When the COVID-19 crisis began in March, consumers and retailers alike scrambled to make dramatic adjustments in order to adapt to an extraordinary situation. As social distancing, sheltering in place, and access to only essential businesses became the new norm, consumers experimented with new channels out of necessity. Seeking to safeguard their health while still accessing products they needed, one retail service consumers have come to rely on heavily is Click & Collect.

This post will share highlights from a comprehensive Numerator analysis on Click & Collect’s impact during the COVID-19 crisis. We’ll look at who has been using the service, how much they’re spending, and the factors driving its popularity. We’ll also offer insights into its staying power moving forward as well as how brands and retailers can build on its success.

Click & Collect Sales Surged Amid COVID-19

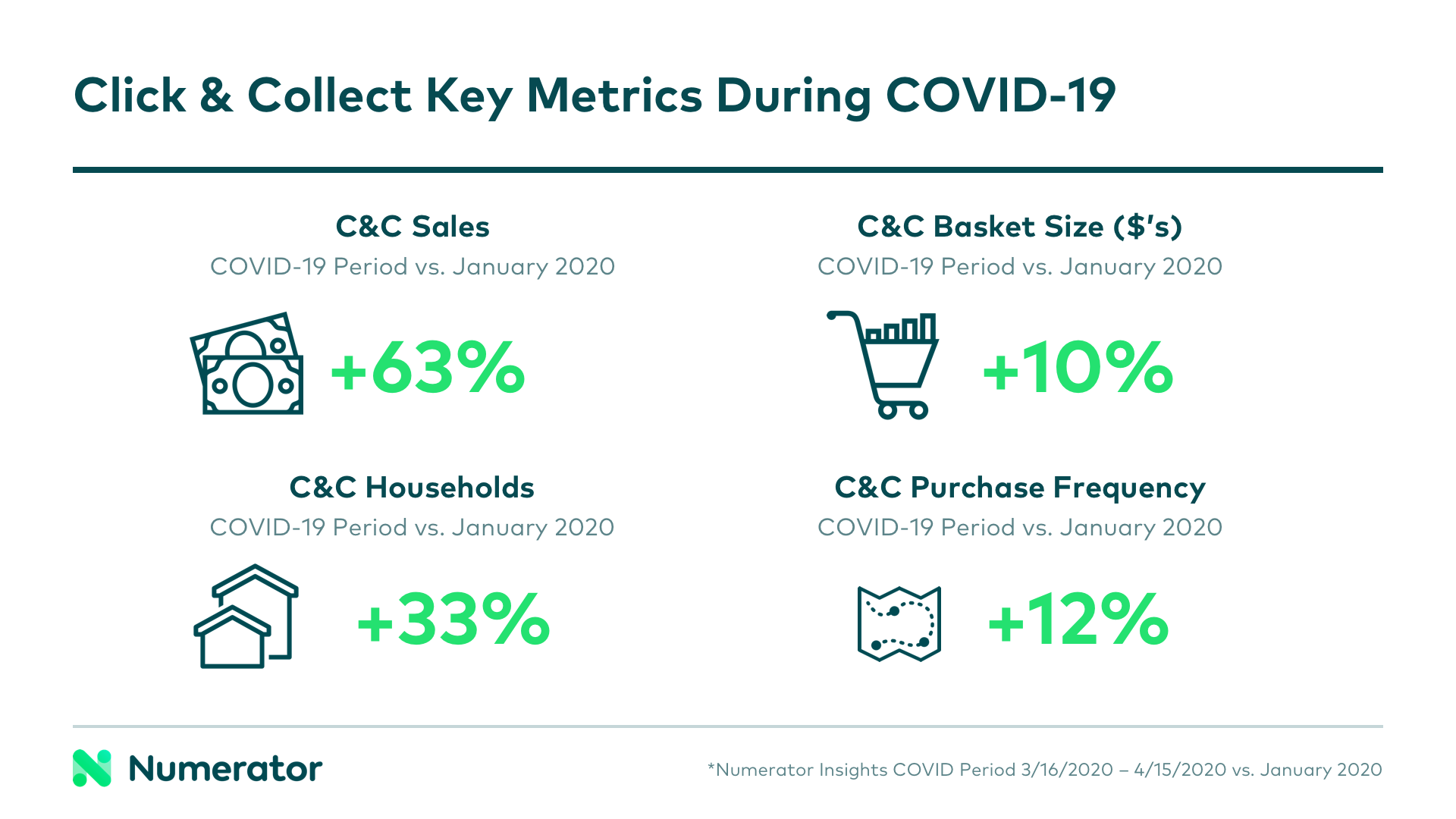

Though Click & Collect options were available well before the crisis began, sales surged 63% once shelter-at-home protocols were announced. Additionally, we’re seeing a 12% increase in purchase frequency and 10% boost in basket size. This is indicative of shoppers stocking up on items while also consuming more of them due to being at home full-time.

Overall, Click & Collect has experienced a 33% increase in the number of households using the services. It gained more first-time users during the pandemic than in the pre-pandemic period.

