As the second-largest restaurant chain in the U.S., Starbucks has established itself not only as a go-to destination for coffee and breakfast, but also as a leader in redefining digital engagement within the quick-service restaurant (QSR) space. Two-thirds (67%) of US households visited Starbucks in the past year, on par with other major QSR chains like Chick-fil-A and Burger King. But where Starbucks truly differentiates itself is in its digital strategy, anchored by one of the more successful restaurant apps in the market.

According to Numerator Verified Voices survey data, nearly three-quarters of Starbucks guests have used the Starbucks mobile app before, and more than half (59%) are active users today. Those who don’t use the app say it’s because they don’t visit frequently enough to see the value, with half visiting the coffee chain monthly or less. In contrast, app users are much more loyal and consistent, with 67% visiting at least a few times a month and nearly 3 in 10 (29%) stopping by multiple times a week.

Starbucks Guest & App User Details

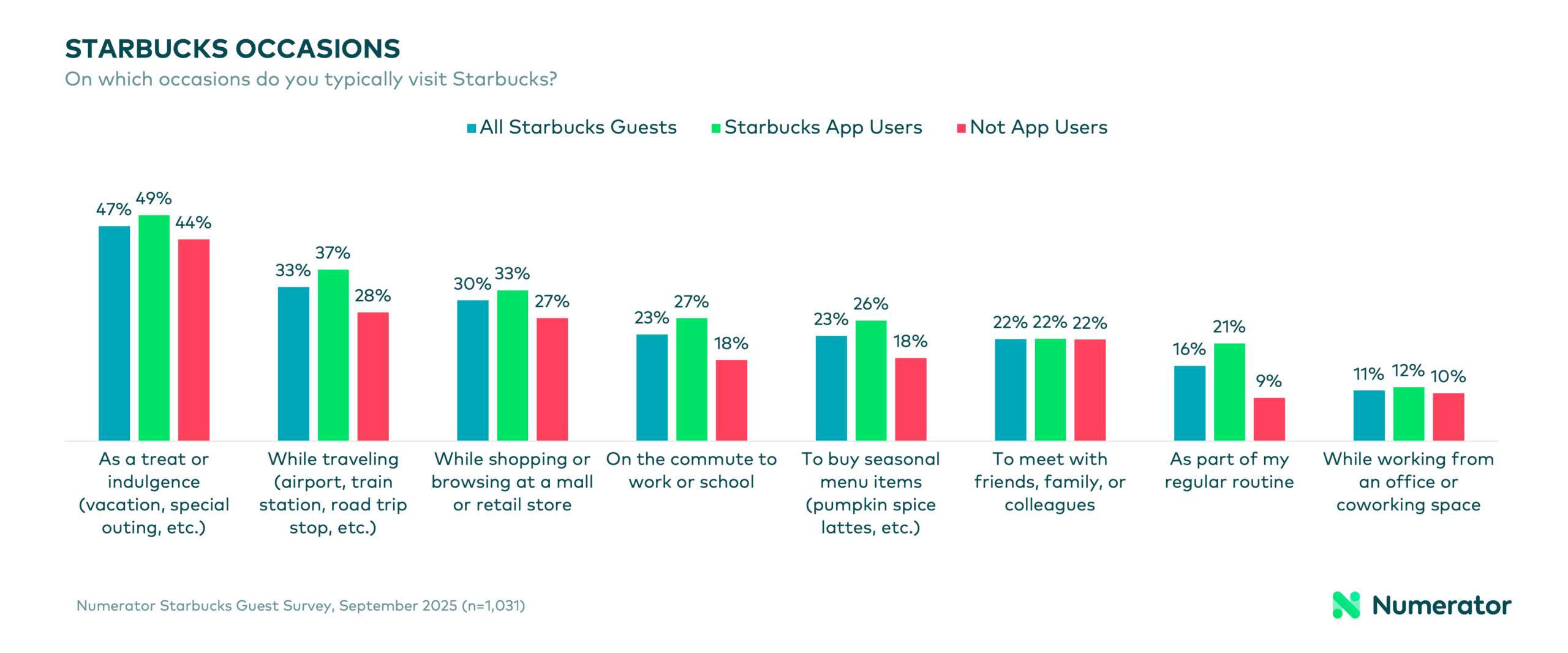

Compared to the average US shopper, Starbucks guests skew higher income, more urban, and are more likely to be Hispanic or Asian Gen X’ers living in the West. App users amplify these core demographics, but are more likely to be Gen Z’ers compared to non-users, a promising sign for future growth and loyalty. In addition to more frequent visits, Starbucks app users visit earlier in the day and are more likely to describe Starbucks as part of their regular routine (+12 pts vs. non-users) or commute (+9 pts). Although most shoppers still view a Starbucks trip as a treat or travel stop, app users weave their visits into everyday rituals.

