Amazon Prime Day 2020 took place on October 13-14, marking the internet retailer’s sixth annual sale celebration, and its first to occur outside the month of July. In addition to its shift in timing, Prime Day 2020 saw a shift in ad strategy, a slight shake-up to the top items list, and moderate changes in consumer behavior– including a move towards holiday gift purchasing.

Check out more up to date Prime Day coverage here!

The following insights were an early read into Prime Day activity and some numbers have since changed. For the most recent numbers and insights, download our full Amazon Prime Day 2020 Recap Report.

—

Twelve hours out from its conclusion, Numerator is sharing first looks and major takeaways from Amazon Prime Day 2020. We spent the past two days sharing live data on our Amazon Prime Day dashboard. The following Prime Day analysis includes highlights from the dashboard and additional insights from multiple Numerator products including:

- Early-read consumer insights from the Numerator OmniPanel, informed by 43,000+ observed Amazon orders from over 17,000 panelists throughout Prime Day 2020*

- Custom Numerator Survey insights from 5,000 verified Prime Day shoppers surveyed in the past 48 hours following their observed Prime Day purchases.

- Ad spend data leading up to Prime Day from Numerator Ad Intel

- Prime Day price changes tracked by Numerator Pricing Intel

*Note: While insights from Numerator Ad Intel, Pricing Intel, and our custom Prime Day survey are comprehensive and complete, insights shared from our OmniPanel are preliminary, and should be viewed as an “early read” that will become more accurate as panelists continue to submit their receipts. Early insights from our OmniPanel span 43k Amazon Prime Day orders from over 17k panelists, providing a robust first look into Prime Day 2020.

