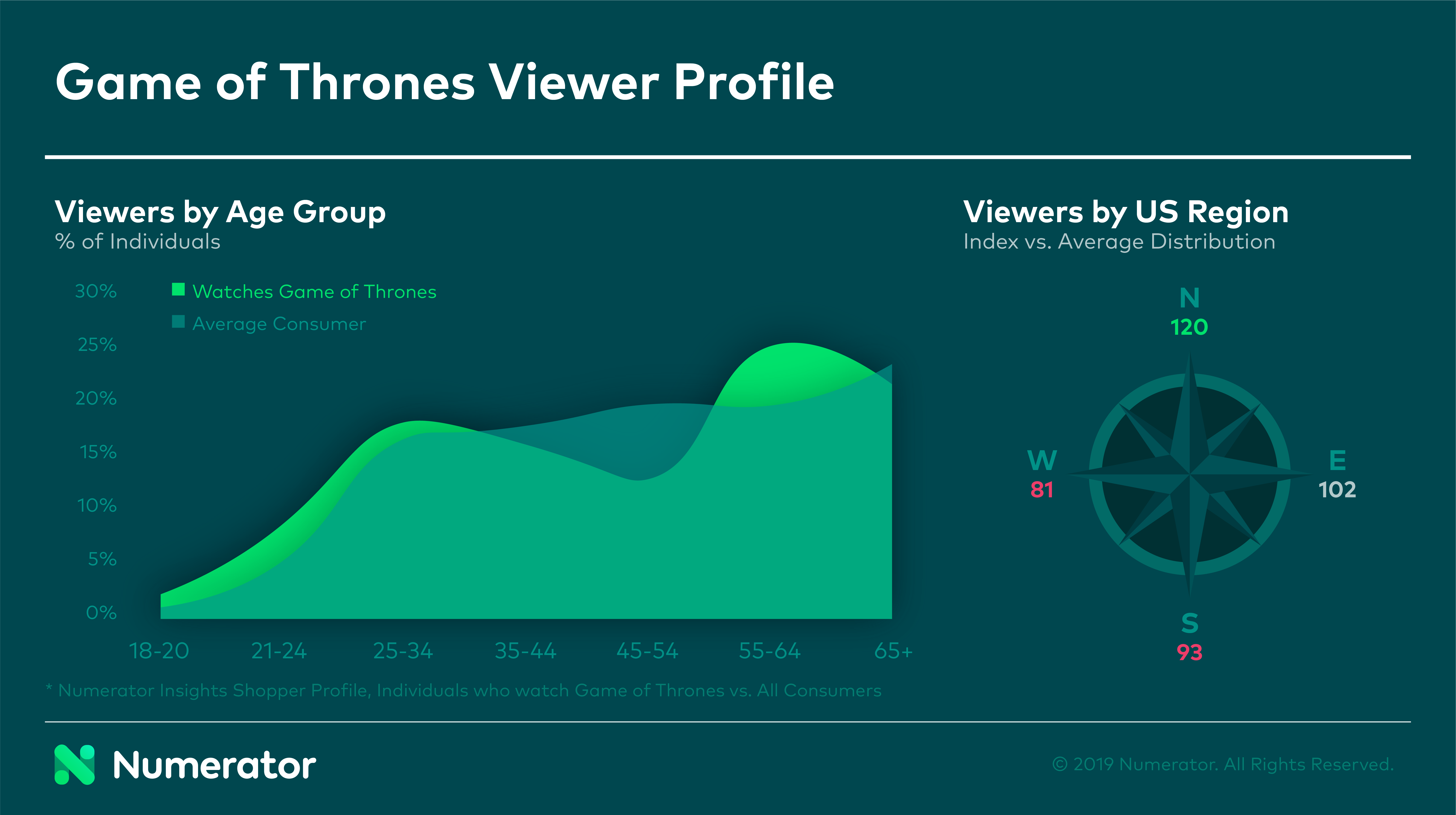

According to a Numerator survey of over 2,100 American consumers, 48% of respondents watch Game of Thrones, and even among those who don’t watch, 100% know someone who does, an impressive feat of brand awareness for the HBO series. Numerator Insights demographic data tells us that Game of Thrones is popular with individuals ages 18-24 (index 182) and also with ages 55-64 (index 128), fitting, given 34.8% of survey respondents identified their adult relatives as fans of the show. The show has also proved to be king in the north, with a fan base that over-indexes in the North Central census divisions (120).

When it comes to behaviors and attitudes, Game of Thrones fans tend to be impulse buyers (20%, index 117) who love to shop online (62%, index 122); two facts that bode well for manufacturers feeding into the frenzy with limited-edition Game of Thrones branded products. Their fandom extends beyond Game of Thrones, with 33% identifying themselves as committed or avid sports fans (index 140). Another fact that seems fitting, in light of the Game of Thrones – MLB partnership announced last month.

Game of Ads

Numerator Ad Intel data shows that HBO and Bud Light paid $10.5 million for their Super Bowl spot and subsequent showings of the “Game of Thrones x Bud Light” commercial. This commercial was the most significant advertising investment for Game of Thrones or its related products in recent years. Brands like Oreo, Mountain Dew, Adidas and Urban Decay, who have all recently launched GoT themed products to honor the final season, have relied much more heavily on viral social media campaigns than on traditional paid media.

