*This article is over 2 years old. Explore our Gen Z Consumer Insights Hub for fresh views of this evolving consumer group.

Today, as the eldest Gen Z’ers begin entering the workforce, brands and retailers need to start figuring out this increasingly powerful generation. Using Numerator data, we’ll take an in-depth look at Generation Z, learn about their shopping behavior, and find out what makes them tick.

Gen Z at a Glance

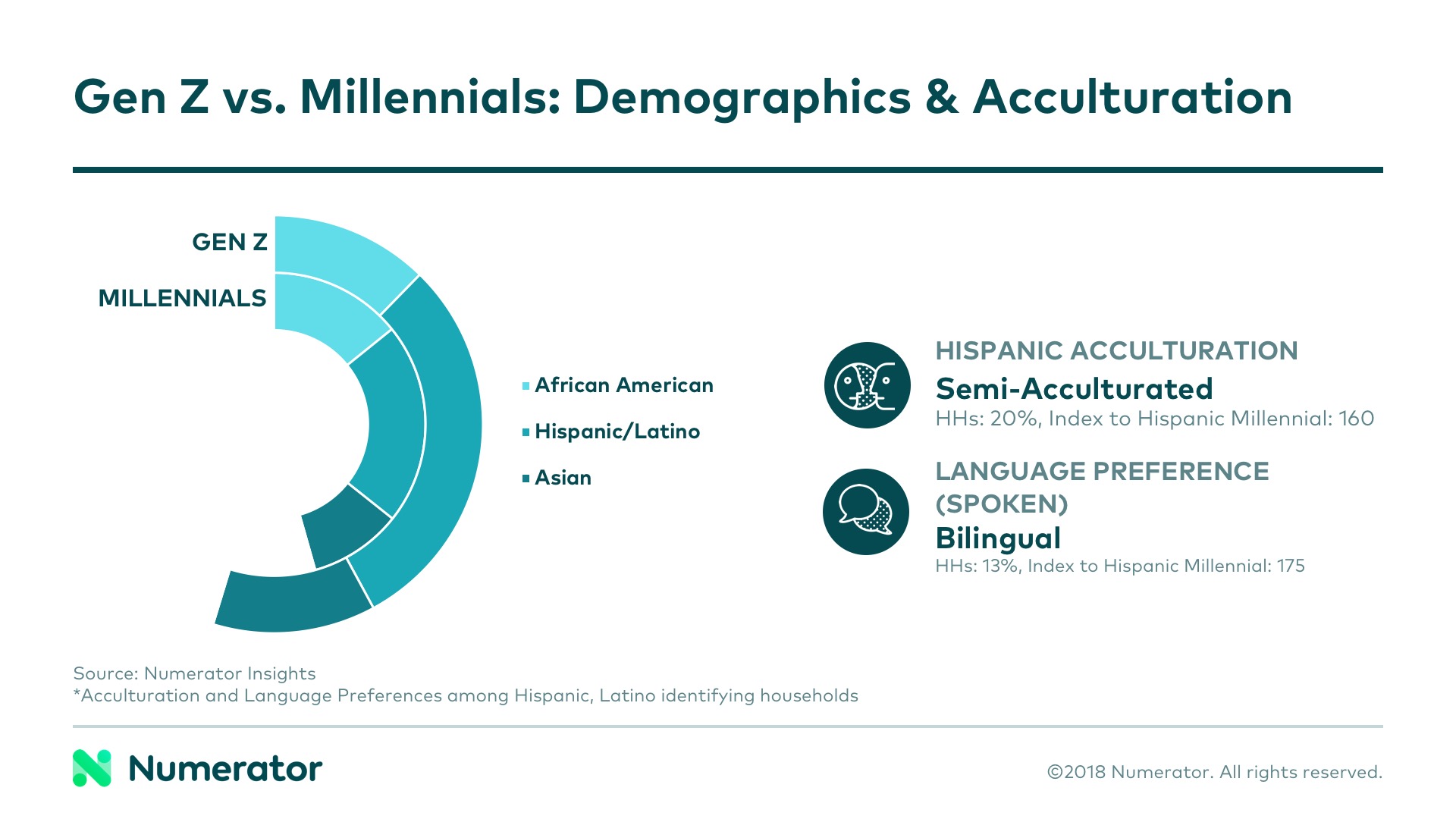

Gen Z is the most ethnically and racially diverse generation in the United States. As the first majority “minority” generation, Gen Z is defined and influenced by multiple cultures, with new acculturation dynamics compared to Millennials, according to new Numerator Insights and Ad Intel data.

Gen Z only knows a world in which instant access to information is never more than an arm’s length away. That makes these digital natives adept at gathering information quickly and sifting through the noise. They use technology to seek out brands that make them happy and convey the right image, and they expect brands to be transparent and accountable.

