As emerging brands expand into new retailers, the ultimate challenge is demonstrating how quickly products are moving off the shelves. Once distribution is secured, brands must deploy shopper marketing strategies that strengthen sales velocity, defined as the speed in which an SKU sells in-store, or the sales rate. This key metric will reveal to retailers how a brand will perform with increased distribution on the shelf. Below, we outline actionable steps based on consumer trends to increase sales velocity and strengthen retailer partnerships:

Understand the Consumer and Correlation to Value Proposition

To enhance in-store velocity, emerging brands must develop a deep understanding of their target consumers and purchase drivers in grocery. Knowing Gen Z is a key demographic for most brands, we’ll use this cohort as an example. Numerator’s Gen Z Consumer analysis reveals this generation is more likely to be a diverse group, with less than half identifying as White/Caucasian. Nearly half (47%) fall into the low-income bracket, and they are spread across urban (42%), suburban (36%), and rural (23%) areas. As a group, they are in tune with current social issues, however their top social causes and issues that drive purchases vary by ethnicity: environmental concerns rank among the top five issues for Asian and Hispanic Gen Z consumers, while Black Gen Z consumers express more interest in social justice. Brands with a purpose-driven approach can leverage these insights to tailor messaging that resonates with retailers’ consumer segments, including current buyers, lapsed shoppers, and untapped audiences. By tapping into the psychographic attributes of target consumers, brands can execute the right marketing messaging and tactics.

Identify the Ideal Retailer Environment for Growth

For emerging brands competing against legacy brands, partnering with retailers who attract similar shoppers as a brand's target consumer segment will lead to a higher velocity. This is especially true for brands in emerging categories, like Non-Alcoholic Beverages. Numerator research shows that new shoppers tend to enter this category through online or health-conscious retailers like Amazon (77% more likely), Sprouts (53%), and Whole Foods (16%). If a non-alcoholic beverage brand’s shopper segment naturally aligns, initial distribution efforts can be focused on these key retailers to capture more new category shoppers. Alternatively, brands must understand which retailers' shoppers are less aligned with their target consumers since a partnership there would result in a slower velocity. While emerging brands might be tempted to expand into as many retailers as possible, identifying the right retail targets and improving sales metrics in existing partnerships will naturally lead to increased distribution. Strong performance within current retailers will signal a brand's success and appeal to potential new retail partners, providing a competitive edge in the CPG market.

