Though nearly all of retail is experiencing this omnichannel revolution, we chose to focus on the baby sector for two reasons. First, it’s dependable: no matter what crazy trends take place in the retail world, shoppers will always need diapers, wipes, formula, and baby food. Second, shoppers of this category are highly likely to be tech-savvy and omnichannel focused; 55% of parents with a child under five belong to the Millennial generation, and as we know, Millennials love online shopping.

Now, to be clear, “online shopping” does not equal “omnichannel shopping,” but it is a key component of a successful omnichannel strategy. This distinction leads to the first question many expectant omnichannel marketers and retailers might be asking…

Everyone’s talking about online— should I focus all of my attention there?

Not necessarily. Although online is an increasingly important channel, it is only one piece of an omnichannel approach. If you’re a first-time omnichannel retailer, the initial plunge might be a bit of a shock, but in time, you’ll find that omnichannel is really just an enhancement of where your business is at now. Within the baby sector, online accounted for 26% of overall dollar sales; this was the fastest growing channel— up from 23% a year ago— but with roughly three-quarters of sales coming from brick-and-mortar, it’s clear that traditional channels aren’t going anywhere. An omnichannel approach shouldn’t change the core of your business, meaning you should continue to make investments anywhere shoppers might encounter your brand in order to create a cohesive experience across channels.

Are omnichannel shoppers more valuable?

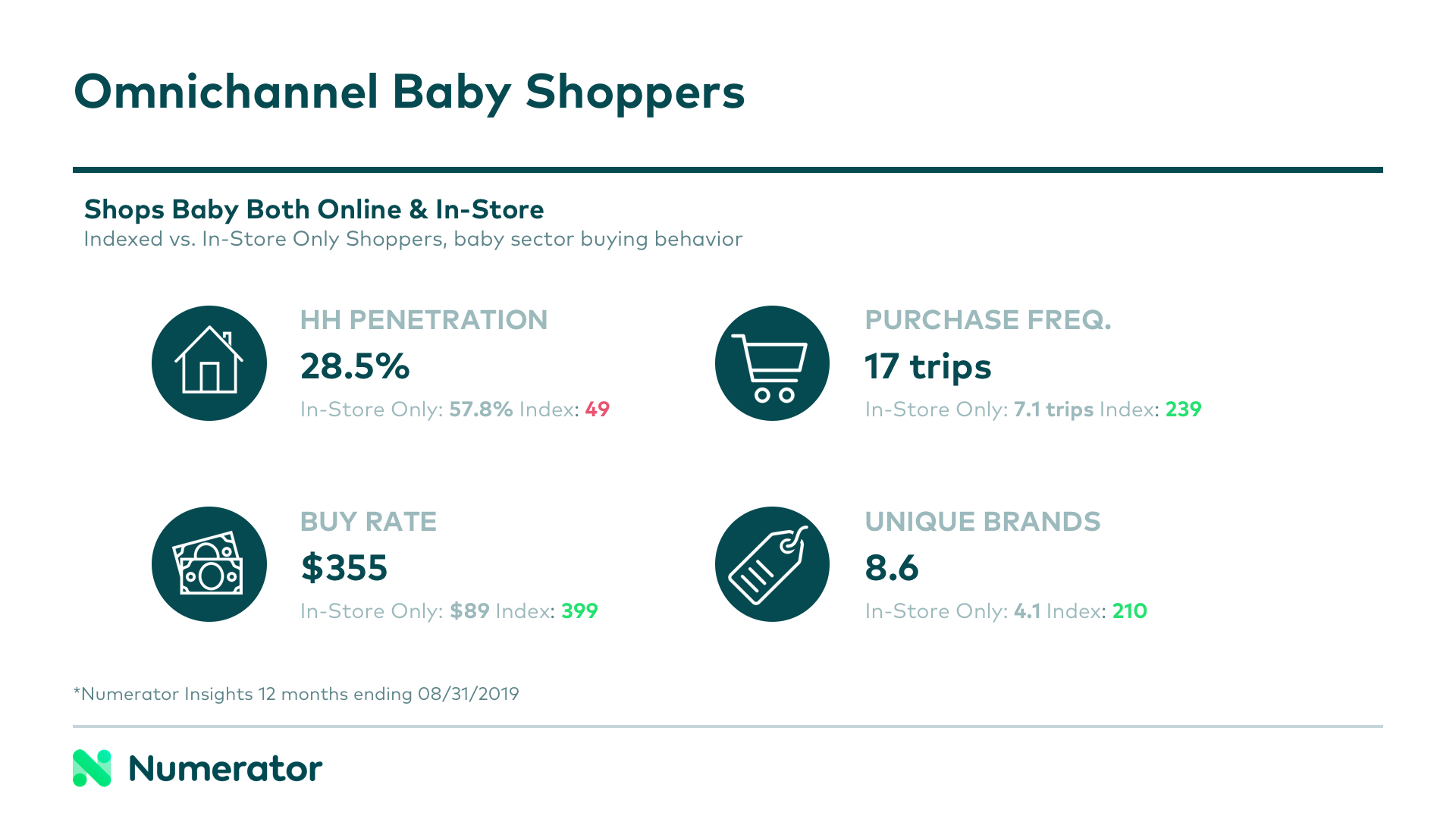

In short, yes, it seems they are. Now, we’re not advocating for choosing favorites, but if the omnichannel shopper held a special place in your heart, we wouldn’t blame you. Not only are these omnichannel shoppers spreading their dollars across more retailers, they’re also spending significantly more than their brick-and-mortar-exclusive counterparts— within baby, they’re spending four times more, to be exact.

