When studying shopper behavior, it’s easy to fall into the habit of examining a standard set of facts, like sales numbers or basic demographic breakdowns. While there’s nothing inherently wrong with this approach, it does leave a lot to be desired. The full picture of a shopper only begins to emerge when we dig deeper and incorporate lifestyle and attitudinal data, available through consumer psychographic data.

There’s no denying that “alternative” foods are on the rise. With the boom of Beyond Meat and the growing popularity of cauliflower-infused classics, shoppers seem to be loving new— often healthier— takes on old grocery staples. While many of these innovations are newer to the market, one alternative beverage comes to mind that has been around for decades; non-dairy milk products.

In the past year, nearly three in five (59%) US households purchased non-dairy milk alternatives. Far from a niche group, alternative milk buyers run the gamut, purchasing the product for a variety of reasons, from food sensitivities to personal preferences. So how do we examine a such a large group and understand the nuances of various segments within?

We took a look at the milk buying habits of households who purchase milk alternatives and tried to understand them through a demographic lens. Then, we took it one step further, layering in psychographic information to better understand the attitudes and preferences of this shopper group.

Glass Half Full

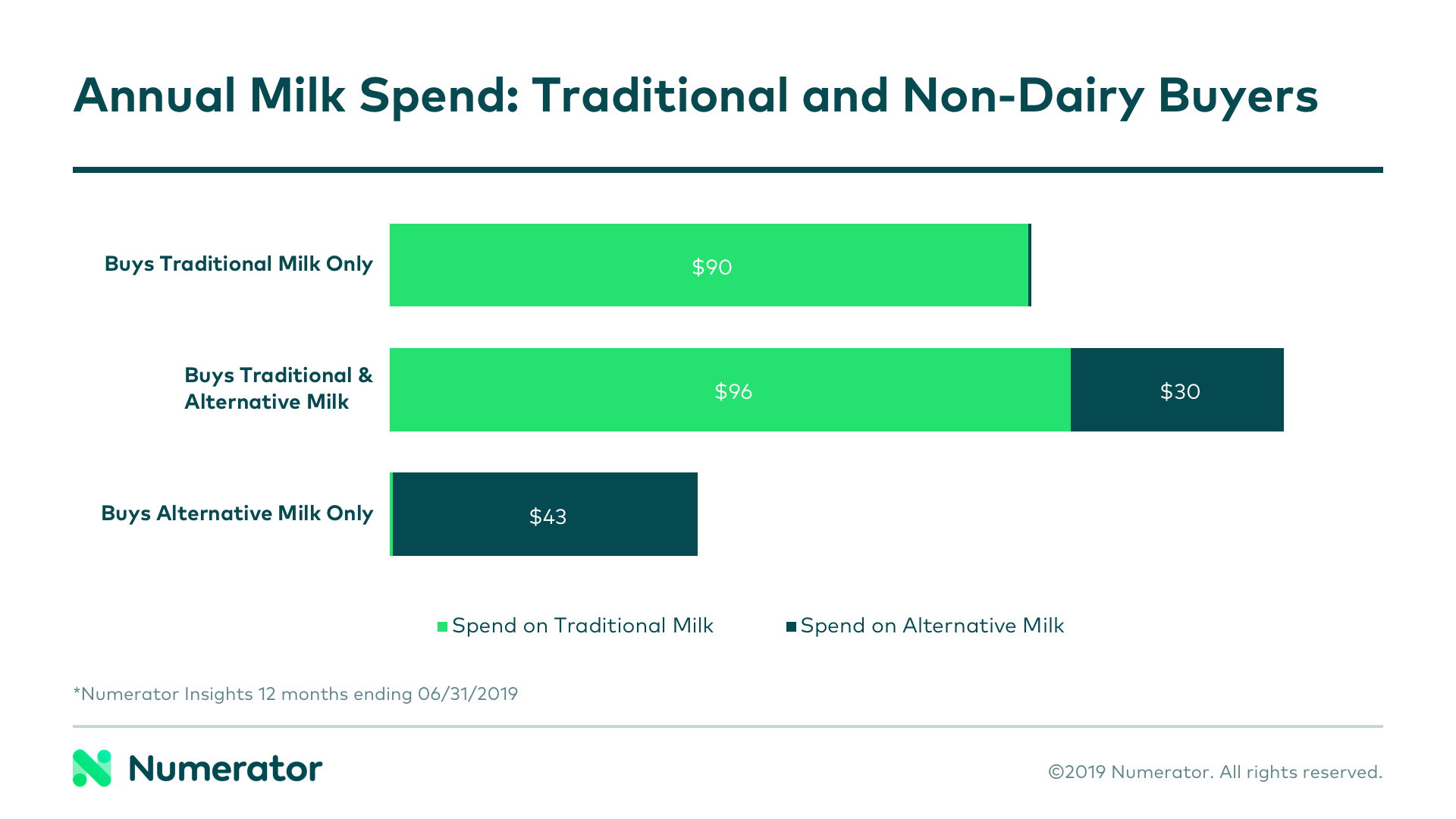

Despite their similarities, alternative milks do not appear to be a complete substitute for traditional milks. Nearly all (97%) households who purchase dairy-free milk also purchase traditional milk. In fact, they buy it at three times the rate of alternative milks, spending $96 per year on traditional milk and an added $30 on non-dairy milks.

