When it comes to consumer insights, there might not be anything scarier than an incomplete— or dare we say… incorrect— view of your consumers. Demographics, psychographics, loyalty and leakage all play an important role in understanding your consumers, and without insight into all of them, you might miss out on big opportunities.

Google, “What does your candy choice say about you,” and you’ll find about 270 million quizzes, lists and articles explaining how your preference for M&M’s over Skittles can distinguish you as either an adventurous or sensitive type. But behind the silly exterior, there’s a truth that any brand manager or consumer insights specialist knows all too well: shopping habits and brand preferences are a reflection of the person behind the purchase, and understanding consumers is crucial to brand health. So, what can we learn about consumers from their candy choices, and what can brand managers take away from these insights?

Candy Consumer Snapshots

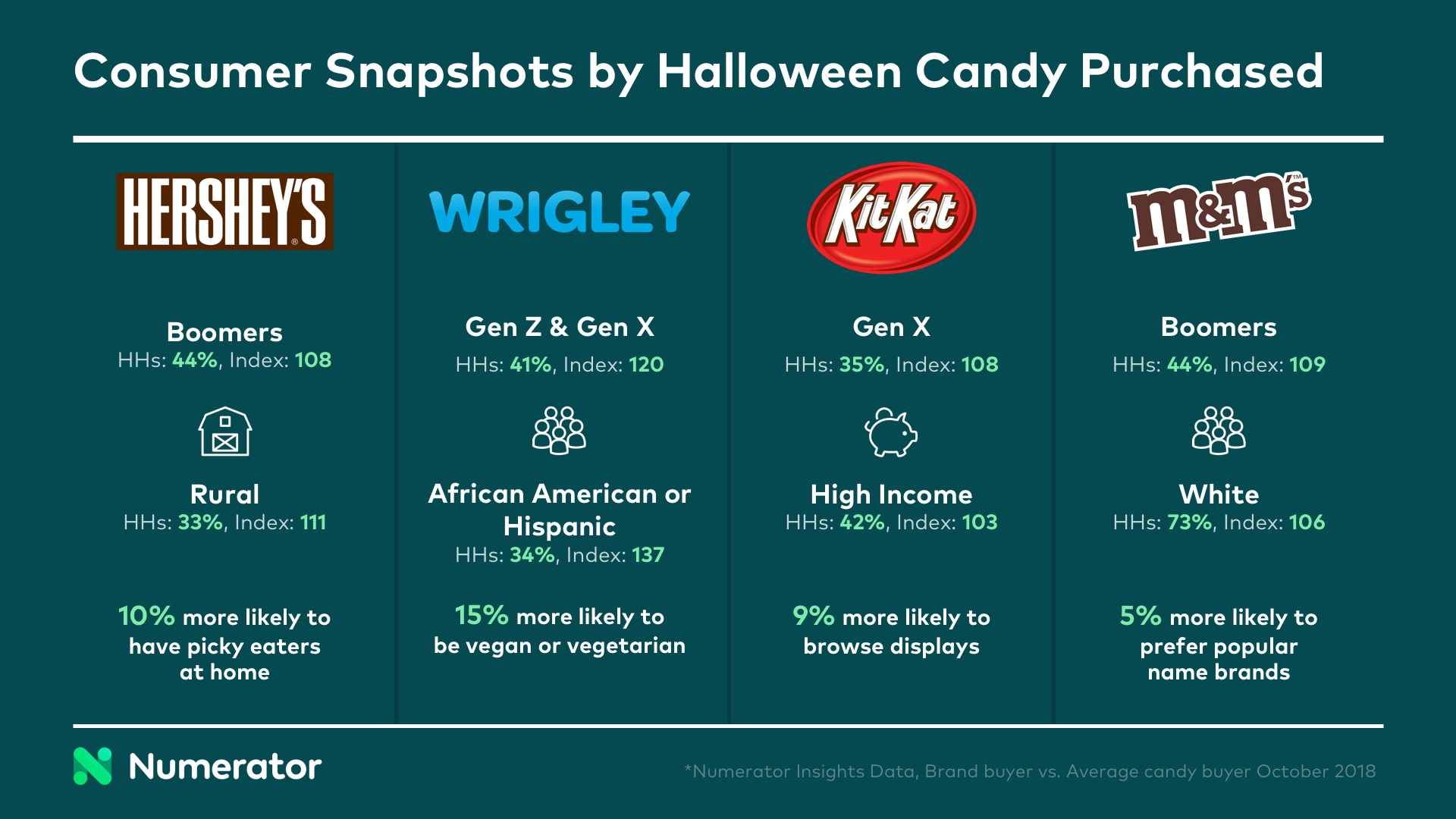

A look at Halloween candy consumers from 2018 revealed a variety of nuances between different brand buyers. While Hershey’s buyers skewed towards rural boomers, Kit Kat buyers tended to be high income Gen X’ers. The Wrigley brand had the youngest and most diverse buyer base, over-indexing with Gen Z, Gen X, African American and Hispanic consumers.

Psychographic attributes also differed between groups. In terms of eating habits, Hershey’s buyers were more likely to have picky eaters in the home, and Wrigley buyers were more likely to be vegetarian or vegan. When it came to shopping attitudes, Kit-Kat buyers were fans of browsing displays and M&M’s buyers had a preference for popular name brands.

