Three years into the Chicken Sandwich Wars, QSRs continue to vie for attention from consumers who are flying the burger coop and craving the variety that chicken sandwiches have to offer. How can QSRs capitalize on poultry’s popularity and stand out in a crowded chicken sandwich market?

Numerator checked in on the current status of the Chicken Sandwich Wars by serving up a sampling of our Insights data in a recent webinar. We examined how new menu item launches impact sales, where openings exist to appeal to first-time and infrequent buyers, and why understanding customer overlap in the market offers a competitive edge. As the public appetite grows, QSRs have an opportunity to build buzz and boost their bottom line by jumping on the chicken sandwich bandwagon.

Sandwich Launches Lure Chicken Lovers New and Old

Leading QSRs have seen a solid boost in sales when introducing new chicken sandwiches to the market. Popeyes’s iconic chicken sandwich launch in 2019 was a huge hit and sparked a social media stir with rival Chick-fil-A. This year, both McDonald’s and KFC tossed their latest fried chicken sandwich selections into the ring, snagging a notable spike in buyers as well.

Though KFC’s launch brought in fewer new buyers, it saw a significant interest among existing customers, with three-fourths of KFC’s regular buyers being new to KFC sandwiches. Over one-third of buyers were new to KFC, and most had already purchased a fried chicken sandwich from a competitive QSR in the past.

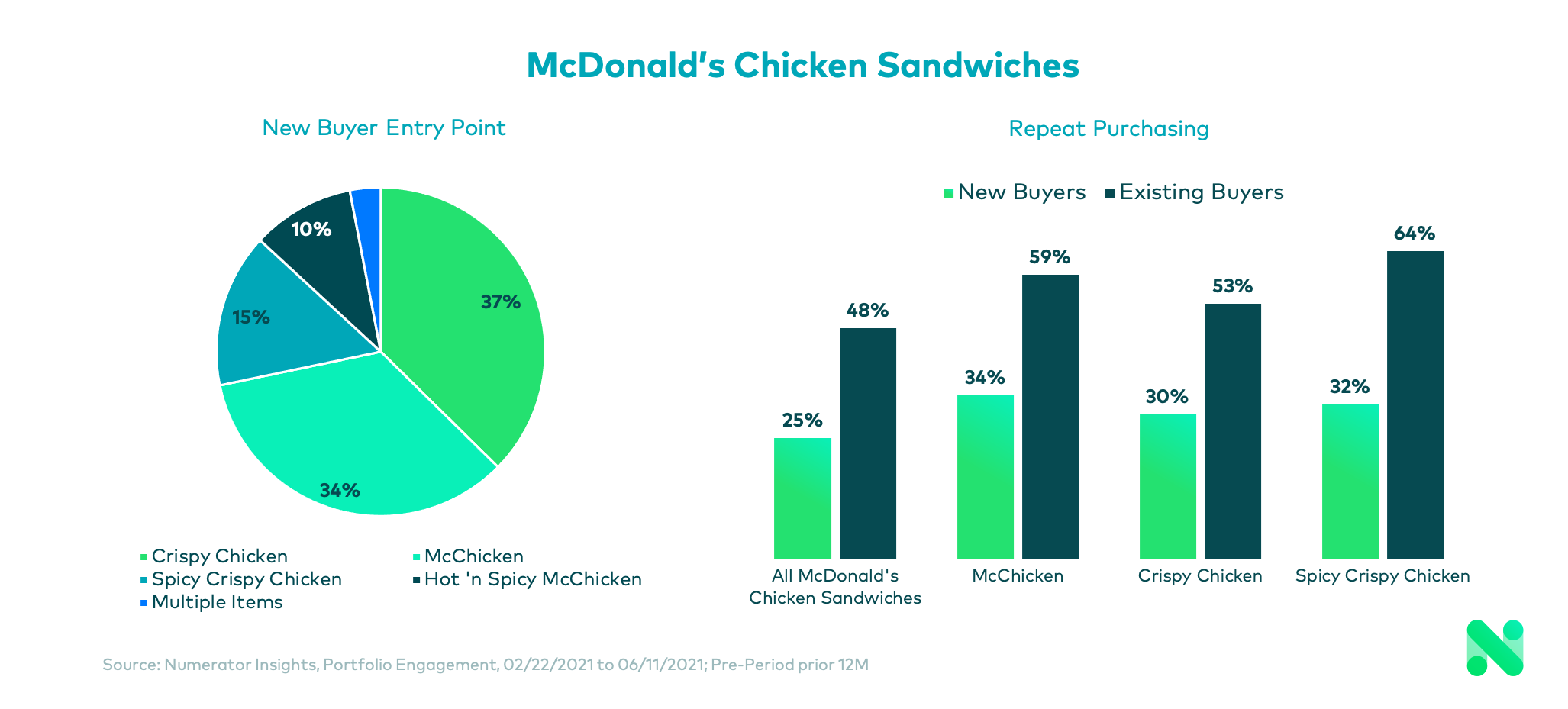

Meanwhile, McDonald’s successfully introduced three new crispy chicken sandwiches to their menu. Their results? One-third of McDonald’s chicken sandwich buyers were brand new to the category, with 37% of first-time buyers choosing the new Crispy Chicken Sandwich and 34% opting for the classic McChicken. McDonald’s also saw a solid number of repeat purchases, with 25% of new buyers returning for more. The new chicken sandwiches resonated with existing customers as well, although the high percentage of repeat purchases for the classic McChicken among both new and existing buyers demonstrates the importance of offering customers familiar stand-bys while still staying competitive with novel menu items.