Advertising and Awareness Leading up to Prime Day: On the Rise

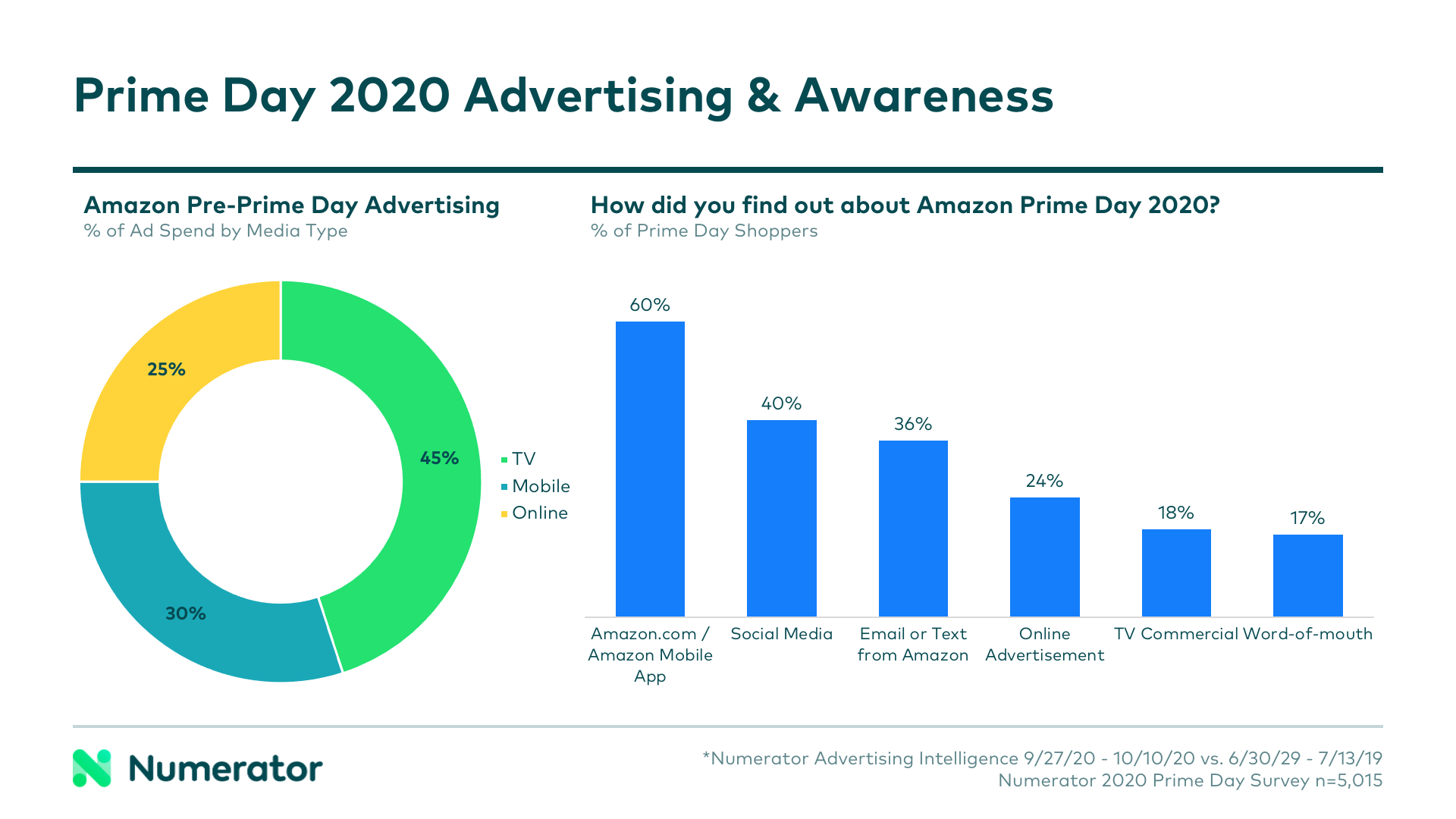

Amazon invested heavily in advertising leading up to Prime Day 2020, with a 25% ad spend increase in the two weeks pre-Prime Day versus the comparable pre-period last year. 45% of Amazon’s pre-Prime Day ad dollars went to TV this year, double last year’s investment. Nearly 1 in 5 Prime Day shoppers (18%) said they became aware of this year’s event through a TV ad, while the majority found out on Amazon.com / the Amazon mobile app (60%) or through social media (40%).

With a nearly three-month delay, awareness was high leading into Prime Day 2020. 93% of shoppers knew it was Prime Day before visiting Amazon to make their purchases on October 13th and 14th, and 83% said Prime Day was a primary or contributing factor in their decision to shop on Amazon. Nearly one-third of Prime Day shoppers (31%) were participating in the day-of-deals for the first time. 3% were new Amazon Prime Members, joining either day-of or in the month leading up to Prime Day, and another 4% had been members for fewer than 6 months, joining since the onset of the COVID-19 pandemic.

