Okay Google, what are the latest insights on households buying smart home devices? Whether you’re team Google or team Alexa, team Siri or team seri-ously not interested in having a smart device listening in on you at home, it’s undeniable that smart home innovations are having a moment.

According to Numerator Insights data, in the past two years, more than a quarter of US households (27.1%) purchased at least one smart home device and more than one-in-ten (11.2%) have purchased multiple.

Who’s buying these devices, what can we learn by comparing buyers over time, and how can brands use deeper consumer insights to make smarter decisions about their smart products? In an industry defined by constant innovation, a comprehensive look at the modern consumer is critical in understanding and anticipating changes, challenges and opportunities.

Profile of a Smart Home Buyer

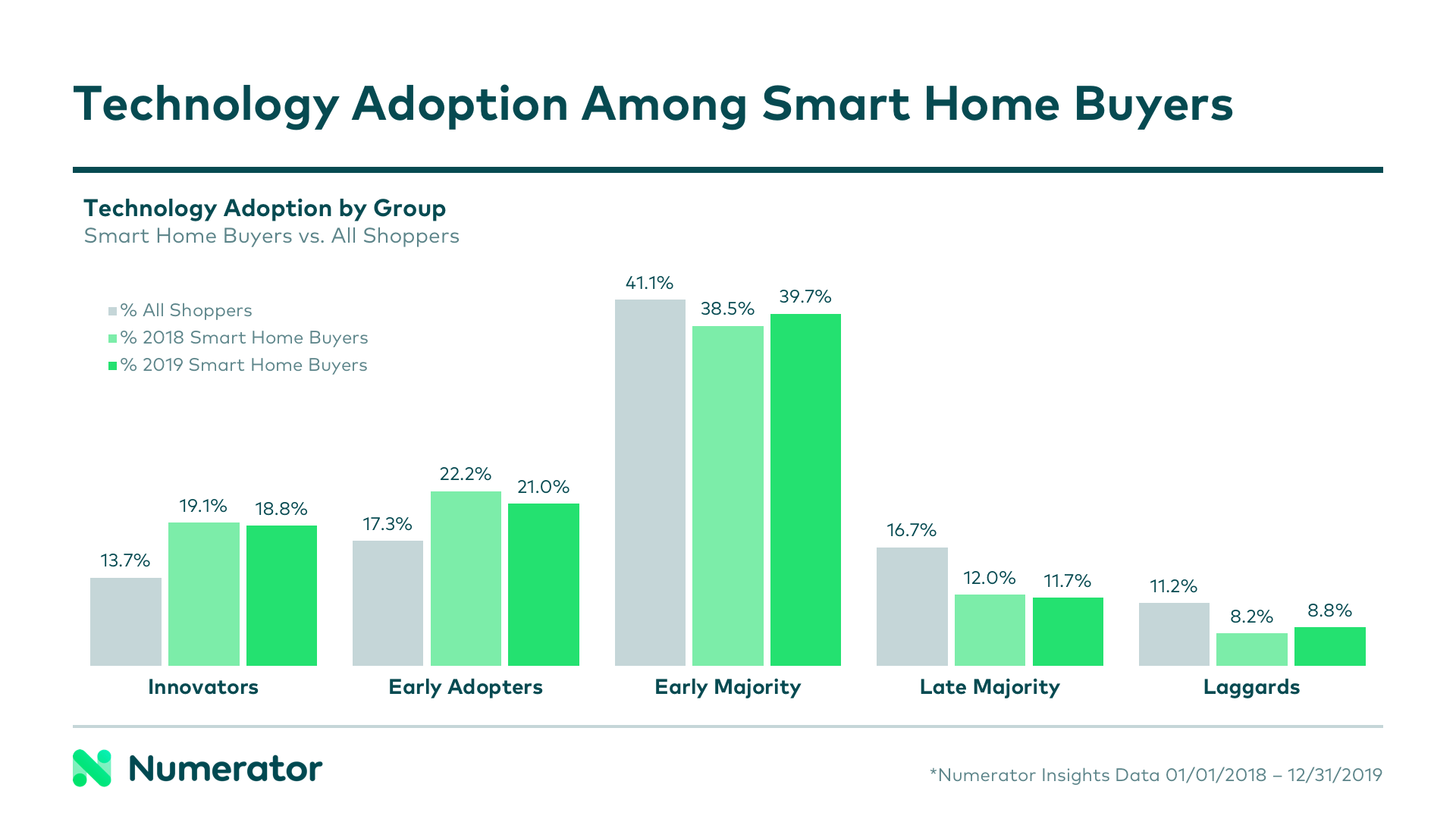

Smart homes devices have been around for a number of years now, but are still a fairly new concept to most consumers. According to Numerator Insights data, those buying smart home devices are far more likely to fall into the “innovator” or “early adopter” groups in the technology adoption lifecycle, identifying their technological interest as, “I love new technologies and am among the first to experiment with and use them,” or “I like new technologies and use them before most people I know.”

