More than one-in-five shoppers indicate that they have “no time to take care of self.” These time crunched shoppers are always looking for ways to make life easier, and all aspects of the shopper journey— from what they buy to how they buy— reinforce the idea that this group is trying to save time. Which brands and retailers are already winning with these shoppers, and how does understanding their lifestyle help to understand their purchase drivers?

Basic Shopping Habits

Weekends are prime shopping time for everyone, but among time crunched shoppers, trips to the store are even more concentrated on Saturdays and Sundays than they are for the average shopper. These shoppers are more likely to be employed full-time (61.5%, index 127), so the chaos of the work week likely explains this timing preference.

When they head to the store, they favor stock-up trips, choosing to get everything they need in one fell swoop rather than making smaller trips to multiple stores. Compared to the average shopper, they are 7% more likely to make a stock up trip (21+ items) and 1% less likely to make a trip with fewer than 10 items.

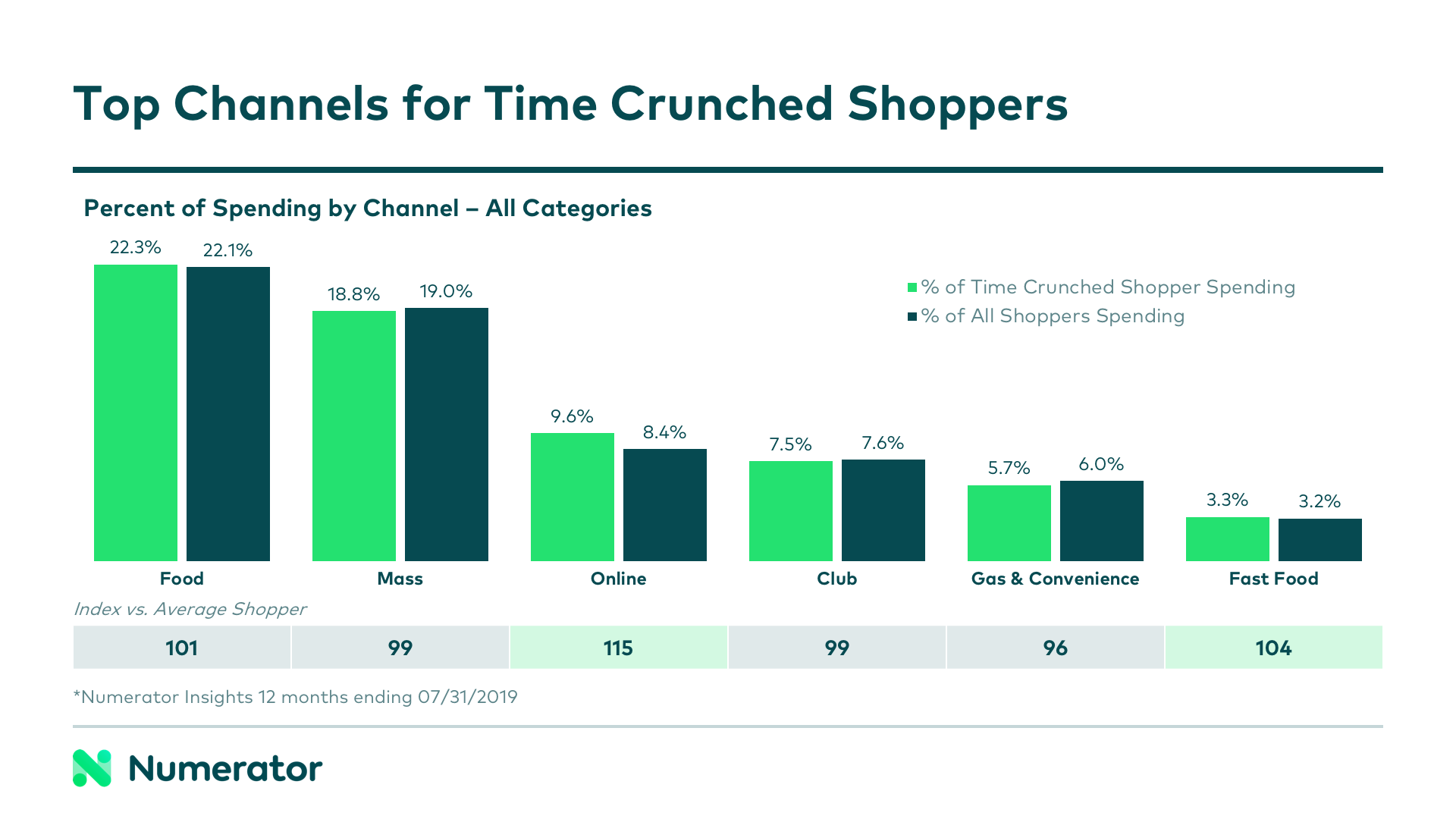

In addition to timing and trip type differences, these consumers have slightly different channel preferences, spending more of their dollars online and on fast food than the average shopper. According to Numerator psychographics data, their top reasons for both eating out and shopping online revolve around convenience and time savings; 36.7% say they dine out because they’re too busy to cook (index 157), and 68.0% say they shop online to save time (index 116). Unsurprisingly, this attitude translates to in-store shopping as well, with 41.2% saying their primary attitude on shopping is to make it a “quick in-and-out” trip (index 128).

