In our latest Home Improvement Report, we examine two key consumer segments within the home improvement industry, the PROsumer and the DIYer, detailing how their shopping habits differ, their expectations for future projects, and how brands and retailers can better target each consumer group.

- The PROsumer group, a term specific to Numerator, is defined as the top 8% of our home improvement shoppers based upon their annual trip count. This group can be thought of as “weekend warriors” that may do PRO work on the side.

- The DIYer group includes the average home improvement shopper, defined as households that do not meet the definition of PROsumer but have made purchases in the home improvement channel.

Our study, released in March 2022, found that there is significant growth potential among DIYers and PROsumers alike within the home improvement category.

DIYers Account for the Majority of Spending

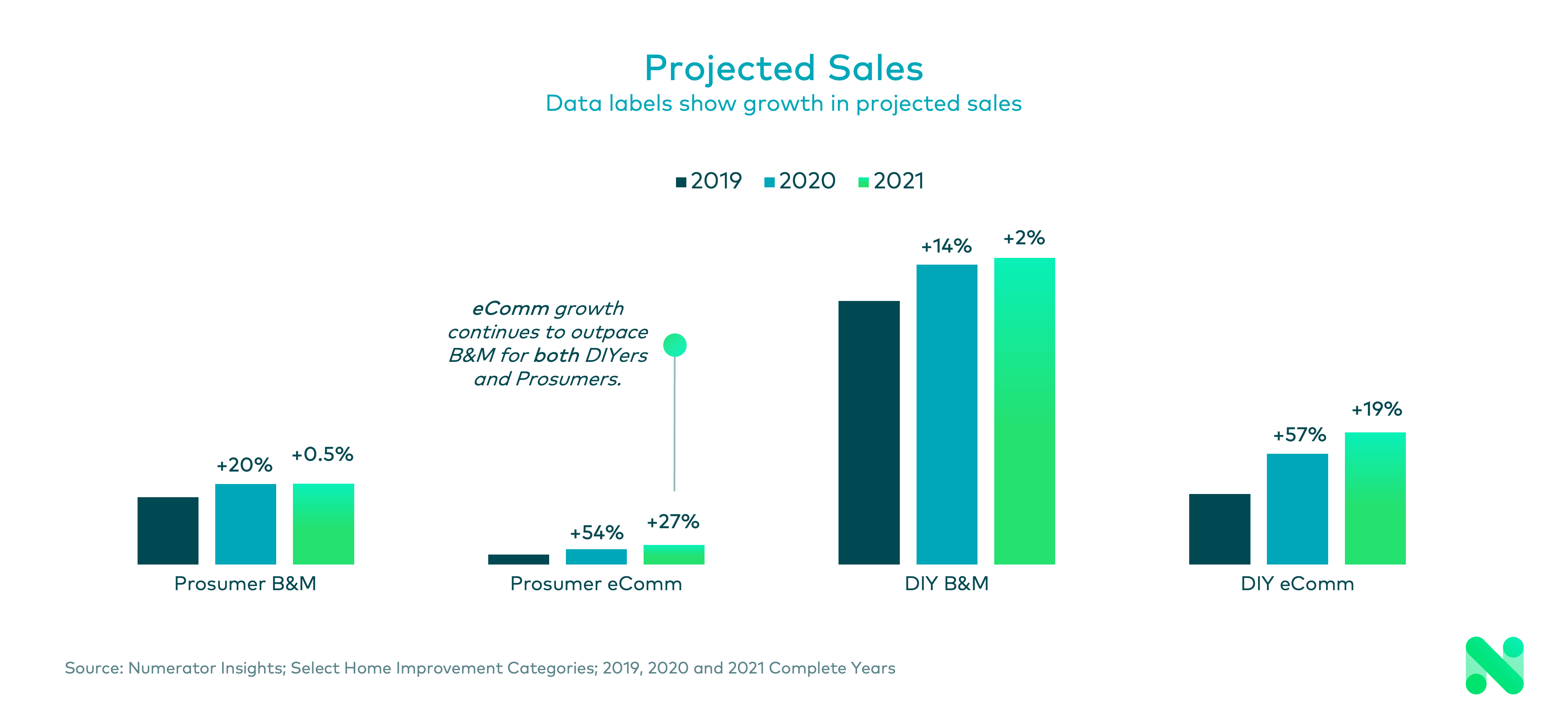

DIYers clearly contribute the majority of spend in the home improvement channel. These shoppers made a healthy 15 home improvement trips per household— an average of more than one trip a month— in 2021, and accounted for 81% of spend in home improvement categories. Their spend continues to increase both online and in-store, but particularly online— eCommerce projected sales grew 19% in 2021 vs the previous year, following a robust 57% growth in 2020 vs 2019.

Not only are DIYers spending more money on home improvements, they are also planning a greater number of projects than in previous years. 40% of DIYers reported that they expect to take on more projects than they did before the pandemic, while an additional 45% of them said they are planning the same amount. Only 15% plan to undertake fewer home projects.

Understanding the PROsumer

While the growth in spending by DIYers is impressive, it is the PROsumer that remains the most valuable consumer segment for home improvement brands.

PROsumers— the top 8% of home improvement shoppers by trip count— make over 5x more trips in the home improvement channel per year than DIYers, an impressive 1.5 home improvement trips per week by household. What’s more, PROsumers spend 141% more than DIYers. Their purchases account for almost one-fifth of all category spend despite only comprising only one in ten of the entire shopper count.

Understanding how this weekend warrior differs from DIYers in how they shop can help foster long-term loyalty for brands and retailers.

