At the end of December, we brought you the data behind three national brands who experienced significant growth in 2019. But as we stated at the end of that piece, the national brands highlighted were not the only ones who grew in 2019. In fact, across a multitude of CPG categories, the real stars of the show when it came to growth were private label brands.

High Growth, High Grossing Private Labels

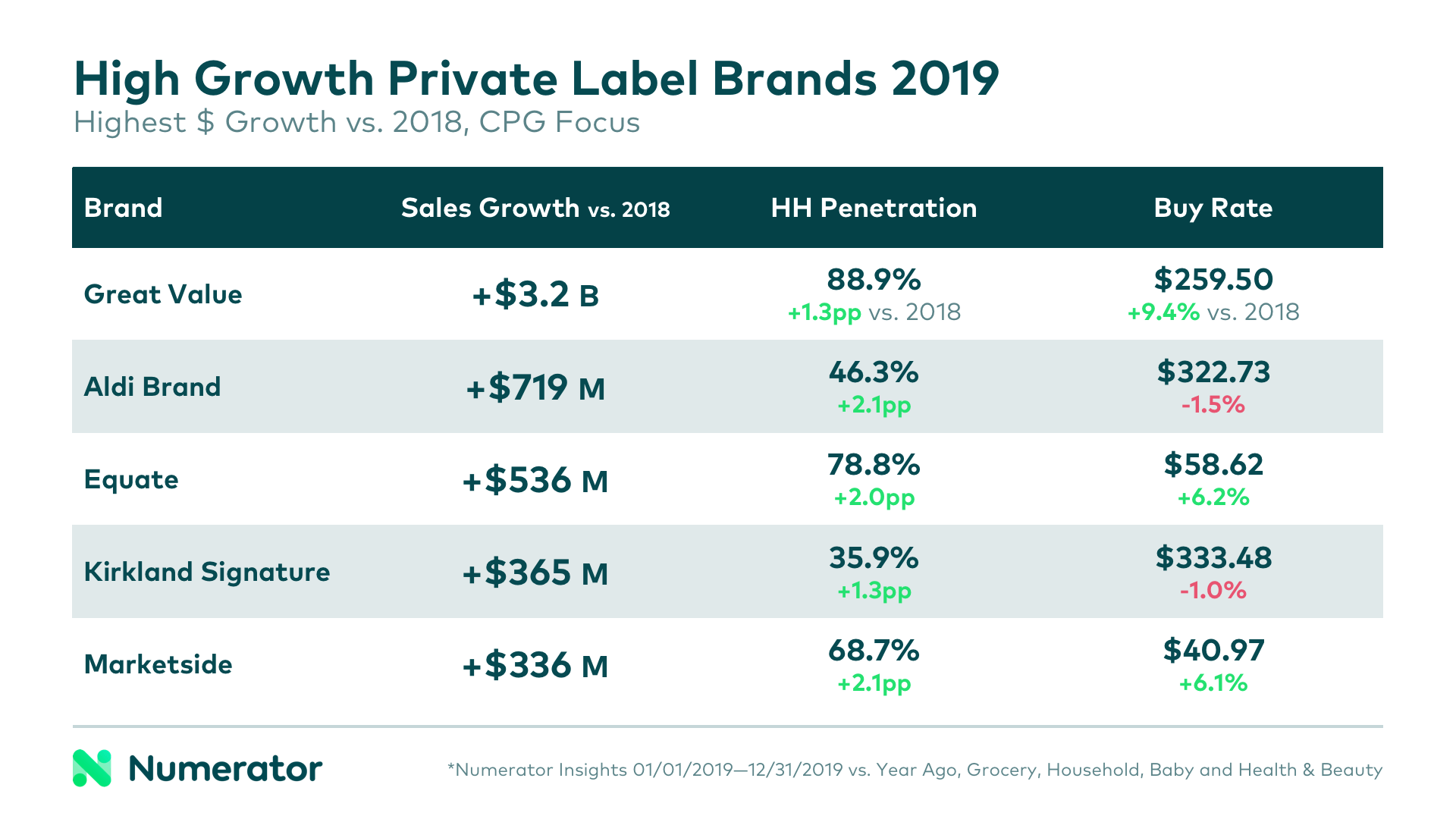

Of the top 50 highest-grossing CPG brands in 2019, 21 were private label. As such, it’s not too surprising that seven of the top ten brands experiencing the largest dollar growth were private label as well. Walmart had three brands atop the list— Great Value (#1), Equate (#3) and Marketside (#5)— while Aldi (#2), Costco (#4), Kroger (#7) and Sam’s Club (#8) each had one brand in the running.

In addition to overall sales growth, each of these brands saw a modest increase in household penetration from last year. All three of Walmart’s top brands captured larger buy rates as well, while Aldi brand and Kirkland Signature buy rates decreased slightly. Although these decreased buy rates were offset by increased household penetration in 2019, they could become more troublesome should household penetration growth slow or stall in coming years.

For Aldi, it seems that the decreased buy rate could have something to do with the new buyers they attracted in 2019. Compared to 2018, new buyers of Aldi private label were lower income and more likely to classify themselves as financially worse-off than the year before. These new buyers tended to be young urban males. Great Value also attracted new buyers in 2019 who fell into the young urban male category. However, these new buyers were more likely to be high income, which may explain the increased buy rate seen among Great Value buyers in 2019.