Again, Gen Z is not simply “Millennial Lite.” Many Millennial stereotypes don’t apply to Gen Z. Gen Z is 43% less likely to be concerned about healthy eating and 22% less likely to exercise regularly. They’re also less likely to be sports fans. In fact, Gen Z is 25% less likely to watch the NFL on television than Millennials.

Gen Z Gets Social

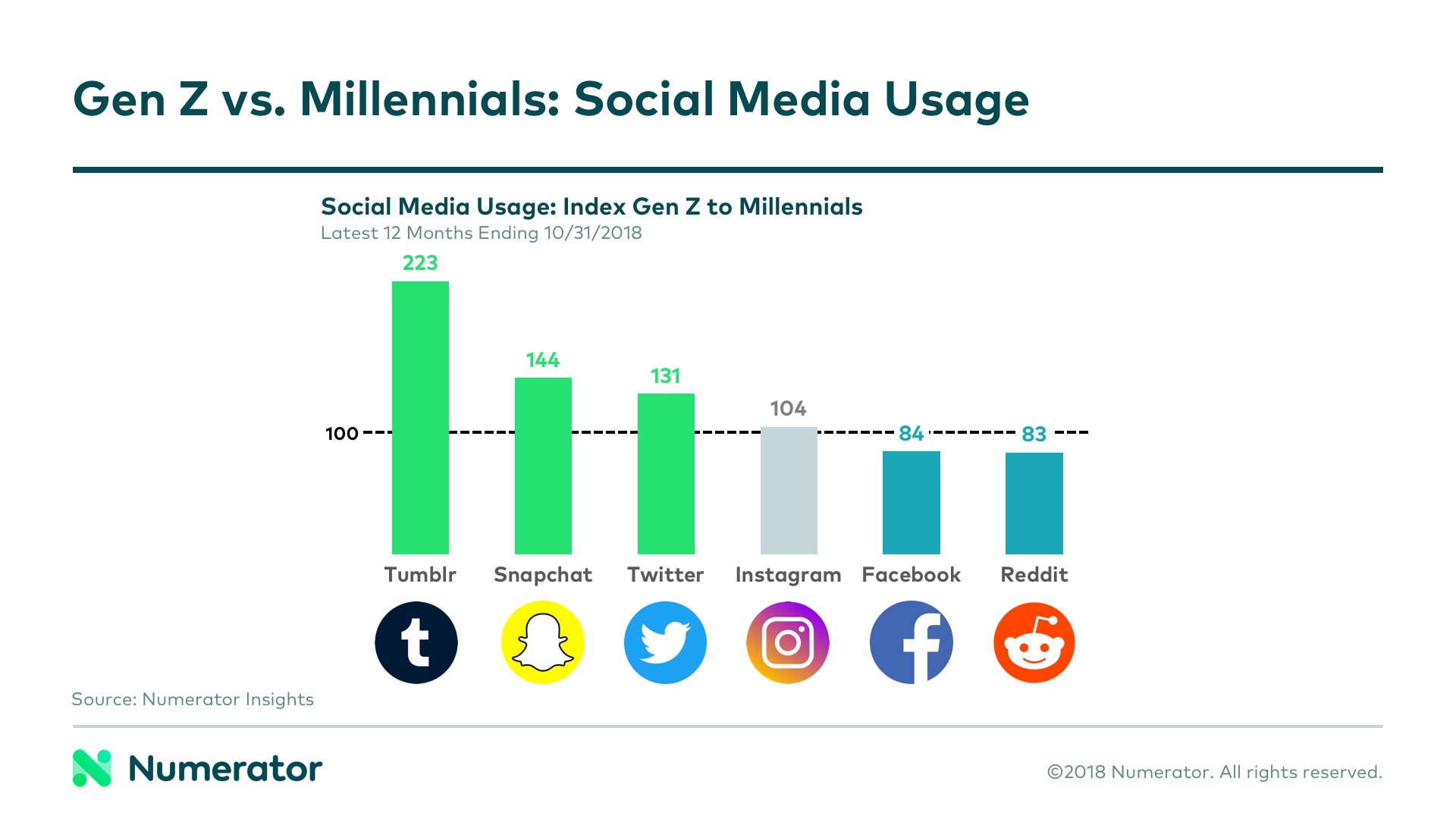

Since Gen Z’ers were born into the era of smartphones, they’re even more likely to be on their mobile devices than their computers compared to Millennials. When it comes to social media, Gen Z is into Tumblr, Snapchat and Twitter. Facebook and Reddit? Not so much, at least not as much as Millennials.

In addition to showing a preference for different social media channels, Gen Z is using them differently than Millennials. Social media isn’t just about connecting with friends. Gen Z is 44% more likely to make friends, 10% more likely to discover new products, and 18% more likely to discover new movies and entertainment through social media.

