Uber and Lyft are both gearing up for what they hope will be high-flying 2019 IPOs. File away the word “flying,” we’re going to come back to it in just a minute.

What do these companies have in common? Well, it’s clear neither company has prioritized profitability as a key step in its growth – what’s losing a billion or two among friends? It’s critical to both business models that drivers remain independent contractors. Oh, and in my observations the reasons consumers choose one ride-sharing service over the other are also similar: habit and price, followed by lag between ordering and pick-up (sadly, my preferred company struggles with long wait times, at least in the areas to which I travel most frequently). Given their rapid growth, it seems that each has nailed the concept of being relevant to riders. So then what makes them different? This quote from a recent article on the investing.com website succinctly sums up the philosophical divide between their business models: “If there is a single major difference between Lyft and Uber, it’s that the former is focusing exclusively on ridesharing while Uber has branched out into other businesses such as freight, self-driving cars, and Uber Eats.”

In other words, Uber is creating a transportation ecosystem. And now it’s taking the ecosystem concept and attempting to connect it for consumers, introducing its first loyalty program, a “terrestrial spin on a frequent flier program.” Whether for Uber rides or Eats, users receive points for their patronage, with (maybe) points for bikes and scooters to follow.

Not that Uber needs any advice from me, but I got to wondering if airline loyalty programs are the best analog for what Uber is trying to accomplish. Over time, airline programs seem to have grown more similar than different (though certainly Uber has the potential to gain a first mover advantage in this area). Maybe retailer programs like Costco memberships or (gulp) Amazon Prime provide a more evolved model for creating a consumer-centric ecosystem.

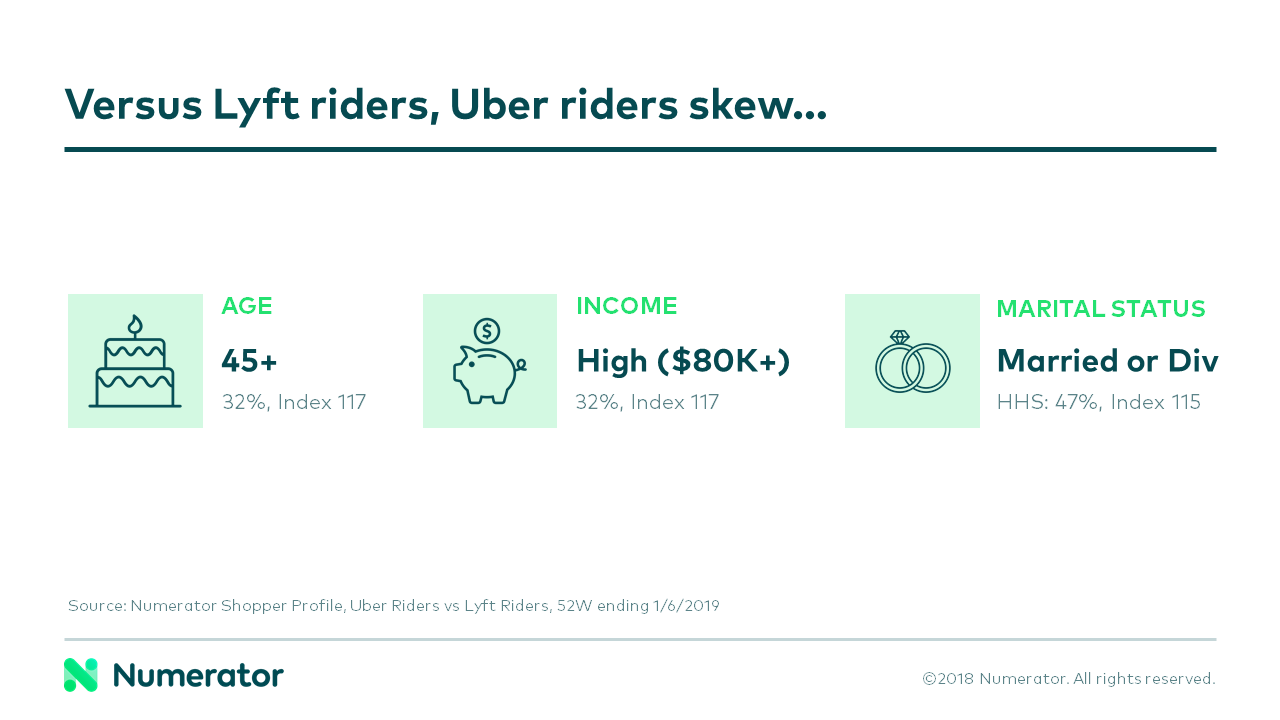

Compared to Lyft riders, Uber customers skew older and higher income, making them a desirable cohort for many goods and services.

