At last count, Amazon boasted an astonishing 135 private label and 330 exclusive brands. About three-fifths of Amazon private label sales (58%) occur in the electronics sector, with Alexa-enabled products like the Amazon Fire TV Stick, Echo Dot and Fire Tablet leading the pack. But while sales of Amazon-branded electronics fell about 10% in 2018, sales of Amazon private label items in core CPG categories (Household, Pet, Baby, Grocery and Health & Beauty) skyrocketed.

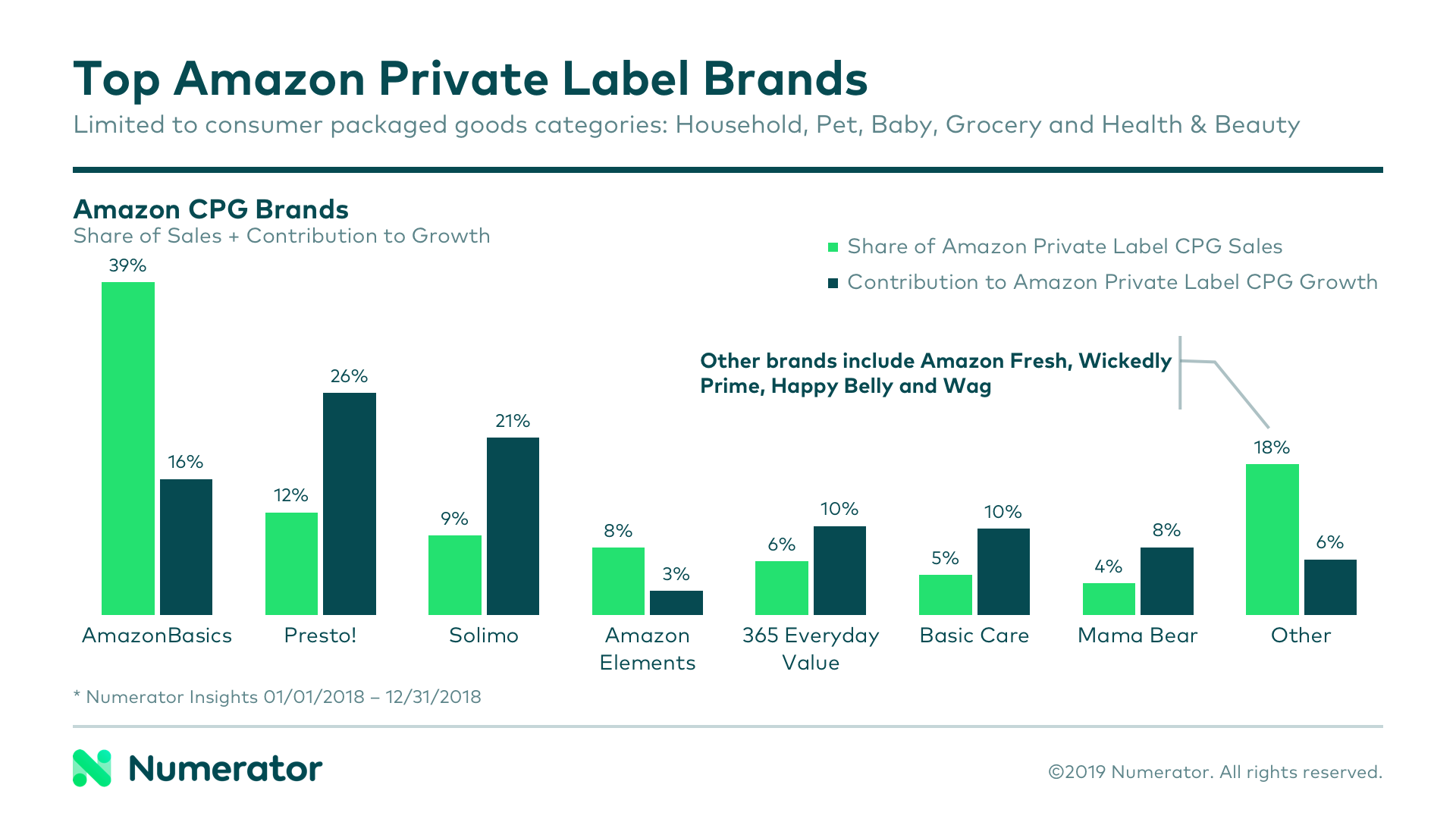

From 2017 to 2018, Amazon private label brands overall experienced a modest 2% growth in dollar sales. But for Amazon brands selling in the core CPG categories mentioned above, growth was closer to 81%. AmazonBasics— the e-tail giant’s most well established and profitable brand— dominated with 39% of Amazon’s private label CPG sales, but up-and-comers Presto! and Solimo quickly established themselves as key players as well, driving nearly half (47%) of Amazon private label CPG growth.

Though Amazon’s Presto! brand has been around since 2016, it didn’t experience immense growth until 2018 when it expanded beyond laundry detergent and began offering a variety of household products like paper towels, bath tissue and garbage bags. Numerator Insights data shows that 78% of Presto! buyers were already purchasing paper and plastic items at Amazon prior to the new Presto! item launches in 2018; for the other 22%, Presto! was their first purchase on Amazon within the paper and plastic category. These findings illustrate Amazon’s ability to not only entice brand switching among category buyers on Amazon, but also to draw in shoppers from other retailers.

Brand loyalty is much higher among Subscribe & Save shoppers, with nearly four-in-five households subscribing to a single brand per category. If Amazon is able to get shoppers signed on for repeat purchases of Amazon-branded items, they have the potential to grow their private label share exponentially.

For a closer look at Amazon private label trends, including shopper profiles, category deep dives and impact on name brands, download our latest report, Amazon’s Private Label Proliferation.

Subscribe below to receive weekly updates from our blog, ensuring you never miss the latest insights into all things shopper.