In today’s data-driven world, businesses depend on consumer insights to guide product development, marketing, and growth strategies. Much of this relies heavily on self-reported survey data, yet Numerator’s research shows that nearly 70% of respondents misreport critical details such as purchase frequency, spend, and brand choice.

This “recall gap” undermines the accuracy of market research, leading to poor business decisions and misaligned strategies. The solution is clear: researchers must integrate verified buyer data to ensure that surveys deliver complete, accurate, and actionable results.

Numerator leveraged its Verified Voices panel to quantify this gap and its impact in our latest whitepaper, “Risky Recall: Why Verified Buyer Data is the New Research Imperative.” In this article, we’ll explore the fundamentals of strong survey development, as highlighted in the whitepaper.

What Makes a High-Quality Survey Panel and How Can Brands Tell the Difference?

A survey panel is a group of individuals who have agreed to participate in ongoing surveys over time. For businesses and brands, survey panels provide valuable insights into customer behavior, brand perception, and market trends. Surveys should enable organizations to make more informed, evidence-based decisions that drive growth, strengthen customer relationships, and improve competitive advantage.

The panel is typically designed to reflect a broader population by carefully selecting members based on demographic, geographic, and behavioral characteristics. By using statistical weighting and sampling methods, the panel can be adjusted to align with the demographics of the general population, ensuring that the results are representative and reliable. However, representativeness needs to go beyond just basic weighting and sampling.

Numerator’s panel requies real-life receipts to be tagged and processed as being legitimate vs. duplicative, which inherently helps to prevent bots from being able to game the system. The verified nature of Numerator’s panel makes us a better option than survey firms that source their panels from all over the Internet, recruiting through web apps and/or recruiting professional survey takers. The benefits of Numerator Verified Voices surveys include faster access to feedback, higher data quality, and the ability to conduct longitudinal studies that reveal not just what consumers think, but how and why those opinions shift.

Why Are Traditional Survey Panels Prone to Inaccurate and Misleading Responses?

One inherent problem with traditional survey panels is that they often depend on human memory. Think back to your last shopping trip: can you remember exactly what you bought, when you bought it, and how much you spent? You probably can’t, and that means survey respondents can’t either. Numerator data shows consumers visit 15+ retailers monthly and purchase nearly 400 brands annually proving that relying on recall can cause:

- Over-reporting or under-reporting: Many respondents misstate how often they purchase a product.

- False confidence: Studies show that even highly confident responses can be wrong.

- Distorted insights: Entire strategies may be built on flawed assumptions about the target audience.

- Misleading consumer profiles: Claimed data can inflate the size and profile of a brand’s heavy consumers.

Numerator tested the impact of recall gaps by comparing survey responses from thousands of our panelists to verified purchase data captured through receipts, loyalty transactions and online purchase records across 40 categories. The results showed:

- 73% of consumers couldn’t recall when they last purchased a category.

- 70% misreported frequency of purchasing a category.

- 61% inaccurately reported spend per trip.

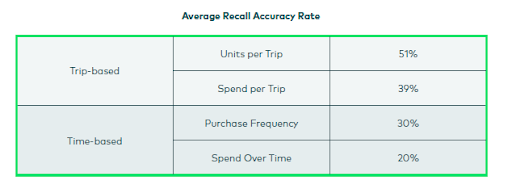

Only one-third of respondents could accurately recall information across all tested metrics, with trip-based metrics having a slightly higher accuracy rate than time-based metrics.

Even with well-crafted survey questions, self-reported answers alone cannot overcome the limits of memory. Numerator’s research also found that while 56% of respondents expressed high confidence in their answers, verified buyer data showed these recollections were no more accurate than less confident respondents. Researchers gain more reliable insights for hard-to-reach audiences by incorporating verified buyers. Many traditional survey research companies claim to provide ‘verified’ respondents, but the term ‘verified’ can mean very different things. To ensure you’re getting accurate data, ask your supplier whether their definition involves verified buyers with confirmed purchase data.

How Does Verified Buyer Data Reduce Recall Bias in Survey Research?

Verified buyer data is captured directly from receipts and transactions, ensuring that purchase-based insights reflect reality rather than recollection. Numerator’s survey panel collects data from over 600,000 U.S. households, pairing survey responses with actual purchase behavior, as well as more than 2,500 demographic, psychographic, and media consumption attributes that panelists elect to share with Numerator.

Key advantages include:

- Behaviorally representative samples — ensuring insights align with real-world consumer actions.

- Minimized recall bias — eliminating errors from faulty memory.

- Higher accuracy in targeting — identifying the right buyer segments with confidence.

- Greater research efficiency — verified buyer panels reduce the need for screeners and incidence costs.

Verified purchase data combined with survey responses delivers a holistic view of consumer behavior, enriching attitudes with real buying actions.

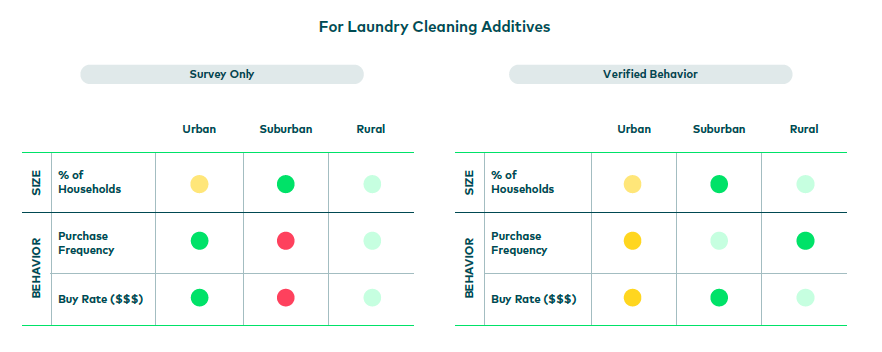

Recall challenges are universal. No category is immune and suppliers relying on claimed purchase behavior are all vulnerable. In one example from our research, survey data showed that brands in the Laundry Cleaning Additives category should target Urban consumers given their survey responses. However, when purchasing behavior is validated by using verified buyers, it is clear that Suburban consumers should be prioritized.

Why Is Verified Purchase Data Becoming the New Standard for Market Research?

The message is clear: relying on recall is risky. With nearly 70% of consumers misreporting key purchase details as found by Numerator, survey research without verification is increasingly insufficient and dangerous to brands and retailers. Traditional survey panels come with major disadvantages ranging from inaccurate recall to misleading consumer profiles. Verified buyer data closes this recall gap, ensuring that every survey response is grounded in real behavior.

As expectations for high quality survey panels and survey samples continue to grow, verified buyer data is no longer optional. By shifting toward verified purchase behavior as the new research standard, brands can future-proof their insights and ensure smarter, more confident decision-making.