Gen Z looks and behaves differently than Millennials. They’re more diverse and unacculturated. They’re students on a budget with different priorities. They use different social platforms for different purposes. The obvious takeaway here is that brands and retailers can’t expect the marketing strategies that worked for Millennials to work for this younger generation that’s poised to disrupt the marketplace.

Gen Z Goes Shopping

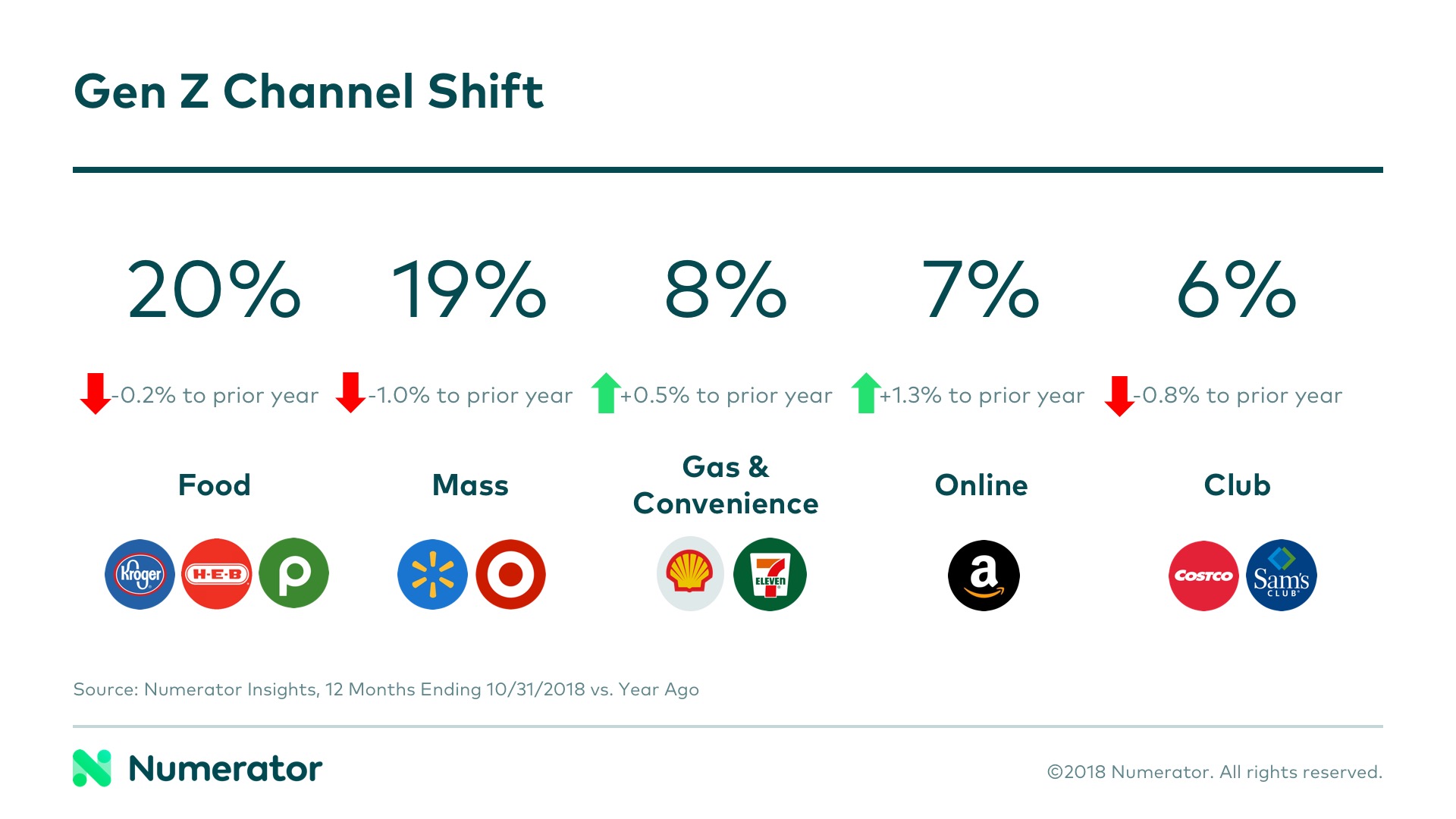

Each year, 4 million members of Gen Z enter adulthood. But where are they spending their money? According to Numerator Insights and Ad Intel data, Gen Z spending in Food, Mass and Club channels is trending down, while Online and Gas & Convenience spending is up.

