Q4 2025 QSR Recap: Insights Shaping Menu Innovation, Loyalty, and Category Momentum

Q4 was a pivotal quarter for the quick-service restaurant (QSR) industry. Rising competition, cautious consumer spending, and shifting expectations around digital convenience forced brands to rethink how they attract, retain and grow their guest base.

Against this backdrop, Numerator delivered a regular schedule of high-impact consumer insights—from limited-time menu innovations to macro foodservice trends and the continued evolution of loyalty ecosystems—and launched Insights to Grow, a thought leadership series designed to help QSR leaders anticipate where guests are headed and how to meet them there.

Reviewed together, this research reveals a clear picture of the strategies that will be most effective in driving growth as the industry moves into 2026.

Strategy #1: Leverage Dual LTOs to Activate Multiple Growth Levers

Not all limited-time offers deliver equal outcomes, and Chipotle’s recent dual LTO strategy proved it.

Our analysis of Chipotle’s dual LTOs, Chicken and Adobo Ranch, reveals that by launching these items simultaneously, Chipotle was able to encourage distinct guest behaviors that drove growth in different ways. Honey Chicken acted as a powerful trip driver, attracting new guests and encouraging repeat visits throughout the promotional period. In contrast, Adobo Ranch functioned as a check builder: frequently added to existing orders, it drove meaningful lift in average check size among loyal guests.

What this means for QSRs in 2026:

Together, these launches demonstrated how dual LTO strategies can activate multiple growth levers at once, balancing guest acquisition with check value. Not all LTOs deliver the same outcome, and brands that intentionally pair items that pull in guests with items that grow checks can generate stronger returns across a promotional window.

Strategy #2: Build Loyalty Ecosystems Around Routines, Not Discounts

Digital loyalty can shape everyday behavior, and no brand illustrates that better than Starbucks.

Our Starbucks Loyalty article showcases how a well-built loyalty and app ecosystem can shape daily routines and drive repeat behavior in QSR. The analysis showed that loyalty members visit more frequently and spend more per visit than non-members, particularly during routine-driven occasions like the morning commute. By embedding itself in these habitual touchpoints, Starbucks is able to own high-frequency dayparts, while ease of use and personalization in the app encourage add-ons and trade-ups without disrupting the core order.

What this means for QSRs in 2026:

The most effective loyalty strategies go beyond just rewards and discounts. QSRs should focus on integrating loyalty into habitual occasions, using digital convenience and personalized nudges to drive frequency and incremental spend. When loyalty becomes part of a guest’s daily rhythm, it reinforces long term engagement—not just short term traffic spikes.

Strategy #3: Leverage Chicken’s Versatility to Capture Incremental Occasions

Chicken continues to be a powerful growth driver in QSR, but its role is expanding beyond traditional formats.

In our Winner, Winner Chicken Dinner report, we highlight how poultry has become a key growth engine for QSR, gaining a meaningful share of stomach over the past two years. This momentum isn’t just driven by traditional chicken loyalists, but also a growing group of “Chicken Increasers” who gravitate toward produce-forward meals, bowls, and salads. Their choices signal how health-conscious behaviors are beginning to shape menu demand.

What this means for QSRs in 2026:

Chicken’s versatility creates an opportunity for QSRs to win new occasions and attract incremental guests. Brands that evolve chicken offerings to align with health-driven motivations can capture growth while defending share in an increasingly competitive category—without abandoning familiar proteins guests already trust.

Strategy #4: Innovate to Compete on Value and Desire

Consumers are spending more intentionally—but they don’t want to give up the “treat yourself” moments that drive QSR visits.

Our Fast Food Future report explores the rapid evolution of the QSR landscape as economic pressures drive consumers to increasingly seek out value, without sacrificing emotional payoff. The brands that gained traction in 2025 were those capable of turning fast meals into craveable and meaningful experiences. Three core strategies stand out:

- Trendy Menu Innovation: “build the base” by converting trial into loyalty

- Value Communication: “plug the leaks” among budget-conscious diners

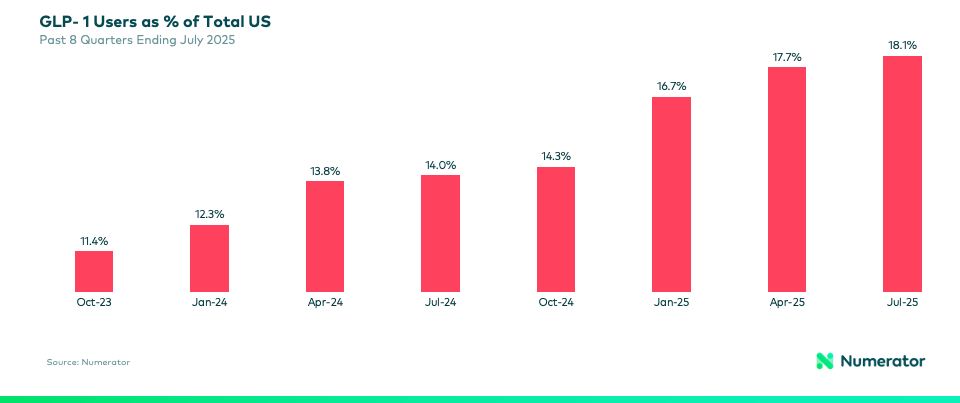

- Brand Buzz: “excite and delight” both core guests and growing cohorts, such as GLP-1 users, who are making fewer and more intentional QSR visits

Together, these pillars provide a roadmap for navigating rising competition and shifting value expectations.