Starbucks Mobile App Use Cases

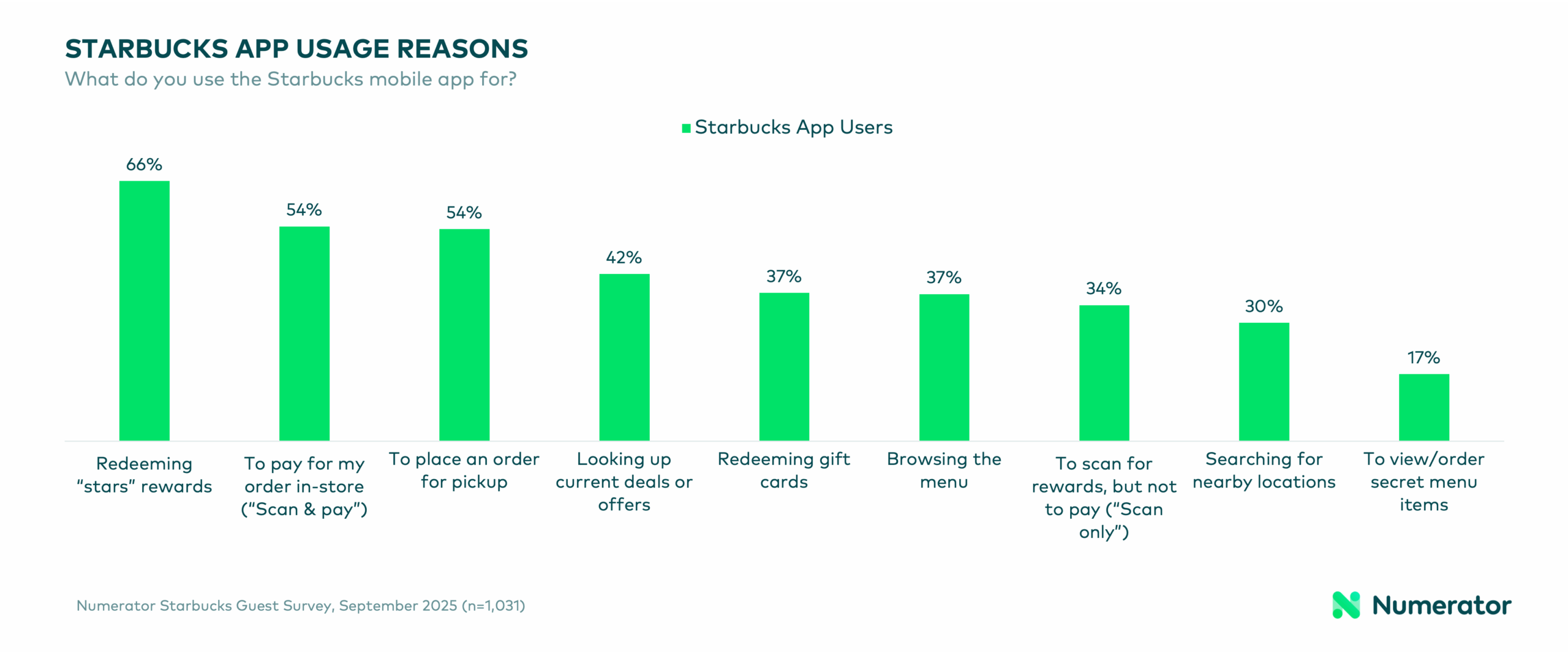

Most app users engage frequently; 64% use the app every time they visit Starbucks, and 23% use it on most visits. Participation in the Starbucks loyalty program is the top driver for app use, followed by the scan & pay feature or mobile ordering for pickup. The rewards program and mobile ordering are also the two features users cite as most valuable. Gen Z and Millennials in particular value the mobile ordering option, consistent with past Numerator research showing younger generations value self-serve options more than older generations.

The Role of Pre-Loaded Starbucks Funds

While the rewards program delivers clear perks to Starbucks app users, pre-loaded funds create equally big wins for Starbucks. The company collects cash upfront and benefits whether or not every dollar is redeemed—in fact, as of 2024, nearly $1.77 billion in funds remained unused.1 And consumers are eager participants: more than 9 in 10 app users manage funds directly in the app. Among them, 46% reload manually as needed, 28% rely on autoload to top up when balances run low, and 18% add funds when redeeming gift cards.