A Vital Assist to At-Risk Consumers

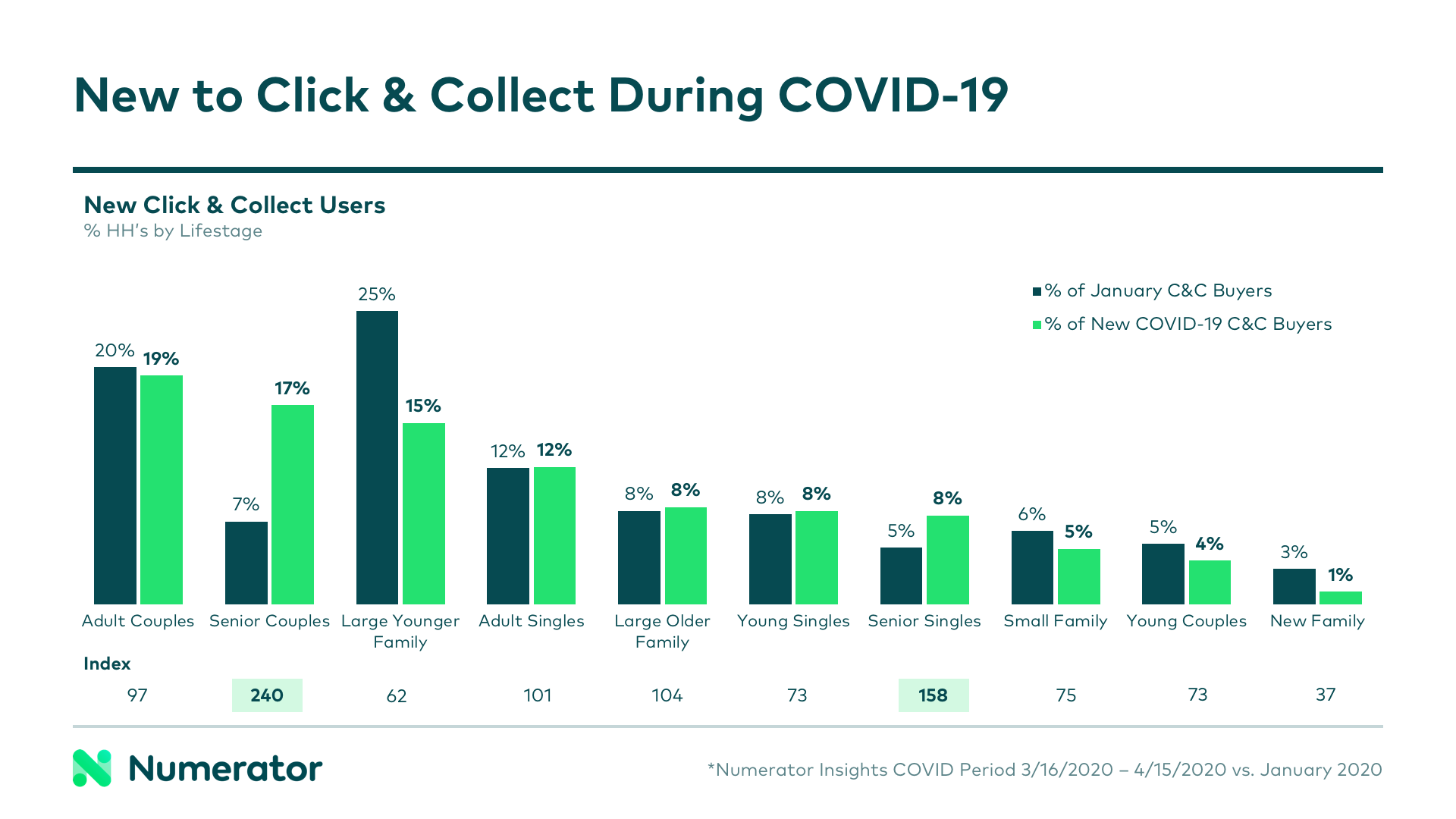

Click & Collect is attracting a brand new customer base consisting of older, lower income households without children. Usage among seniors, both married and single, has risen 25%.

What makes these new users unique is that they have historically preferred shopping in physical stores over making online purchases. They are both quality and value-minded and place greater trust in the in-store experience. However, with public health officials warning of the greater infection risk among this demographic, their desire to bypass busy stores likely contributed to this shift.