The Hustle for Households

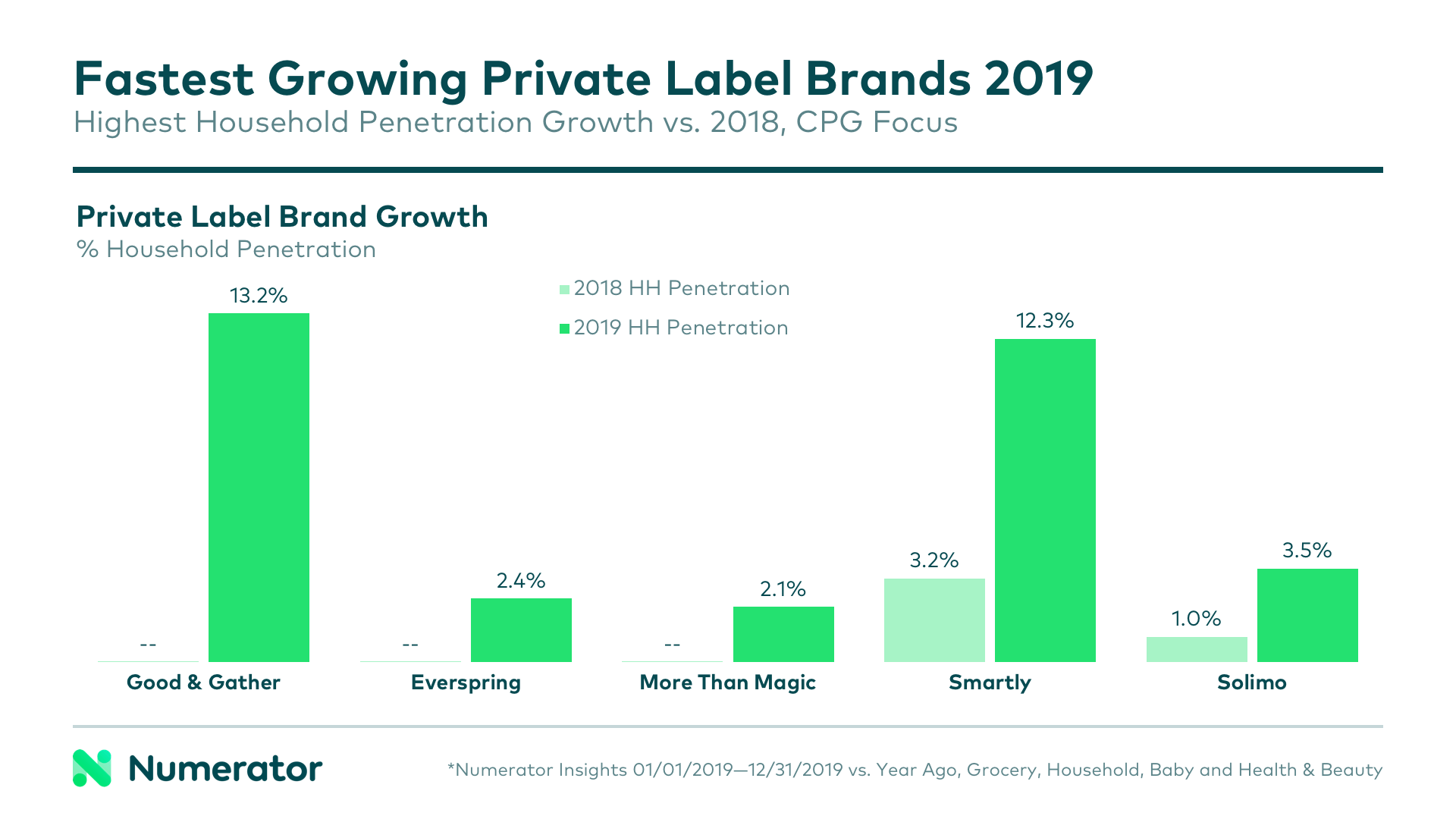

When we sorted brands based on household penetration increases between 2018 and 2019, Target dominated the field. Target brands— Good & Gather, Everspring, More than Magic and Smartly— held the top four spots for private label brands with significant household penetration growth last year. The fifth spot was rounded out by Amazon’s household brand Solimo.

Target has undergone a significant revamping of their private label strategy, phasing out older brands like Archer Farms and Simply Balanced in favor of their new brand Good & Gather. They have also added brands like Everspring and Smartly to complement their already well-established household essentials brand Up & Up. We’ll dig deeper into these three brands next week when we examine Target’s private label strategy and its early successes.

Private labels are taking the CPG world by storm, and if 2019 is any indication, their growth isn’t going to stop any time soon. In order to better compete and position themselves for success, retailers need to know what their competitors are doing with regards to private label, and national brands need to understand how private label is impacting their categories and shoppers.

Stay tuned next week for our two-part analysis on private label advancements, including the growth of “premium private label” and focus on Target’s private label strategy. For more information on how Numerator data can help your business thrive in the quickly-changing world of consumer goods, reach out today.