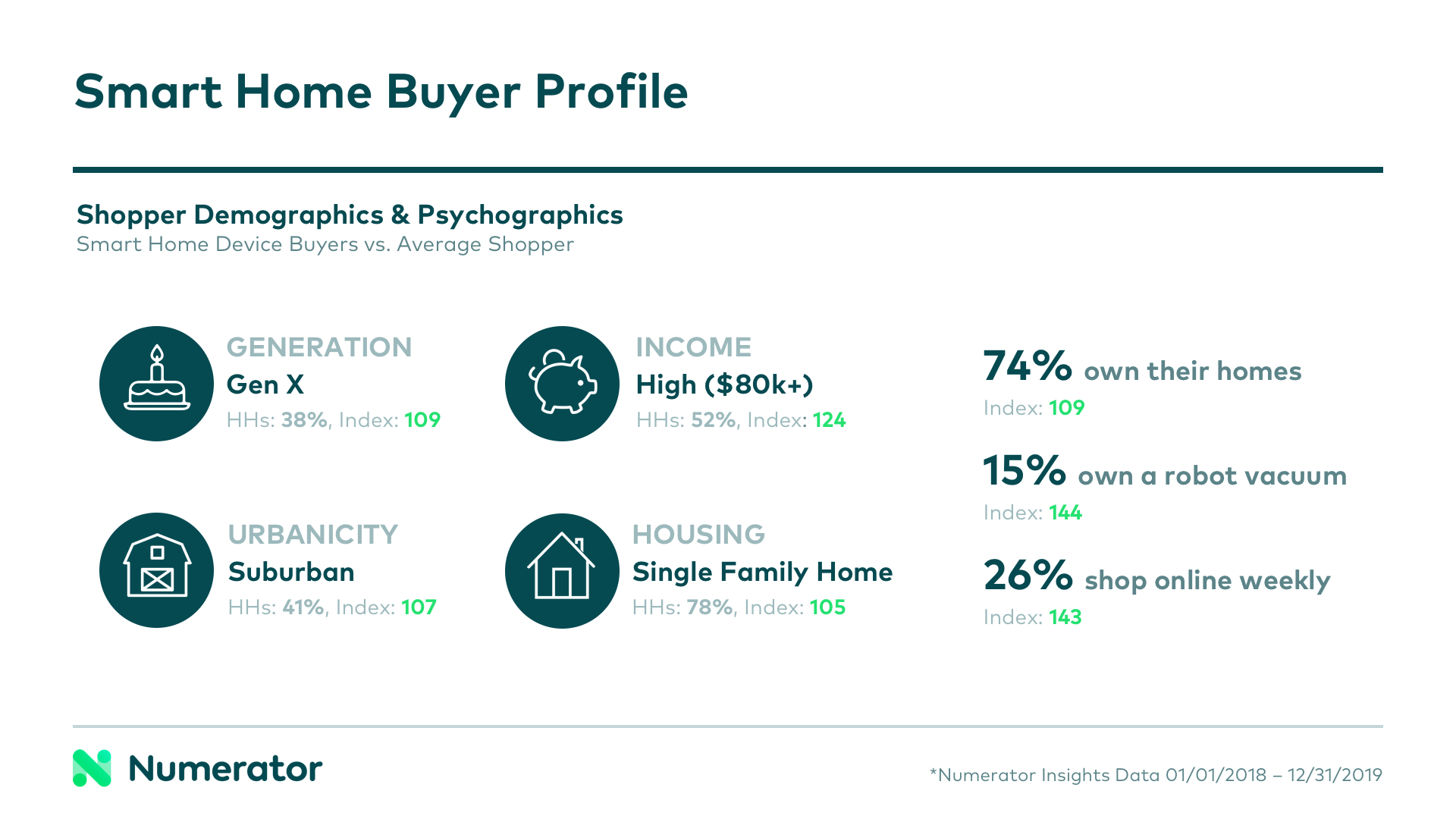

Smart home buyers are most likely to be Gen X, high income, suburban families. 14.6% live in apartments and condos, but the majority live in single family homes that they own. They are more likely to own a variety of tech-forward devices like robot vacuums and streaming devices, and are also heavy online shoppers.

Smart Home Spreads Beyond Early Adopters

Though the the typical profile of a smart home buyer falls within the scope outlined above, Numerator data shows that smart home products are beginning to resonate with additional households who were not among the first wave of adopters.

Between 2018 and 2019, the demographic and psychographic breakdowns of smart home buyers saw a slight shift. Compared to 2018, 2019 brought a wave of middle and low income buyers, rural households, and Black/African American and Hispanic/Latino households. They were less likely to own other tech-forward devices (robot vacuums, streaming devices) and shopped online slightly less frequently than the initial wave of smart home buyers.

Additionally, 2019 buyers fell farther back in the technology adoption curve; they were most likely to be among the “early majority”— behind innovators and early adopters— and were also more likely to be “laggards,” proving smart home may be— slowly but surely— resonating with even the more tech-skeptical buyers.

A growing consumer base is certainly beneficial, but it also comes with a new set of challenges. While innovators and early adopters are eager to try new technologies, leaning in more heavily to products like smart home devices, other groups may be less excited. Less emotional investment begs less financial investment, and we see newer buyers spending less on smart devices than the earlier wave.

In 2018, buying households spent an average of $187 on smart home devices; in 2019, they spent $176. If we eliminate multi-year buyers who pull up the average— these were heavy spenders who dropped an average of $309 on smart devices— we see 2018 buyers spending $130 and 2019 buyers spending $103. While some of this change could be due to shrinking price tags on some products, it also points to a shift in these buyers’ willingness to invest, especially up-front.