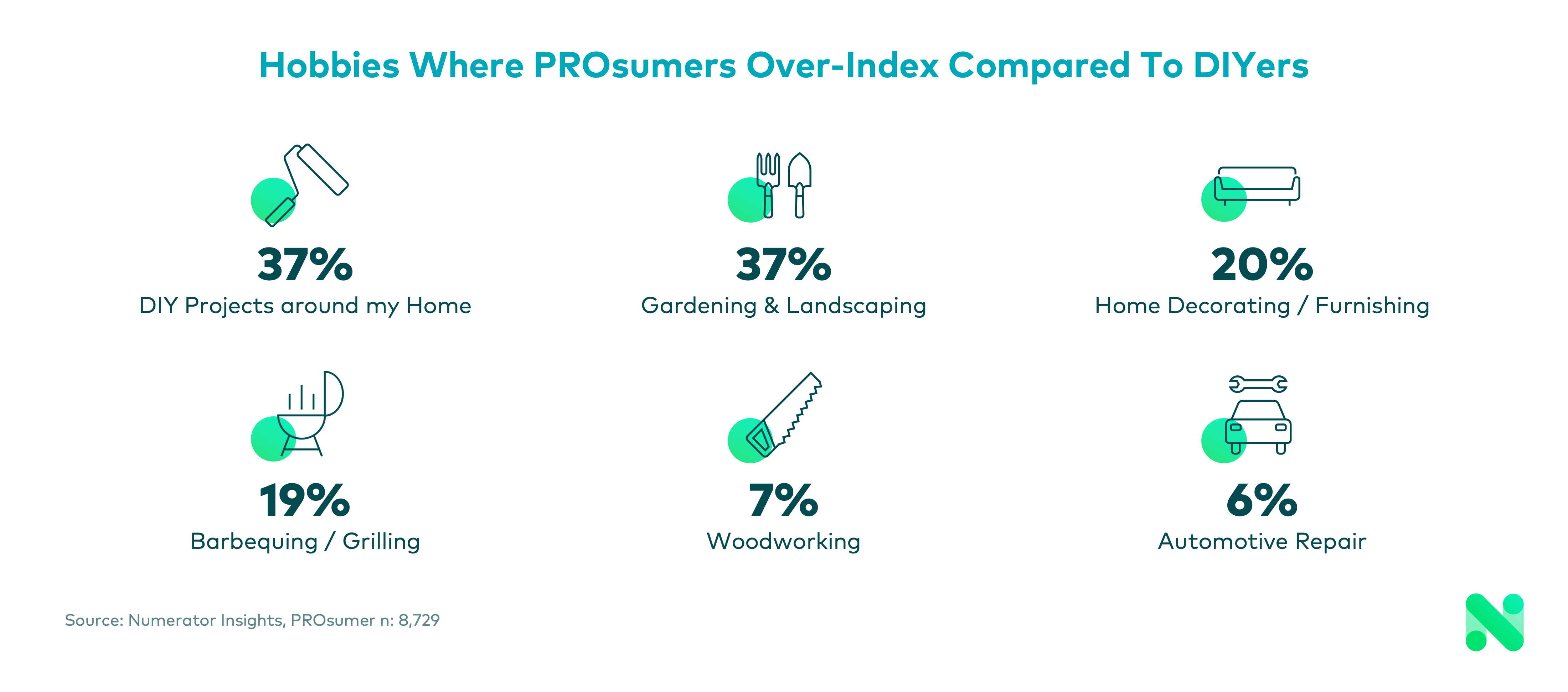

PROsumers— generally older males, earning a household income of more than $80K per year and employed full time— tend to list home improvement projects among their preferred hobbies. At the top, “DIY projects around my home,” “garden and landscaping,” and “home decorating/furnishing,” all over-indexed compared to DIYers.