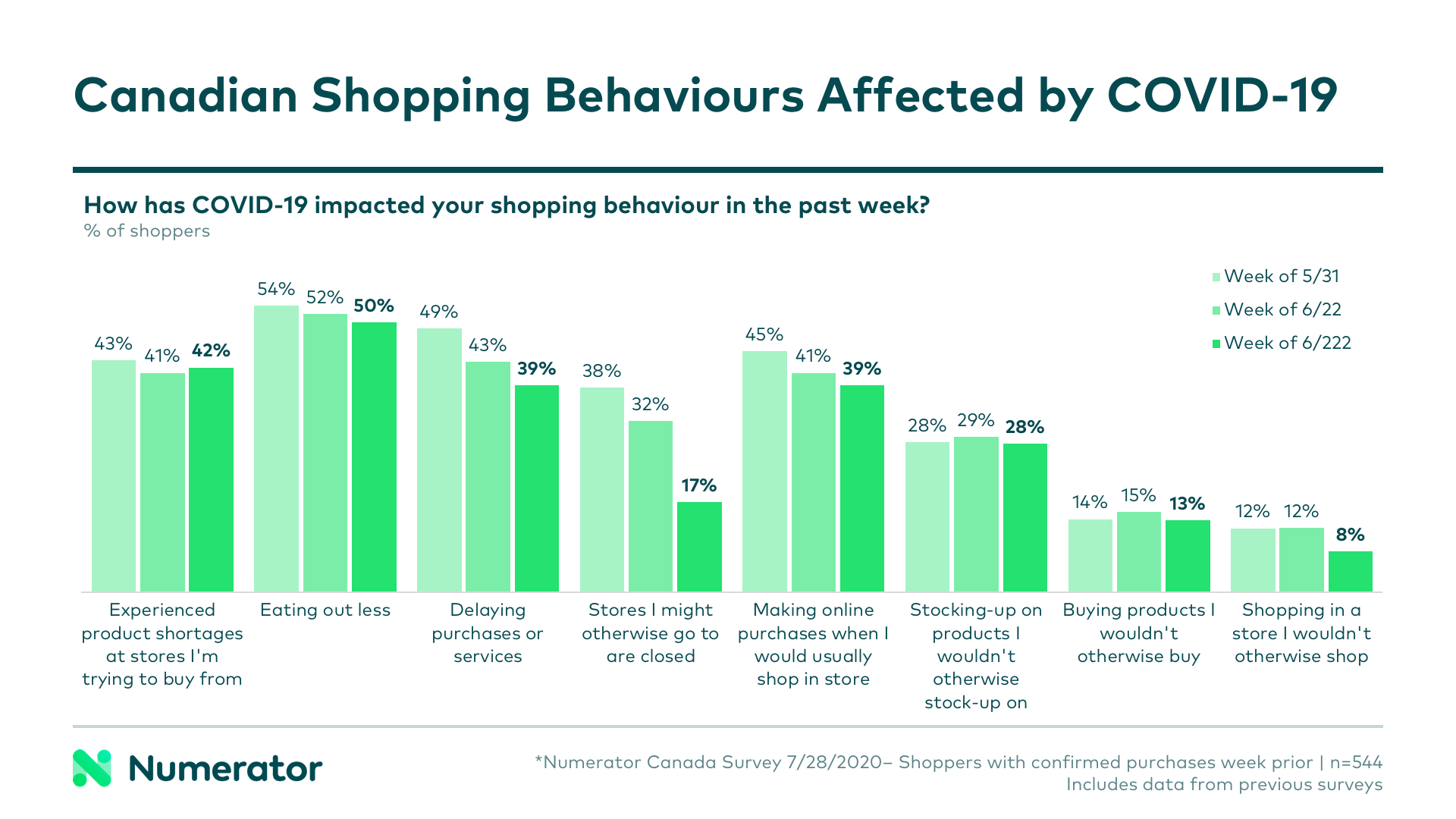

Social Distancing and Product Availability Drive Usage

When surveyed, 83% of new Click & Collect consumers stated they were using the service as a way to avoid crowds and maintain social distancing practices. Shoppers also said the convenience and time-saving aspects of the service were important.

Product availability is another incentive for Click & Collect users. When choosing where to place an order, 60% of shoppers selected a retailer they knew would have the specific products they wanted. The added benefit of drive-up or contactless pick-up play important roles as well in retailer choice.

Pantry Staples Fill Online Carts

Grocery staples such as canned and frozen vegetables are the more prevalent items filling Click & Collect shopping carts as consumers seek to keep their pantries and freezers well-stocked. Shoppers have been buying more of these goods in bulk through this service than they typically do in stores.

It’s important to note that while shoppers haven’t experienced many shortages or out-of-stock issues using Click & Collect, brands and retailers should be aware they risk losing sales if products aren’t available. When faced with out-of-stock items, 57% of shoppers indicated they either bought a different brand or purchased those products through another retailer.

