The annual back-to-school shopping shuffle is underway, bringing swarms of parents and children to a retailer near you in search of the best gear for their new school year. While many aspects of back-to-school shopping seem to stand the test of time, each season also brings new trends, challenges and opportunities for brands and retailers. Last year, we shared more about the impact of electronics in the classroom on traditional BTS categories. This year, two additional topics gained prevalence: deal-seeking behaviors in a tight economy and how school-provided meals impact family grocery budgets.

The insights shared below come from a Numerator Verified Voices survey conducted in August 2025, which was fielded to over 3,000 households with children entering grades K-12 this upcoming school year. Their responses are combined with verified purchase behavior from their households during the 2024/2025 school year to showcase how certain preferences and circumstances have impacted past purchasing.

Back-to-School Savings

How important are deals for back-to-school shoppers?

Over half (57%) of back-to-school shoppers say their most important consideration is getting their BTS items for the best prices possible, up from 52% who said the same in last year’s Numerator back-to-school survey. While expected spending varies across grade levels and number of children in the household, 26% expect to spend more this year than they did last back-to-school season—the top reason for this expectation is that prices have increased, cited by two-thirds (64%) of those expecting to spend more. With tariffs and a tough economy top-of-mind, this year’s back-to-school shoppers are more sensitive than ever to pricing and are increasingly looking for the best deals.

How are shoppers saving money on back-to-school shopping?