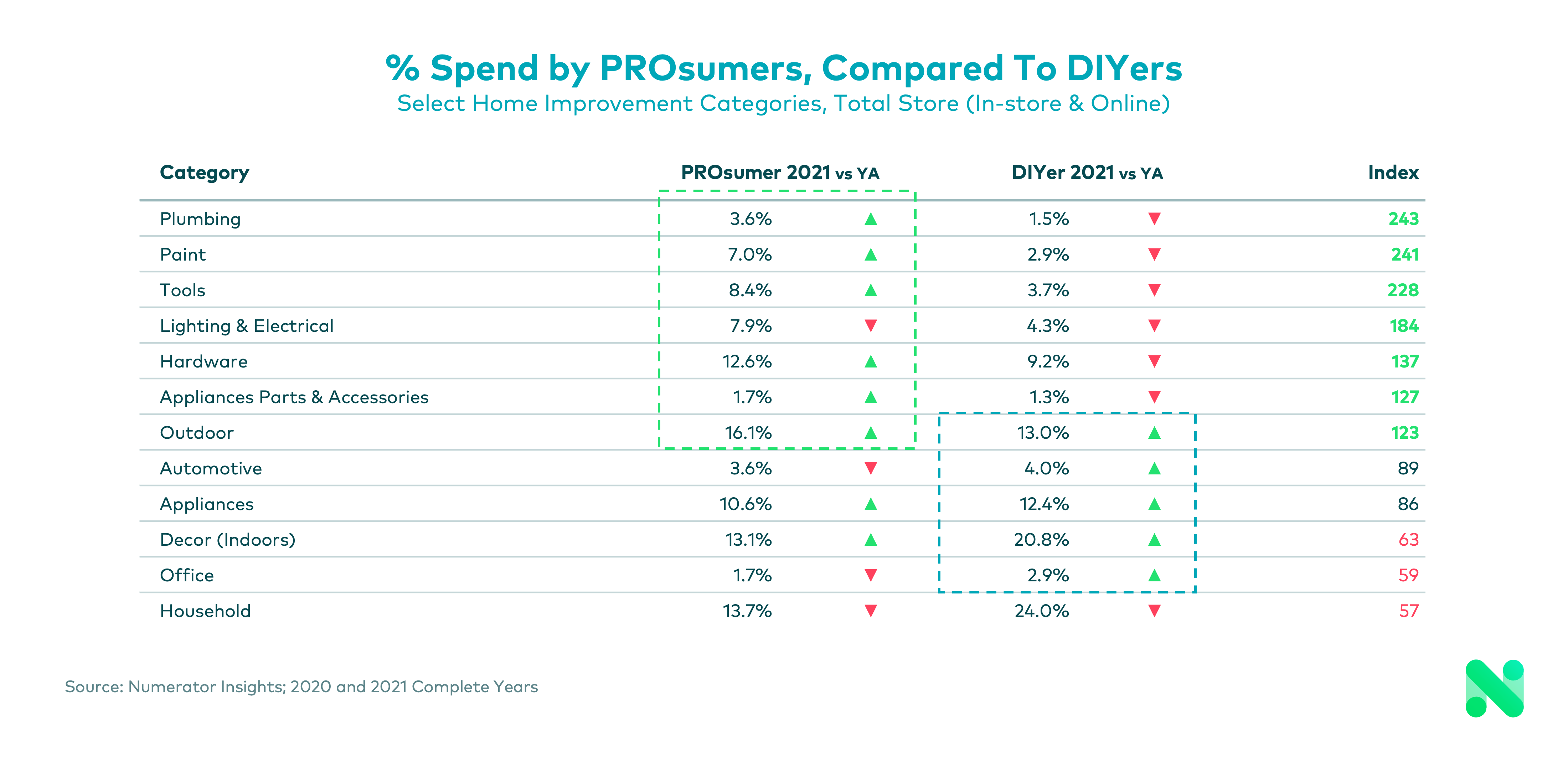

Not surprisingly, PROsumers also tend to take on more complex projects than their DIYer counterparts, tracking a higher percentage of spending in categories such as plumbing, paint, tools, lighting and electric, hardware, and appliance parts and accessories. DIYers, on the other hand, tend to spend more in the outdoor, automotive, appliances, decor, office and household categories.

Shifting to Online Purchases

Similar to DIYers, PROsumers are increasingly shifting into online shopping. While only a small percentage— less than one in five— of PROsumers report finding online shopping to be “very enjoyable,” their shopping habits since the onset of the pandemic have reflected a strong mix of both bricks and clicks. Most respondents (85%) have made an in-person visit to a retail store in the past year but nearly half (45%) have also made an online shopping trip for home improvement materials, showing a decided overlap in shopping preferences.