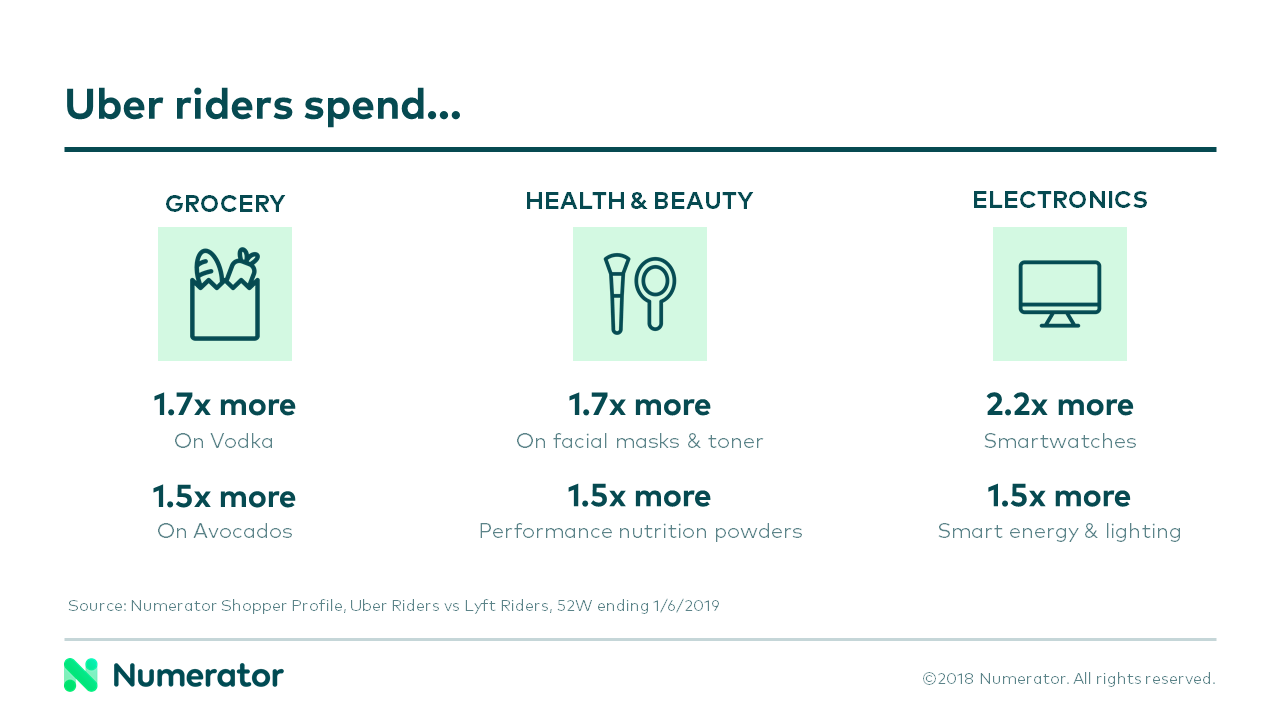

Borrowing from the Amazon model, and knowing that car travel is mainly boredom punctuated by moments of terror, what if loyalty unlocked a Wall Street Journal subscription, or access to Wired magazine or The Economist? Or YouTube TV (now I’m not just borrowing from Amazon, I’m flat-out stealing)? Something to do during a gridlocked [insert your city here] commute. Likewise, compared to the population overall, Uber riders spend disproportionately more than the population at large on smartwatches and smart energy and lighting. Is there a broader ecosystem that involves smart luggage, smart clothing or maybe just plain old Smarties candy?

From membership programs to ecosystem retailing, increasingly companies are attempting to use the gravity of their offer to hold consumers in their orbit. And Uber is only at the starting line here in terms of creating loyalty.

Whether you consider yourself a partner or competitor of Uber, Numerator knows how their users behave, what they purchase and in many cases how they think. Flag us down so we can go on this ride together.