Whetting the Appetite of New and Infrequent Buyers

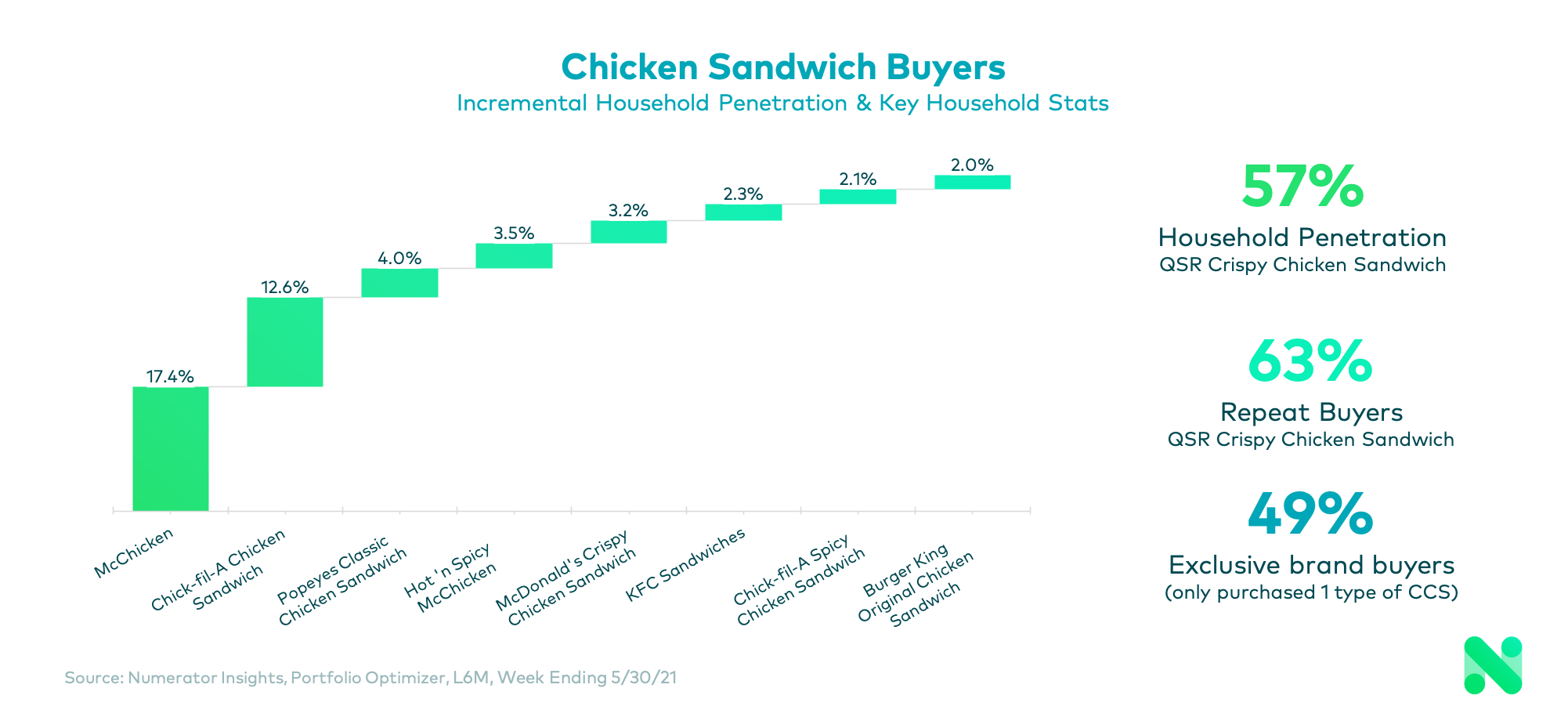

Additional proof of poultry’s appeal can be found in overall household penetration. Over the last six months, 57% of U.S households purchased a QSR crispy chicken sandwich and 63% of those households were repeat buyers. McDonald’s and Chick-fil-A rule the roost, capturing roughly one-half of purchases, while the remaining half is shared among QSRs whose customers don’t visit those top two spots. There is plenty of room for growth among consumers who are typically loyal to one chicken sandwich but open to others.

And while McDonald’s and Chick-fil-A are also generally the most popular points of entry for new chicken sandwich buyers, there is no shortage of opportunities for other chains to capture first-timers as well. This year’s launch of McDonald’s and KFC’s crispy chicken sandwiches over indexed in bringing new customers into the category. By adding innovative chicken sandwich options to their menu, QSRs have the potential to grow their customer base for years to come.