Despite the continued growth of Gen Z’s online shopping habits, we still see a smaller share of Gen Z’s spend going to online channels compared to Millennials (7.4% to 10.4%). However, data suggests this could be related to life stage. At this point, Gen Z shops online less frequently, spends less per trip, and builds smaller online baskets than Millennials. But there is significant growth potential as Gen Z moves into different life stages, and given their high adoption rates of online shopping, it’s important to earn this generation’s loyalty now.

Gen Z is expected to be the largest generation of consumers by next year, so retailers and brands need to gain a better understanding of Gen Z and what’s driving their shopping behavior. Let’s continue our comparison of Gen Z and Millennials by looking at preferences when dining out, how this is reflected in grocery shopping behavior, and whether the current creative mix used by retailers and brands to attract Gen-Z shoppers is on-target.

Fast Food? Gen Z Is Lovin’ It!

Nearly one in five (19.4%) Gen Z’ers dine out at least four times per week, indexing 111 to Millennials. Gen Z is also more likely to choose fast food than Millennials. Among fast food restaurants, McDonald’s is the top choice for both Gen Z and Millennials, while Taco Bell has jumped into the number two spot for Gen Z.

For Gen Z shoppers, dining out is more about indulgence. Their decision to dine out is driven by the desire to satisfy a craving or treat themselves. Millennials are more likely to dine out because they’re crunched for time and too busy to cook. This indicates that Gen Z would be more receptive to marketing messages that focus less on convenience and more on the enjoyment of dining out.

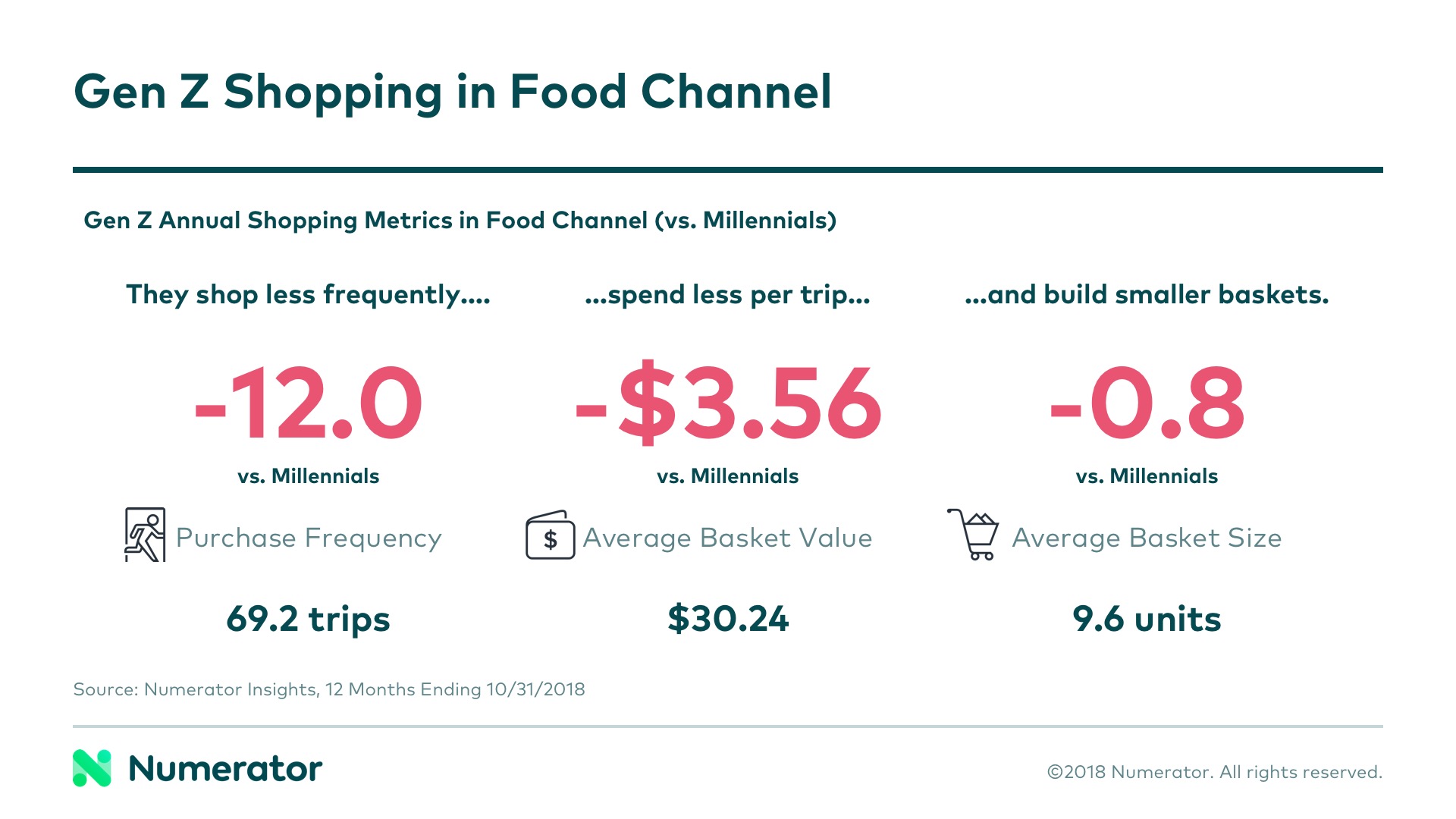

The Food Channel? Not as Engaged.

