No two events bring sports lovers together quite like the Super Bowl or the Olympics, and this year, consumers will get a head-to-head showdown between the two. The 2026 Winter Olympics begin on Friday, 2/6, with Super Bowl LX kicking off two days later on Sunday, 2/8. As NBC prepares for a blockbuster broadcasting weekend, consumers are making game plans for their snack platters and watch parties.

Super Bowl LX and Winter Olympics Viewership

The Super Bowl reigns supreme in total intended viewers, with 69% of U.S. consumers saying they will be watching the big game on Sunday, compared to 58% who plan to tune into the Winter Olympics. For many, it is not an either-or decision; nearly half (45%) of consumers say they’ll follow both events. Viewing habits also vary by age, with older consumers showing more interest in both events than their younger counterparts.

When it comes to how people are watching, streaming platforms lead the way. 63% of Olympic viewers and 53% of Super Bowl LX viewers plan to tune in via streaming. Cable still has an important role, with about half of viewers using traditional services to watch each event. Consumers also plan to catch highlights on social media platforms, a trend that is more popular for the Olympics (23%) than the Super Bowl (14%).

Watch Parties and Favorite Features

The Super Bowl is seen as more of a collective viewing experience than the Olympics, which tend to be a bit more low-key. Olympic viewers are more likely to tune in at home alone or with members of their household (77%) than Super Bowl viewers (45%). However, the extended nature of the Olympic Games gives viewers plenty of chances to catch events in different settings.

When it comes to hosting others or heading to a friend’s house, the two events look very similar: about three in ten plan to host others at home (30% Olympics, 29% Super Bowl), while less than one-fifth plan to watch at someone else’s house (16% Olympics, 17% Super Bowl). In a win for the food service industry and community spaces, the Olympics are more than twice as likely to bring viewers to a bar, restaurant, or public space to watch (15% vs. 6%).

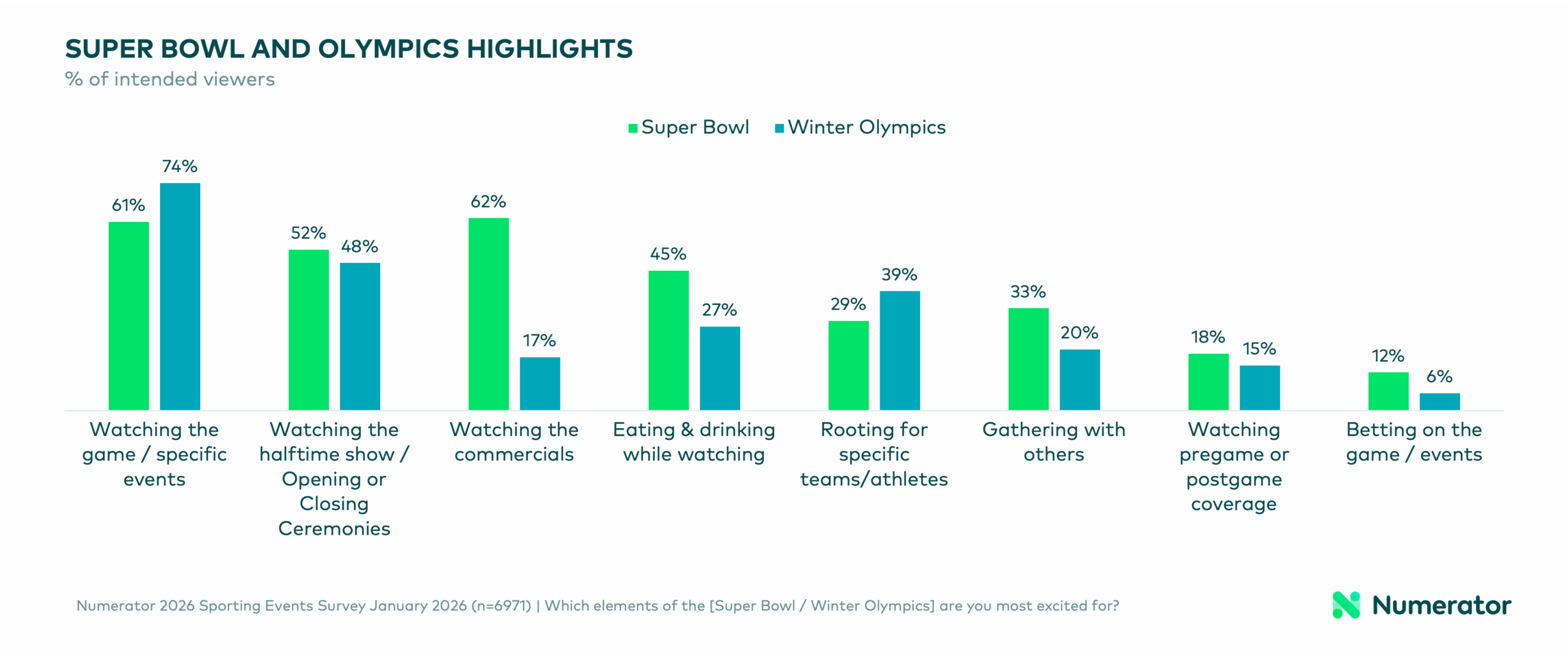

Over time, it seems like the Super Bowl has become less football-focused and more entertainment-driven, with 62% of viewers saying they are most excited for the commercials taking place during Super Bowl LX. Many (61%) are still excited for the game itself, while about half (52%) are looking forward to the halftime show. For the Olympics, viewers are most excited to watch specific events (74%), which is not surprising given that 70% of those planning to watch both the Super Bowl and the Olympics say that the Olympics have the better overall athletes. 48% are excited to watch the Opening and/or Closing Ceremonies (48%), and 39% are ready to root for specific teams or athletes (39%).

