As 2019 draws to a close, we thought it only fitting to take a look at a few of the fastest growing brands of the year. Based on increases in household penetration, we identified two national brands who experienced significant growth in 2019. Who are they, how do their new shoppers differ from their old ones, and what do we know about their keys to success?

While the following is not an exhaustive list of the fastest-growing brands in today’s marketplace, the brands we chose to examine in-depth each experienced a significant increase in household penetration this year. From channel expansions to tapping into new consumer groups, each of these CPG brands offers a unique growth success story that we felt compelled to tell.

White Claw: From Niche to Mainstream

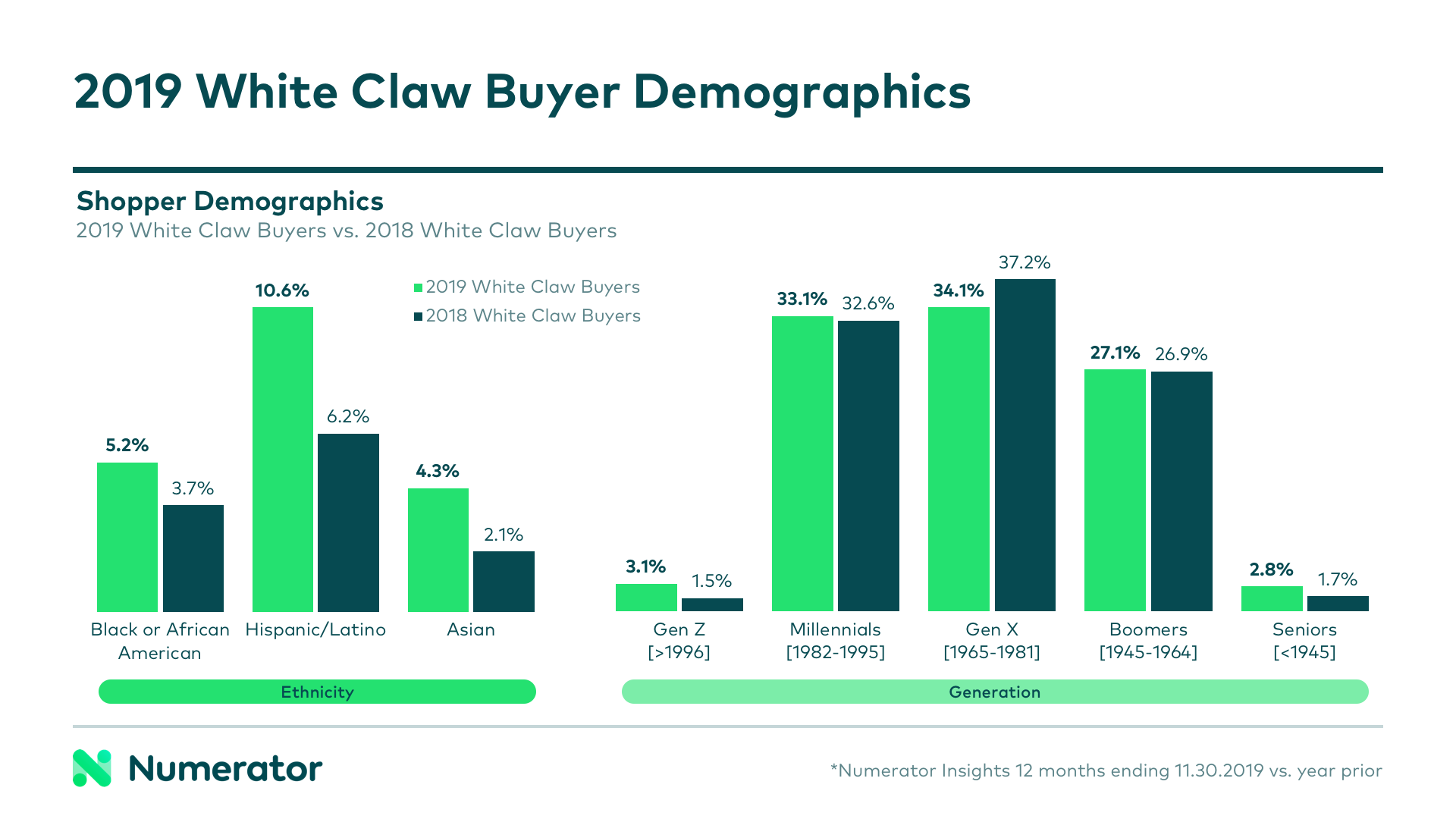

With all the news about the White Claw shortage of 2019, it’s no surprise to find this brand atop the list for brands that saw a dramatic increase in household penetration. Jumping from 2.9% household penetration in 2018 to 8.1% penetration in 2019, White Claw was the fastest-growing brand we chose to examine. While White Claw’s overall consumer base skews young, white, and high income, the new buyers they attracted in 2019 differ significantly from 2018 buyers. These new shoppers are multi-generational and multicultural, showing that what once was a trendy beverage for a niche group has now made its way to the mainstream.