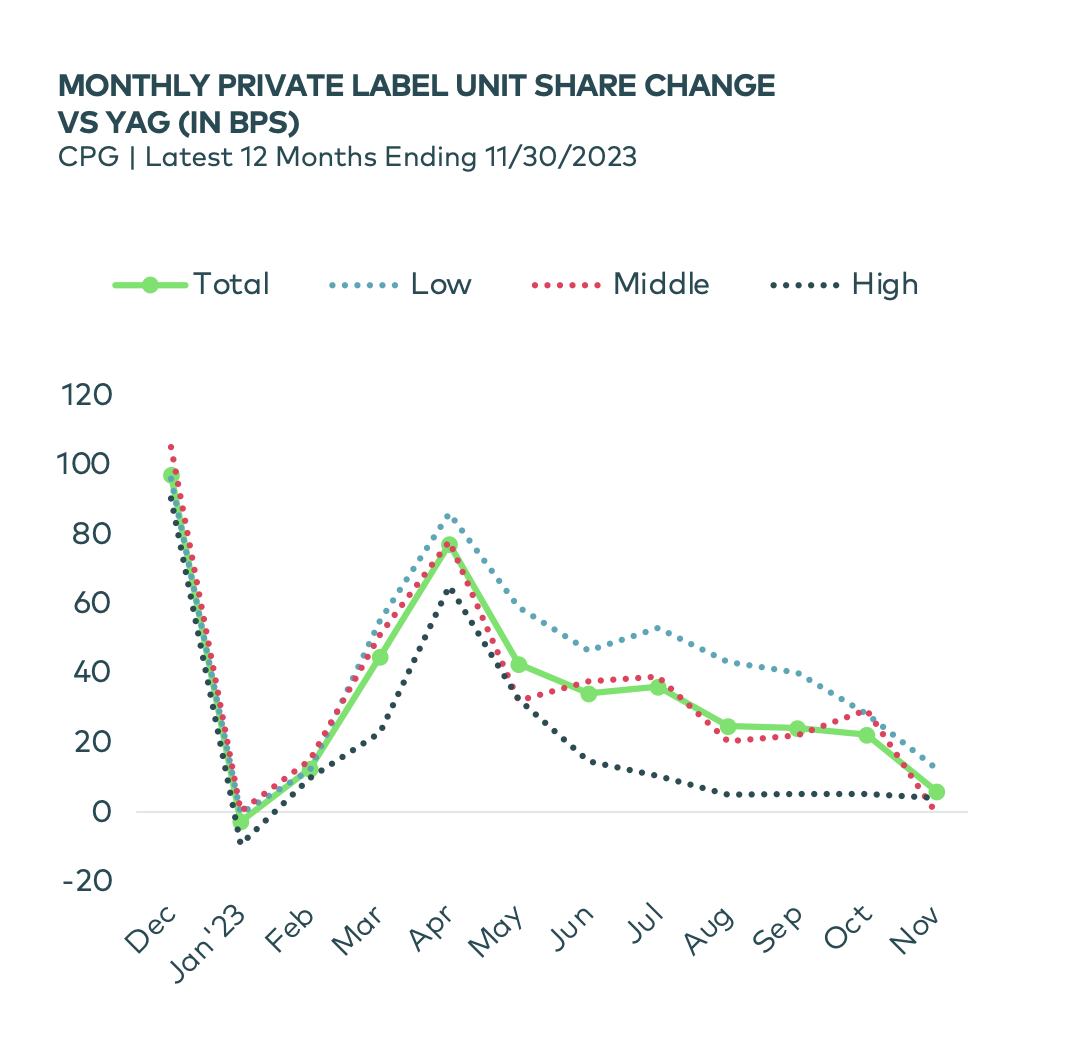

Compete with Private Label: Set the Right Price and Pack Size

Numerator’s annual Visions report states that private label brands have consistently expanded their unit share every month at the expense of name brands, driven by all income brackets and even more so with lower-income households. Contributors to the growth in private label unit share across grocery include Great Value (+1.3B units vs YAG), Aldi (+188M), Kirkland Signature (+140M), Bowl & Basket (+130M), and Trader Joe’s (+129M). As emerging brands build marketing and sales strategies to stand out on the shelf against the more affordable competition, it's essential to reassess pricing structures and redefine value propositions. By reevaluating price pack architecture, brands can pinpoint optimal pack sizes that drive customer retention or encourage trade-ups. Moreover, reinforcing brand value drivers enables the creation of a distinct value proposition tailored to specific consumer segments and psychographic profiles. These strategic initiatives are critical for emerging brands to enhance in-store velocity and outperform competitors, particularly in the face of private label growth and pricing pressures.