Top Items and Categories from Prime Day: The Shift to Gifts

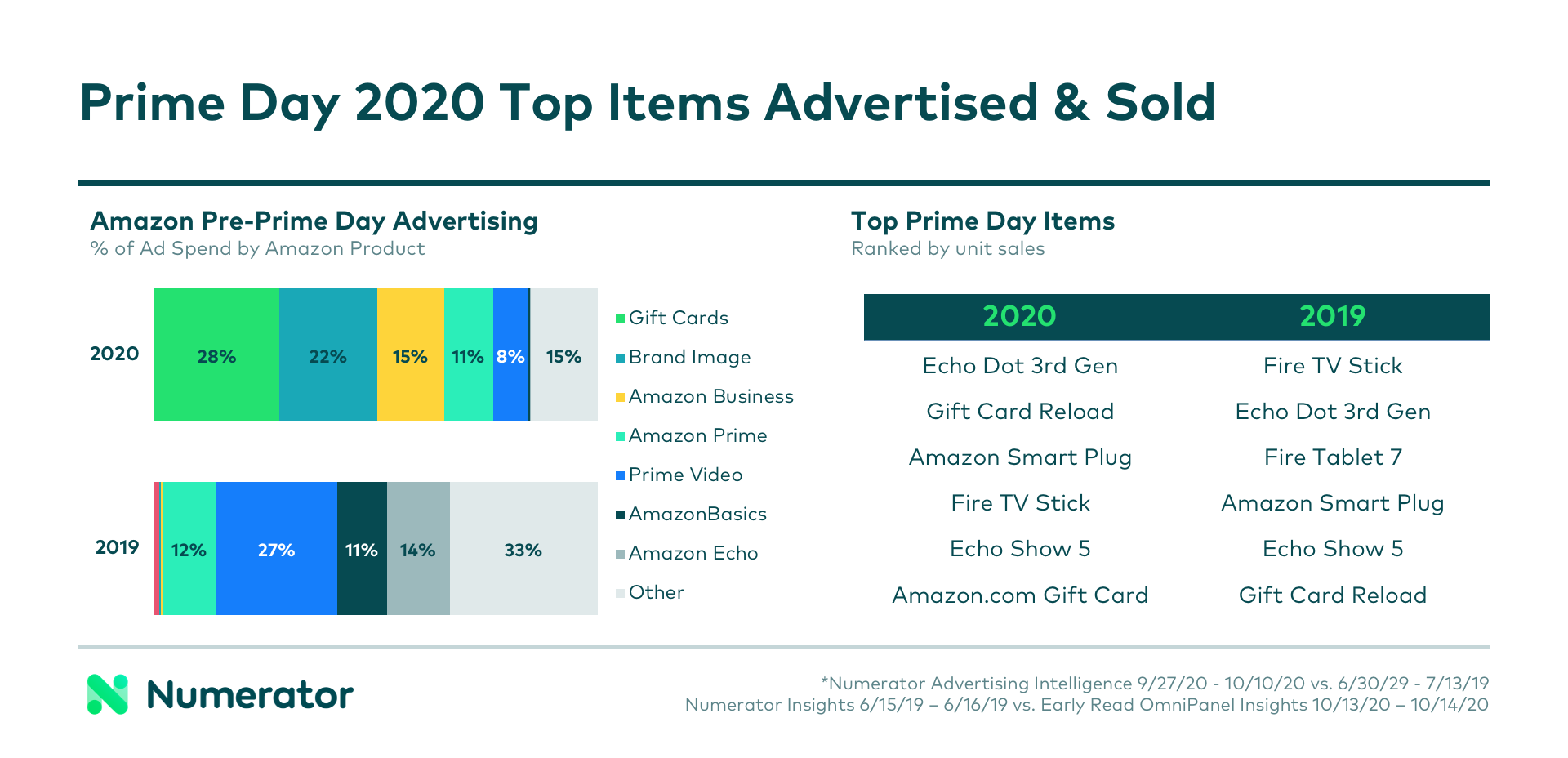

Amazon chose to heavily promote gift cards this Prime Day, dedicating approximately 28% of their ad dollars to messaging mentioning gift cards, compared to only 1% last year. Their offer for $10 in credit after spending $40 or more on Amazon gift cards drove massive sales, with existing card reloads and new Amazon Gift Cards purchases ranking second and sixth, respectively, for top items sold on Prime Day 2020. Last year, gift card reloads took the sixth spot, and new gift card purchases did not make the list.

Other top Prime Day items mirrored those seen in 2019, though most switched places; the Echo Dot 3rd Generation, Fire TV Stick, and Amazon Smart Plug all placed in the top five both years, based on observed purchases from Numerator OmniPanel. Investment in ads mentioning Amazon-branded products and services like the Echo line and Prime Video were down significantly this year, as well.