Pringles: Tried and True Growth

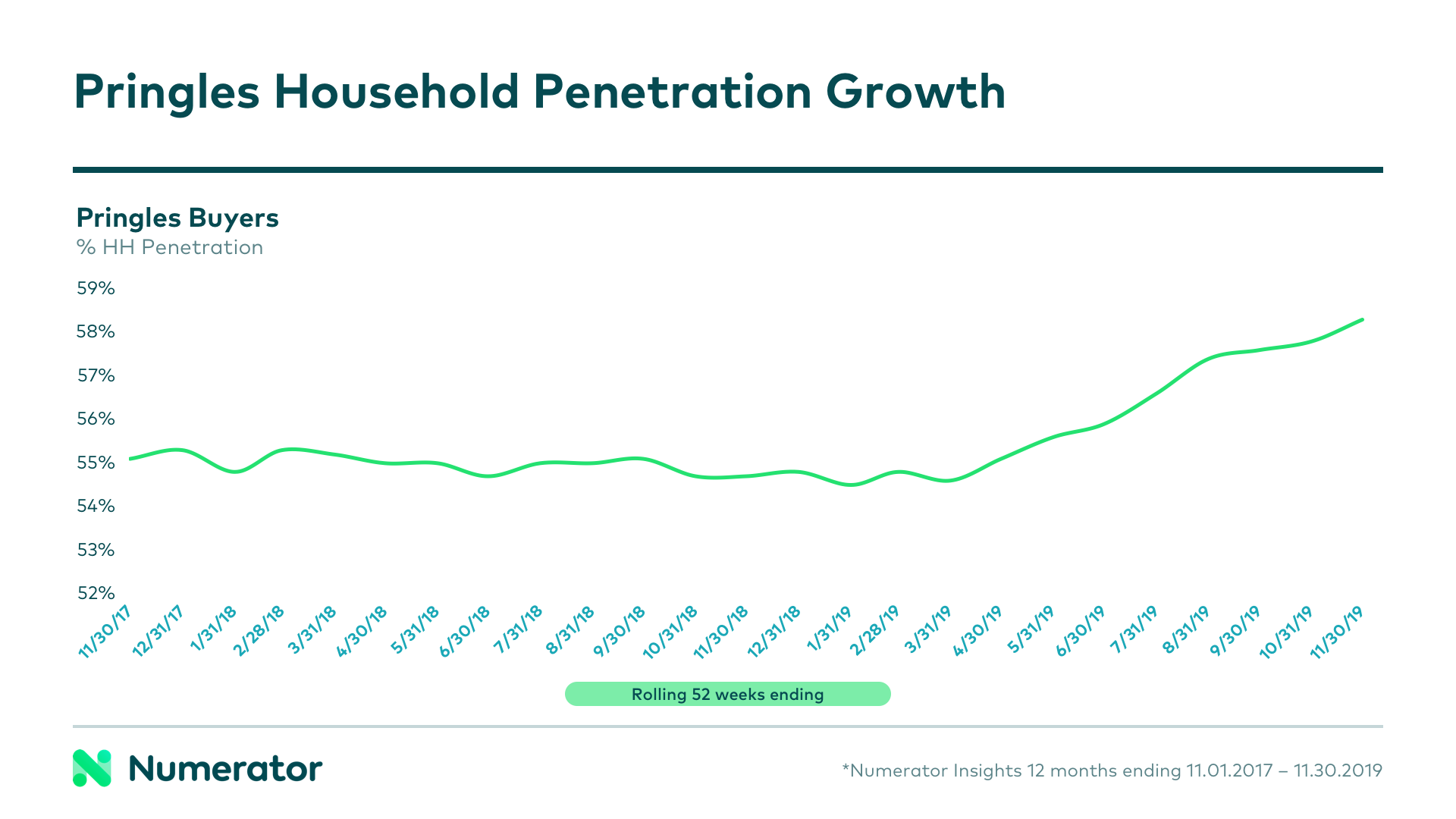

Pringles was able to expand their already solid reach from 54.7% to 58.3% of households in 2019. In part, their growth seems to have come from increased spending in mass, dollar and drug channels. They also managed to get in with the youngest generation (Gen Z’ers) and continue to stay relevant despite being a brand that has been in the market for many years. Numerator Ad Intel data shows that Pringles slightly increased their focus on online display ads and television ads in 2019, which seems to have paid off, with their new buyers over-indexing heavily on their online and television usage behaviors.

It is also worth noting that national brands weren’t the only ones who experienced success in 2019; of all the CPG categories we took a look at, private label brands floated to the top of the list, experiencing just as much— if not more— success attracting new buyers versus their national brand counterparts. From Aldi brand to Smartly to Kirkland Signature, private label dominated 2019. Stay tuned in 2020 as we take deeper dives into the world of private label.

At Numerator, we help brands grow and thrive by providing an in-depth understanding of who their buyers are and the why’s behind their buys. Whether you’re an up-and-coming brand like White Claw or an industry powerhouse like Pringles, we are here to help you make sense of the quickly changing retail world. Reach out today and let us help you start the new year off with a bang.