Cross Purchasing Insights: Uncovering Divided Loyalty in Key Demographics

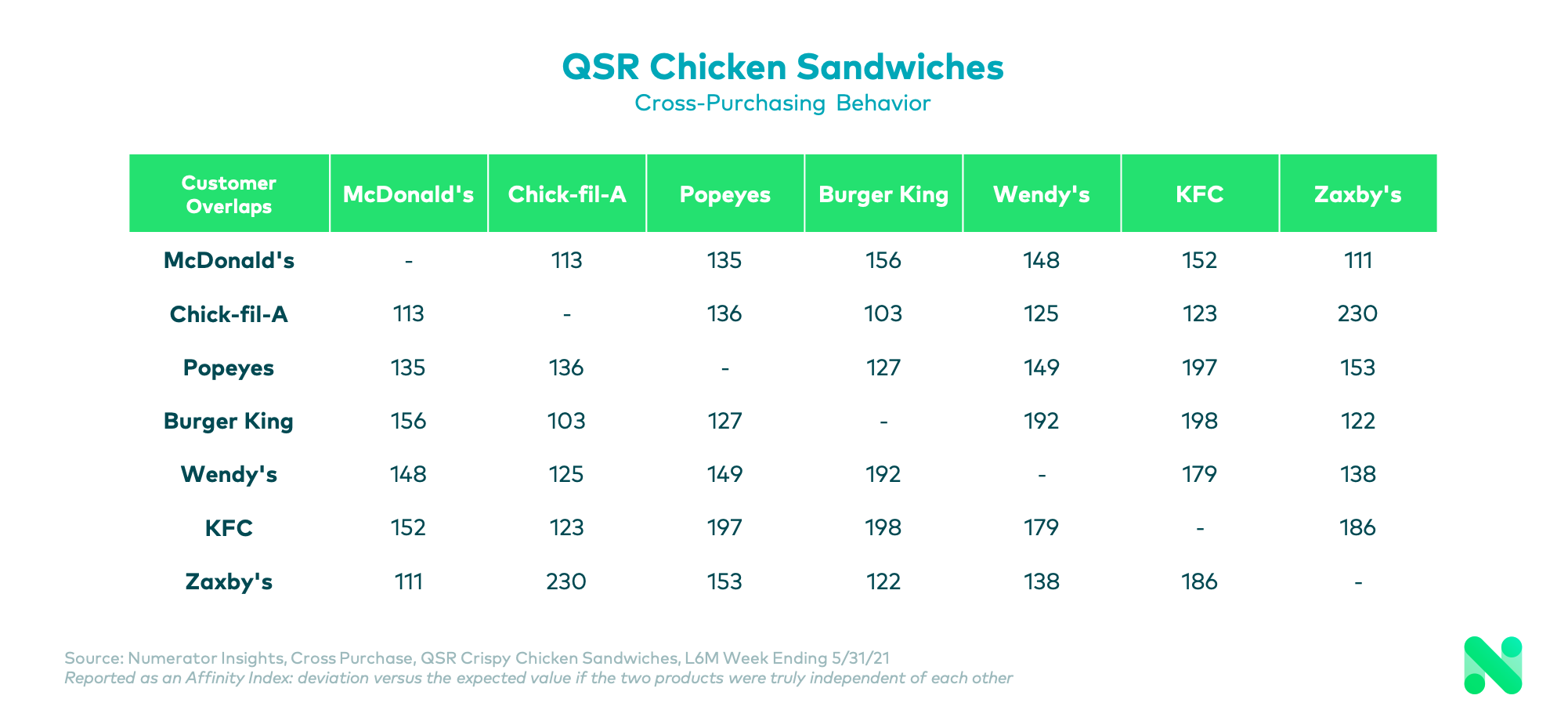

QSRs need to understand who their most valuable customers and critical competitors are, as well as where the two cross paths. Competitive insights are critical for developing strategies to attract and retain less loyal consumers who buy sandwiches from more than one QSR.

One example of a key demographic overlap is Popeyes and KFC, which share buyers among Black or African-American men in the classic chicken sandwich category. Using our Affinity Index to delve deeper into this overlap, we found this demographic is significantly likely to switch between these two retailers when buying chicken sandwiches. Burger King, Wendy’s, and KFC also see significant customer overlap.

Looking Ahead

In the three years since Popeyes kicked off the Chicken Sandwich Wars, chicken sandwiches have become a consumer favorite and a vehicle for growth in the QSR channel. QSRs will want to explore expanding their menu options, in alignment with consumer tastes and preferences, to drive purchases and trips as well as engage and increase customer loyalty. In addition, understanding where overlap exists between specific customers and competitors gives QSRs the ability to develop strategies to attract new buyers from crucial demographics and encourage repeat purchases among loyal buyers.

Craving chicken sandwich insights and feeling empty on what you missed? Fill your bucket with insights from the webinar replay.

To learn more about how to engage existing chicken sandwich buyers and win over new ones, please contact your Numerator Customer Success Consultants or get in touch with us.