2019 was a record-breaking year for retail, cumulating in over 67 billion shopping trips. According to Numerator Insights data, households made an average of 520 trips each, spending nearly $18,500 for the year— more trips and spend per household than ever before.

With more trips comes more opportunity, but also more competition. Despite growth across the industry as a whole, many retailers and manufacturers still struggled, especially well-established powerhouses we’ve come to know and love. But the future is not bleak for retail; in fact, it’s brimming with possibility. As we look back on 2019— the trends, the shoppers, and the market leaders— we begin to see just how many opportunities lie in wait. What can retailers and brands learn from last year’s performance, and how can they set themselves up for success in 2020?

Opportunities Galore

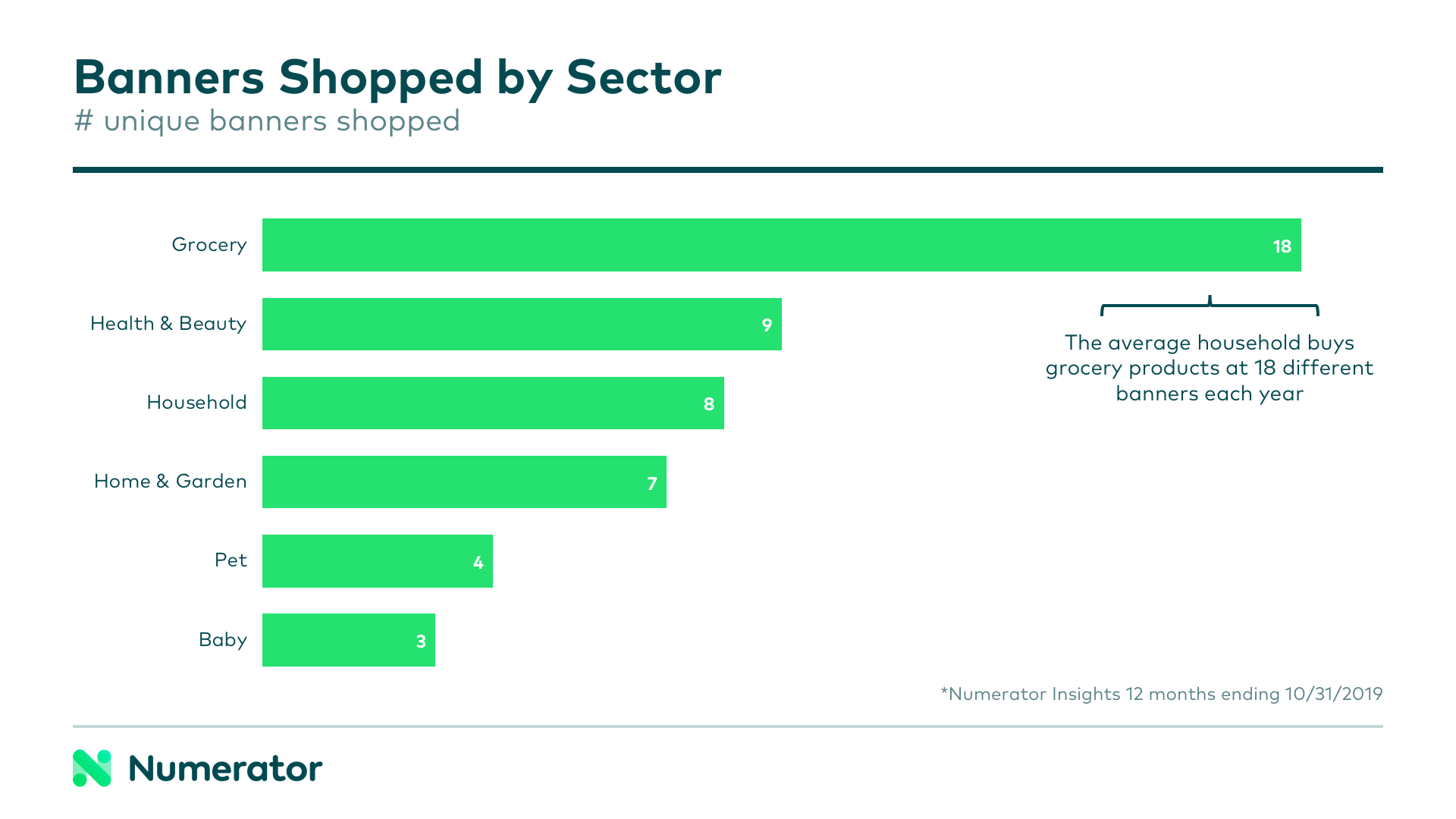

In 2019, shoppers spread their dollars across many different retailers— even within the same category. Gone are the days of strict loyalty. Over the past year, the average shopper bought their groceries at 18 different banners, health & beauty products at nine different banners, household goods at eight, and home & garden at seven. What does this mean for retailers? Just because you won a consumer’s business in a given category, doesn’t mean your job is done. Earning their repeat purchases is just as critical as earning their business in the first place.

Between 2018 and 2019, we saw an increase of roughly 5.4 billion trips overall— and 75% of this incremental trip growth came from outside of the food, drug and mass channels. The largest driver of this incremental growth was online sales— while online shopping represented only 9% of trips in the market overall, it accounted for 26% of incremental trips. The takeaway? Online is absolutely essential if your business hopes to continue capturing new shoppers and trips.

Tapping into Online Shopping Growth

We know online is important, and attitudes collected through Numerator Psychographics data suggest that its importance will only continue to grow. Online shopping appeals to buyers for many reasons, including convenience— 61% of shoppers buy online to save time— and simply because it’s fun— 53% shop online because they find it enjoyable.