What this means for QSRs in 2026:

To sustain growth, QSRs must balance innovation and value without eroding pricing power. Menu innovation can convert first-time guests into loyal fans, value messaging can protect traffic during periods of heightened price sensitivity, and brand buzz can fuel cultural relevance across generations. Leveraging guest-level insights allows brands to tailor these strategies to specific guest motivations and behaviors, helping QSRs remain competitive as expectations continue to evolve.

Strategy #5: Use Beverage Innovation as a High-Frequency Traffic Driver

Beverages are becoming an increasingly important lever for differentiation and traffic in QSR.

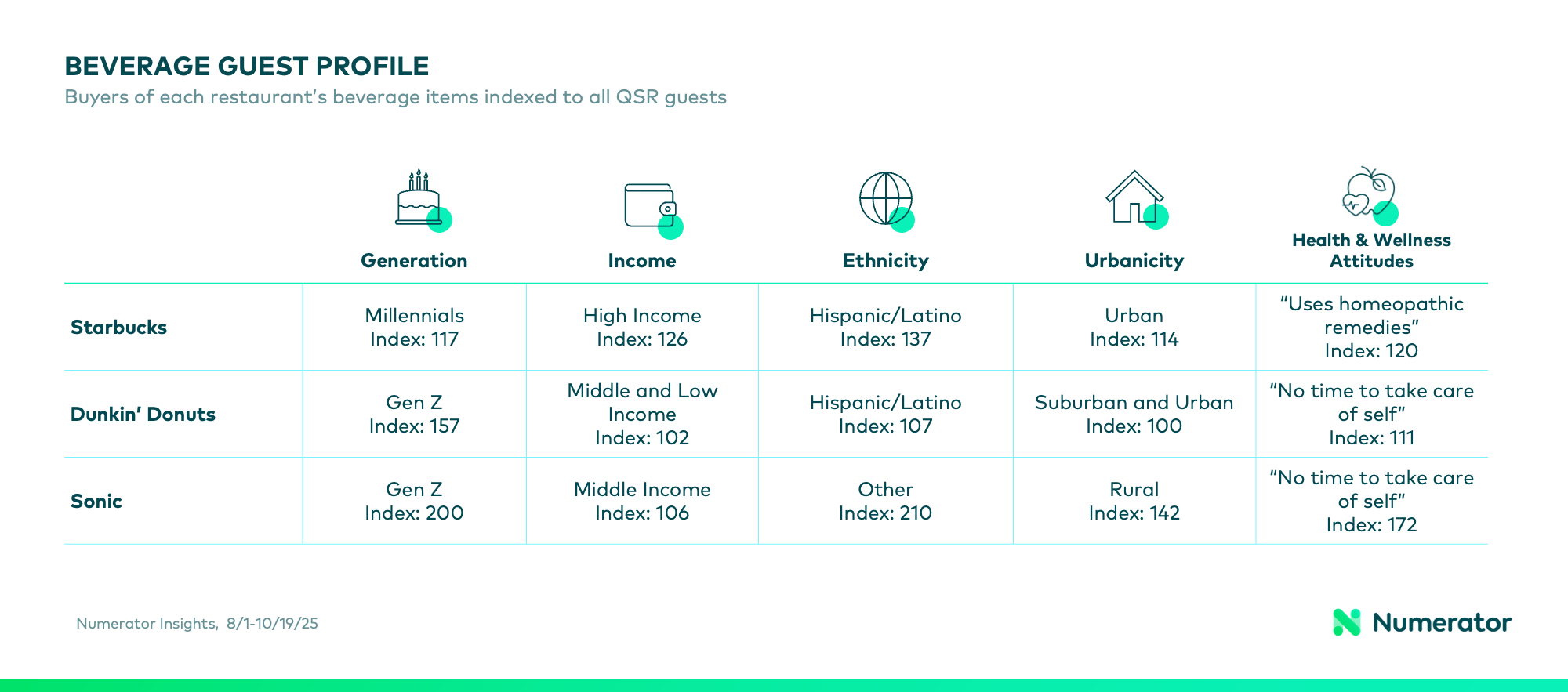

Our Sip Season Showdown report, the first installment in Numerator’s Insights to Grow thought leadership series, delivers a focused look at beverage competition during one of the most active seasons for drink innovation. Using Starbucks, Dunkin’, and Sonic as examples, the analysis underscores a growing trend: beverages are a powerful way to capture guest attention, differentiate offerings, and drive incremental visits in a crowded QSR landscape.

What this means for QSRs in 2026:

When timed strategically, beverage-led innovation can act as a powerful traffic engine. QSRs should treat beverages as a core growth lever, using seasonality, flavor innovation, and limited-time offers to drive frequency, reinforce brand relevance, and create repeat visitation throughout the year.

What Q4 ‘25 Told Us About 2026

Across every analysis released this quarter, a clear theme emerged: the QSR brands that win in 2026 will be those who understand guest motivations deeply and respond with timely innovation, digital convenience, and clear value.

Together, these insights revealed:

- Innovation drives trial, especially when menu items serve distinct roles (trip drivers vs. check builders).

- Chicken remains a category powerhouse, benefiting from health-driven momentum and familiarity.

- Digital loyalty ecosystems can redefine engagement, increasing visit frequency and spend.

- Macroeconomic pressures shape guest expectations, pushing brands to communicate value more consistently.

As the Restaurant industry enters 2026, Numerator will continue to deliver real-time, verified guest insights that help QSR leaders identify opportunities, strengthen strategy, and stay ahead of category shifts.

Ready to Uncover What Motivates Your Guests?

If your brand is preparing 2026 strategies, our Verified Voices and Insights solutions can help you understand your verified guests’ motivations, consumption routines and attitudes, and purchase behavior at competitive restaurants in unmatched detail.

Reach out to our team to explore how Numerator can support your growth and subscribe to our Restaurant newsletter to receive our thought leadership for QSR leaders first.