NUMERATOR OMNIPANEL

Consumer panel data at speed, scale and coverage never seen before.

Make decisions with confidence and speed by leveraging a panel that is architected to evolve with the modern consumer and provides a single source for omni insights and understanding.

Access fast and actionable consumer

insights in a changing market.

Market dynamics are changing faster than ever before. There are more ways to shop with eCommerce, click-and-collect, and direct-to-consumer options. There are also more options to choose from with an explosion of private labels and direct-to-consumer brands — all while consumers are under unprecedented pressure. Navigate this variable market with Numerator’s OmniPanels that go beyond traditional measurement to gain a clearer view of your consumer.

2B+

SHOPPING TRIPS CAPTURED

44k+

RETAILERS TRACKED

1

SINGLE DATA SOURCE

What makes our data special?

Omnichannel Visibility

All retail channels from bodegas to big box to eCommerce.

Holistic Understanding

Deep insights via purchase-triggered surveys that combine consumer behaviors and attitudes.

Fast Consumer Insights

On-demand access to consumer insights and purchase data updated daily.

We start with the consumer, because channels don't create trends, people do.

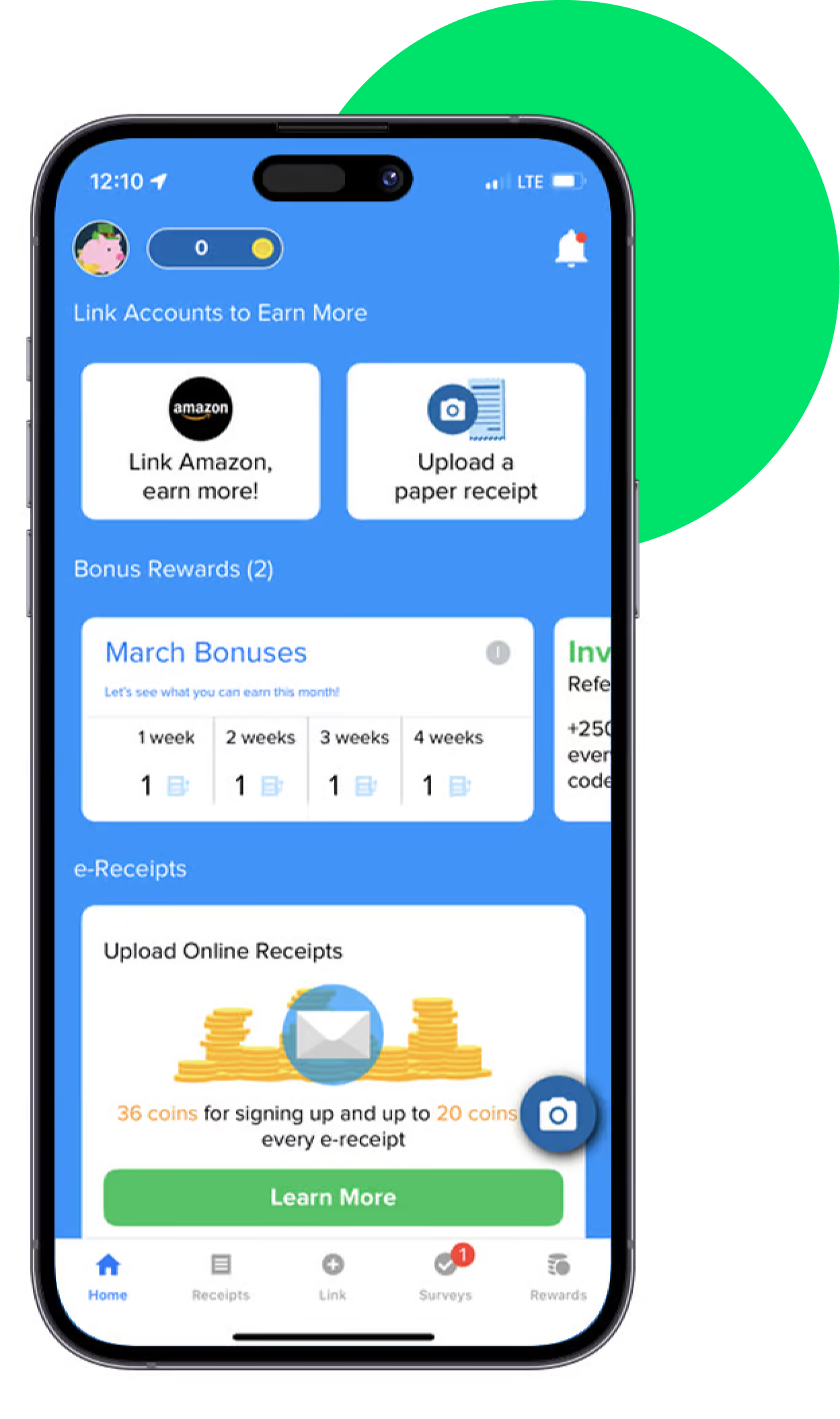

Our consumer-facing app makes it easy and fun for shoppers to share buying and sentiment behavior, creating a single data source that enables richer consumer understanding.

Channels

Traditional

B&M

eCommerce

Club & Specialty

Gas & Convenience

Dollar Store

and more

Transaction Sources

Paper Receipts

Retailer Loyalty Data

Mobile App Purchases

Email

Consumer Profiles

Survey Data

Demographics

Psychographics

Media Consumption

Numerator OmniPanel

Numerator OmniPanel is comprised of consumers using the Receipt Hog app. Different subsets of those consumers are then used to form panels that power our products.

Total Commerce Panel

200K households power Numerator Insights for longitudinal understanding. LEARN MORE

Survey Panel

600K panelists who have submitted a trip in the last 60 days with known core demographics power Verified Voices to reach engaged buyers. LEARN MORE

Measurement Panel

1M+ active househoulds power Numerator Truview for a people-based approach to omnichannel market share. LEARN MORE

Test Panel

50K households power Numerator Surveys to reach engaged verified buyers without biasing current or potential static panelists. LEARN MORE

See more trips, more channels, and more insights.

More Data Updates

Monitor changing consumer behaviors and sentiments on demand.

More Channels and More Products

Capture purchases of all product categories across all channels.

More Consumer Context

Gain richer consumer understanding with 2,500+ demographic, psychographic and media consumption attributes.

Thank you!

A member of our team will get back to you within 24 hours. In the meantime, explore our content to get a pulse on the latest consumer and shopper insights trends.

Brands that trust Numerator Omnipanels

WHITE PAPER

Clarifying the Roles of Omnichannel Market Share Measurement, POS and Panel Data.

Learn when it is appropriate to use POS data vs. Panel data vs. the newcomer, Omnichannel Market Share Measurement data, especially as they relate to understanding the behavior of today’s consumer.