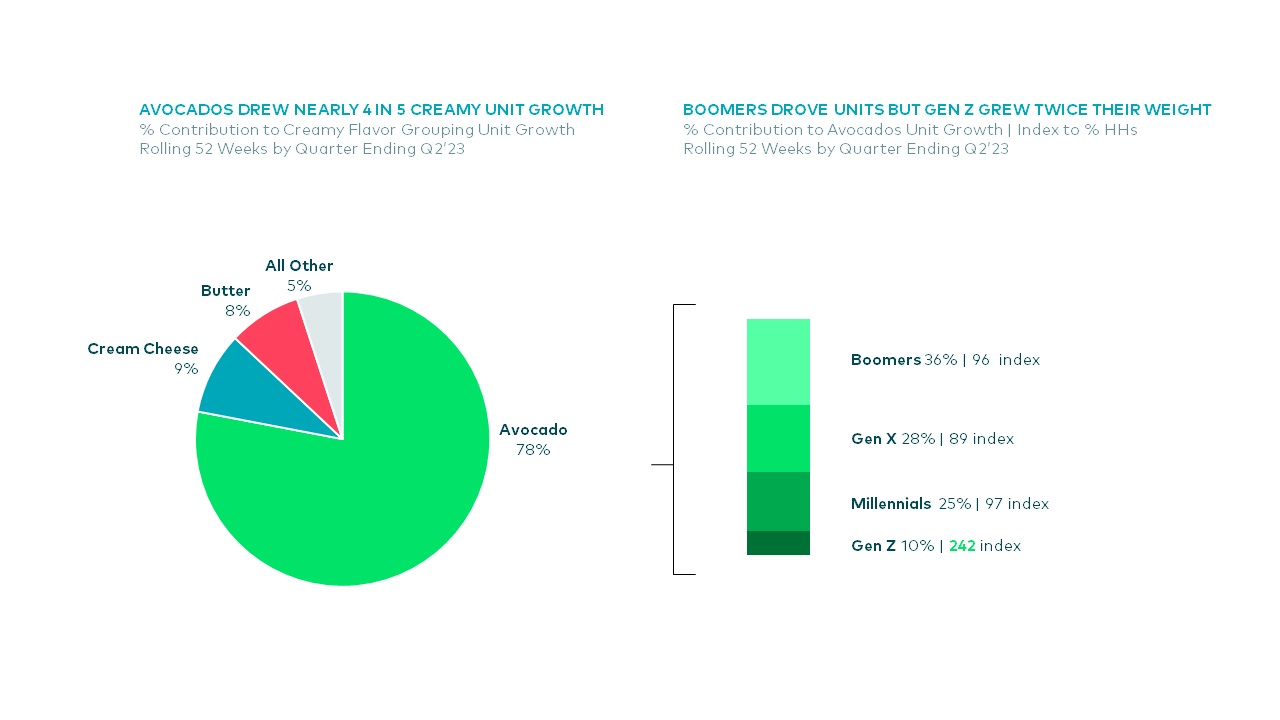

Innovate Strategically to Capture Occasions in the Right Category

Another way emerging brands can naturally boost their in-store velocity is through strategic placement in categories that will allow them to capture specific consumer occasions. Brands that can adapt and explore new categories based on consumer needs often experience a surge in sales when positioned in the most appropriate section. For instance, according to Numerator’s Stomach Share report, avocados in grocery have found success beyond the produce section in "creamy" based categories, resonating particularly well with Gen Z. Avocados contributed a significant 78% to the unit growth in the creamy flavor grouping, outperforming traditional products like cream cheese and butter. Identifying the right market fit is instrumental in expanding into new categories and gaining shelf space.

Consider the Right Metrics in the SKU Rationalization Process

Often, a brand’s portfolio can have a handful of underperforming items slowing down its average velocity. Removing SKUs from production will drive consumers toward a brand’s core offering and rebuild its innovation pipeline that aligns with consumers' needs. However, according to Numerator’s Accounting for Consumers in M&A Decisions, core shopper metrics such as household penetration will not provide the full picture of whether a brand should divest one of its items. Customer lifetime value (CLV) is a modern measure that calculates a quantifiable value for the financial relationship between a business and a customer by measuring the entire revenue a customer will likely spend on an item over a designated period. Beyond loyalty to a specific brand, CLV can also measure engagement across a category. Understanding a brand’s CLV can help determine what strategy will look like going forward considering what product offerings are needed through the journey and opportunities for future cross-selling.