Starbucks Ordering Habits

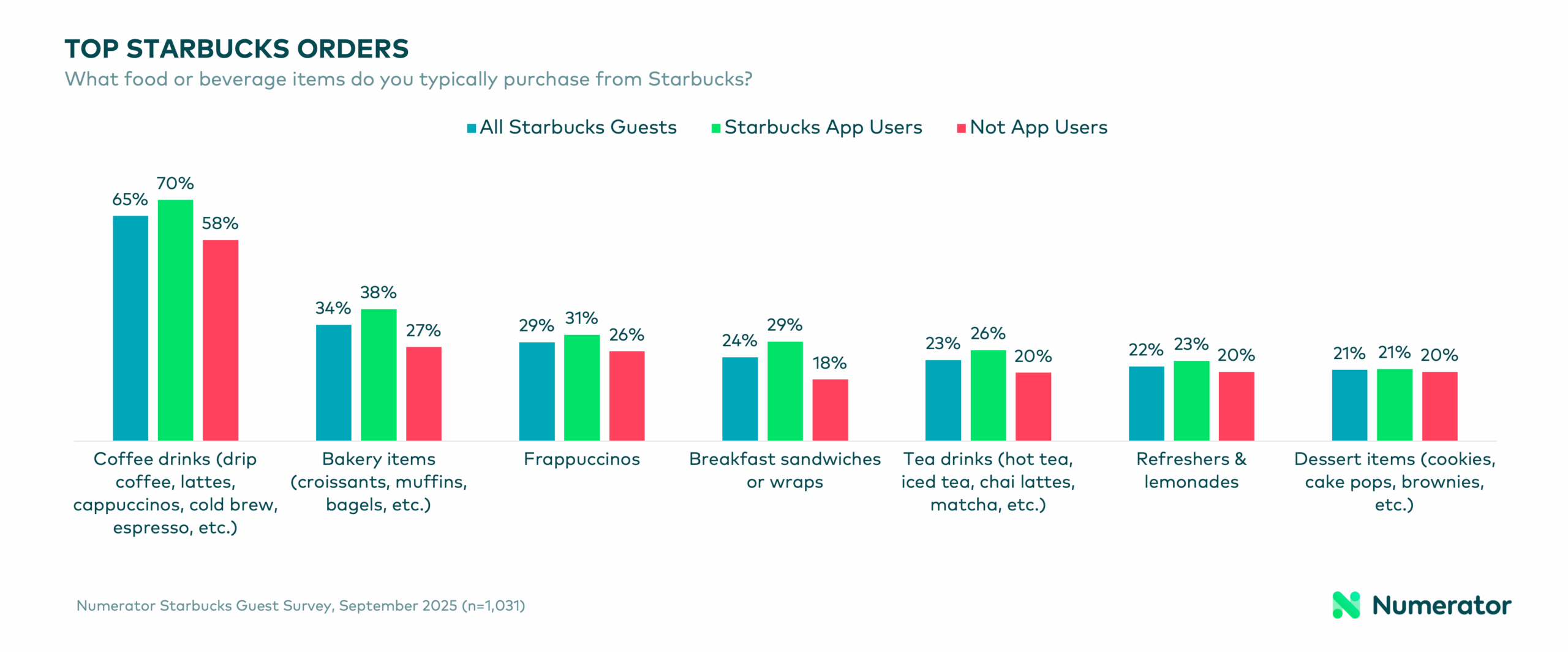

Many Starbucks guests are creatures of habit, but app users are even more entrenched in their ways. 38% of users say they have one standard order and usually get the same thing each time they visit (vs. 30% of non-users), and 54% rotate among a few favorites. Coffee drinks remain the top choice for all Starbucks guest groups, but app users also show a preference for bakery items and breakfast sandwiches & wraps—likely tied to their earlier morning visits.

Competing for Share of Stomach

For competitors—QSR and beyond—going up against Starbucks requires more than carrying appealing food and beverages. The most difficult part of competing will be to disrupt the Starbucks cycle and promote trial of your brand. To win share, competitors need to deliver not only strong promotions and pricing, but also an equally seamless—or better—digital experience.

Are you a QSR or brand manager looking to break up the breakfast routine? To shift consumer behavior, you need to start with a clear picture of who your buyers are, how they shop, and what drives their loyalty. Numerator’s Verified Voices surveys connect you directly with verified buyers of your brand—or your competitor’s—so you can understand preferences, motivations and routines in rich detail. Pair that with purchase data for a complete view of the consumer journey. Reach out to our team today and let us help you uncover the insights you need to disrupt the morning cycle and capture new growth.

1 MarketWatch, The bank of Starbucks: Coffee retailer has $1.77 billion in unredeemed gift cards