As we head into the Final Four round of the 2024 NCAA Basketball Tournament, anticipation and excitement are reaching a fever pitch among basketball fans. To dive deeper into consumer plans surrounding March Madness, we leveraged Numerator’s Instant Survey solution to ask over 500 consumers about their viewing intentions, reasons for tuning in, and what they might consume while watching the games. Here’s a breakdown of what we uncovered:

Intentions to Watch

According to our findings, 33% of consumers planned to tune in to the 2024 NCAA men’s basketball tournament, while 12% remained undecided. Among the 55% who planned to opt-out, the prevailing reason (70%) was their lack of interest in men’s college basketball games.

Similarly, our survey revealed that 30% of consumers planned to tune in to the women’s tournament, with 12% undecided. Among the 58% not planning to watch, a significant majority (73%) attributed their disinterest to not typically following women’s college basketball games, while 5% admitted to exclusively watching the men’s tournament.

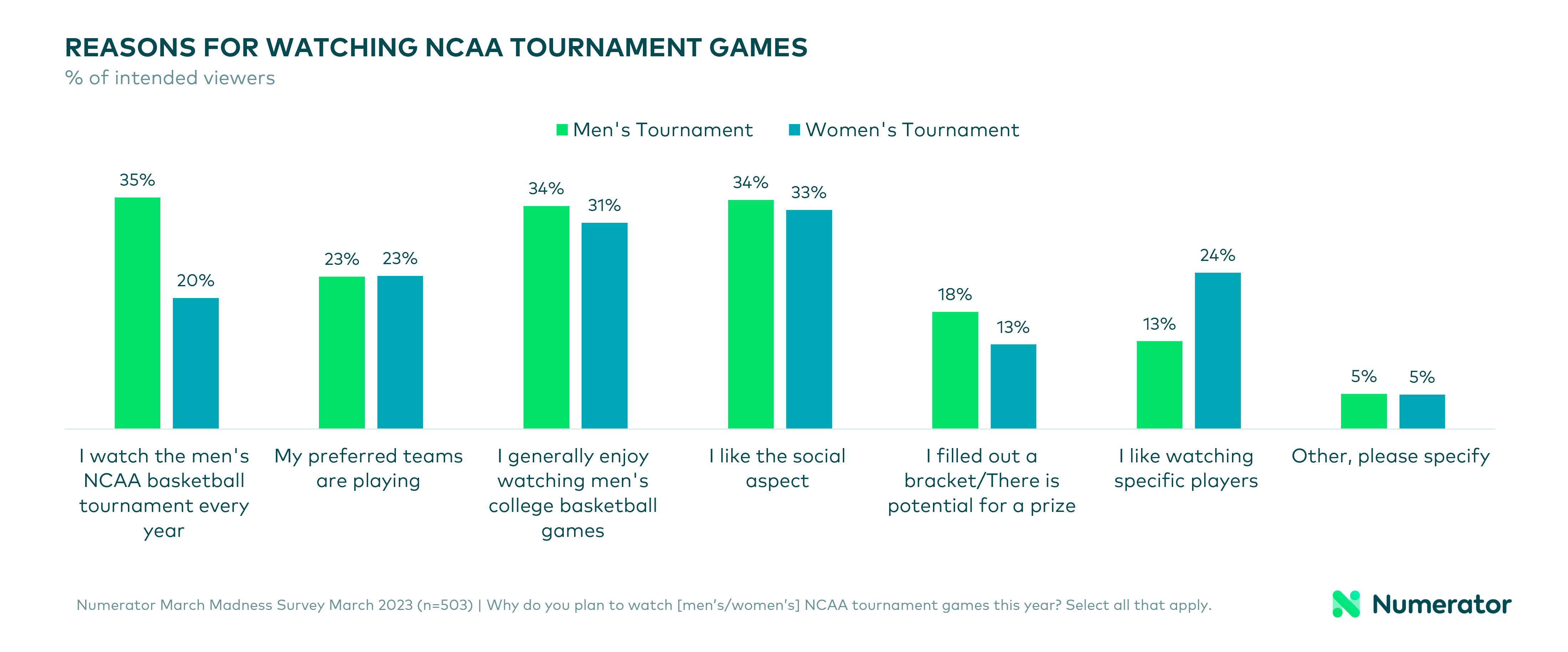

Among consumers who planned to tune into the tournaments this year, motivations for watching are varied. 35% of NCAA Men’s tournament viewers indicated they watch the men’s tournament every year, compared to only 20% of intended women’s tournament viewers. Beyond that, reasons for watching each tournament are similar: approximately one-third cited the social aspect and another third expressed a general enjoyment for college basketball. 23% were particularly invested because— at the time— their favorite teams were playing.