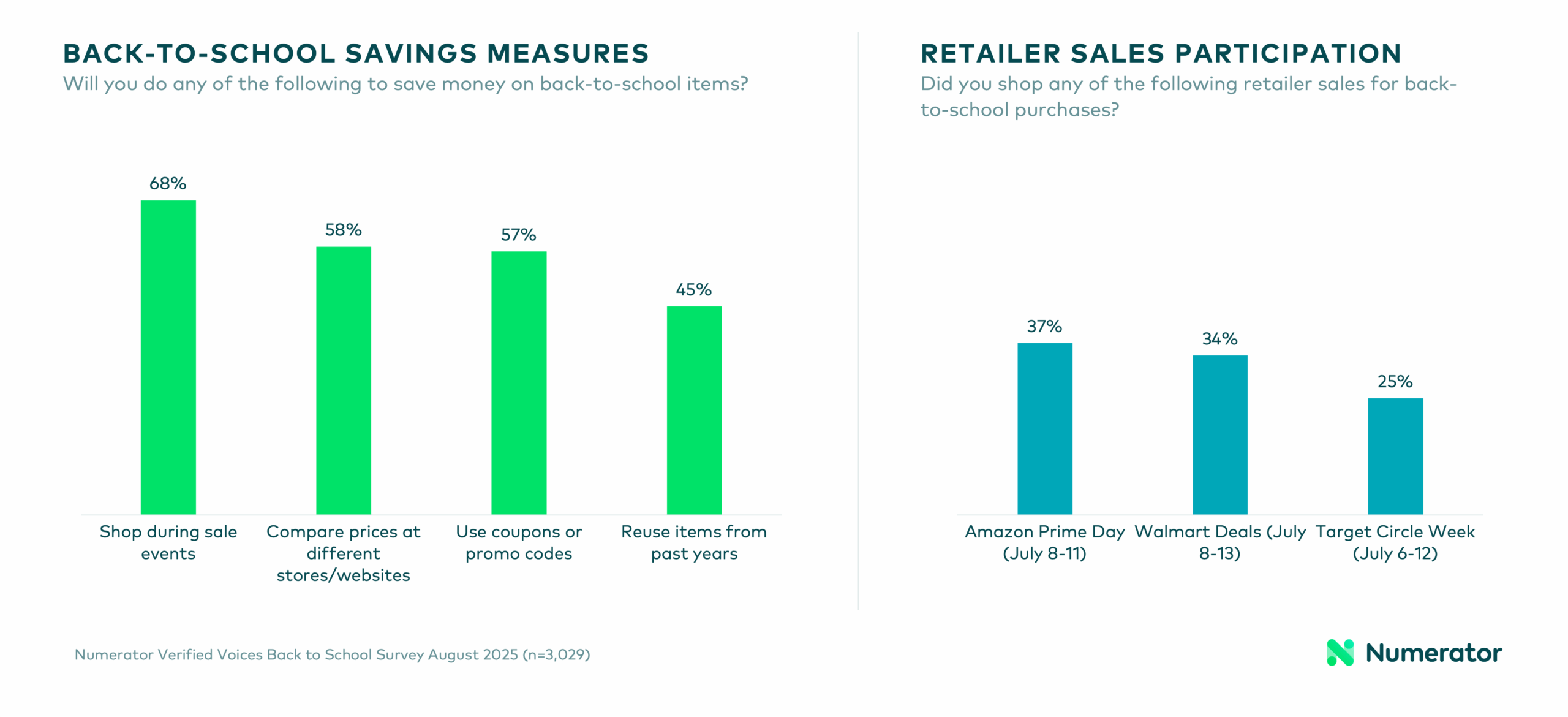

Nearly all back-to-school shoppers plan to employ some sort of money-saving measures this year, with 68% shopping sales events, 58% comparing retailer prices, 57% using coupons or promo codes and 45% reusing school supplies from past years. Many participated in summer sales events like Prime Day (37%), Walmart Deals (34%) and Target Circle Week (25%) to do their back-to-school shopping, as well. Retailers seem to be meeting price-sensitive consumers where they’re at. Numerator Promotions Intel data shows back-to-school promotional volume was up in July versus year ago, as top retailers like Amazon, Target, Walmart and Staples lean heavily on digital promotions.

Which retailers are offering the best back-to-school deals?

Consumers are clear on their back-to-school rankings: 49% said they believe Walmart is offering the best back-to-school deals this year, followed by Target with 22% and Amazon with 12%. Although this is a significant margin, a deeper dive also helps clarify competing priorities among shoppers. Those who ranked Walmart the highest were more likely to cite its overall value and competitive prices on school essentials. Amazon and Target favorers also believed their preferred retailer offered competitive pricing and good deals, in addition to making back-to-school shopping stress-free.

Lunchbox Logistics

Who’s packing snacks and meals for school?