Though traditional brick-and-mortar shopping is still the default— everyone’s doing it— 34% of baby shoppers also purchased baby products online, up four percentage points from last year. These shoppers spent 38% of their baby dollars online, and the remaining 62% elsewhere. On average, they shopped four different retailers and bought nine unique brands within baby, compared to in-store-only shoppers who shopped two retailers and bought four brands.

How do I know if my omnichannel sales are growing properly?

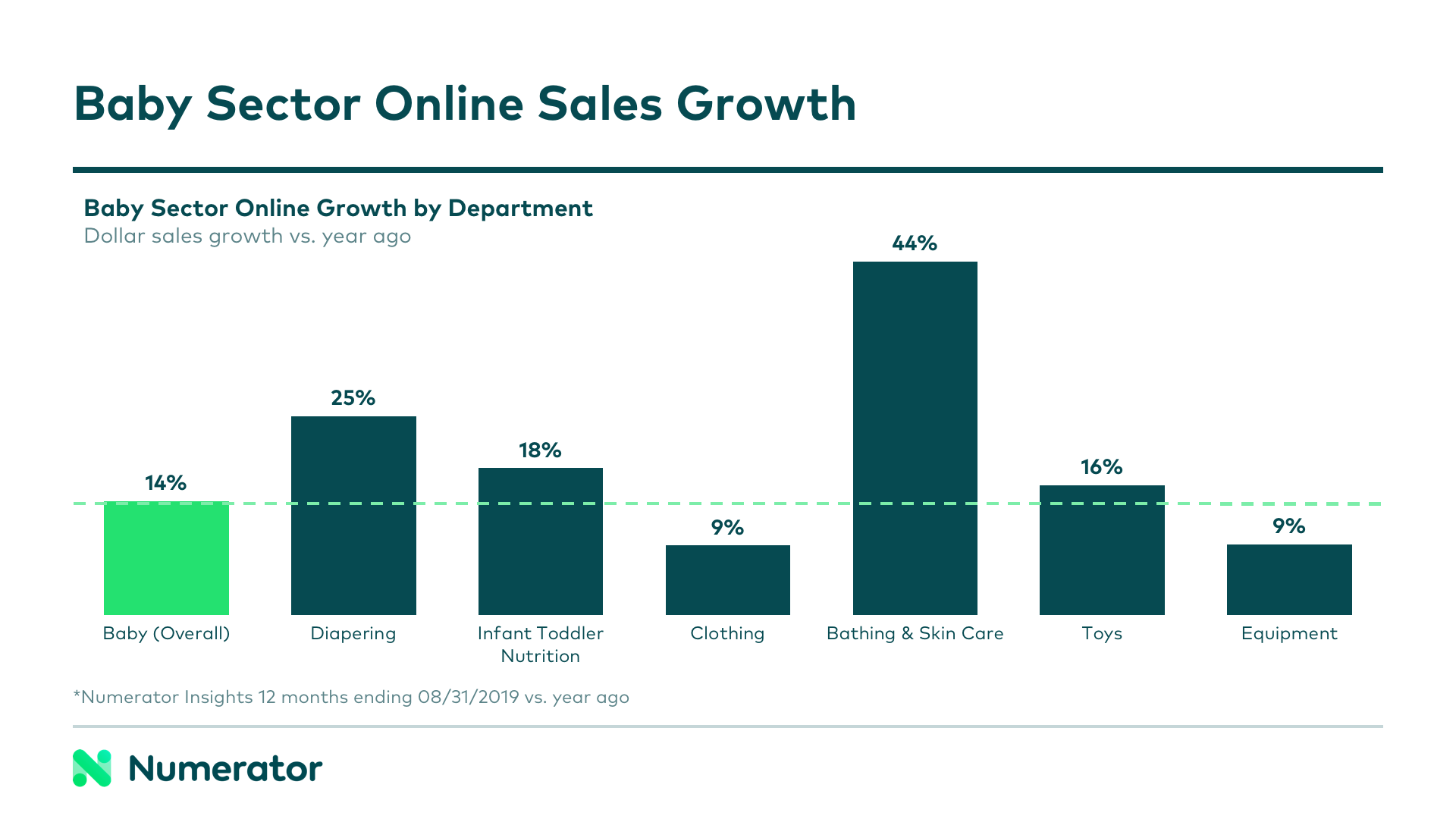

There’s no “one size fits all” when it comes to omnichannel growth trajectories, and this is heavily influenced by a category’s success online. As you begin to execute and analyze your omnichannel efforts, you’ll quickly find out that every category will adjust at its own pace. Some products are inherently more likely to succeed online than others, so it’s important to be patient and not to worry about slower growth in some areas. For baby, we saw diapering supplies and bathing & skin care products significantly outpacing the overall online growth of the sector, while non-FMCG products like clothing and equipment grew a bit more slowly.

Creating and executing an omnichannel strategy can be hard, and whether you’re a first-timer or a seasoned pro, everyone needs a little guidance from time to time. Here at Numerator, we’re full of omnichannel insights, so give us a shout and let us help grow your omnichannel sales.