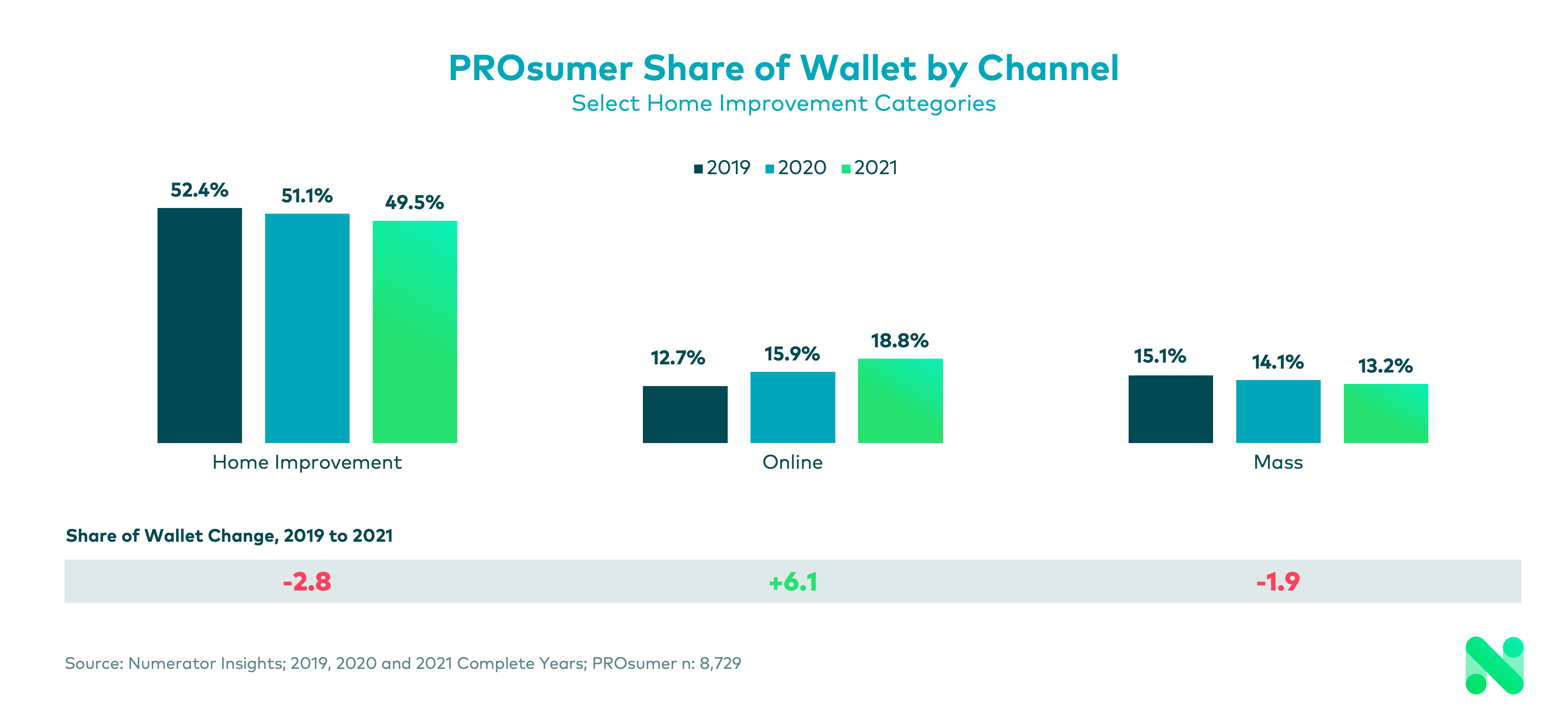

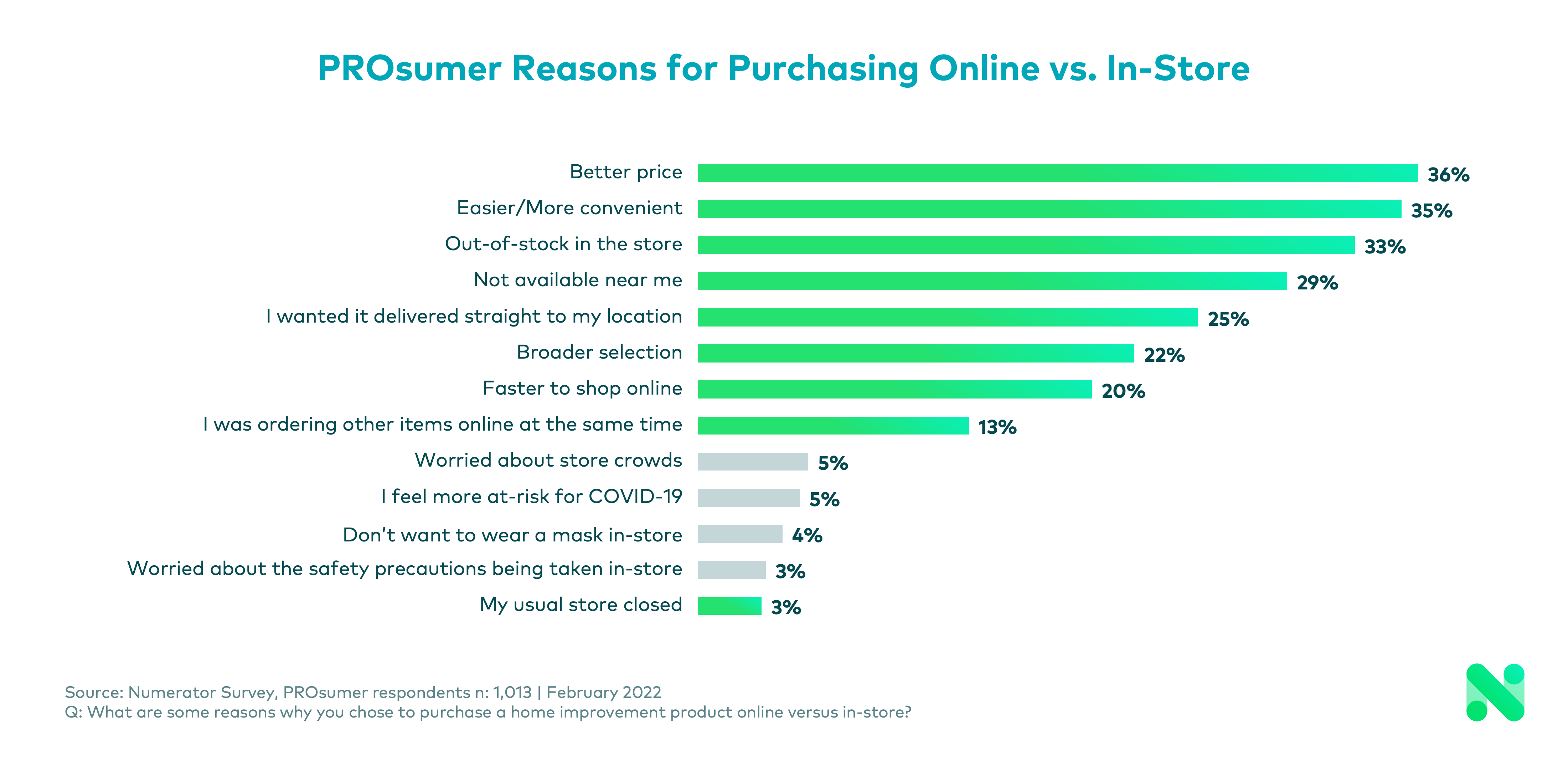

In the case of online purchases, the percentage of total home improvement spending has the most telling story as it reflects a noticeable upward tick from 12.7% of total share of wallet in 2019 to 18.8% in 2021. The reasons for the shift? PROsumers cited convenience, pricing and product availability as their main reasons for shopping online. COVID, on the other hand, appears not to have played a significant role in driving online visits.

When it comes to online retailer preference, Amazon.com is the clear choice with PROsumers. However, Amazon’s online share of wallet has downshifted some, from 69.6% in 2019 to 58.4% in 2021. Instead, PROsumers are increasing their spend at online retailers such as HomeDepot.com, Walmart.com and Lowes.com. While each retailer’s online site tracked substantially lower sales than Amazon, they each realized a gain in share of wallet over the previous two years.