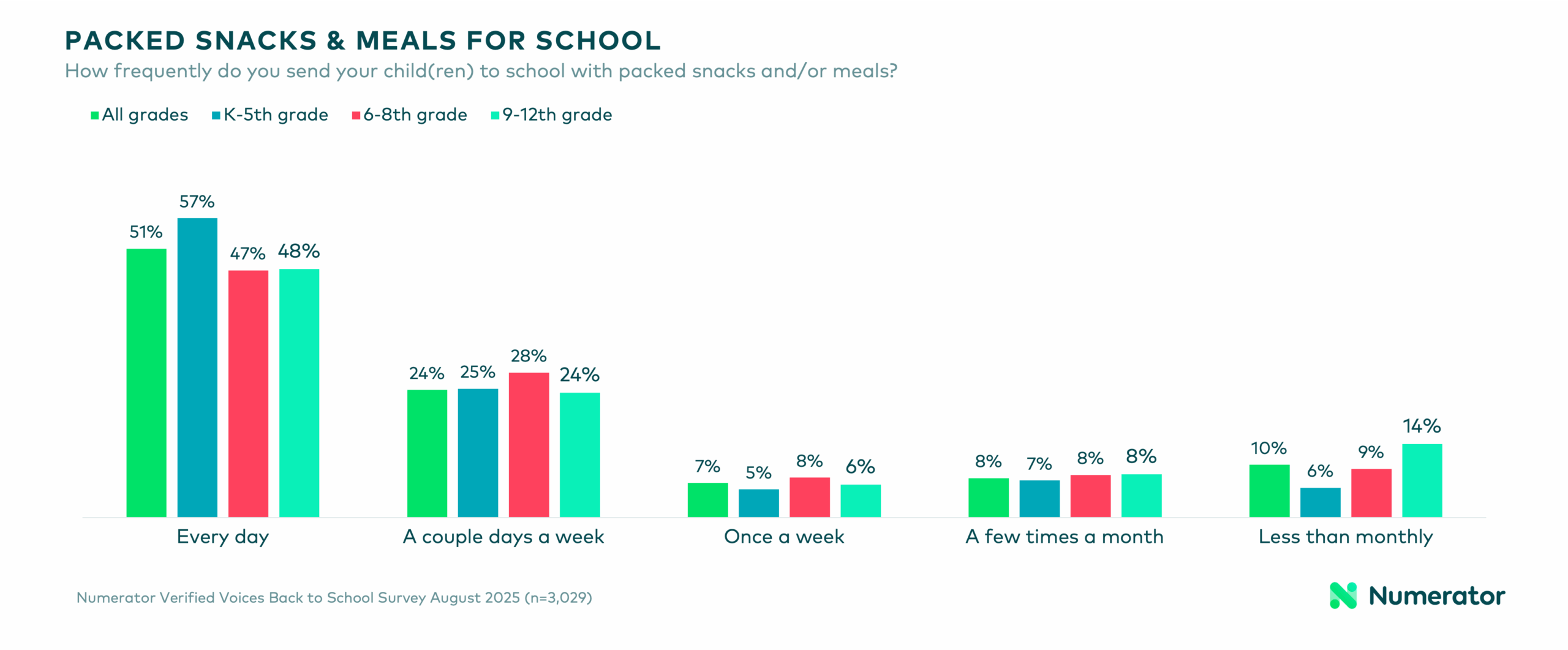

School-day snacks and meals are another ongoing financial commitment for families. Over half of parents (51%) say they send their children to school with packed snacks or meals every day, while another quarter (24%) do so a few times a week. These behaviors are more common among those with children in grades K-5 (57% / 25%), but drop slightly by high school (48% / 24%). Daily packers are more likely to be high-income millennials, and they’re also more likely to care about eating organic, reviewing ingredients and food labels, and meal planning for their household. They dine out less frequently than other households, signaling an overall preference for control over their family’s consumption habits and less reliance on external sources like restaurants or school cafeterias.

What do students bring for school snacks and meals?

Snack time is the top occasion for students to bring food to school—51% typically pack a morning snack and 45% an afternoon snack—followed by lunch time (35%). The top items parents say they toss in the bag are chips, crackers and pretzels (66%); fresh fruit or vegetables (62%); granola bars or snack bars (60%); bottled water or other drinks (50%); and cheese snacks (50%). When considering what to pack, parents are understandably most concerned about choosing something their child will actually eat (61%). After that, they also factor in sufficient daily nutrition (53%), easy-to-pack or grab-and-go options (53%), or items that are ready to eat with no heating required (41%). In households with high schoolers, there is also an increased focus on packing items with enough protein (33% vs. 30% for all grades).

How does packing school snacks and lunch impact grocery spend?