Convenient Cleaning Supplies

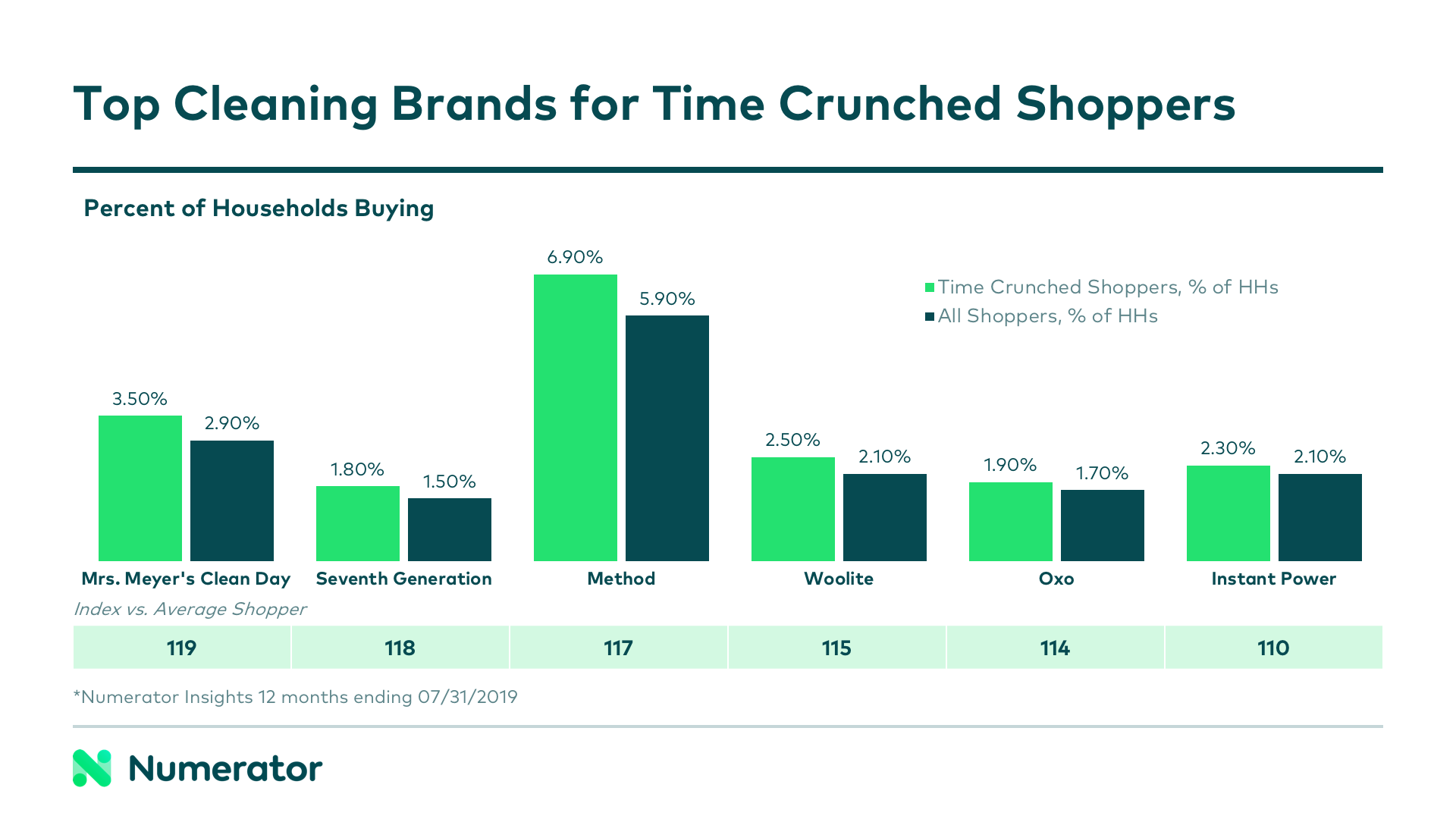

Cleaning is one of those activities that few enjoy fitting into their schedules, but all must do, making it an interesting category to look at through the lens of time savings. Top brands within this category for time crunched shoppers were Mrs. Meyer’s Clean Day, Method, and Seventh Generation.

Three “green” brands topping the list would normally lead us to believe this group has a preference for eco-friendly products. Interestingly, though, this does not seem to be the case. This group is actually not that much more concerned with environmental issues than the general population, and they weren’t very willing to pay premiums for green products— most (60%) said they’d only buy at price parity (index 108). Clearly, these three brands, in addition to being green, have done a good job of appealing to convenience seekers for other reasons.

There are many potential reasons these brands are winning with time crunched consumers. First and foremost, this group over-indexes at Target and Amazon, both of which prominently feature these brands in-store and online. In addition to being well-placed on both the physical and digital shelf, these brands have clean, easily identifiable packaging, which likely aides in grabbing shoppers’ attention. If you’re looking to win shoppers on a timely mission, the trick may be as simple as catching their eye first.

Each brand is also fairly simple in terms of their product offerings, with limited variations of core products like all purpose cleaner, dish soap, and hand soaps. With a less overwhelming selection, it may be easier for consumers to choose, and easy choices make for quicker shopping trips.