Gen Z’s preference for fast food and dining out is reflected in their grocery shopping behavior. Gen Z is less engaged than Millennials in the Food channel, with less frequent grocery shopping trips, lower spend per trip, and smaller baskets.

When it comes to grocery shopping, Gen Z seems to focus more on value (Food4Less, Stater Bros.) and less on natural or organic items (Whole Foods, Sprouts) when choosing a food retailer. They’re also less likely than Millennials to shop at retailers with a significant private label presence (Aldi, Trader Joe’s).

A Disconnect Between Retailer Creative and Gen Z Preferences

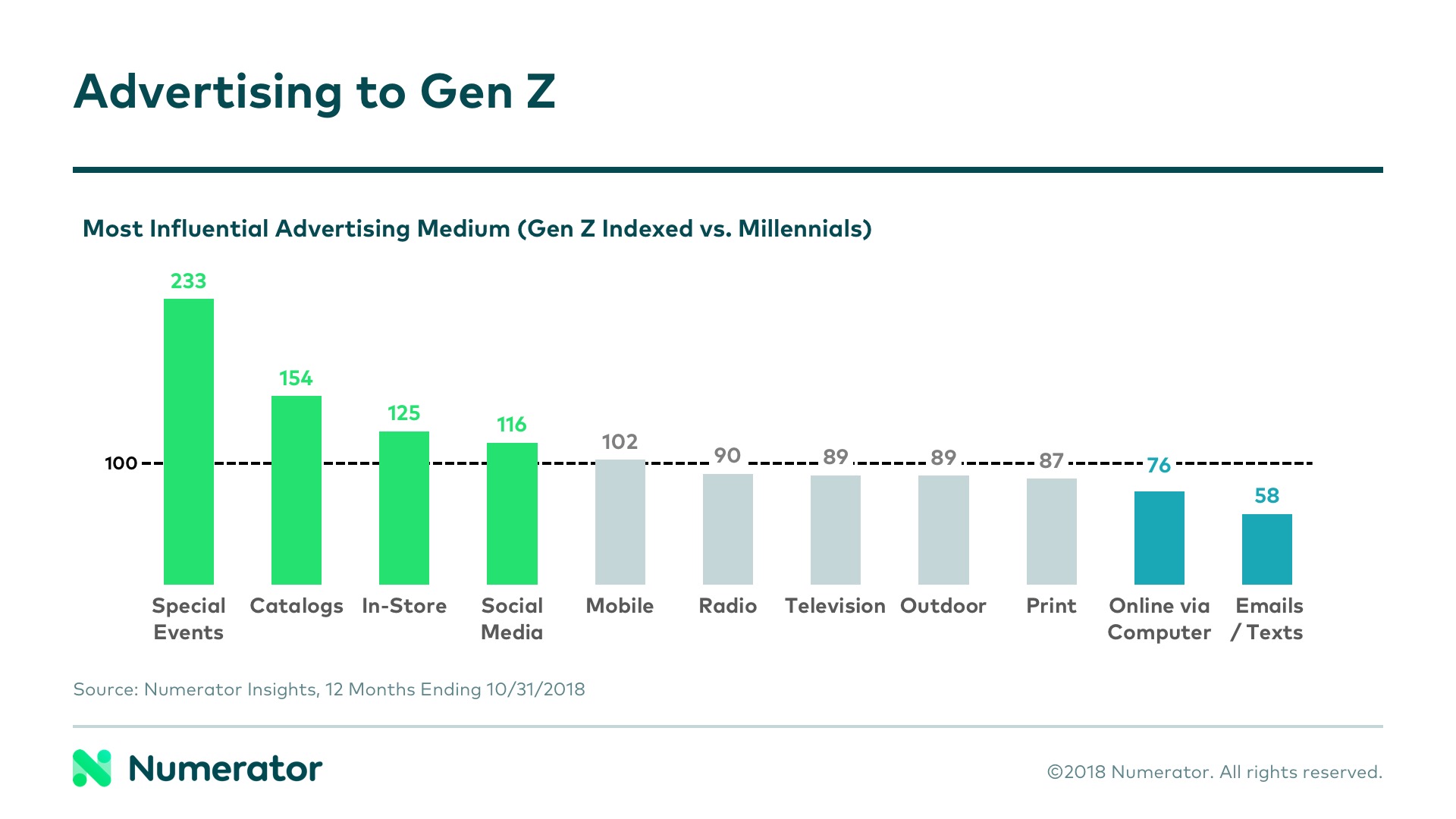

Gen Z is all about the experience. According to Numerator Insights data, Gen Z is far more likely to engage with and be influenced by in-store and special event experiences than Millennials. When it comes to advertisements, Gen Z also prefers social media and mobile over emails, texts or desktop ads.

