NUMERATOR VISIONS

Consumer behavior trends for 2023

Welcome to our inaugural release of Numerator Visions, an annual perspective that looks back at the past year, provides forward-looking insights into the year to come, and serves as a starting point for deciding what to do next.

Every year, we will share several visions for the future of US consumer trends and what industry leaders and executives should be prepared for. We create these visions by drawing on our comprehensive understanding of the consumer, which we gain through Numerator’s full suite of products.

Download the full report to see all the insights.

In the full report, you will discover more about the three visions and what it means for your brand. More insights include:

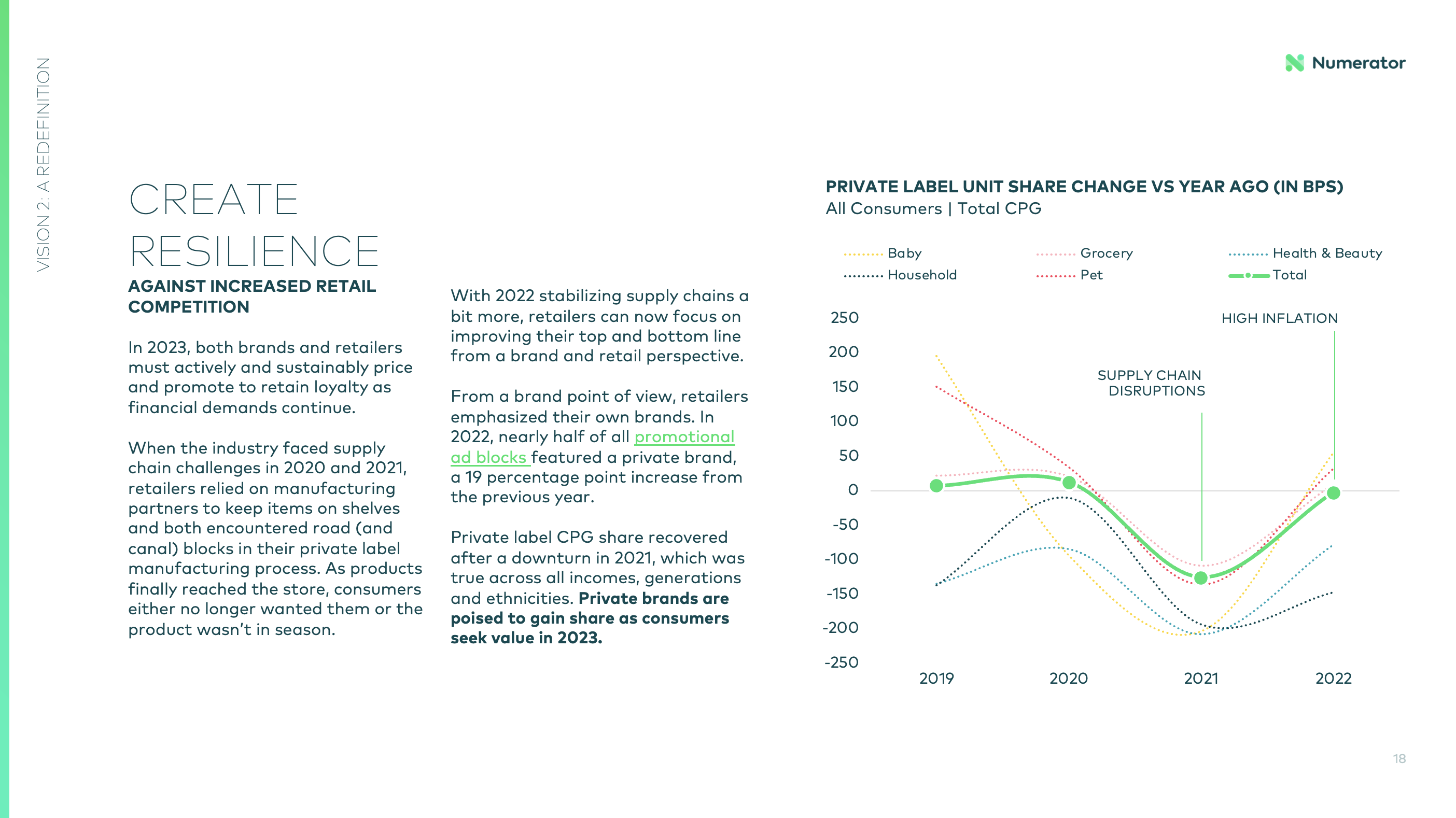

- What private label brands are poised to grow in 2023

- Why protein water and prebiotic sodas are paving the way for health & wellness

- How Gen Z and Boomers are reacting differently to the current economy

Find out how Numerator can help your brand grow more.

More trips across more channels.

Infinite insights to help you know more.

Thank you!

A member of our team will get back to you within 24 hours. In the meantime, explore our content to get a pulse on the latest consumer and shopper insights trends.