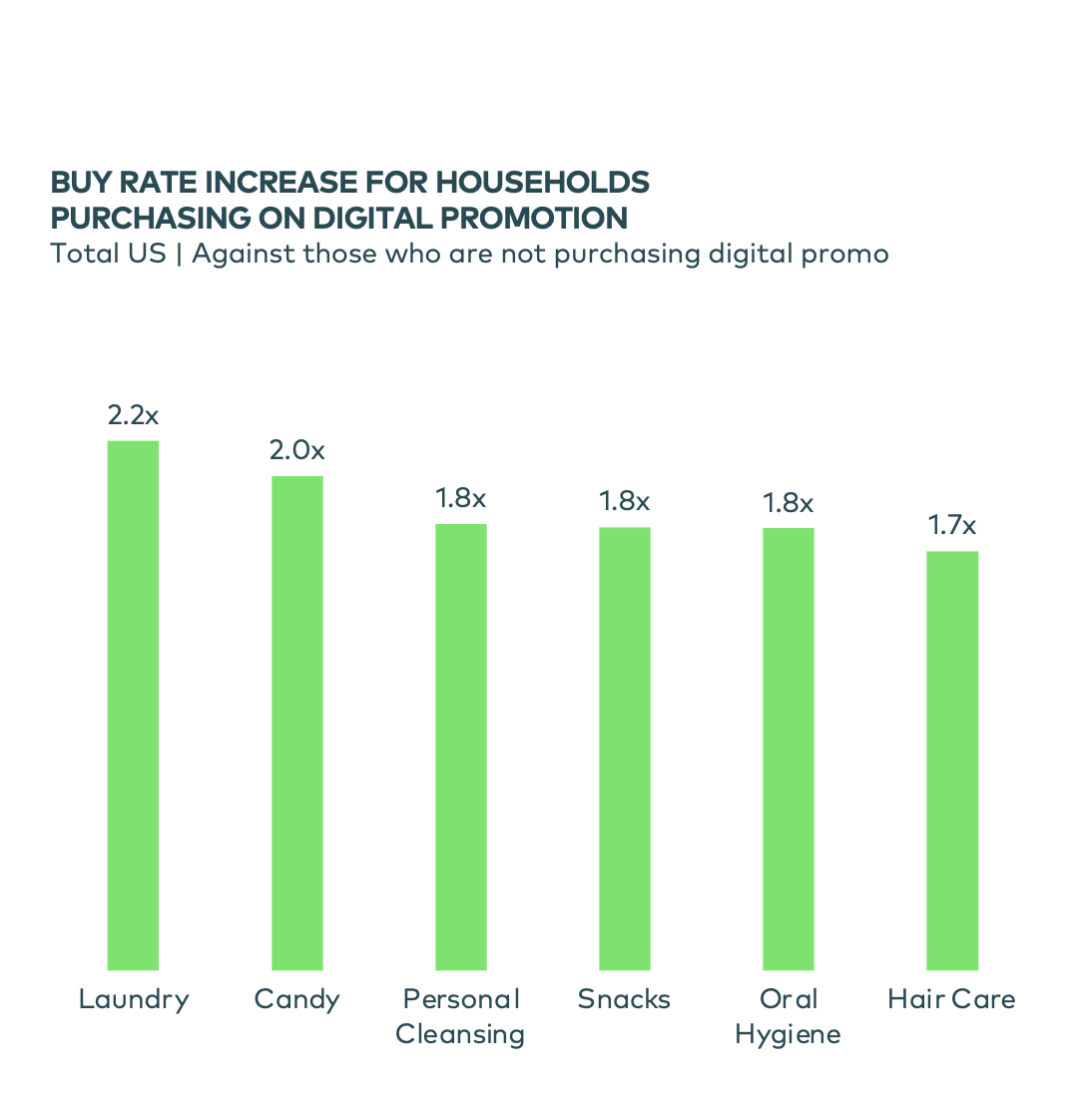

Center Promotional Strategies on the Modern Consumer

Brands must optimize their promotional strategies to enhance shopper loyalty and attract new, younger households. According to our Visions report, a significant shift towards digital promotions is evident. In 2023, three of every four promotional ad blocks for essentials were delivered digitally. The impact of digital promotions on consumer purchasing behavior is noticeable, with redemptions significantly increasing purchase frequency, resulting in a 71% surge in yearly spending. Buy rate has risen for households engaging with digital promotions in CPG categories such as Laundry, Candy, Personal Cleansing, Snacks, Oral Hygiene, and Hair Care. To optimize trade budgets effectively, emerging brands should strategically allocate resources to digital channels, considering the distinctive dynamics of their retailers’ category consumers, ultimately fueling incremental sales growth.

Incorporate Influencers in Shopper Marketing Strategies

As retailers search for fast-growing brands that will drive their business, influencers have become a central topic of discussion. Integrating influencers into a brand's strategy can align with various marketing principles, including premium pricing strategies or targeting specific niche consumer segments. For instance, as highlighted in our Influencer & Celebrity Impact on Shopping Behavior report, influencer brands often drive lower customer acquisition costs and a quicker go-to-market; however, brands may encounter the challenge of consumers being unaware of a public figure's association with a brand. Only 32% of influencer brand shoppers recognized the brand's affiliation with a public figure, and just 1 in 5 could correctly identify the celebrity or influencer linked to the brand. As brands consider an influencer strategy, they must outweigh the benefits and risks associated with their category, brand identity, and target retailers to drive increased velocity and success in-store.

Conclusion: How to Accelerate In-store CPG Velocity

To accelerate in-store velocity, brands need consumer-centric strategies rooted in a deep understanding of their target consumers' behaviors, occasions, and purchase drivers. Consumer-sourced data is instrumental in providing the insights necessary to drive CPG purchases and cultivate stronger partnerships with retailers. Through leveraging panel data, brands can demonstrate a clear understanding of their purpose within a category and align their strategies with retailer objectives. To explore how Numerator data can help your brand increase velocity and showcase ROI to your retailer partners, reach out to our team today.