Click & Collect Wins Wide Consumer Praise

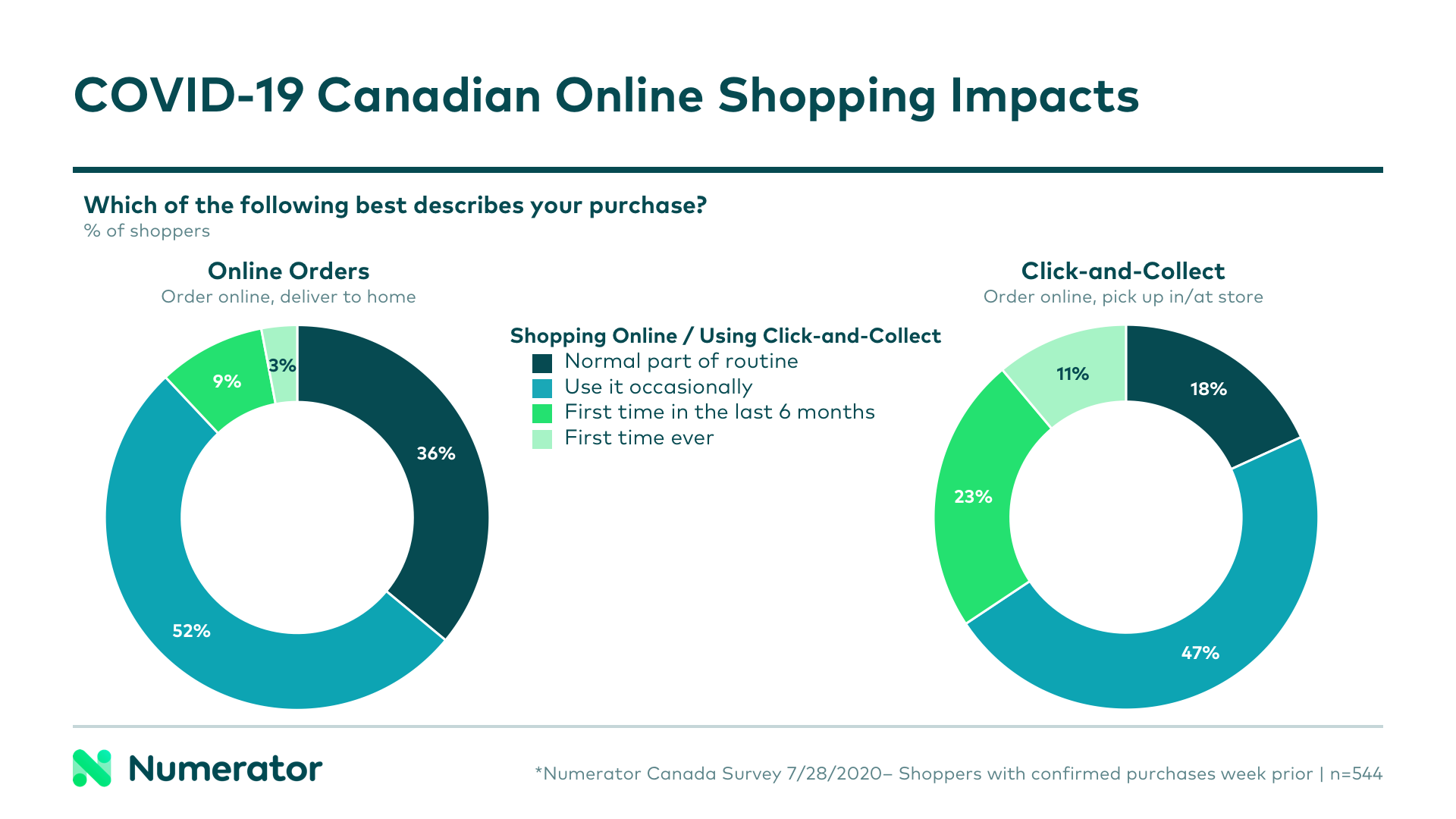

Feedback from new users of Click & Collect services has been overwhelmingly positive with 83% of shoppers saying they enjoyed the experience. As mentioned previously, consumers appreciate the convenience of Click & Collect as well as seeing it as a safe alternative to in-store shopping during the COVID-19 crisis.

These factors have driven the service’s increased success and led to higher repeat rates during the crisis than pre-pandemic. 66% of new users and 87% of existing users indicating they are likely to continue using the service post-pandemic.

What’s Next for Brands and Retailers?

Brands should ensure their products are included among Click & Collect choices on their retail partners websites. They can also optimize their online presence by comparing their product messaging to that of their competitors and enhancing their messaging. We also recommend exploring sponsored placement options with retailers to help promote products.

Retailers will want to consider expanding the variety of products available for Click & Collect pick-up. Marketing to older shoppers and emphasizing how the service complements in-store shopping will be important as well. Shoppers also say product discounts and the elimination of fees would give them additional incentive to continue using the service.

Click & Collect’s curbside service has proven to be indispensable during these uncertain times. As speculation intensifies over the possibility of a second wave of COVID-19 infections, consumers are likely to remain cautious. We predict Click & Collect usage becoming one consumer behavior likely to stick for the foreseeable future.

We encourage our manufacturer and retail clients to download the full report on our website. It has additional, in-depth details on consumer response to Click & Collect and offers strategies to make the service even more beneficial for you and your customers.

As always, Numerator is here to help, especially during this unprecedented period. Reach out to us with any questions and to gain a greater understanding of evolving consumer behavior throughout the COVID-19 crisis as well as its impact on your brand or category.