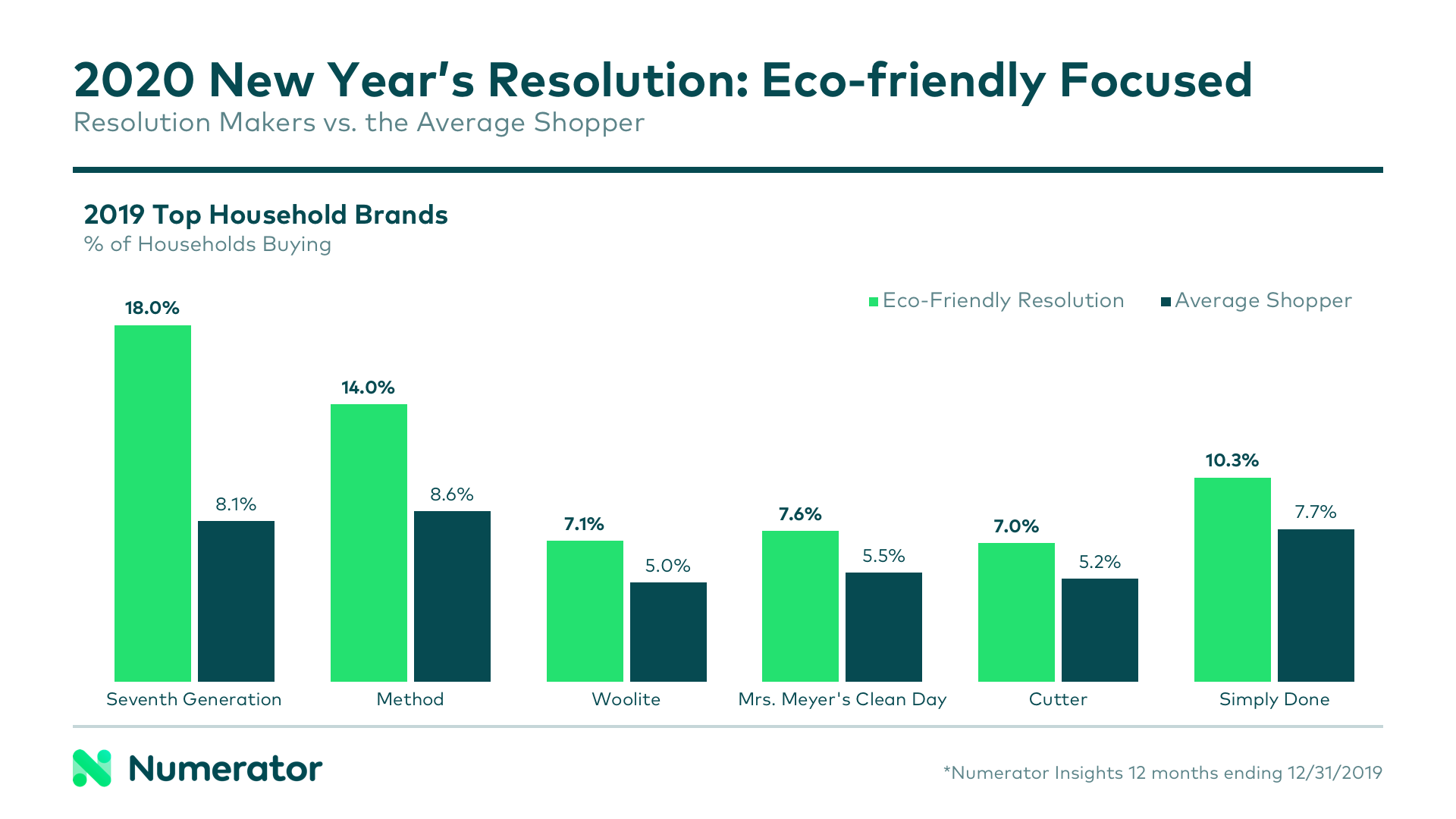

As we saw with the health-focused resolution makers, the eco-friendly resolution makers were clearly already environmental enthusiasts prior to their resolution making. 64.5% almost always recycle, 57.3% categorize themselves as “extremely concerned” for the environment, and 52.4% are willing to pay a green premium for eco-friendly brands and products. This last attitude was evident in their 2019 buying behavior, with up to twice as many households buying brands like Seventh Generation (2.2x), Method (1.6x) and Mrs. Meyer’s Clean Day (1.4x).

New Year, Same Us

While the new year undoubtedly brings a boost in sales to certain product groups, it doesn’t necessarily mean an influx of new— or new types of— buyers. In fact, the new year poses an even better opportunity to increase loyalty among your current buyers, rather than targeting those who may or may not change their ways. Since resolutions don’t appear to be a complete 180 from current behaviors— at least as it relates to buying behavior— the approach of doubling down with your current consumers will likely yield the best results.

If your new year’s resolutions include better consumer insights, deeper understanding of your buyers, or more strategic decision making for your business, Numerator is here to assist. Reach out today and let us help you make this year the best yet for your business.