There’s no doubt the 2020-21 school year is going to look different in light of COVID-19. As a result, back-to-school shopping— a key period for many brands and retailers— will look different as well. How are parents and guardians thinking about back-to-school shopping, and what are their plans to prepare for the upcoming school year?

*Note: These insights are from 2020. Read our 2021 Back to School blog to learn more about shopper intentions, or check out our 2021 Back-to-School Tracker for the latest insights into the shopping, advertising, and promotional activity.

—

Uncertainty around how schools plan to resume— be it in-person or online— has led to questions on how consumers should prepare, including what types of school supplies will be needed. Additionally, the risks of in-store shopping have continued to push sales online across categories, something we’ll certainly see happen with back-to-school purchases.

Numerator surveyed over 1000 households with school-aged children to get an idea of what back-to-school shopping may look like this year. 94% of these households said they purchased school supplies last year for their children, but only 78% said they plan to do so this year, with another 18% saying they weren’t sure yet.

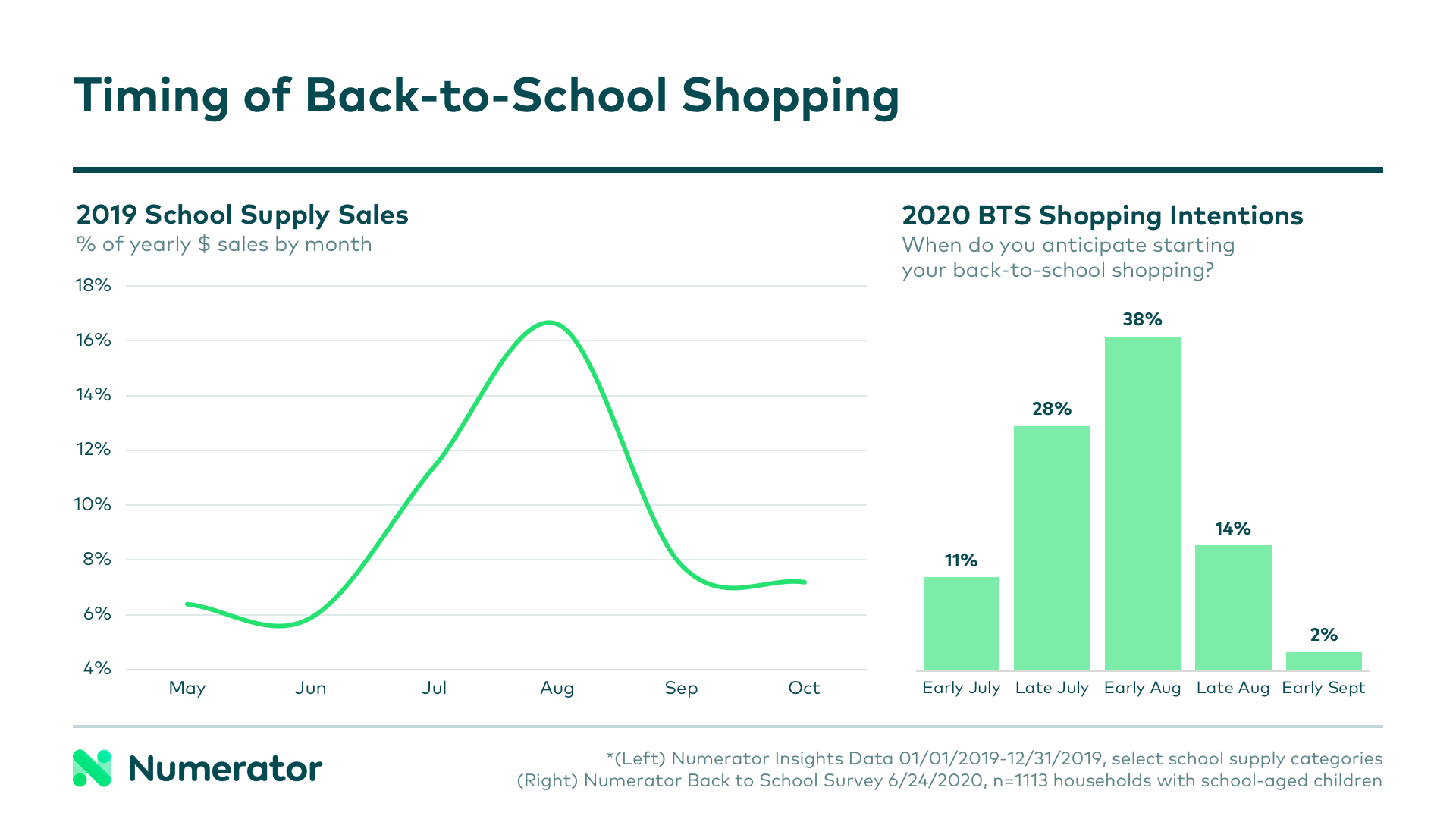

Timing and Spend Likely to Mirror Last Year’s Shopping Behavior

Historically, we have seen school supply sales ramp up in late July, peak in August, and begin to drop off in mid-September. According to our back-to-school survey, this general timing is likely to hold up this year as well, with most consumers indicating an intention to do their back-to-school shopping in late July or early August. In terms of intended spending, 82% said they planned to spend about the same amount as last year on back-to-school products. While the types of products purchased may differ depending on schooling plans, the back-to-school timeline has not notably changed.