The Candy Plan

For the majority of Halloween candy buyers in 2018, the decision to purchase candy was intentional and planned; 48% had a specific brand in mind before going to the store, and 18% knew they’d buy the category, but hadn’t settled on a specific brand ahead of time. M&M’s and Reese’s purchases were the most likely to be planned ahead, and Private Label and Snickers were most likely purchased when a brand hadn’t been predetermined. What does this mean for brand managers in the candy category? If you’re waiting to appeal to consumers until they reach the shelf, you’re already down to 50-50 odds. Advertise early and get your brand in the consumer’s mind before they make their shopping trip.

Candy Brand Buying

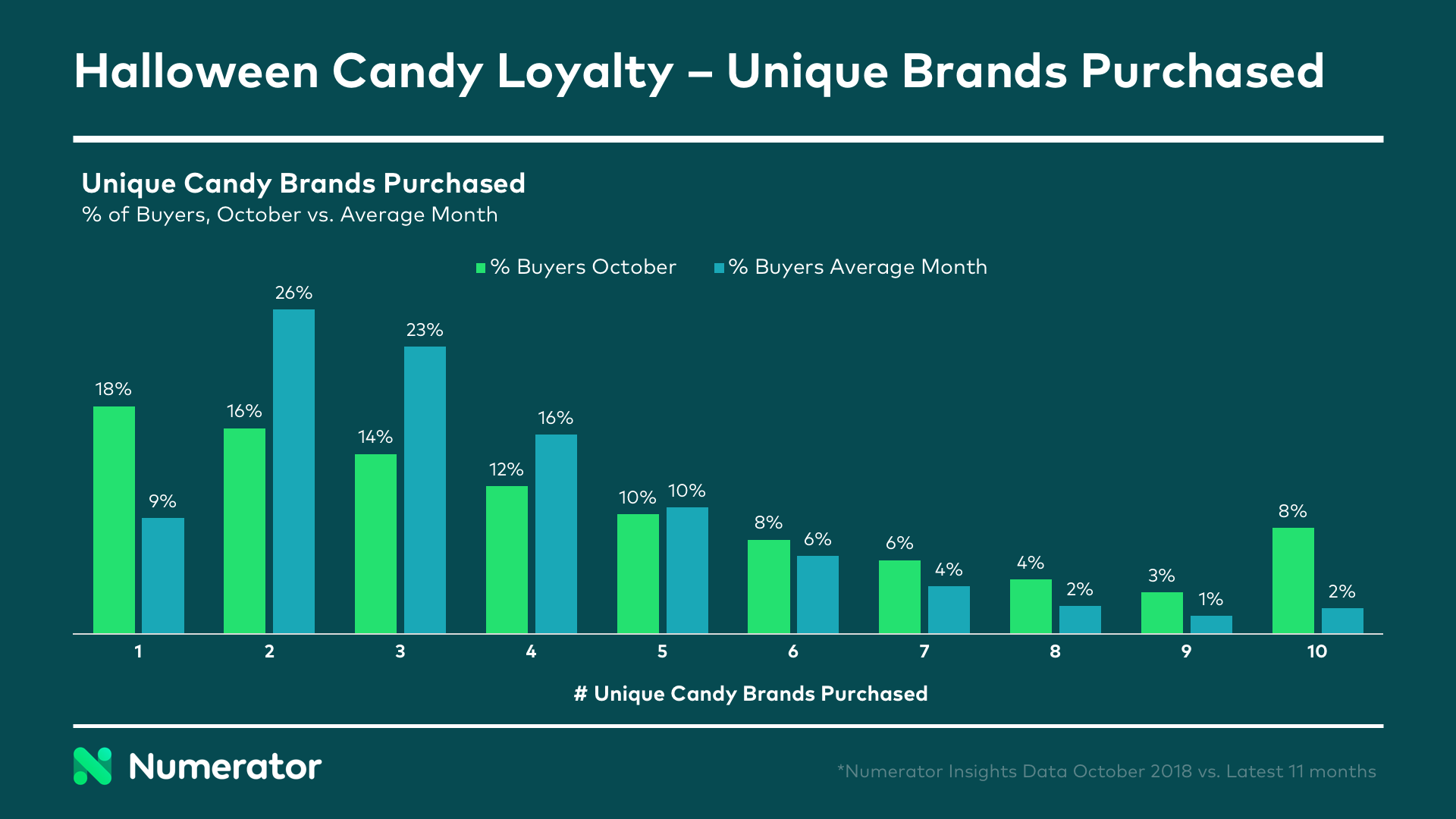

Around Halloween, consumers’ buying behavior in the candy category sees a notable shift. Obviously, sales are up— that’s a no-brainer. But when it comes to the number of unique brands purchased, Halloween candy buyers are much more likely to either stock up on a single brand or to buy a large assortment of brands— purchasing the typical range of two to four unique brands is far less likely. The percent of consumers buying a single brand doubles in October versus other months of the year, as does the percent of households buying six-plus brands.

If you want to be that single brand purchased in bulk, invest in advertisements, promotions and displays in stores where your consumers shop. If you’re willing to share the basket— and it’s likely you’ll have to regardless— think about cross promotional opportunities with other bands that complement your own. The majority of consumers will be buying more than one brand, so how you position yourself and your ability to play well with others matters.

The world of consumer insights might feel daunting at times, but with the right data and strong partner, you can’t lose. Reach out to Numerator today to learn more about our scary-good solutions and how we can help you succeed.