The Caitlin Clark Effect

Interestingly, consumers who planned to watch the women’s tournament were more likely to cite their excitement to see specific players as a reason for watching than those planning to tune into the men’s tournament— 24% of women’s tournament viewers indicated they were looking forward to watching specific players compared to only 13% of men’s tournament viewers.

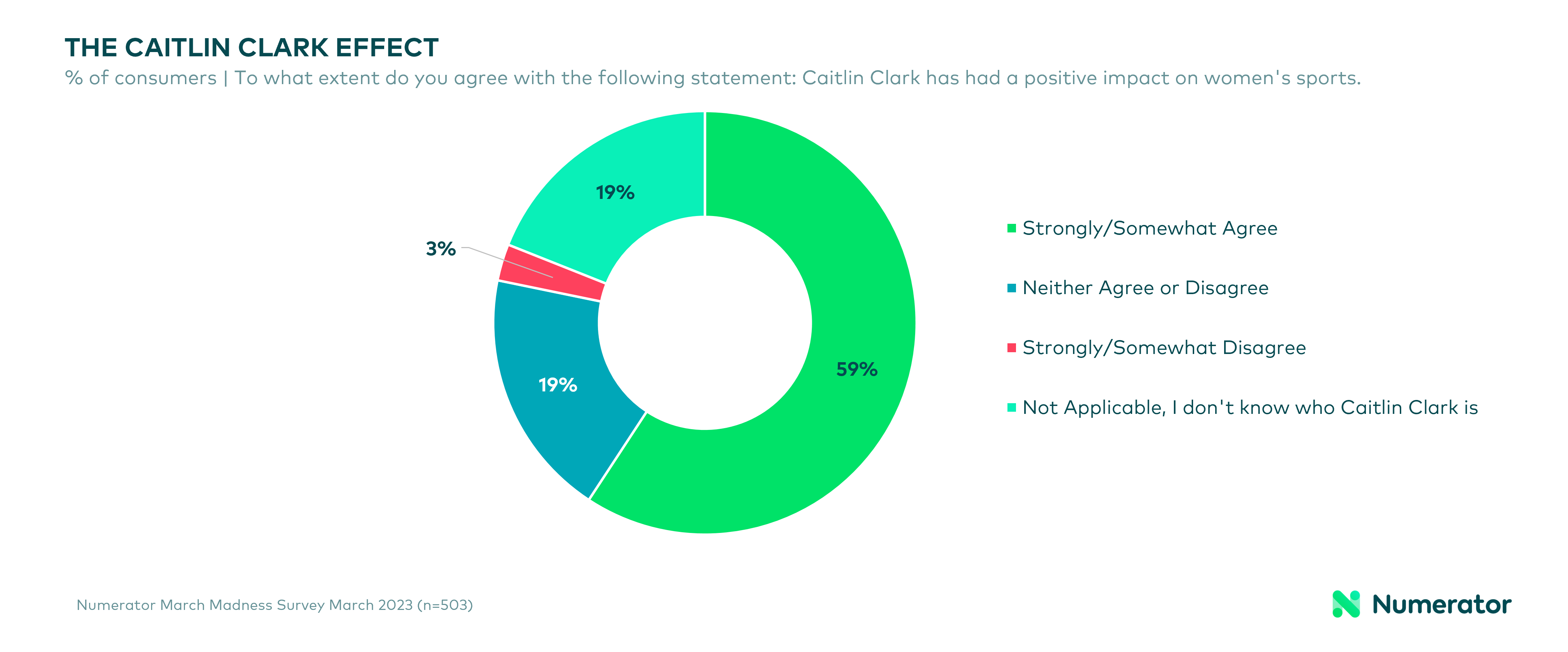

Of those expressing interest in individual women’s tournament players, the standout favorite was Caitlin Clark with 79% of respondents naming her as a reason to tune in. JuJu Watkins came in a distant second (26%), followed by Angel Reese (23%). Moreover, when asked how much they agree or disagree with the statement “Caitlin Clark has had a positive impact on women’s sports,” 59% of all NCAA tournament watchers somewhat or strongly agreed— indicating her positive influence extends well beyond the basketball court.

Notable names on the radar of men’s tournament viewers included RJ Davis (39%), Zach Edey (35%), Tyler Kolek (35%), Dalton Knecht (31%), and Tristen Newton (23%).

Tournament Viewing Plans

When it comes to where consumers plan to catch the games, the majority (72%) intended to watch from the comfort of their homes. 15% indicated they would head to a bar or restaurant and 12% said they would be attending gatherings at friends’ places.