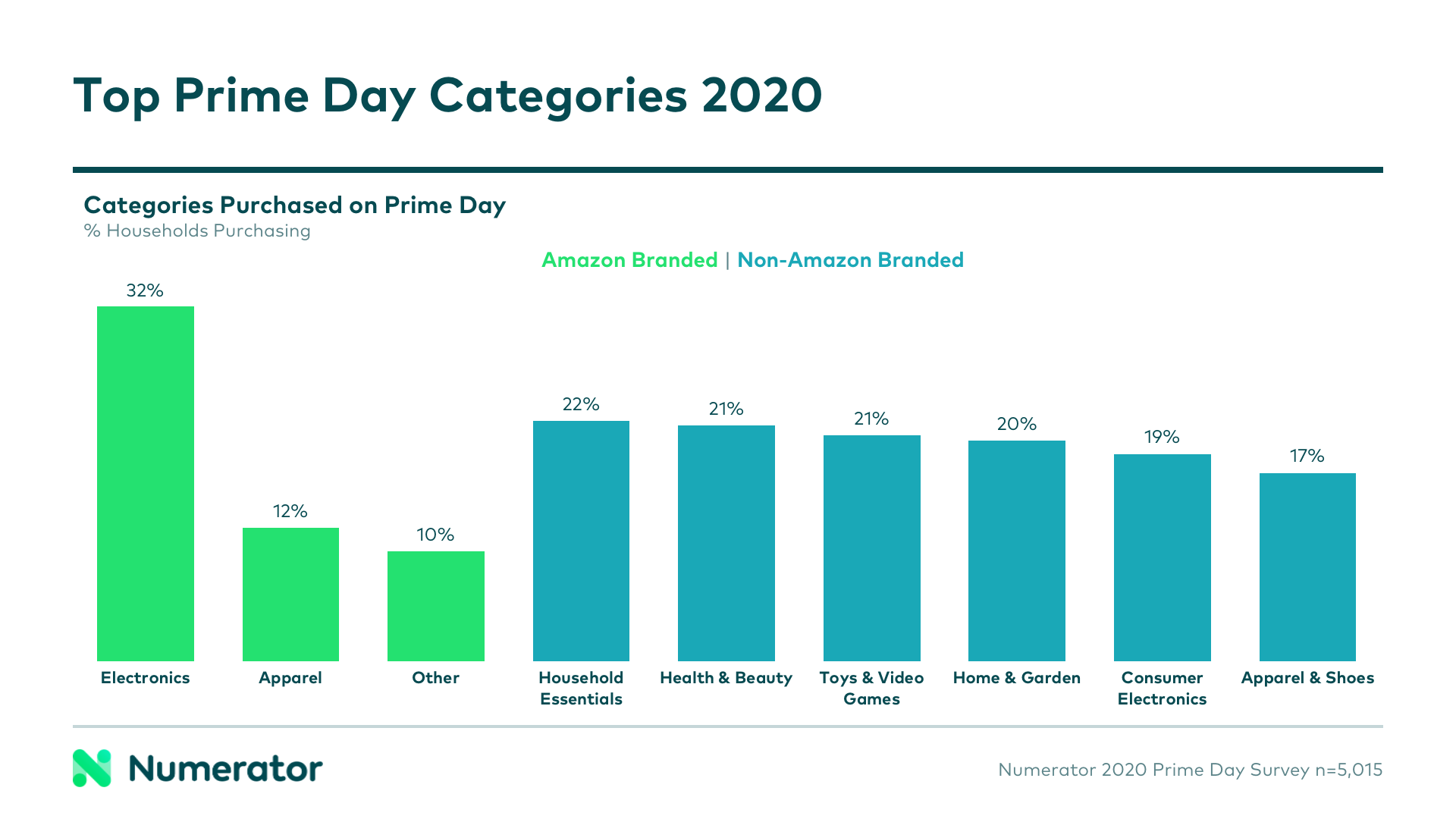

According to Numerator’s Prime Day survey, one-in-three shoppers (32%) purchased Amazon-branded electronics. Further, two-in-three (67%) shared they likely would not have purchased said products had it not been for Prime Day. Other top categories included household essentials (22%), health & beauty (21%), and toys & video games (21%).