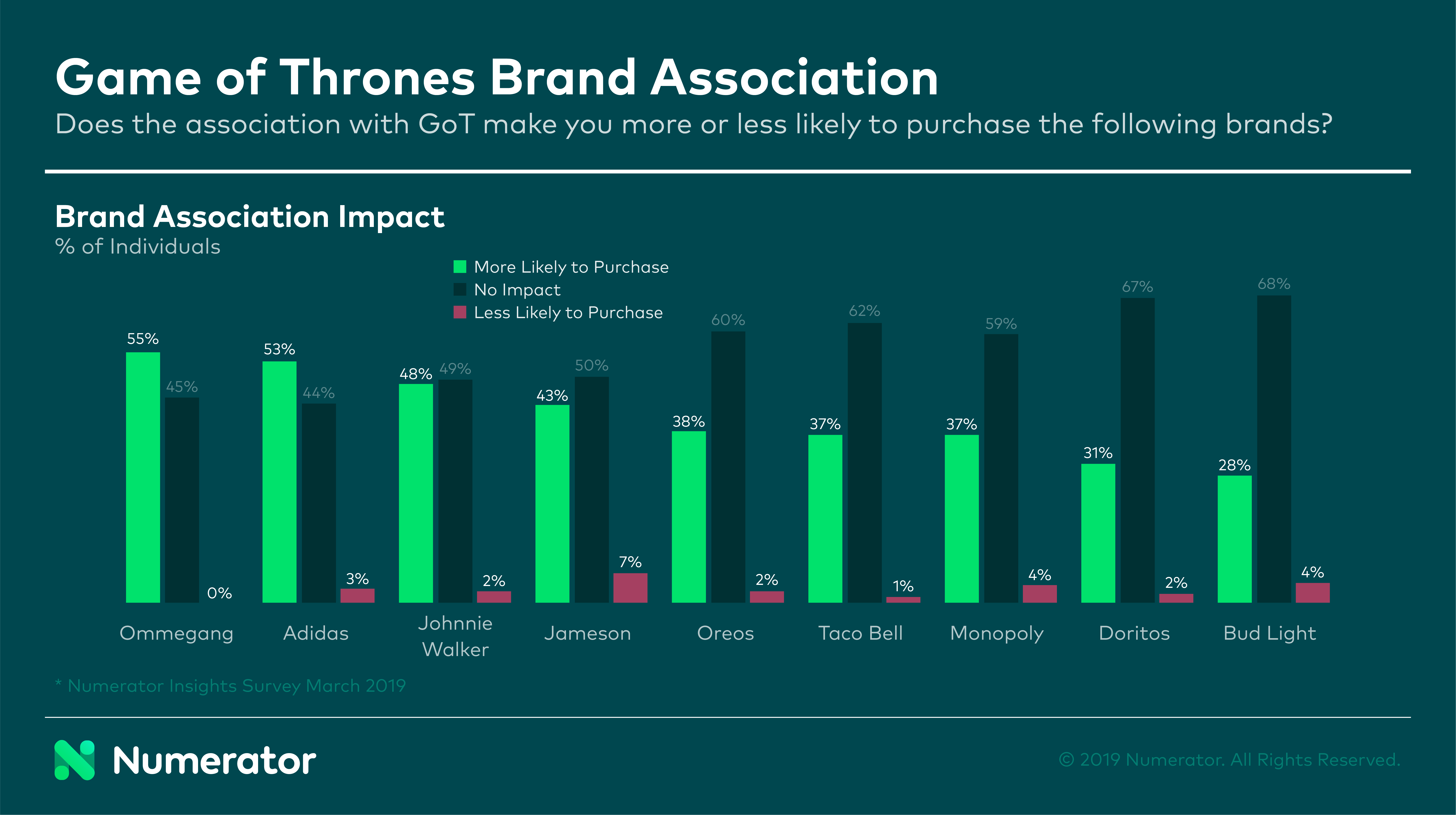

56% of people— even those who don’t watch the show— associate Game of Thrones with at least one other brand; the top three brand associations are Playstation (16.6%), Doritos (13.9%) and Bud Light (10.8%). Associations are slightly stronger among the show’s fans, particularly those who are more invested and have seen every season.

Brands partnering with Game of Thrones on co-branded products are very likely to see a return on their investment, with many individuals indicating they’d be more inclined to purchase an item because it was associated with the show. In fact, 46% of viewers indicated they have actually purchased Game of Thrones branded products. Brands seeing the most significant benefit from association were Ommegang, Adidas and Johnnie Walker.

Game of Thrones has grown to be one of the most well-known series in recent years. Its cult following has resulted in an active and dedicated fan base, making possible the success of numerous limited-time and co-branded products. As the series draws to a close, we’re interested to see what— if any— series can fill the void left behind by Game of Thrones.

Interested in learning more about how Numerator can help you identify opportunities in the marketplace and win the game of brands? Contact us today, and raise a drink to knowing things.