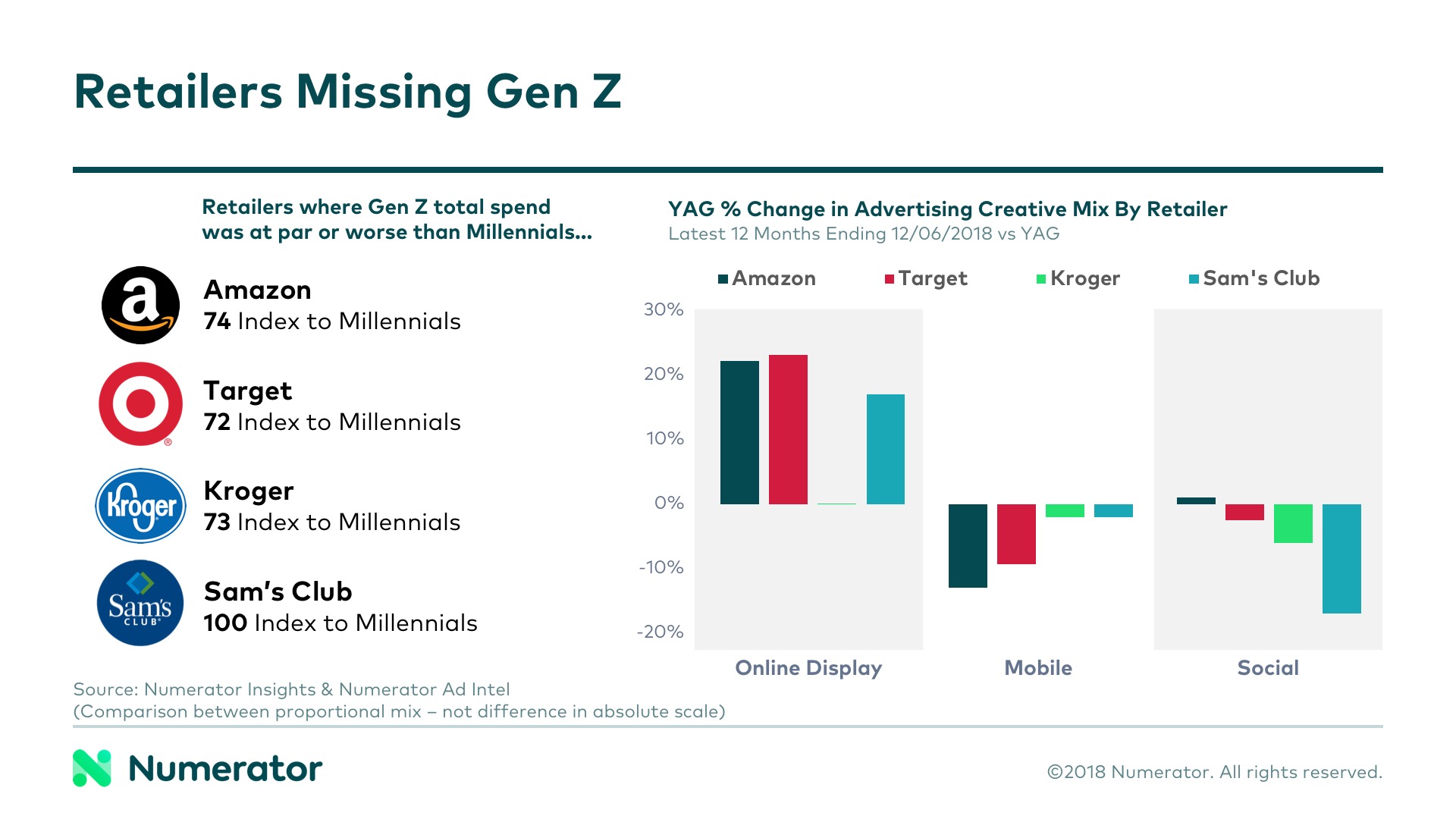

Even though Gen Z is clearly a mobile-first generation, most retailers seem to be shifting to online display advertising, often at the expense of mobile and social media. As top retailers like Amazon, Target and Kroger invest more in online display than mobile and social, they miss out on targeting the Gen Z shoppers, and it shows: Gen Z’ers aren’t spending as much as Millennials in those those retailers.