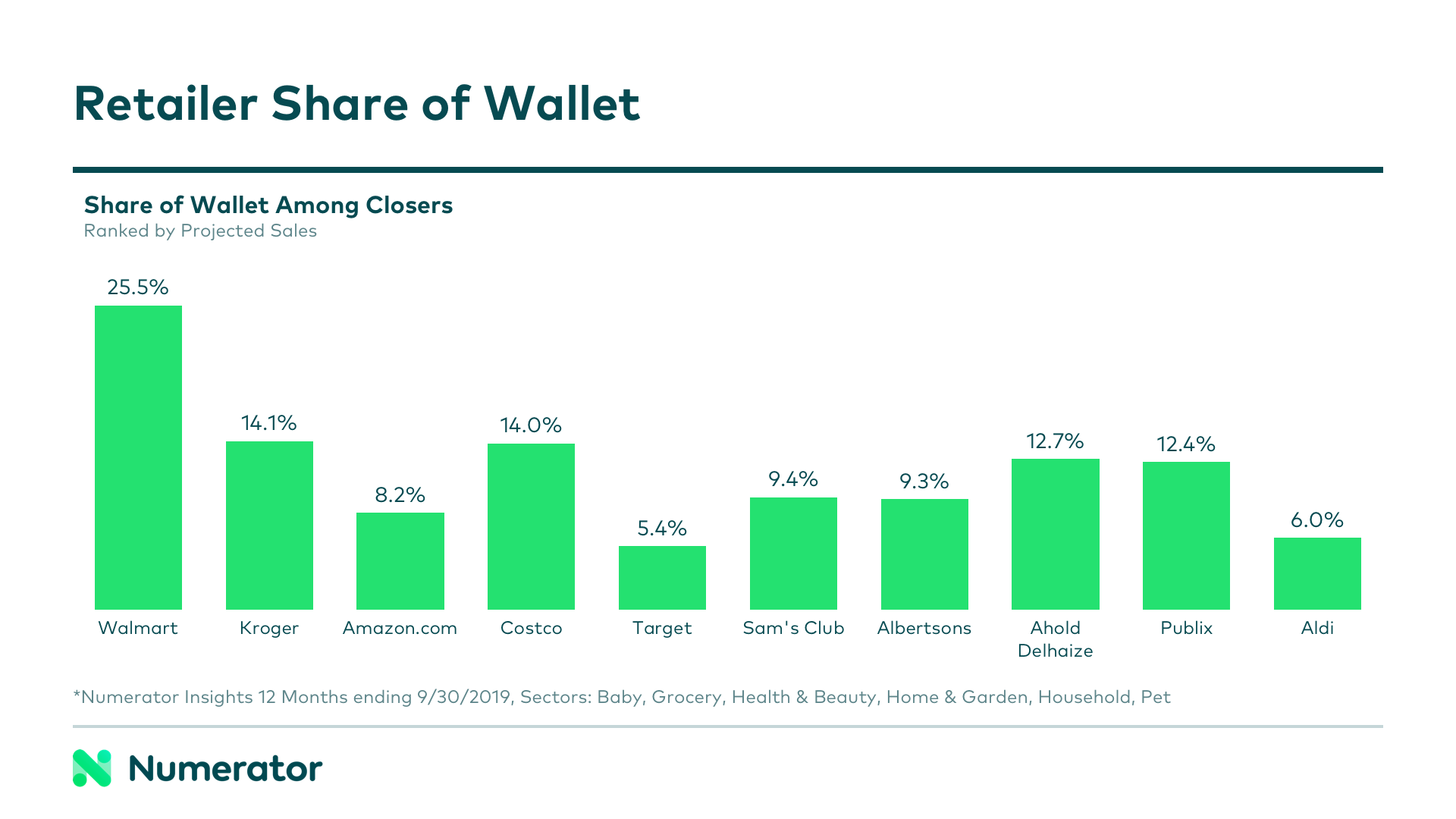

Not surprisingly, Amazon is claiming the biggest piece of the online shopping pie, capturing significantly higher household penetration and trip frequency than any other online retailer. However, they still have an opportunity to grow loyalty. Compared to other major retailers, Amazon’s share of wallet among closers is in the middle of the pack and is far behind Walmart.

Though Amazon is undoubtedly powerful, it has only scratched the surface of its shoppers’ potential spend. The average Amazon shopper has purchased roughly 24 categories from Amazon— 1.7% of potential categories, given the breadth of what’s available at the e-tail giant. In comparison, Walmart shoppers purchase 7.2% of potential categories available.

Online Push is Worth the Effort

In addition to Amazon, big hitters like Walmart and Target upped their online game in 2019. While Walmart pushed free same-day grocery pickup, Target heavily promoted curbside pickup and Shipt membership, which promises same-day delivery of food and essentials.