Prime Day Order and Shopper Insights: One to Watch

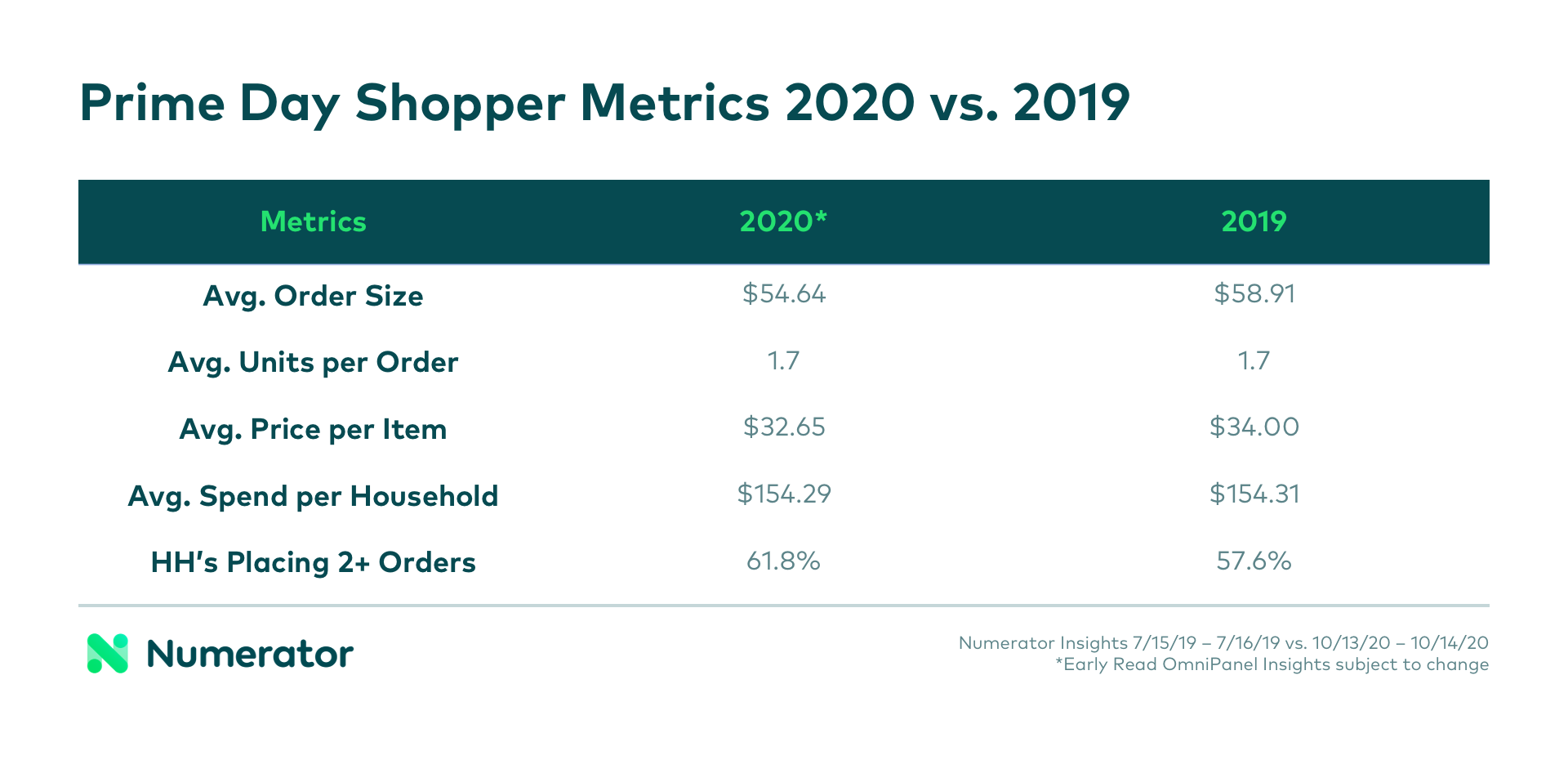

[This section was updated on 10/22] Preliminary insights from the Numerator OmniPanel show smaller order sizes in 2020 vs. 2019 ($54.64 vs. $58.91) and a slight decrease in average price per item ($32.65 vs. $34.00). Percent of households placing multiple orders was up from last year (61.8% vs. 57.6%) while overall spend per household was steady ($154.29 vs. $154.31).