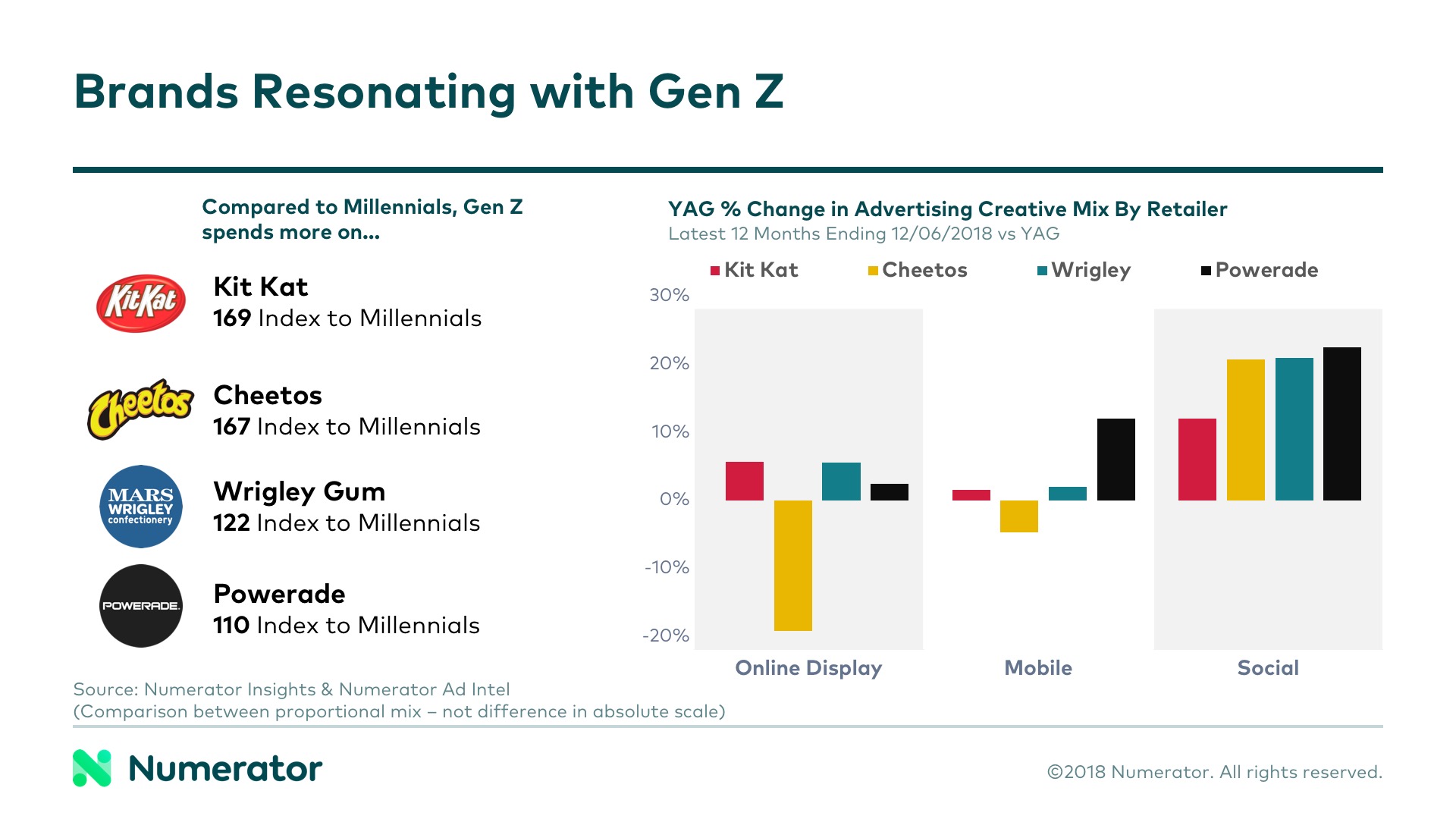

On the other hand, we see that brands that are making social media a bigger part of their creative mix, such as Wrigley Gum, Cheetos, Powerade and Kit Kat, are generating more sales from Gen Z.

Gen Z Preferences & Practices

Private label brands in particular have some catching up to do when it comes to product perception with Gen Z. Private label brands are winning over Millennials, but Gen Z is more skeptical of private label product quality and less likely to associate a private label purchase with being a smart shopper.