Alternative milk buyers tend to be younger (26% Millennial, index 112), high income (44%, index 107), and more diverse (38% non-white, index 114) than the average shopper. They are also more likely to hold a four-year or graduate degree (45%, index 108).

While all of this is helpful in beginning to define the alternative milk buyer, it doesn’t quite fill our desire for a deep understanding, especially when it comes to shopper attitudes and the why behind the buy. Our glass of insights may be half full, but it’s also half empty.

Top it Off

To get the full picture of a shopper and really overflow our glass, we need to tap into some psychographic data. For alternative milk buyers, some of the most telling psychographics were those related to dietary restrictions, food & drink preferences, and natural or organic considerations.

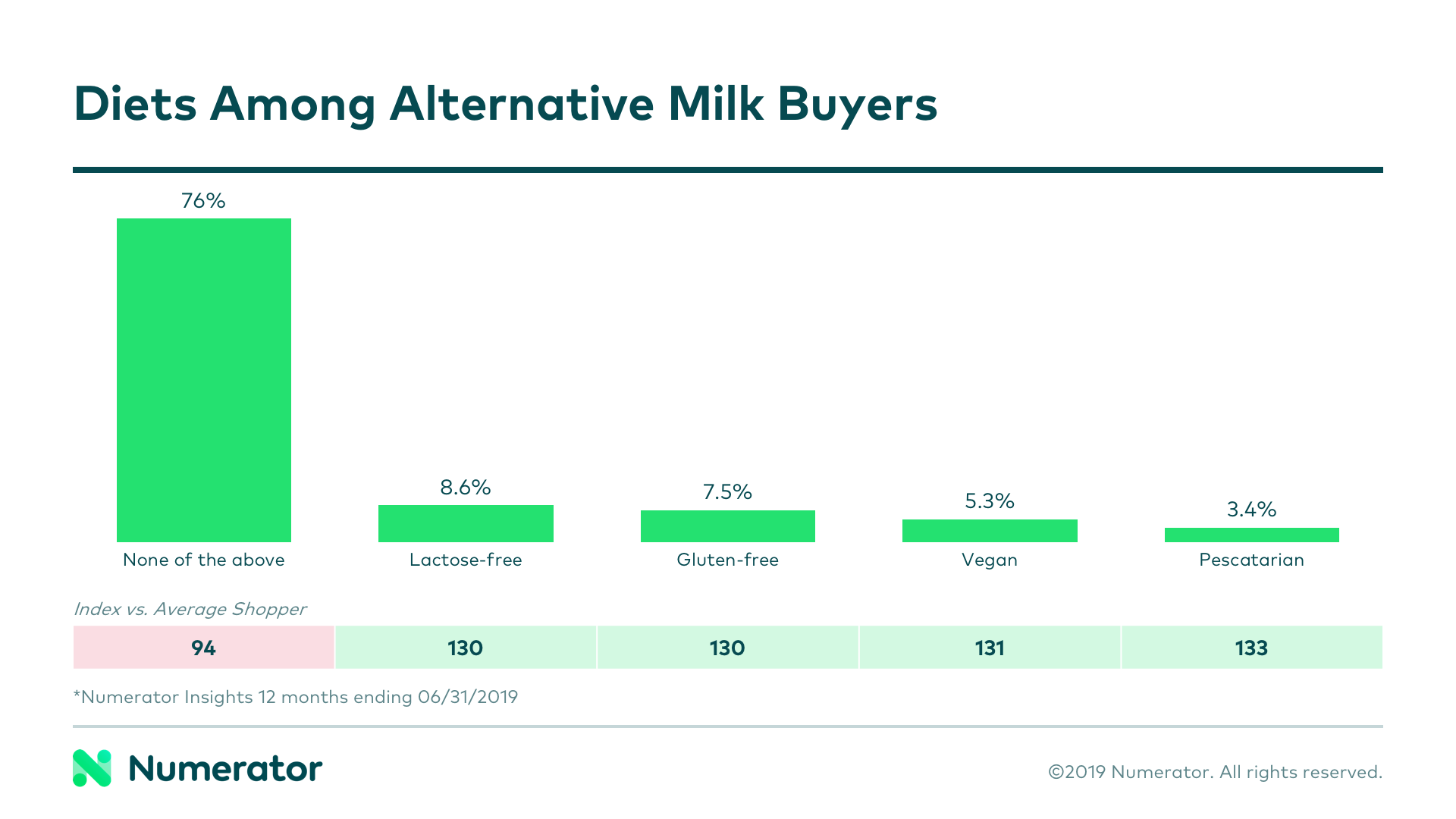

One might think that a large portion of those purchasing non-dairy milk products are doing so because of a sensitivity to lactose. However, Numerator psychographics data tells us that only about 8.6% of alternative milk buying households have a household member on a lactose-free diet. This is roughly 1.3x higher than the general population, but is nowhere near the majority of this group of shoppers.

