Picture it: It’s Black Friday. The lines are long, the internet is lagging, and the busiest shopping day of the year is underway. But while others battle over doorbusters or wait for websites to load, you’re relaxing and enjoying your leftovers, knowing the real work begins after the fact, when the numbers roll in and you are tasked with dissecting your brand’s performance over the pinnacle weekend of holiday sales.

Check out more up to date Black Friday and Cyber Monday content here.

As with any major retail event, profits are paramount, but understanding the people behind the purchase is also key to evaluating success. Did your Black Friday and Cyber Monday promotions attract new buyers to your brand? Do these first-time buyers differ in any way from your typical buyers?

We took a look at a number of top brands and how they performed last year on Black Friday and Cyber Monday. Did Apple, Lego, and Nintendo succeed in bringing in new or lapsed buyers? If so, how did these buyers stack up against their existing or more frequent customers? Here’s what we found.

Fresh Faces for Big Brands

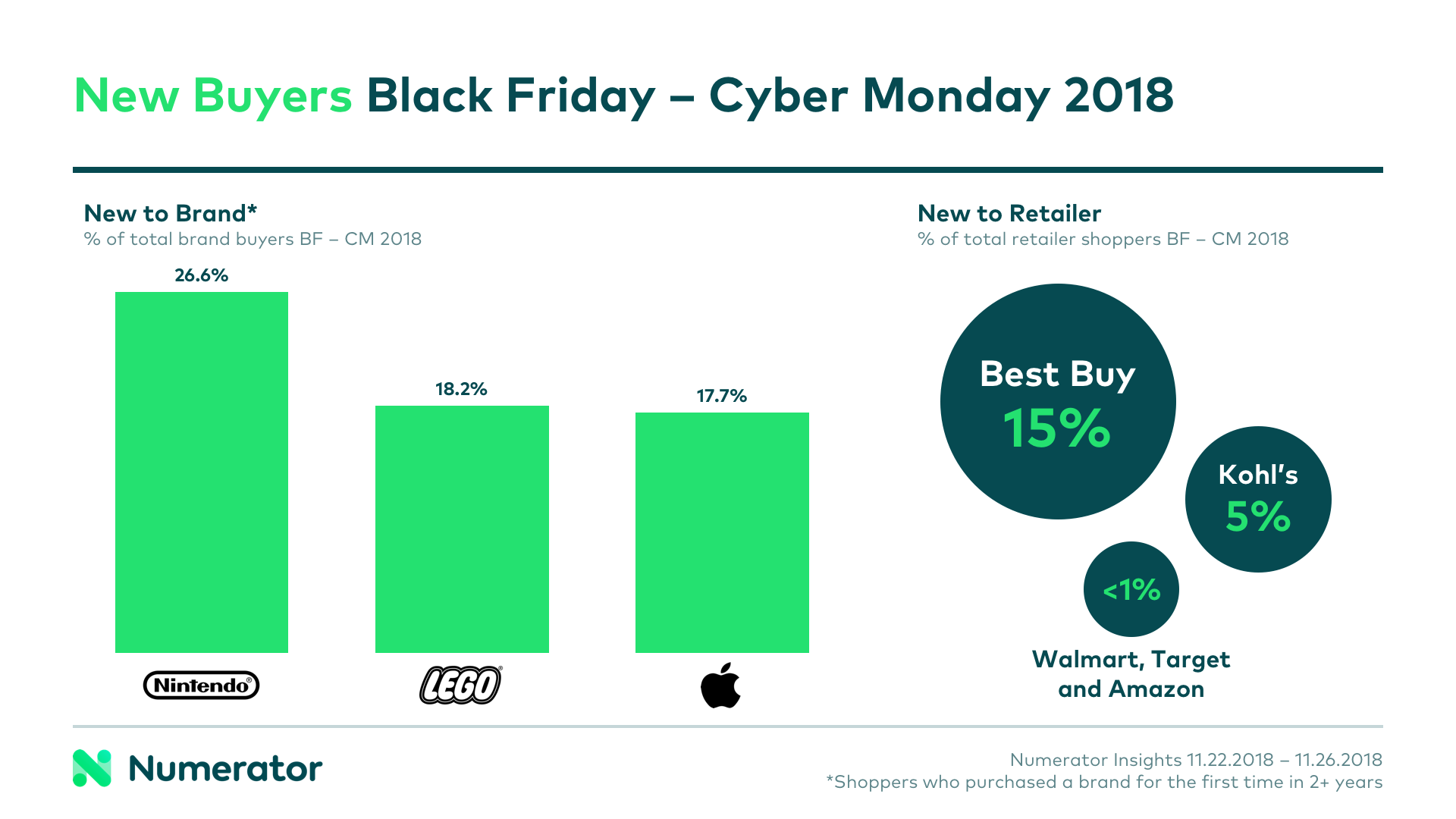

Last year between Black Friday and Cyber Monday, each of the brands we analyzed saw an influx of buyers who had either never purchased the brand before, or who had not purchased in over two years. Nintendo led the pack, with 26.6% of their buyers purchasing the brand for the first time— or at least the first time in a long time. Lego and Apple had similar portions of first-time buyers, 18.2% and 17.7% of each brand’s overall weekend buyers.

And brands weren’t the only ones attracting fresh faces; 15% of Best Buy shoppers and 5% of Kohl’s shoppers made their first-ever trips to the given retailers over the holiday weekend. Walmart, Target, and Amazon brought in very few new shoppers, but that’s to be expected, given their already high household penetration rates.