Health and Hygiene Products Will be Back-to-School Staples

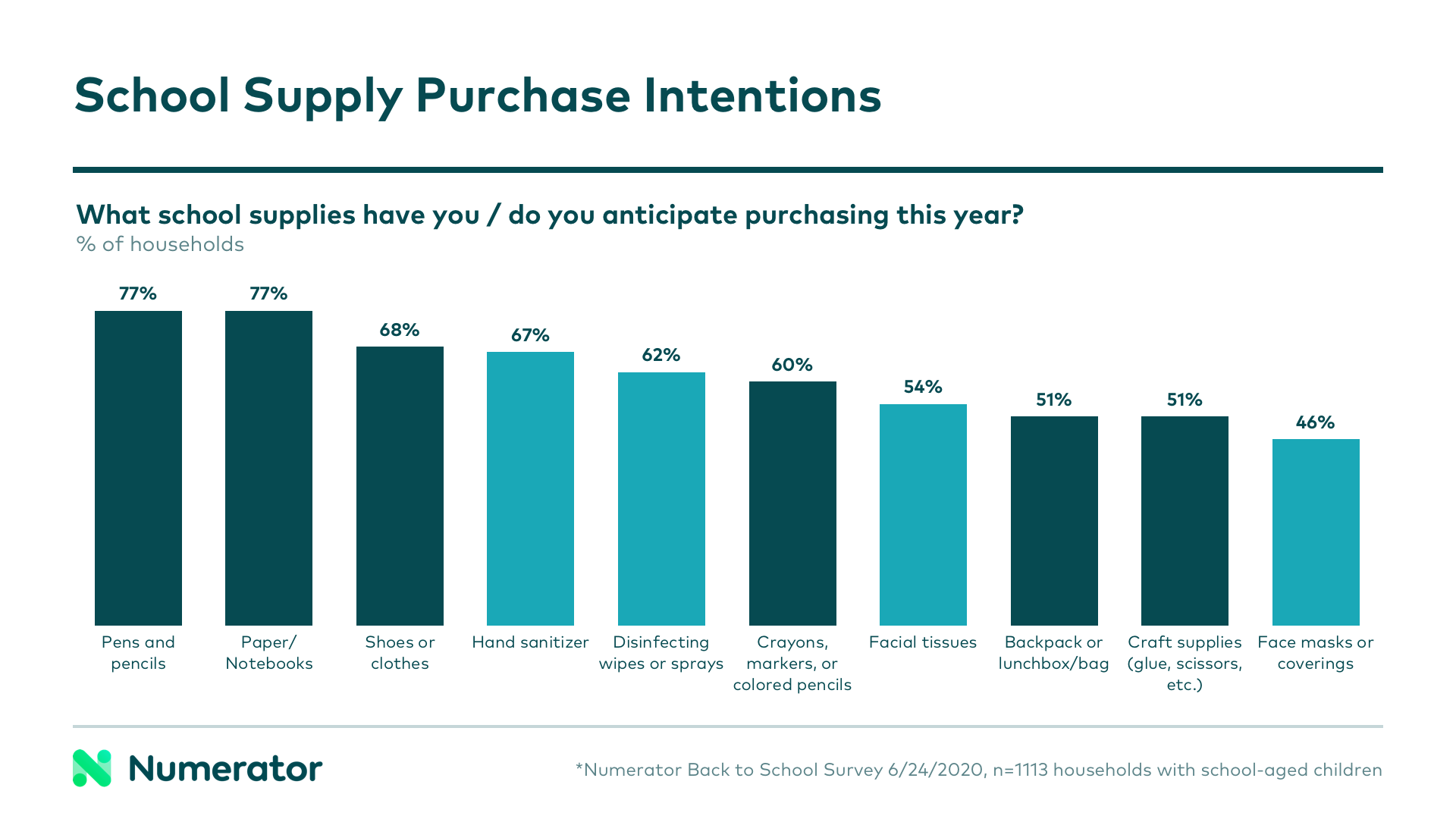

The influence of COVID-19 is evident in the types of products parents and guardians are planning to purchase for back to school. They are as likely to buy hand sanitizer as they are new clothes or shoes, are more likely to buy disinfecting wipes than crayons and markers, and are nearly as likely to buy face masks as they are backpacks or craft supplies.

13% said they planned to purchase electronics like laptops, tablets or printers and 5% said they’d be getting desks or computer chairs for their children’s at-home use— among those who already know their children’s classes will be online, this number is 3x higher. Given 62% of households surveyed are still unsure whether their children will be attending classes in-person or online, purchases of these products will likely surpass current estimates if e-learning becomes the norm, and brands and retailers should be prepared to scale up supply if needed.