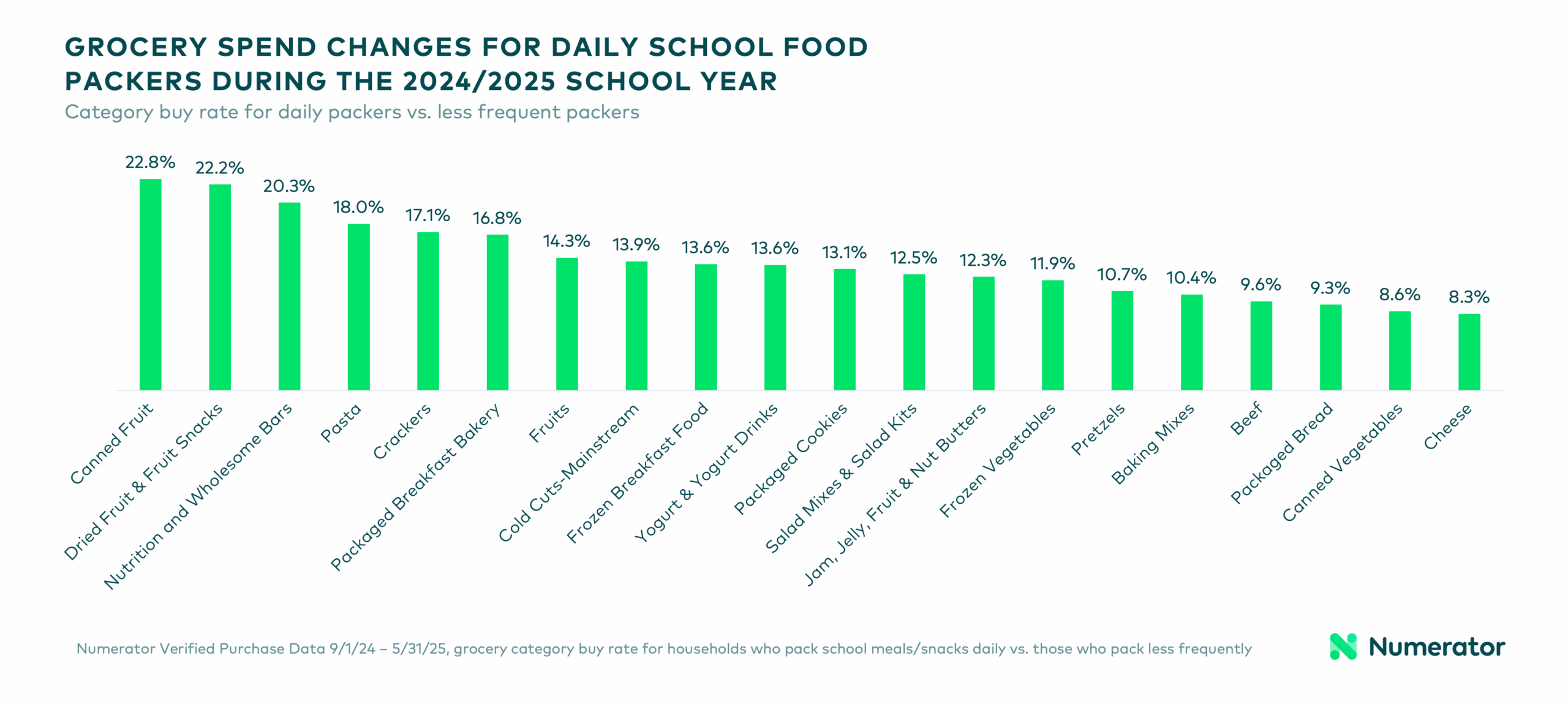

Verified purchase behavior among frequent school food packers reflects many of the preferences uncovered in our survey. During the 2024/2025 school year, daily snack and meal packers spent about 4.7% more on groceries than those who sent food to school on a less frequent basis. Increased spending for this group was most evident in snack and produce categories, including nutrition and wholesome bars (+20.3%), crackers (+17.1%), fruits (+14.3%), yogurt (+13.6%) and packaged cookies (+13.1%). They also had elevated spending in traditional sandwich-making categories like cold cuts (+13.9%), jellies & nut butters (+12.3%), packaged bread (+9.3%) and cheese (+8.3%).

School Breakfast Breakdown

Who’s participating in school-provided breakfast programs?

While school-provided breakfast has been around for decades, it has received increased attention in the past five years as more states and districts make “the most important meal of the day” more widely available. Nearly half (45%) of parents say their children will primarily eat breakfast at school during the 2025/2026 school year, with three-fourths of those receiving the meal for free. Children relying on school breakfast—both free and paid options—are significantly more likely to come from low income households making less than $40k annually, and are less likely to live in suburban areas. Their households are also twice as likely to be consistent SNAP/WIC users, defined as having at least 12 verified SNAP/WIC purchases in the past 12 months. These dynamics are especially important to understand in light of proposed cuts to the SNAP program.

How does school-provided breakfast impact grocery spending?

Similar to what we saw with packed meals and snacks, school day food preferences have a discernible impact on overall grocery spend for a household. Households with children participating in school breakfast programs spent 7.1% less on groceries during the 2024/2025 school year than those whose kids did not participate. The group specifically spent less on produce (-17.4%) and traditional breakfast foods (-9.2%), including toaster pastries (-17.3%) and breakfast cereal (-8.3%).

Back-to-School and Beyond

While the back-to-school season represents a major sales opportunity for brands and retailers, spending doesn’t stop once students are back in the classroom. Tighter budgets call for tighter planning around brand offerings and promotions, and a comprehensive understanding of your consumers is a great starting point as you plan a successful school year strategy. For more information on how seasonal spending or school-day dynamics impact your business, reach out to our team today.