Buy, Buy Again

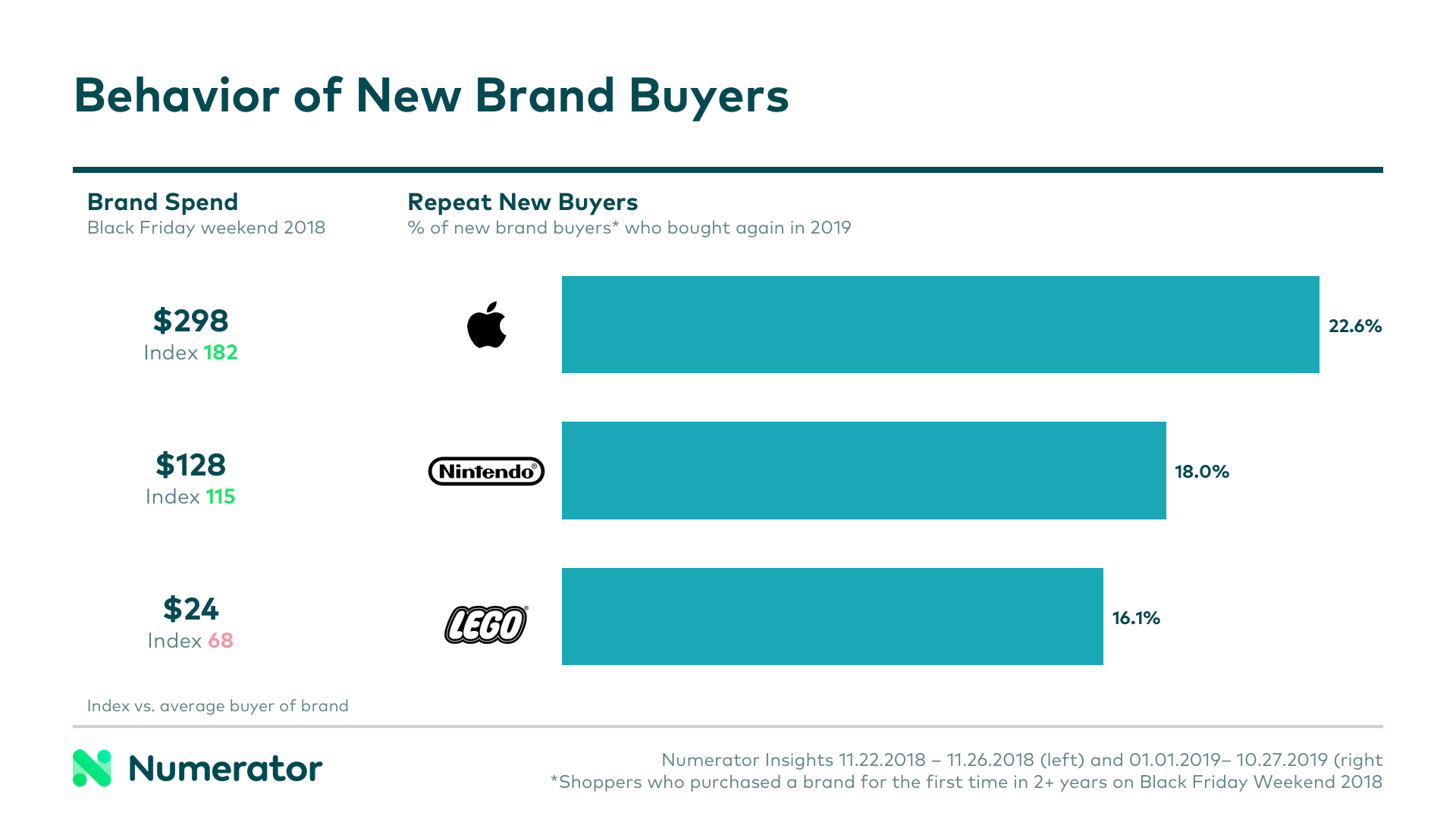

So, these brands attracted new buyers, but how did newer buyers stack up against existing customers, and most importantly, did these new buyers purchase the brand again post-holidays? Lego’s new buyers tended to be older and were less likely to have children. It’s possible these shoppers were buying a gift for grandchildren or for other young friends & family, which would explain why they hadn’t purchased before, and also why they spent less than, say, parents splurging on larger or multiple items for their kids.

Electronics brands Nintendo and Apple saw slightly different patterns with their new buyers. Nintendo first-time buyers did skew older overall, but there was also a spike among 21 to 24 year-olds. New Apple buyers were more likely to be Millennials and to have lower incomes than the average Apple buyer. These buyer demographics, in contrast to what we saw with toy brands, align with who we’d expect the end users to be as well. Coupled with the high spending, the data suggests these shoppers were holding out for good sales to buy themselves an otherwise too expensive product.

Apple had the highest repeat rates post-holidays among their new buyers, which feels fitting, given the brand is known for a strong ecosystem and loyal consumer base. The Lego brand was least likely to be purchased again post-holidays, reinforcing the idea that the buyers were not the end users, and that they didn’t have much need for the brand after holiday gifting had passed.

Alexa, Find Me New Buyers

Another interesting pattern emerged when analyzing these new brand buyers: they were far more likely to purchase these brands online— particularly at Amazon. Across these brands, Amazon held about 1.5 times the share of wallet among new buyers compared to existing buyers. Despite bringing in very few of their own new shoppers, Amazon seems to be a great gateway for bringing in new buyers of other brands.

Interested in diving deeper into these insights, or taking a look at new buyers of your brand? You know your business, we know people. Reach out today and let us help you add a dash of personality to your insights, this holiday season and beyond.