Competitive Pricing: A Primary Focus on Prime Day

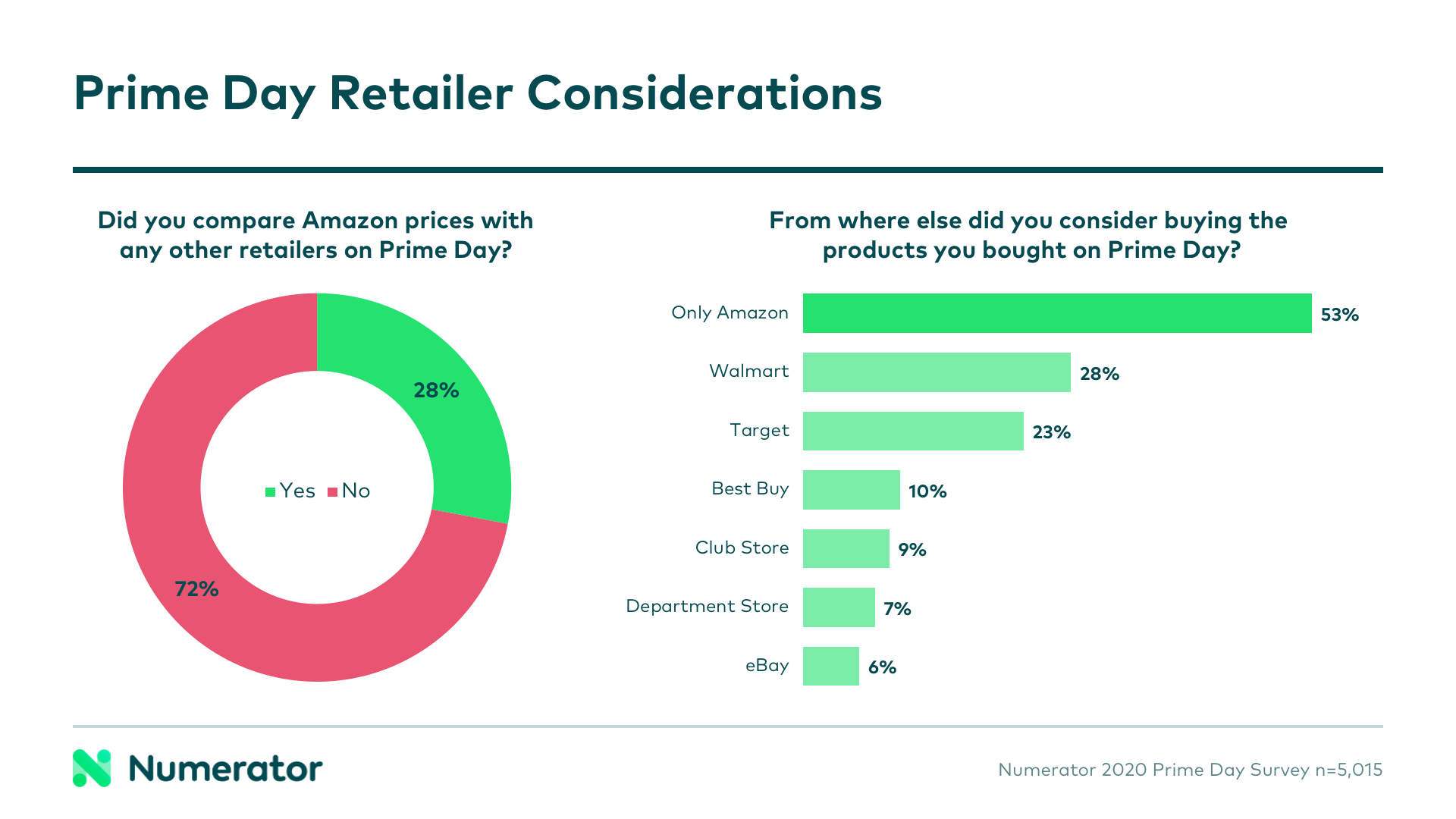

Amazon was not the only retailer offering steep sales on October 13-14; Target hosted its third annual Deals Days and Walmart held its Big Save event to coincide with Amazon Prime Day. Despite multiple options for savings, 72% of Prime Day shoppers did not compare Amazon prices with any other retailers before making their purchases. While 53% of shoppers only considered Amazon for the purchases they made on Prime Day, 28% considered Walmart, and 23% considered Target before ultimately choosing Amazon. 1 in 5 (21%) of Prime Day shoppers also placed a purchase at a website other than Amazon in addition to their Prime Day purchases.