In fact, about 76% of these shoppers actually indicated that they don’t have any dietary restrictions or food allergies in the household, meaning they’re purchasing these dairy-free milks based on personal preference. What other preferences do these shoppers have when it comes to food and beverages?

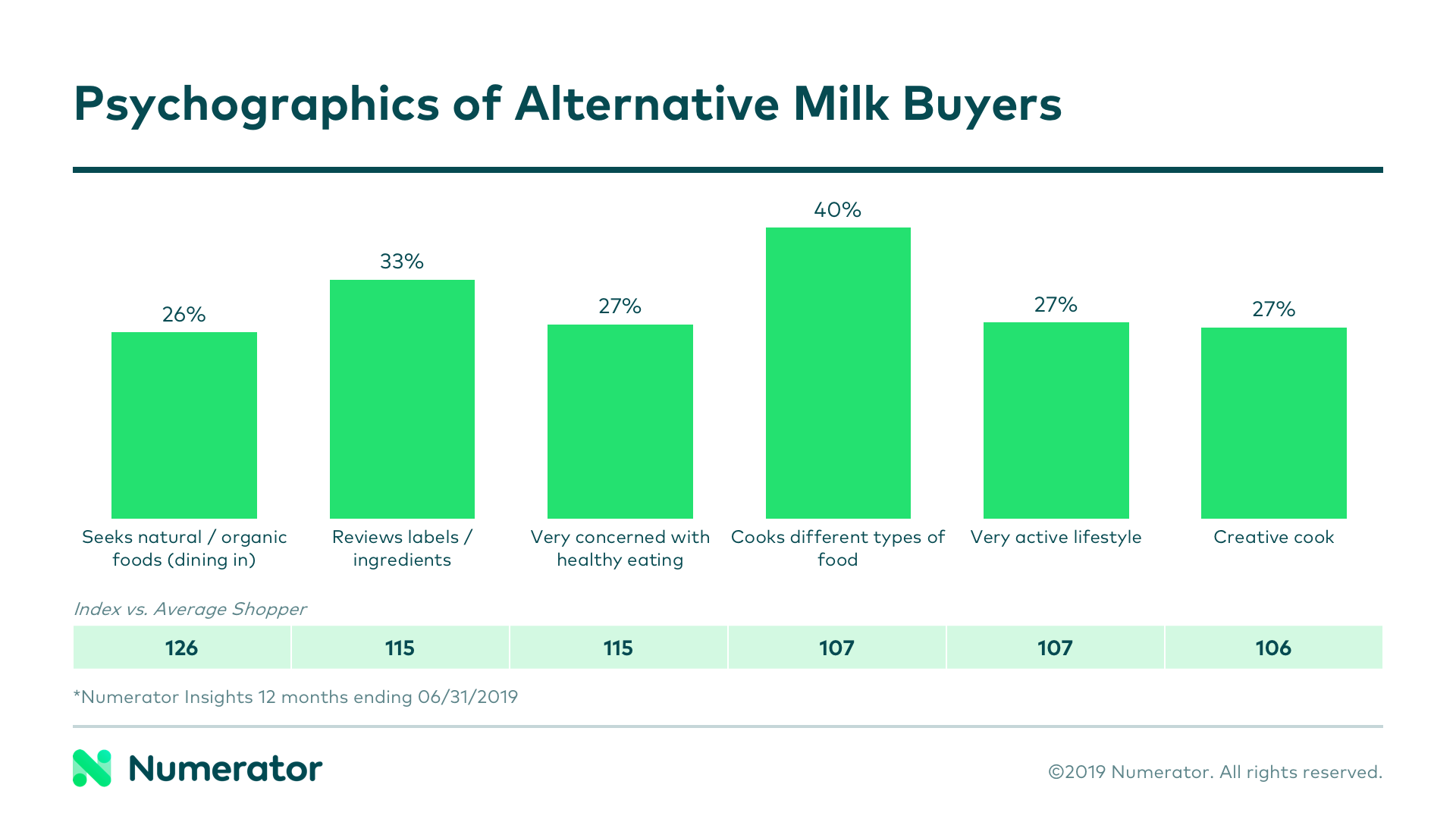

For one, they’re much more likely to consider organic products, with 26% indicating they seek out natural / organic products when possible (index 126). This preference also extends to dining out (12%, index 132). In terms of cooking, this group considers themselves creative (27%, index 106) and enjoys making different types of food (40%, index 107).

This group is also conscious of healthy living and eating. 27% say they’re “very concerned” with eating healthy (index 115) and 41% associate organic products with health benefits (index 114).

With these deeper psychographic insights into the non-dairy milk buyer, we begin to see segments within the greater group— individuals who buy because of dietary restrictions, adventurous eaters and cooks who may be using it to shake up their recipes, and health-focused individuals who would likely appreciate— and pay a premium for— organic options.

How might psychographic data help you better understand your own consumers and category buyers? Reach out to Numerator today and let us help you fill your glass of insights to the brim.