Grocery Preferences

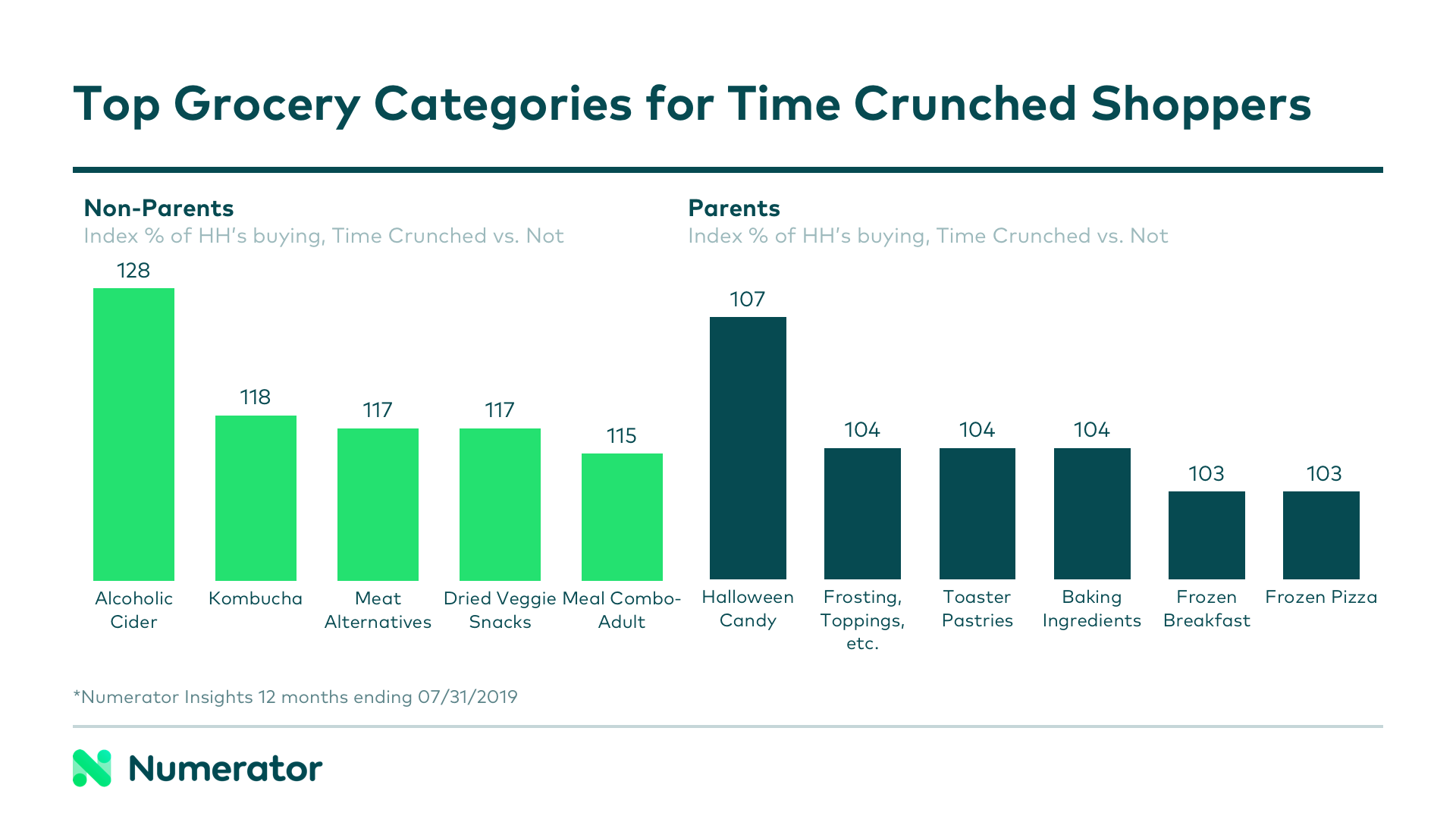

Another important but time-consuming activity is grocery shopping and meal preparation. In addition to being full-time workers, time crunched shoppers are also more likely to be parents; since the presence of children in the household has a large impact on types of food purchased, we decided to take a look at time crunched parents and non-parents separately.

Compared to the average household with no children, time crunched non-parents are more likely to purchase alcoholic cider, kombucha, meat alternatives, dried veggie snacks, and adult combo meals. Despite having little time for self care, this group seems to prefer quick, healthier options when choosing foods.

The time crunched parent spends more on seasonal candy and baking supplies than the average parent. Given the time investment required for most baking endeavors, it’s a bit surprising that a time sensitive group would over index here. However, it does seem to line up with the fact that these parents are far more likely to categorize themselves as “guilt ridden when not cooking.”

In less surprising news, this group also over-indexed on toaster pastries, snack mixes, frozen breakfast foods and frozen pizzas. For the parent with little time on their hands, an ode to pop-tarts and all-purpose cleaners seems appropriate.

The time crunched consumer is important to understand, but is only one of many shopper segments you may be looking to win. Who do you want to target, and what lifestyle traits might make them more or less attracted to your brand? Reach out today and let us help you get clarity on your core consumers using our hundreds of psychographic and demographic attributes.