Surprisingly, despite the excitement surrounding bracketology, 61% of viewers did not fill out a bracket this year. Among those who did, 15% completed brackets for both the men’s and women’s tournaments, 18% exclusively for the men’s, and 6% solely for the women’s.

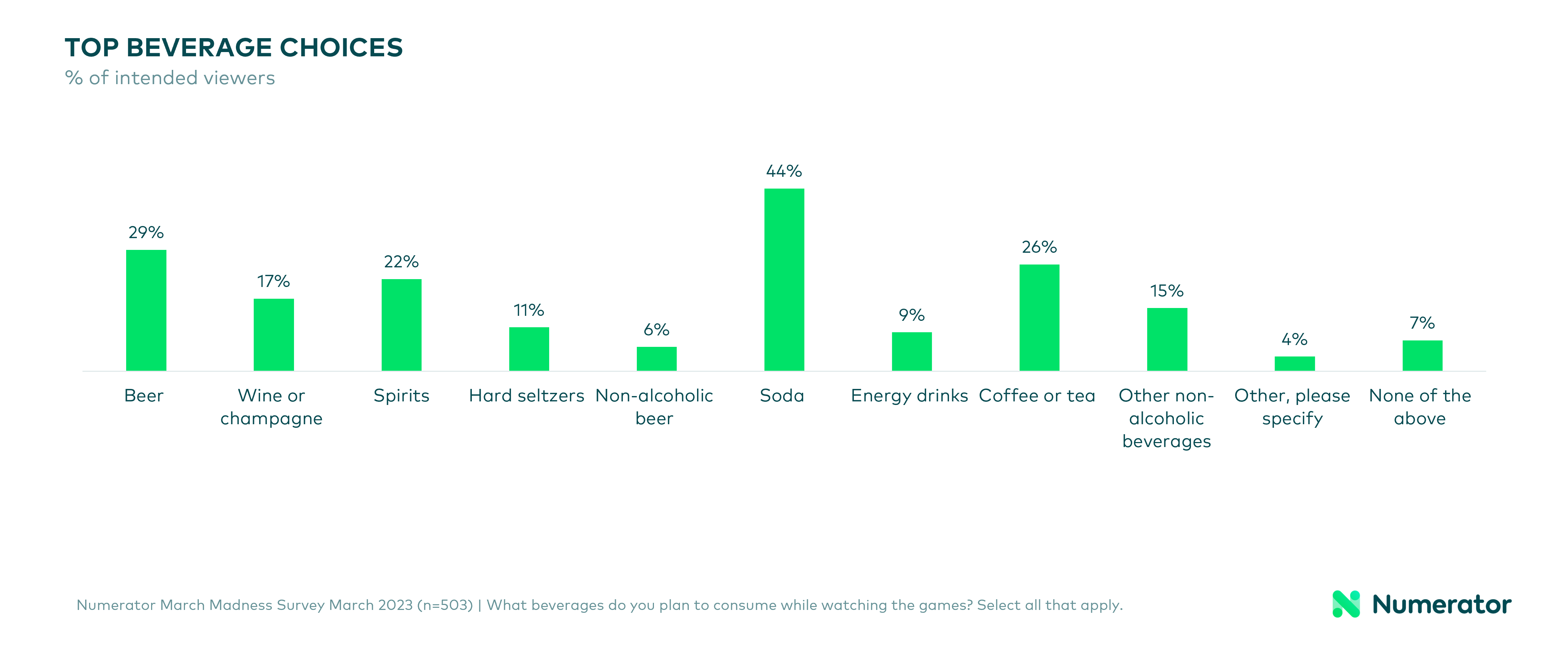

And how will tournament viewers be dropping dimes this year? As far as refreshments go, the top beverages of choice included soda (43%), beer (30%), coffee or tea (26%), spirits (22%), and wine or champagne (17%).

Who Are College Basketball Fans?

15.5% of consumers identify as college basketball fans, and half of these individuals describe themselves as avid or committed sports fans. College basketball fans skew older (45+), higher income, and Black or White. They’re more likely to have attended a four-year university themselves and are concentrated in the Midwest and the East South Central US.

In addition to a higher affinity for sports across the board, college basketball fans are more likely to exercise regularly and to describe themselves as physically fit. They engage with a variety of media types, and are more likely to have watched live TV, listened to the radio, or used sports-related mobile apps in the past 12 months.

Sports fandom is just one of the 2,500+ consumer attributes that Numerator collects for enhanced targeting and profiling of your shoppers. Alongside verified purchase data and a highly engaged panel, Numerator offers flexible, easy-to-use survey solutions designed to help you connect with your consumers quickly on timely topics. To learn more about how we can help you draw up a playbook for a winning business strategy, reach out today.