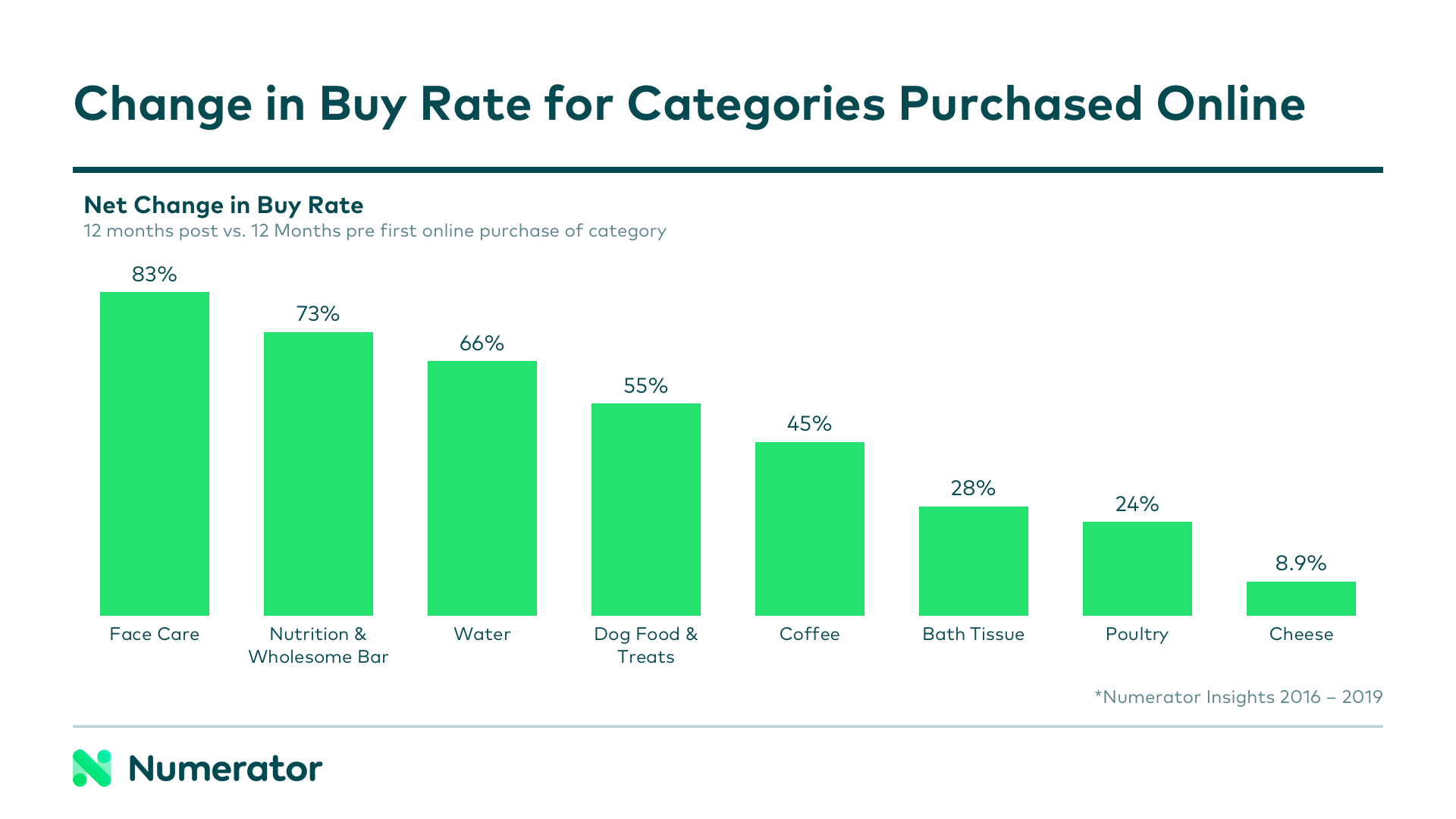

So why such a push online? Numerator data shows that shoppers eventually spend more with the retailers and categories they interact with online. Several categories see increases in net buy rate from a shopper’s first online category purchase, including face care, nutrition & wholesome bars, water, and coffee. Categories with a shorter shelf life, such as cheese, tend to see lower growth.

In acknowledging the importance of online shopping, it’d be a mistake to overlook traditional brick-and-mortar shopping, which still accounts for 93% of trips for major CPG products.

Brick-and-Mortar Still Dominates

Despite predictions of doom and gloom for in-store shopping over the past 10 years or so, 93% of trips for major CPG product sectors occur in the store, according to Numerator Insights data.

Shoppers also spend more in brick-and-mortar stores than they do online. When shopping in-store, 74% of respondents to a Numerator survey on shopping attitudes said they’re likely to make impulsive purchases, and 67% are likely to exceed their budgets. 62% said it’s easy to take an unplanned trip to a physical store.