Whether watching for stumbles or spirals, Olympic viewers prefer figure skating by a wide margin over other Olympic sports. 67% of Olympic viewers rated figure skating as their favorite sport, followed by snowboarding (27%) and speed skating, ski jumping, ice hockey, alpine skiing, and sliding events (24%).

Sporting Event Driven Purchasing

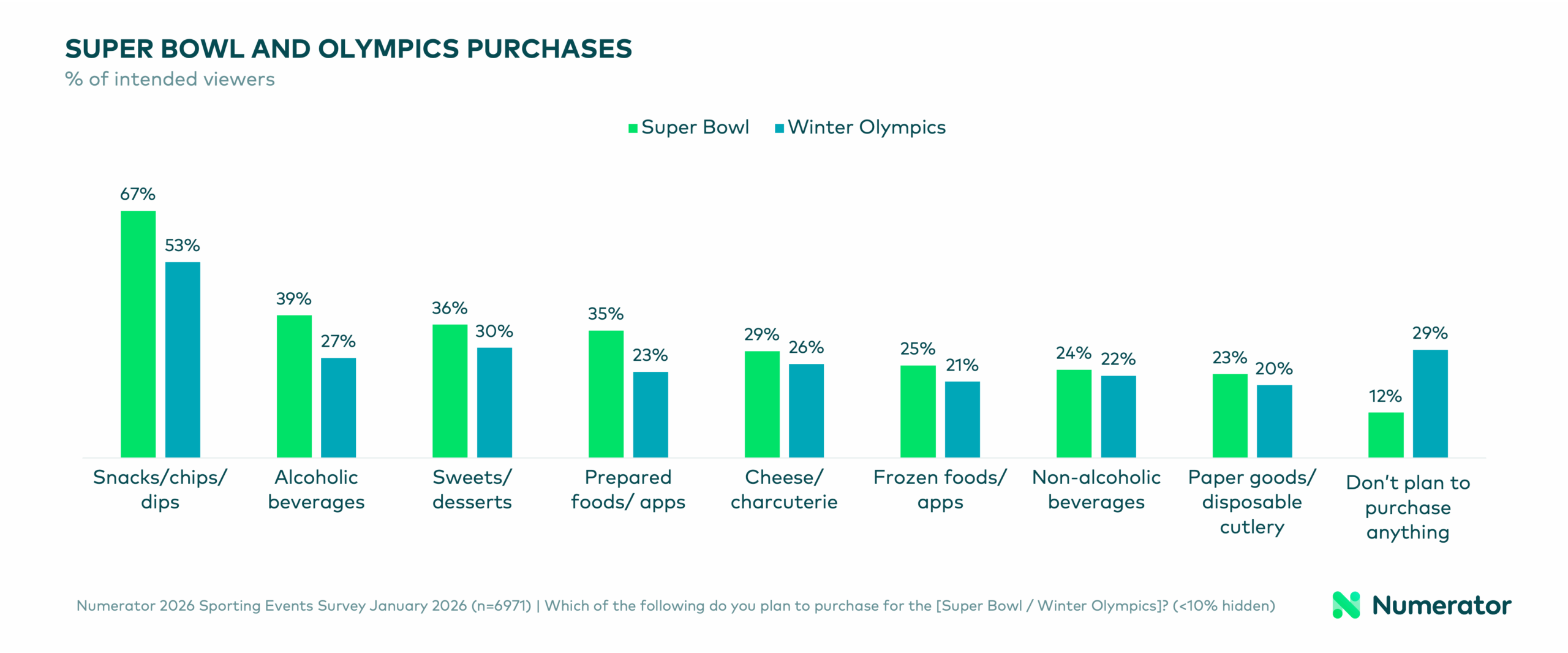

Since viewers are more likely to gather for the Super Bowl, it is expected to drive more consumer behavior than the Olympics. In fact, the Saturday before last year’s Super Bowl was the single-highest day of grocery unit volume in 2025 and was the third-highest day of grocery dollar sales, trailing only the days leading up to Christmas. That spending momentum is reflected in shopping plans, as nearly nine in ten (88%) Super Bowl viewers plan to purchase something for the game, with the top items being snacks/chips/dips (67%), alcoholic beverages (39%), and sweets/desserts (36%). Olympic viewers are slightly less likely to shop but remain engaged with 71% planning to make a purchase, including snacks/chips/dips (53%), sweets/desserts (30%), and alcoholic beverages (27%).

Together, Super Bowl LX and the 2026 Winter Olympics highlight two very different viewing moments—one centered on big, communal gatherings and high-impact spending, and the other spread across quieter, more flexible viewing occasions. Both events capture massive attention, but they engage consumers in distinct ways that matter for brands and retailers. To learn more about how viewing and spending patterns across cultural moments can impact your business, reach out to Numerator or your account representative.