The COVID-19 outbreak has impacted individuals, communities, and businesses across the board. While much coverage has been given to the virus’s impact on purchases of fast-moving goods like food and household staples, less has been dedicated to the impact on consumer durables purchases. How has COVID-19 impacted durable goods categories, and what do manufacturers and retailers of these products need to know?

There has been an undeniable shift in the market in response to COVID-19. Retailers of non-essential goods and services have been asked to close their doors in an effort to keep social interactions to a minimum. This has led some durables-centric retailers to close their doors completely, and others to shift primarily to online or click-and-collect fulfillment methods.

While these limitations are causing difficulties for many durables retailers, there have also been unexpected demand surges in certain durables categories. With so many consumers stuck at home, products tied to in-home entertainment, hobbies, or home improvement have experienced an influx of attention. According to our weekly Shopping Behavior Index, we know that trips and sales have been up in the home improvement channel versus this time last year, while they’ve been down in both electronics and office stores.

To better understand the dynamics behind durables purchases during this time of COVID-19, Numerator surveyed verified buyers of a variety of durables categories. These shoppers purchased at least one consumer electronics or durables product in the month of March, and we asked them about that purchase specifically, as well as their intentions and behaviors across a variety of other durables categories.

COVID-19 Impacts on Durables Purchases

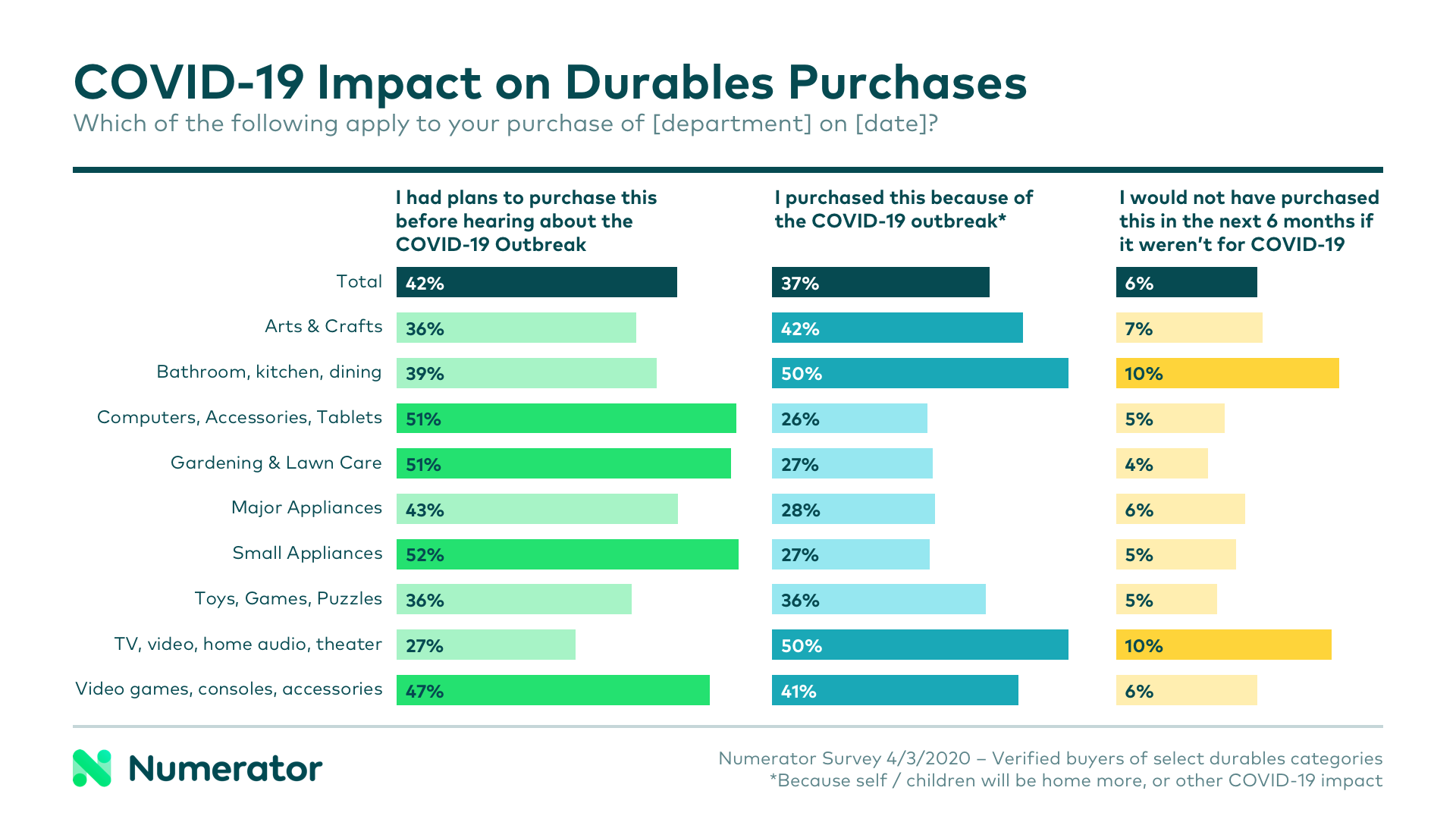

Less than half (42%) of consumer electronics and durables purchases in the month of March were planned prior to the COVID-19 outbreak. Over one-third (37%) of these purchases were influenced in some way by the outbreak, primarily because an individual or their children would be spending more time at home.

This number was even higher in certain category groupings; 50% of “bathroom, kitchen & dining,” and “TV, video, home audio & theater” purchases were made in direct response to COVID-19. Furthermore, in each of these category groups, 10% of buyers said they would not have purchased these items in the next six months were it not for COVID-19.

Overall, about 6% of buyers indicated that they would not have bought the item in the next six months were it not for COVID-19. This means that 6% of purchases– higher in select categories– were incremental or accelerated by six-plus months. For durables categories– many of which experience months or years-long buying cycles, a shift of this magnitude is significant.