PROsumers are Shopping Earlier in the Year

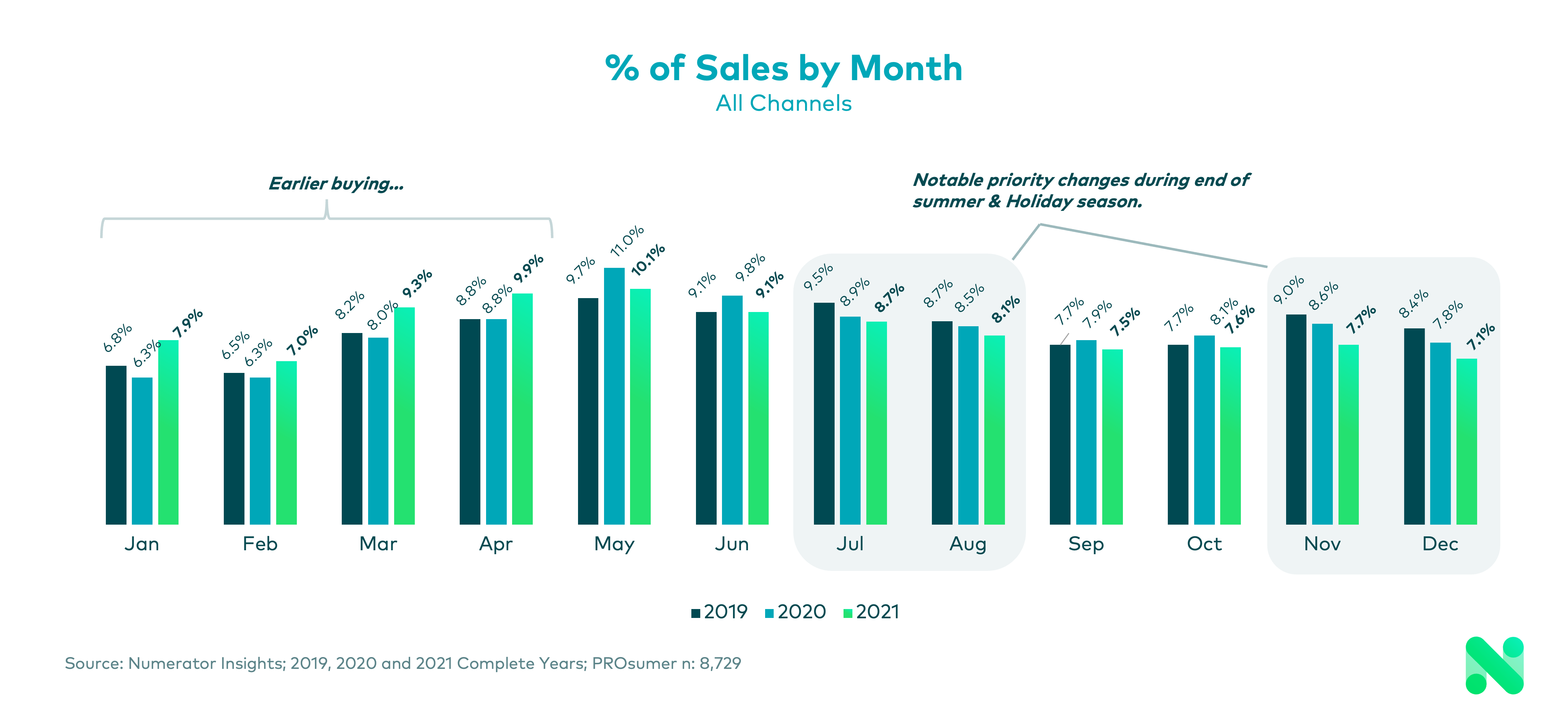

PROsumers aren’t just shifting their purchases online— they’re also shifting them to earlier in the year. In 2021, May reflected the highest percentage of home improvement sales, as it has done since 2019. But the share for May also is lower than the previous two years. For 2021, only January, February, March and April reflected an increase in the share of wallet, with March and April growing by at least one point over the previous two years.

Conversely, every month following April has shown a decrease in the share of sales.

This shift in timing can be attributed, at least in part, to ongoing supply chain disruptions and inconsistent product availability. “Numerous times I am not able to get the items that I want because there is either a supply shortage or some other reason,” said one PROsumer panelist. “Very frustrating since I’m trying to get my job done and cannot do so sometimes without shopping at multiple stores or ordering online.”

Why it Matters

As brands and retailers look to capture their share of the annual home improvement spend, watching the shifting habits of the high-spending, high-value PROsumer can generate valuable insights. Finding and addressing PROsumer pain points could lead to longer-term brand loyalty.

In particular, longer lead times to find and source materials and rising costs may continue to shape the PROsumer purchase journey. In response, online promotions held earlier in the year could create more impact as PROsumers plan their home improvement projects.

If you’d like to learn more about the PROsumer and how they interact with your own brand or category, contact your Numerator representative or get in touch with us today.