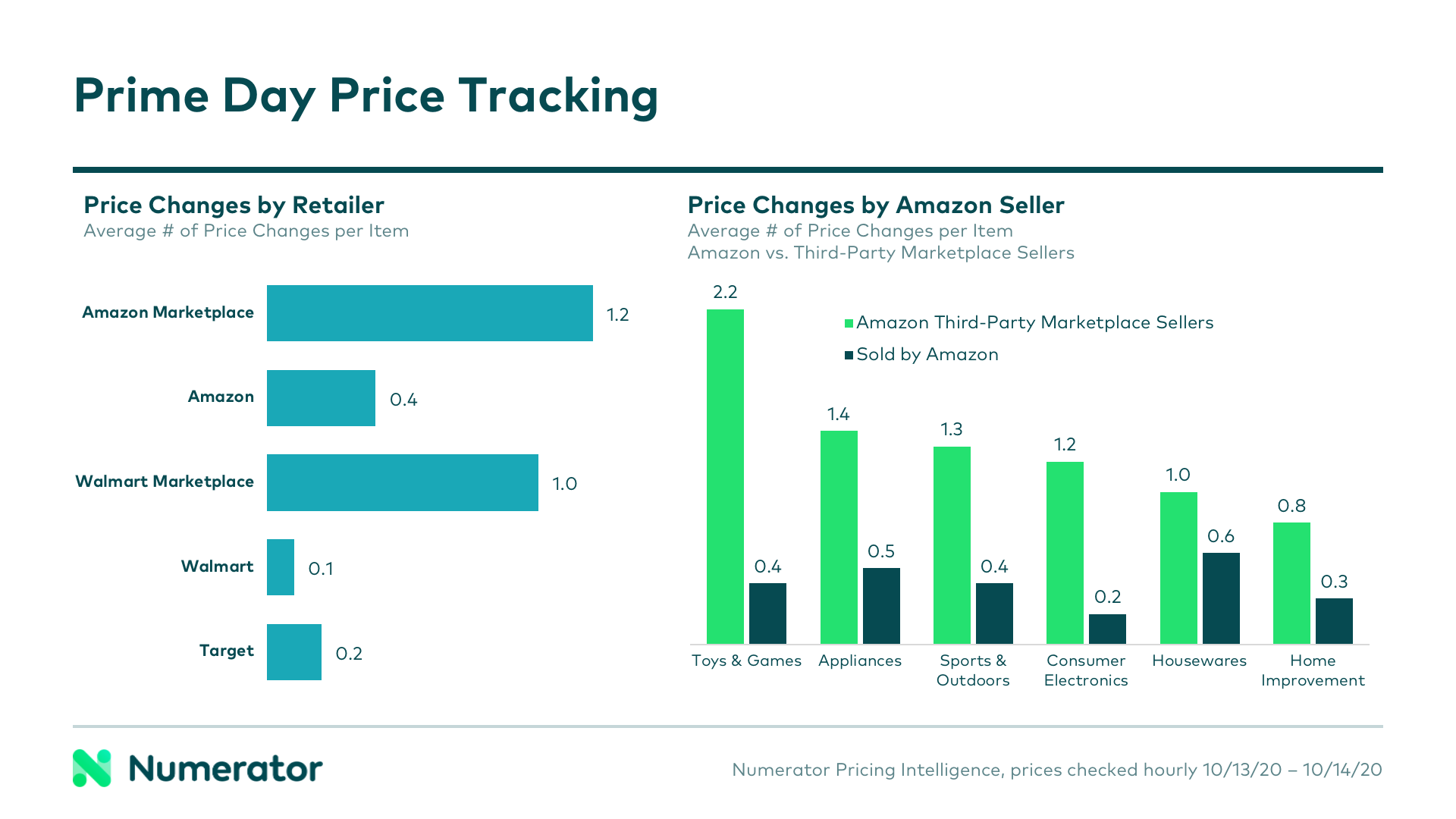

Shoppers refreshing their pages in hopes of catching a price drop weren’t likely to see many changes; for the most part, prices on Amazon, Walmart and Target were stable throughout the two-day sales, based on Numerator pricing data, which scraped select product list prices hourly over the course of the sales. The average tracked item on each site changed less than once throughout the sales days, though this number was significantly higher for third-party sellers on Amazon, who appeared to be more reactionary, changing prices more frequently, particularly within toys & games.

Prime Day’s Impact on Future Holiday Shopping: Shaping the Season

The most significant change to Prime Day 2020 was its newfound proximity to the holiday shopping season. 29% of Prime Day shoppers used the day of deals to purchase gifts for the holidays, according to Numerator’s survey. Of those shoppers, one-in-four (25%) said they completed at least half of their holiday gift shopping with their Prime Day purchases.

While 54% of Prime Day shoppers were “very” or “extremely” satisfied with the deals offered on Prime Day, they generally perceive Black Friday as having the best deals, compared to Prime Day and Cyber Monday. It doesn’t appear participation in Prime Day will drastically hinder any future sales participation; 80% of Prime Day shoppers still anticipate shopping on Black Friday, and 88% say the same of Cyber Monday. In light of their Prime Day purchases, 17% say they expect to spend less than previous years during the two sales periods, and 90% said they will shop on Amazon again before the holidays.

Get the Full Prime Day 2020 Report

Some numbers have changed since the publishing of this early read data. Check out our full report for the latest numbers and insights!

GET THE FULL REPORT >>

For more information or to run a custom analysis on your brand or category, reach out to your Numerator Customer Success Representative or contact us today.