Durables Purchases Postponed and Accelerated

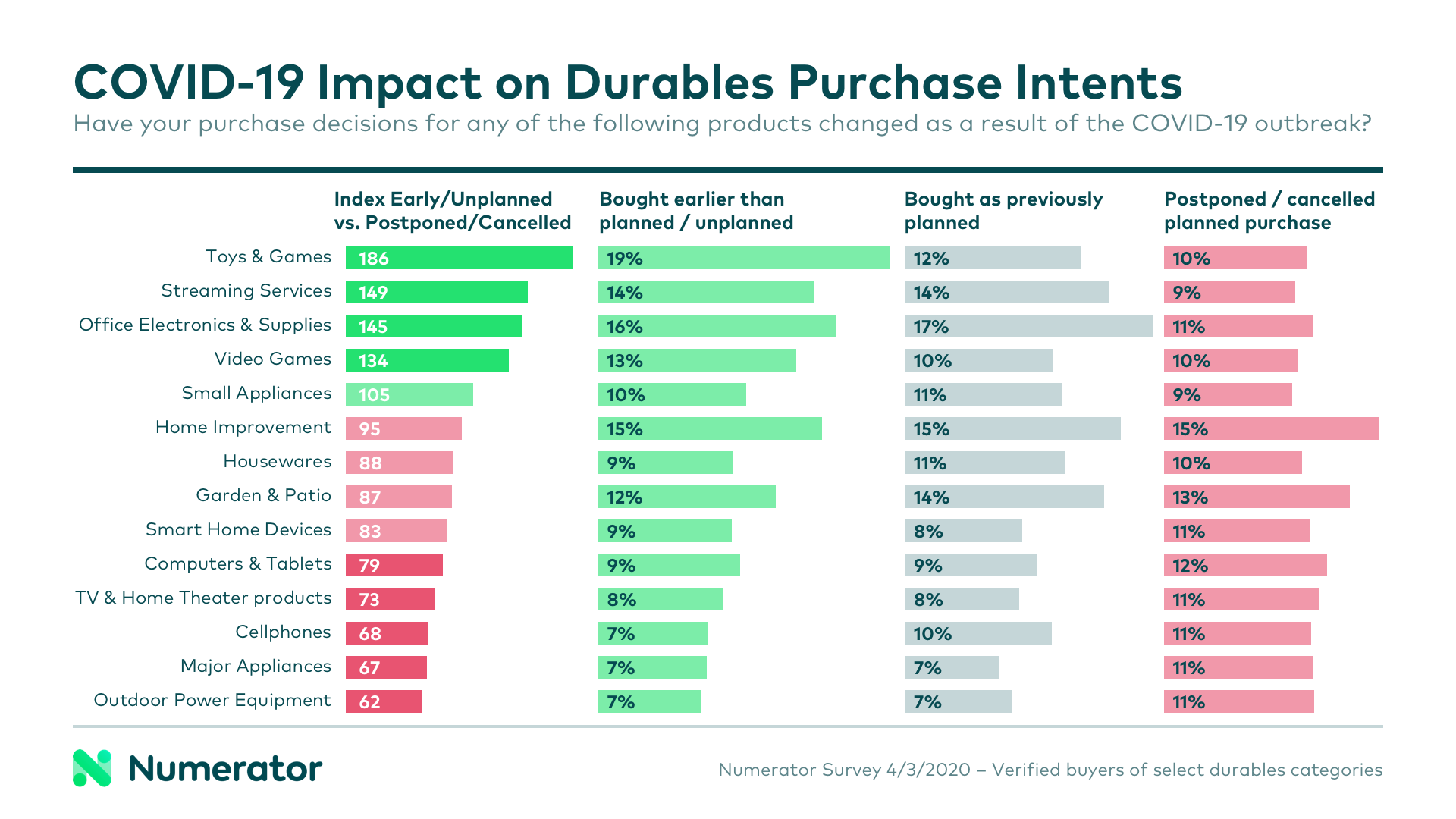

We asked these same consumers about how COVID-19 had impacted their purchases or purchase intentions in a variety of other durables categories. In doing so, we were able to get a wider view of which categories have been positively and negatively impacted by COVID-19. Consumers were able to indicate whether they had cancelled or postponed a planned purchase, purchased as previously planned, if they bought a product earlier than initially planned, or if they had purchased something they previously had not planned to.

In comparing the percent of consumers who made an early or unplanned purchase to those who postponed or cancelled a planned purchase, a clear trend emerged: low-commitment, entertainment-focused categories experienced a net-positive, while higher-investment categories experienced a net-negative.

More consumers made early or unplanned purchases of toys & games, streaming services, and video games than postponed or cancelled purchases in these categories. Office electronics & supplies also saw a boost as many prepared for an extended period of working-from-home. Categories like outdoor power equipment, major appliances, and cell phones all experienced more postponements and cancelled purchases than they did early or unplanned ones.

Given their larger price tags, it’s likely many of these big-ticket items will continue to experience a lull in activity until consumers are in a better economic position. Additionally, consumers may postpone these purchases until they’re able to view the items in person when stores reopen.

Looking Ahead

While many consumers are pushing back big, non-essential purchases, there is a light at the end of the tunnel for durables retailers and manufacturers: once stores begin re-opening, demand for these products is likely to pick back up– and in some areas, play catch-up for the time that was missed. Additionally, some categories– particularly home improvement, housewares and TV & audio– have experienced both incremental boosts and purchase delays in the short term, meaning pent-up demand in the long run.

For more information on how your brand or category is affected by COVID-19, please contact your Numerator Customer Success and Consultants or get in touch with us.