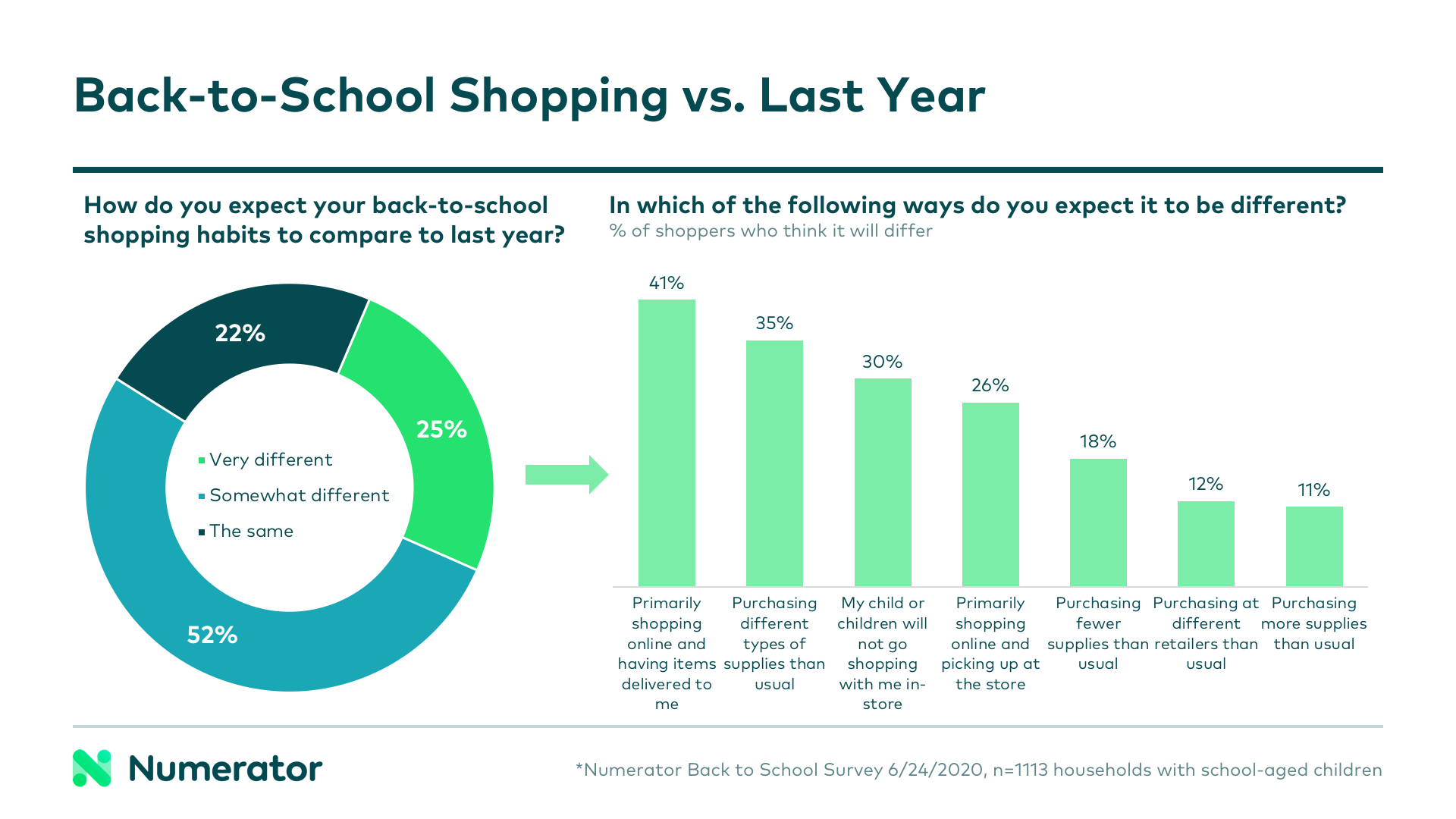

Back-to-School Shopping will look Different

Four in five shoppers expect their back-to-school shopping habits to be at least somewhat different than last year. For many, the key difference will be buying online; two-fifths said they’d be doing most of their back-to-school shopping online and having items delivered, and a quarter said they’d be using click-and-collect.

Nearly a third said they would not be bringing their children along on an in-store shopping trip, something that will drastically impact any brands or products designed to capture kids’ attention on the shelf. For a shopping event that has historically been driven by in-store sales with the input of children, a shift to online or childless trips will be significant. Brands and retailers who are able to take the in-store back-to-school experience— with it’s eye-catching displays and child-centered messaging— and transition some of the allure to their online experience will be best-positioned to capture the back-to-school buyer.

Keeping Track of Back-to-School Plans

With so much changing so quickly, it’s difficult to pinpoint exactly what back-to-school will look like this year. What we do know is that the back-to-school basket will contain more than just crayons, and that health and hygiene will be top priorities for those sending their kids back into the classroom. If virtual learning becomes the norm for some schools, supply needs will shift, and retailers who stay attuned to those shifts will be better able to respond to consumer needs.

If we’ve learned anything in the past months when it comes to back-to-school shopping trends, it’s that brands and retailers must remain flexible and work with what they do know to prepare for multiple scenarios. Only time will tell exactly how back to school will play out, and knowing consumers’ intentions is a first step in planning for various possibilities.

For a more in-depth look at back to school, talk to your Numerator customer success representative and keep an eye out for our Back-to-School Index, launching soon to provide weekly views into omnichannel BTS advertising, promotional and purchase data. As always, we are here to help, so contact us with any questions about our data, products, or insights.