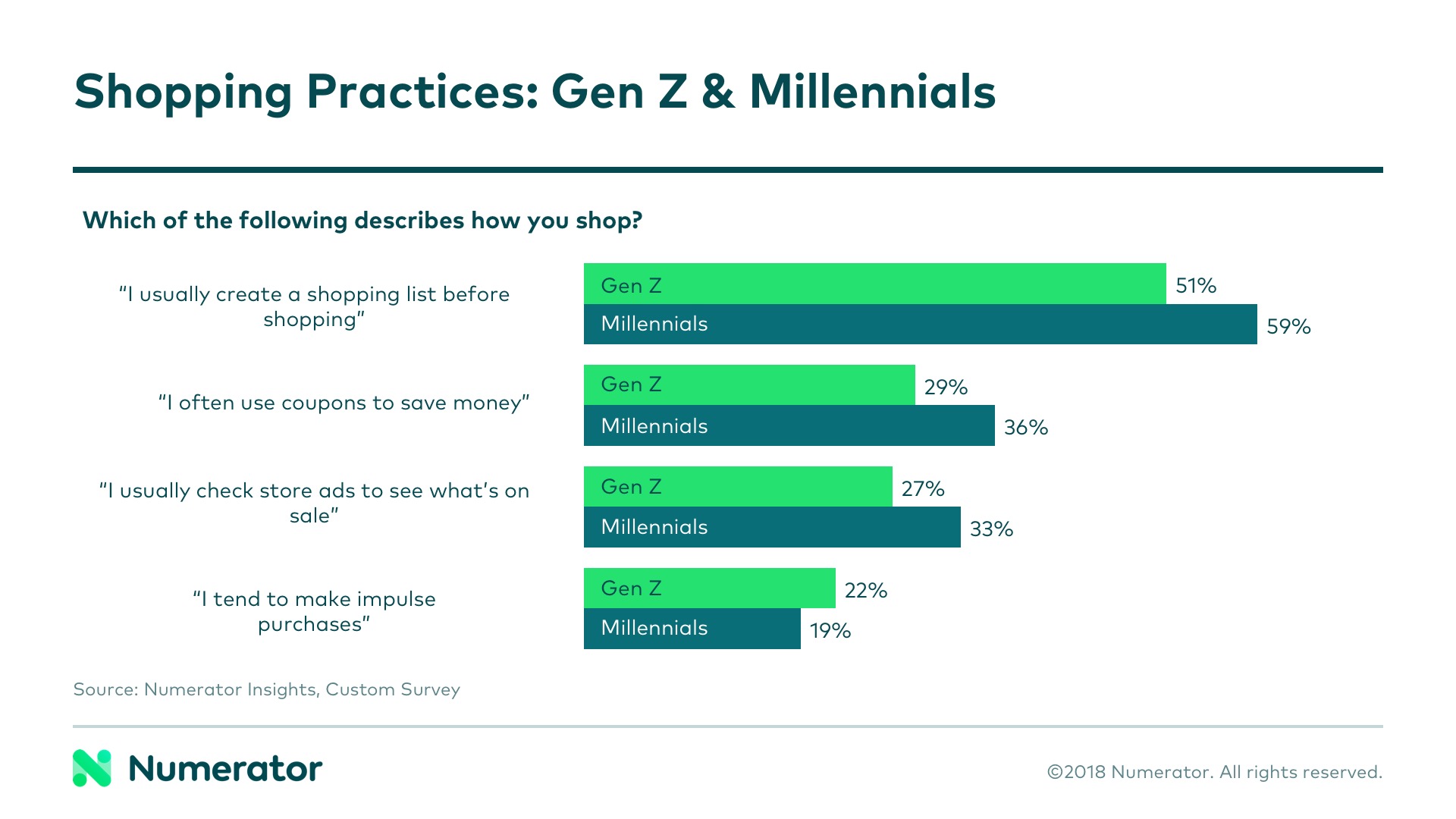

According to Numerator Insights, Gen Z’ers aren’t as likely as Millennials to plan purchases in advance, use coupons, or check store ads. Because Gen Z tends to make impulse purchases, the right in-store experience combined with a well-timed, well-placed mobile ad could lead to more sales.

The importance of the in-store experience to Gen Z speaks to the value of a sound omnichannel strategy. For example, Gen Z is more likely to shop at Walmart than Millennials, but less likely to shop at Walmart.com. More dollars continue to shift online, but brick-and-mortar is still responsible for the lion’s share of sales.

The Next Generation of Shoppers

Brands need to start building loyalty with Gen Z now. This begins with using psychographic data to understand the attitudes that drive shopping behavior and developing marketing strategies that align with media consumption habits.

Where is Gen Z shopping? What are they buying? How can you reach and resonate with them to influence their purchases?

Let Numerator help you answer these and other questions for your product categories. Contact us to find out how we can help you build holistic customer profiles for your campaigns, briefs and media plans.

Additional Sources:

MediaPost, Multiracial Gen Z and the Future of Marketing

Forbes, How Much Financial Influence Does Gen Z Have?