Buying Into a Smart Home Ecosystem

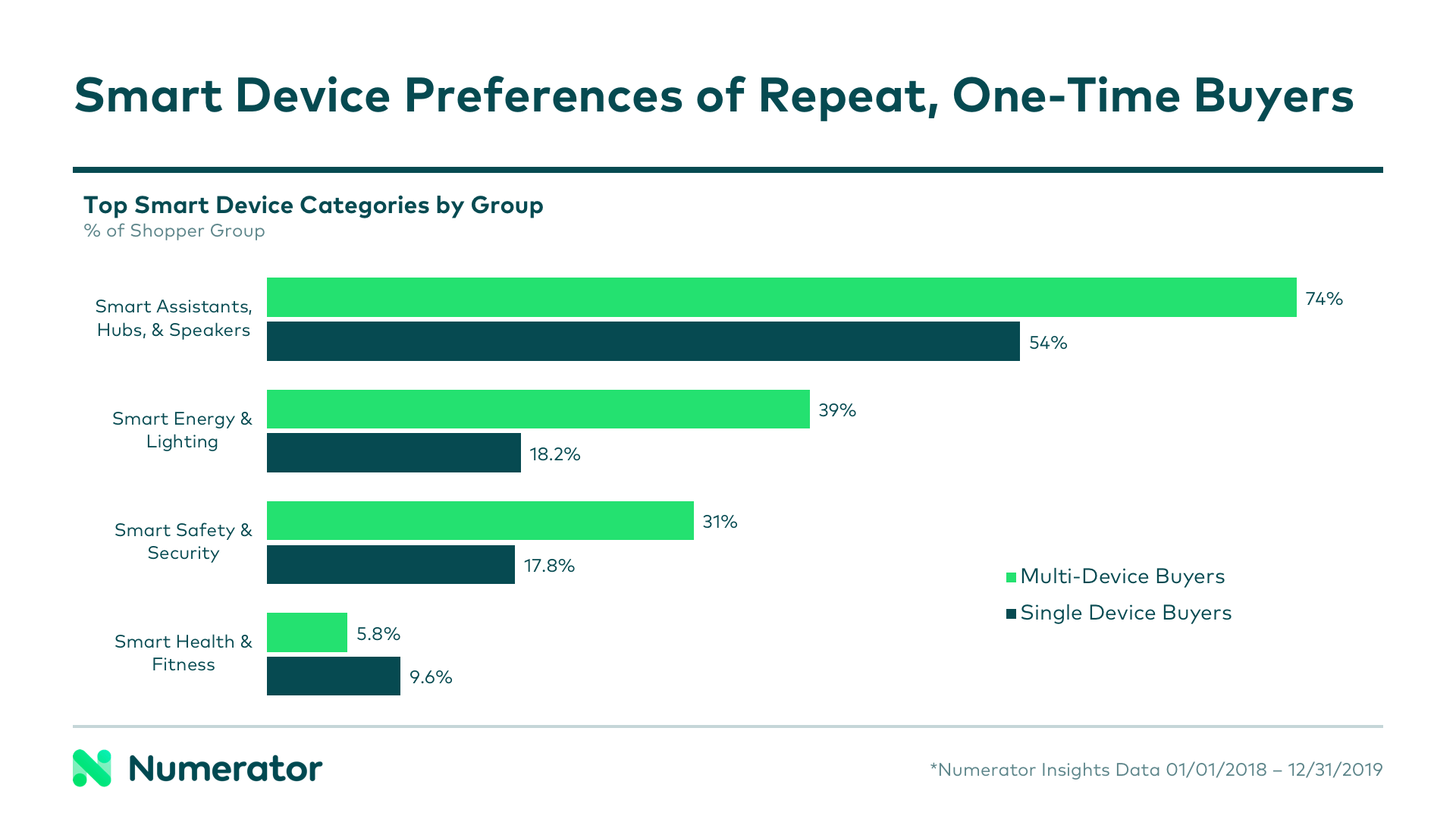

Brands have a significant opportunity to increase spending by enticing follow-up purchases among those who have already purchased one smart device: half of smart home buyers in the past two years never purchased a second device. Smart speakers seem to be the clear gateway device, accounting for over half of single-device households (54%). Those who purchased multiple devices were far more likely to expand into smart energy & lighting solutions, as well as smart safety & security. For multi-device buyers, follow-up purchases typically didn’t occur until a few months after their first smart device purchase, indicating a make-or-break period for brands looking to extend the ecosystem.

As the market for smart devices continues to saturate, brands will need to increasingly rely on less tech-forward shoppers for growth, who are naturally more hesitant to embrace new forms of technology. As we’ve already seen, attracting these shoppers is certainly doable, but brands must continue to look for creative ways to show consumers the benefits of a connected home and deliver secure, consistent, and positive experiences in the first few months of ownership.

For more information on smart home device trends and how your brand stacks up, reach out to your Numerator consultant today, or schedule a demo to see how our data can help you make smarter decisions for your brand.