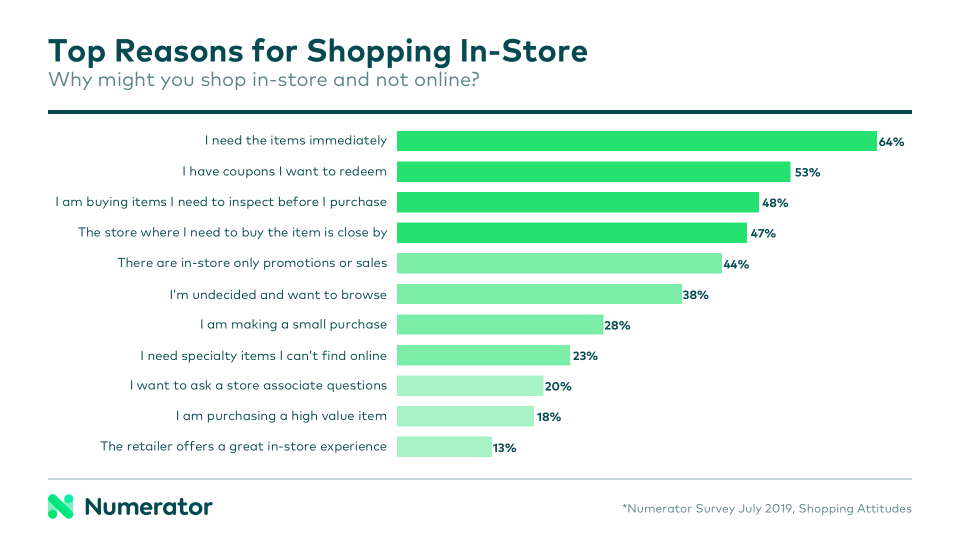

Why do shoppers go to brick-and-mortar stores instead of shopping online? The top reason, according to our survey, is an immediate need for a certain product (64%). Shoppers can’t or don’t want to wait for an item to be shipped. The next top reason is to redeem coupons (53%). Sure, shoppers could find a product online, but they can save money if they visit a specific store during a certain timeframe. Third, shoppers want to see something in person before buying (48%). There’s still something to be said for being able to closely inspect an item, touch it, and try it before making a purchase.

What Do Shoppers Want from Brick-and-Mortar Retail Stores?

Brick-and-mortar retailers can win more trips by matching the pricing, selection, and convenience of online shopping. When shoppers were asked what might encourage them to shop in-store more often, they pointed to lower prices (68%), unique in-store offers (52%), and wide product selection (43%).

The increase in incremental shopping trips aligns with shoppers’ desires for nearby stores and an easier checkout process. Shoppers would also be motivated to visit stores more often if retailers offered more samples, demos, and special events (31%) and a better in-store experience (28%). This is a big reason why we’re seeing more store-within-a-store offerings that shoppers can try before they buy and ask questions about specific products and categories.

What Strategies Are Retailers Using to Draw Shoppers to Stores?

Retailers use in-store incentives and specified reward redemption periods as part of their promotional strategies. For example, Target often includes an in-store stipulation to its gift card incentives on key stock-up products, while Cartwheel deals are also limited to in-store or store pickup. Kohl’s sets specific, tight turnarounds to encourage customers to take advantage of Kohl’s Cash earnings.

This combination of incentives and requirements can be particularly successful at driving traffic to stores and increasing retailer share of wallet. For example, Target had specific requirements in its Back to School promotion that offered 15% savings on a future shopping trip. This offer saw a 50% redemption rate and helped drive share of wallet increases for Target during the weeks it was valid.

How Are Retailers Creating a Better In-Store Shopping Experience?

In-store events and store-within-a-store concepts are being used to elevate shopping trips into outings, especially for families. For example, Target leverages hot brand names like L.O.L. Surprise, and creative experiences like its annual trick-or-treat event, to keep shoppers engaged. Following test pilot success, CVS is expanding its interactive BeautyIRL store-within-a-store format to nearly 50 stores by the end of the year.

In-store events can also be used to drive shoppers to stores during traditional holiday lull periods. In fact, Walmart’s Wishlist Event on November 3 and Playtime Event on December 1 drove in-store trips that over-indexed the average Saturday.

Another important but overlooked component of the in-store experience is the human element. When retailers elevate the role of in-store employees, they add value that you don’t find online. For example, more than 80% of Walgreens’ total TV ad spend in 2019 included references to in-store services and the expertise and personability of its team members, supporting its “trusted since 1901” tagline.

Final Takeaways

It’s no secret that more and more shoppers are moving online. However, brick-and-mortar still owns the lion’s share of shopping trips. Retailers should be using promotions centered on special events, store-only offers, and store-within-a-store concepts to drive in-store sales. The right strategy can help retailers win in key channels at critical times of the year and boost sales during traditionally slow periods.

Numerator can tell you not only what and where shoppers are buying, but why. A combination of verified purchase behavior data and in-the-moment survey data can help you identify categories or seasons to support successful growth strategies. Contact Numerator for actionable insights that enable you to learn from 2019 and increase sales and share of wallet in 2020.